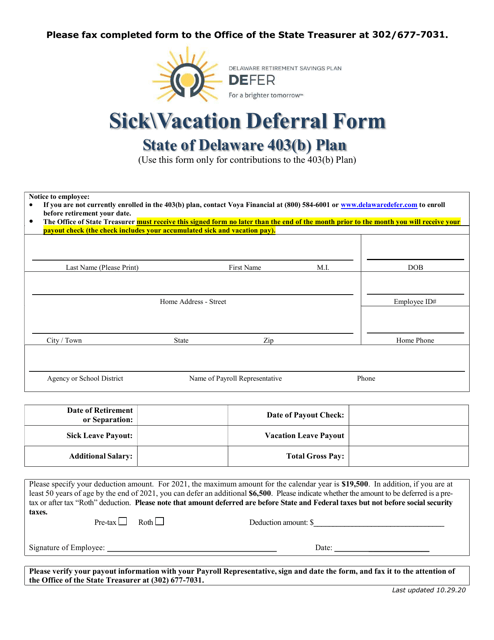

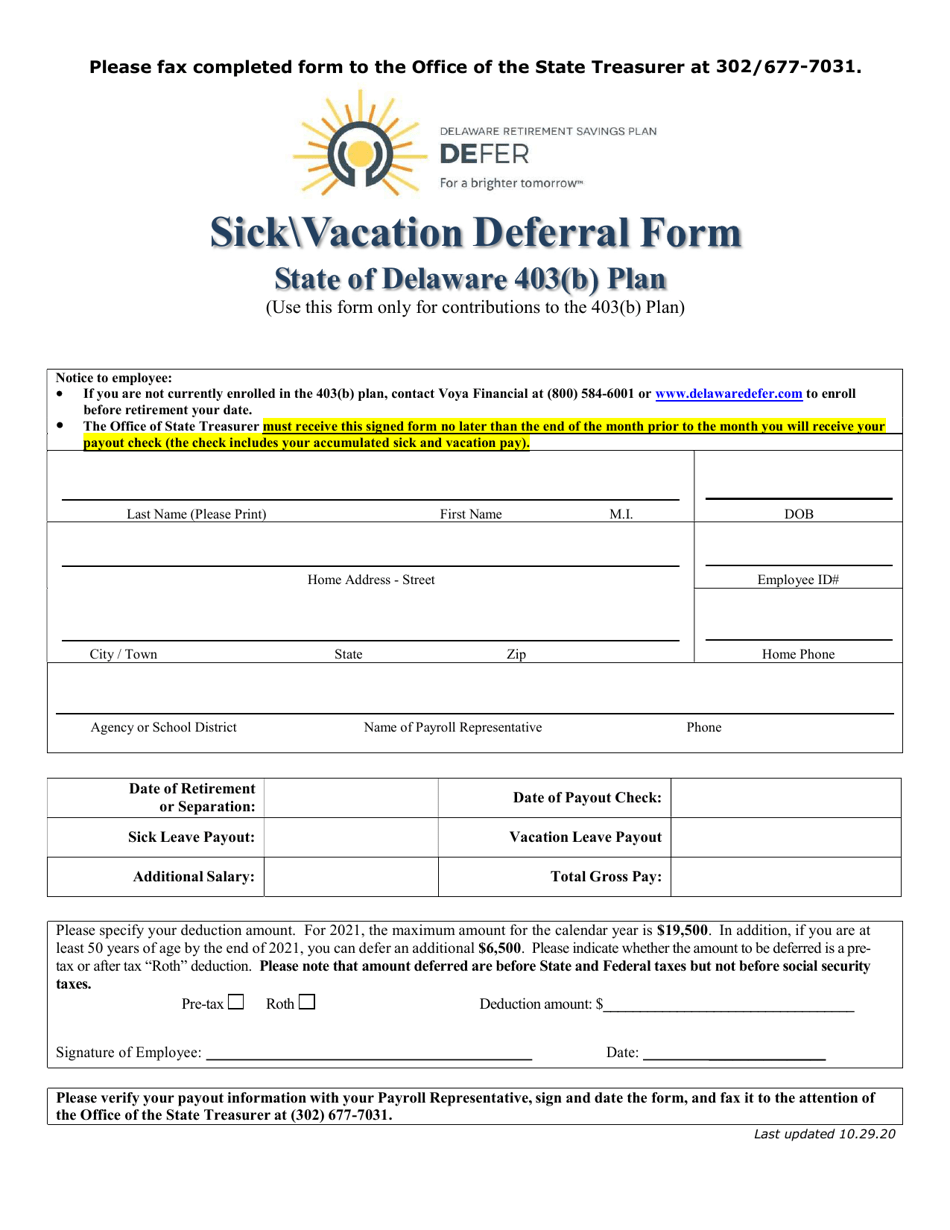

Sick and Vacation Deferral Form 403b - Delaware

Sick and Vacation Deferral Form 403b is a legal document that was released by the Delaware Office of the State Treasurer - a government authority operating within Delaware.

FAQ

Q: What is the Sick and Vacation Deferral Form 403b?

A: The Sick and Vacation Deferral Form 403b is a document used in Delaware for deferring sick and vacation time to a tax-deferred 403b retirement account.

Q: Who can use the Sick and Vacation Deferral Form 403b?

A: Employees in Delaware who are eligible to participate in a 403b retirement plan can use this form. However, it is best to consult with your employer or HR department for specific eligibility requirements.

Q: What does it mean to defer sick and vacation time?

A: Deferring sick and vacation time means setting aside a portion of your accrued time off to be contributed to a 403b retirement account instead of using it for immediate leave.

Q: Why would someone want to defer sick and vacation time?

A: Deferring sick and vacation time can have tax advantages, as the deferred amount is not subject to income tax until it is withdrawn from the 403b account.

Q: Is deferring sick and vacation time mandatory?

A: No, it is not mandatory. The decision to defer sick and vacation time is voluntary and up to the employee.

Q: Are there any limitations on how much sick and vacation time can be deferred?

A: Yes, there are limitations imposed by the Internal Revenue Service (IRS) on the amount of sick and vacation time that can be deferred to a 403b account. It is recommended to consult with a tax advisor or the IRS for specific guidelines.

Q: Can I access the deferred sick and vacation time before retirement?

A: In general, the deferred sick and vacation time in a 403b account cannot be accessed before retirement without incurring penalties. However, there may be exceptions in cases of unforeseen financial hardships. It is advisable to consult with a financial advisor or your retirement plan administrator for more information.

Q: How does deferring sick and vacation time affect my retirement savings?

A: Deferring sick and vacation time to a 403b account can help increase your retirement savings by taking advantage of potential tax benefits, depending on your tax bracket and individual circumstances.

Q: What should I do with the completed Sick and Vacation Deferral Form 403b?

A: Once you have completed the form, you should submit it to your employer or HR department as instructed. They will handle the processing and ensure that the deferral of your sick and vacation time to the 403b account is implemented correctly.

Form Details:

- Released on October 29, 2020;

- The latest edition currently provided by the Delaware Office of the State Treasurer;

- Ready to use and print;

- Easy to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a printable version of the form by clicking the link below or browse more documents and templates provided by the Delaware Office of the State Treasurer.