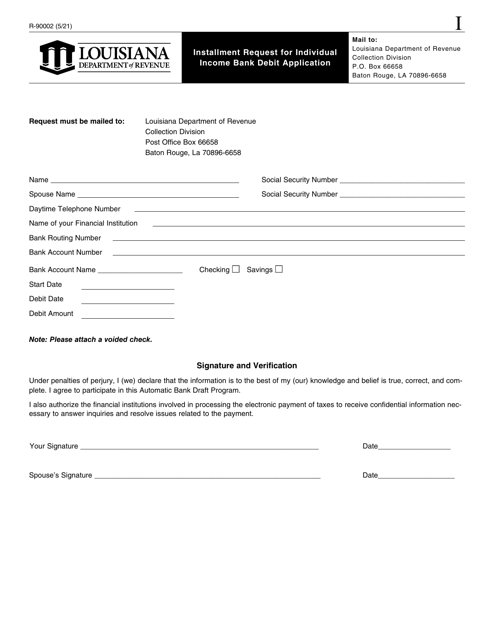

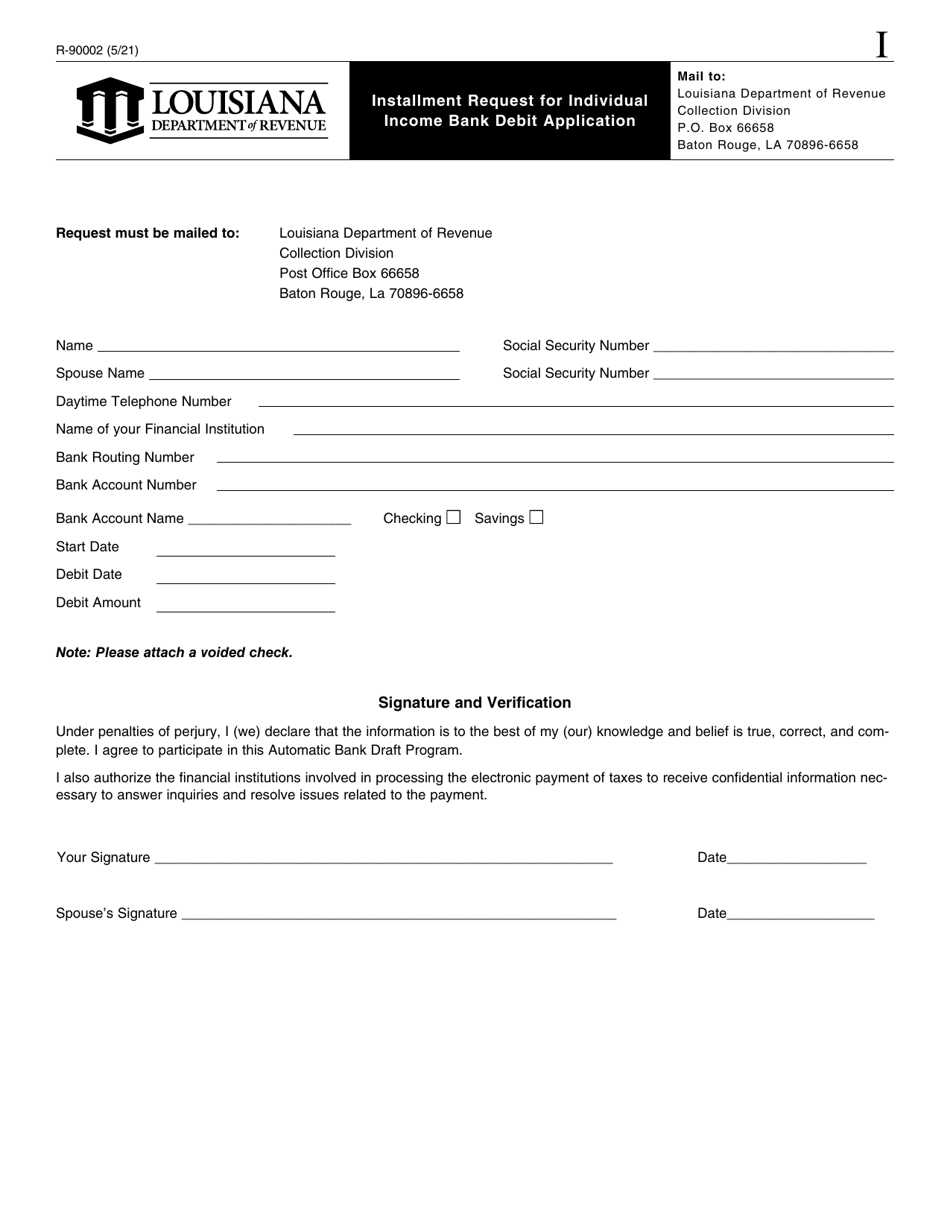

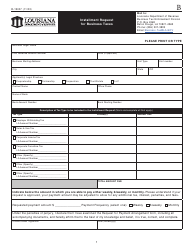

Form R-90002 Installment Request for Individual Income Bank Debit Application - Louisiana

What Is Form R-90002?

This is a legal form that was released by the Louisiana Department of Revenue - a government authority operating within Louisiana. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is Form R-90002?

A: Form R-90002 is an Installment Request forIndividual Income Bank Debit Application in Louisiana.

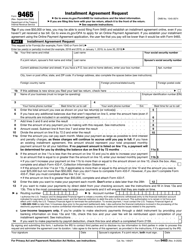

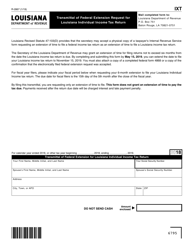

Q: What is the purpose of Form R-90002?

A: The purpose of Form R-90002 is to request an installment plan to pay individual income tax liability.

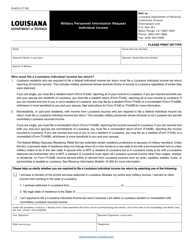

Q: Who can use Form R-90002?

A: Individuals who owe individual income tax in Louisiana can use Form R-90002 to request an installment plan.

Q: Are there any fees for using Form R-90002?

A: Yes, there is a $25 fee for setting up an installment plan using Form R-90002.

Q: What information is required on Form R-90002?

A: Form R-90002 requires information such as taxpayer details, tax liability amount, and bank account information for debit payments.

Form Details:

- Released on May 1, 2021;

- The latest edition provided by the Louisiana Department of Revenue;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form R-90002 by clicking the link below or browse more documents and templates provided by the Louisiana Department of Revenue.