This version of the form is not currently in use and is provided for reference only. Download this version of

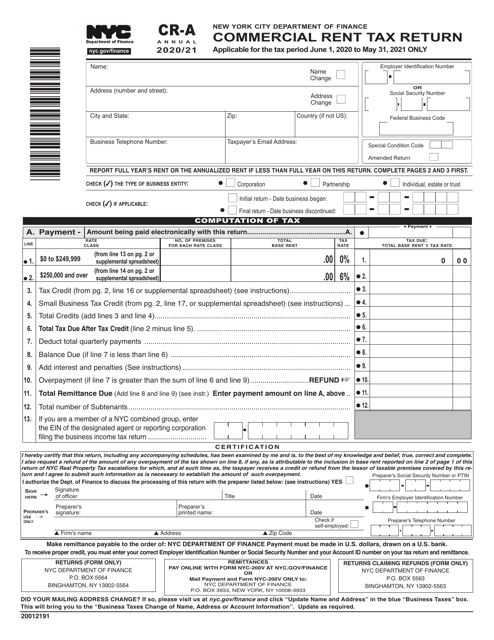

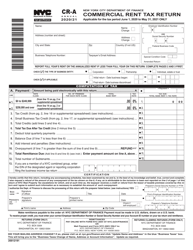

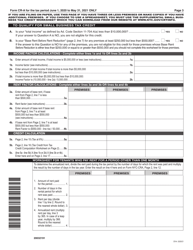

Form CR-A

for the current year.

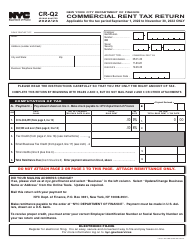

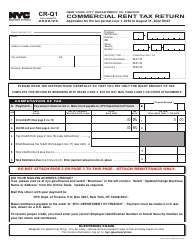

Form CR-A Commercial Rent Tax Return - New York City

What Is Form CR-A?

This is a legal form that was released by the New York City Department of Finance - a government authority operating within New York City. Check the official instructions before completing and submitting the form.

FAQ

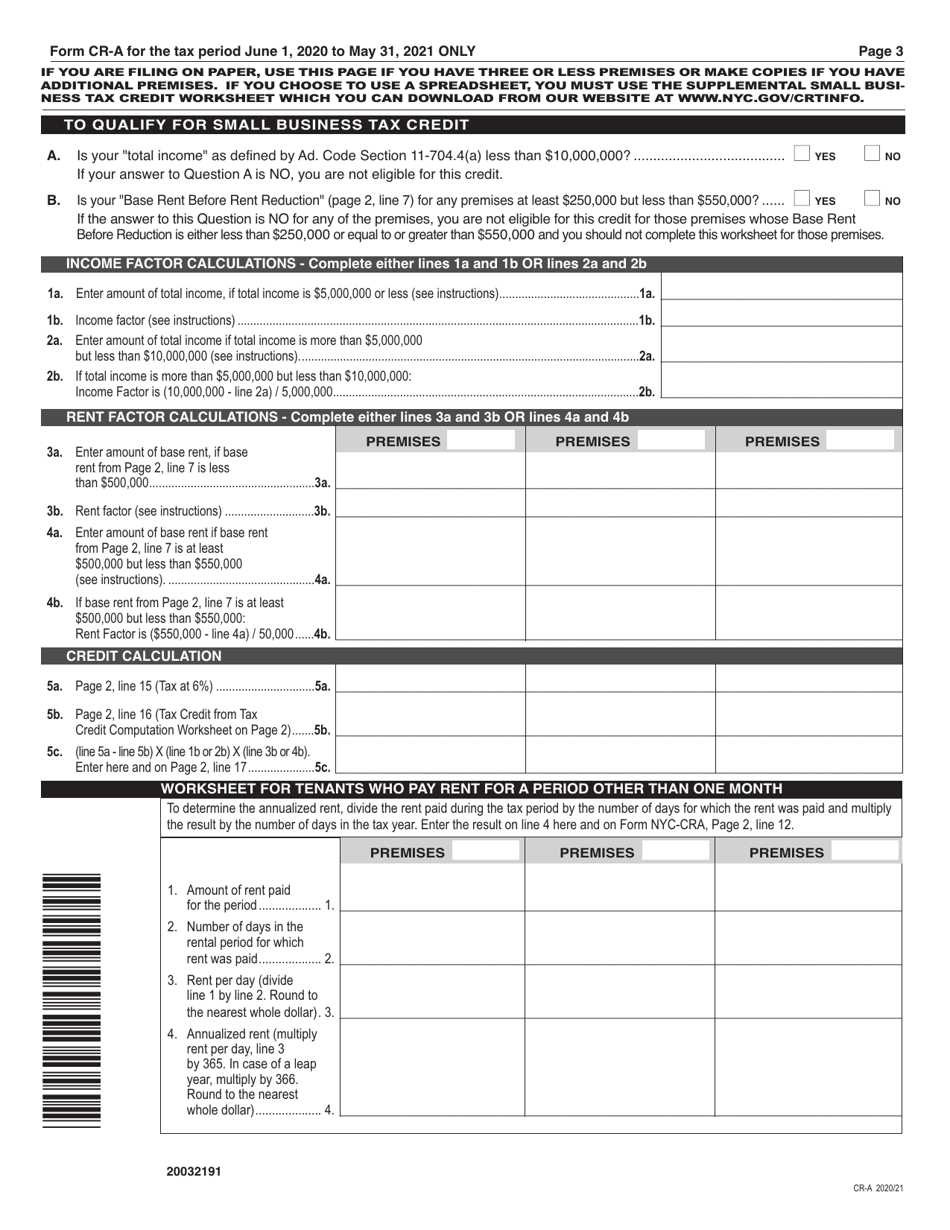

Q: What is the Form CR-A Commercial Rent Tax Return?

A: The Form CR-A is a tax return filed by commercial property owners in New York City.

Q: Who is required to file the Form CR-A Commercial Rent Tax Return?

A: Commercial property owners in New York City must file the Form CR-A.

Q: What is the purpose of the Commercial Rent Tax?

A: The Commercial Rent Tax is a tax imposed by New York City on certain commercial property rentals.

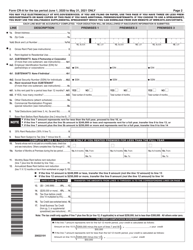

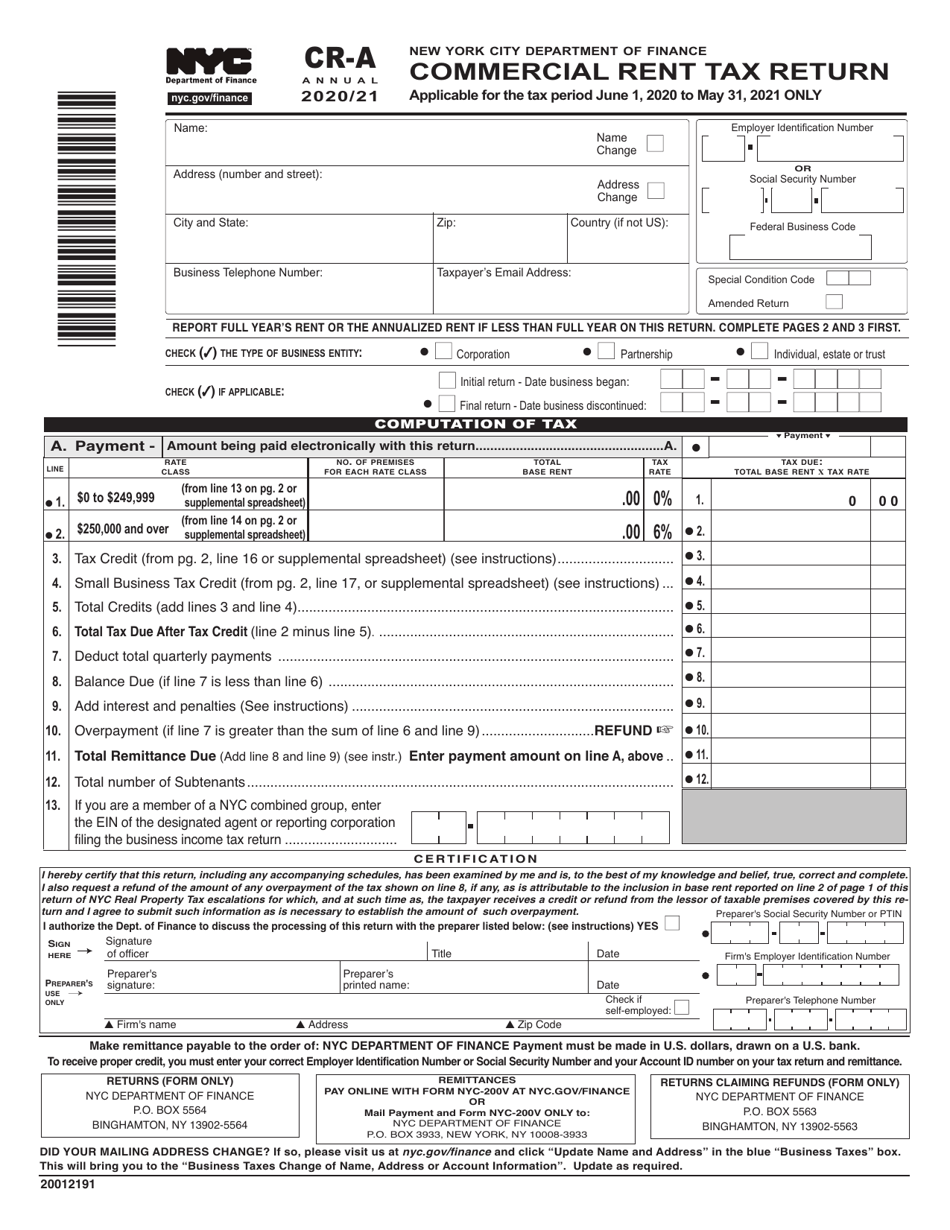

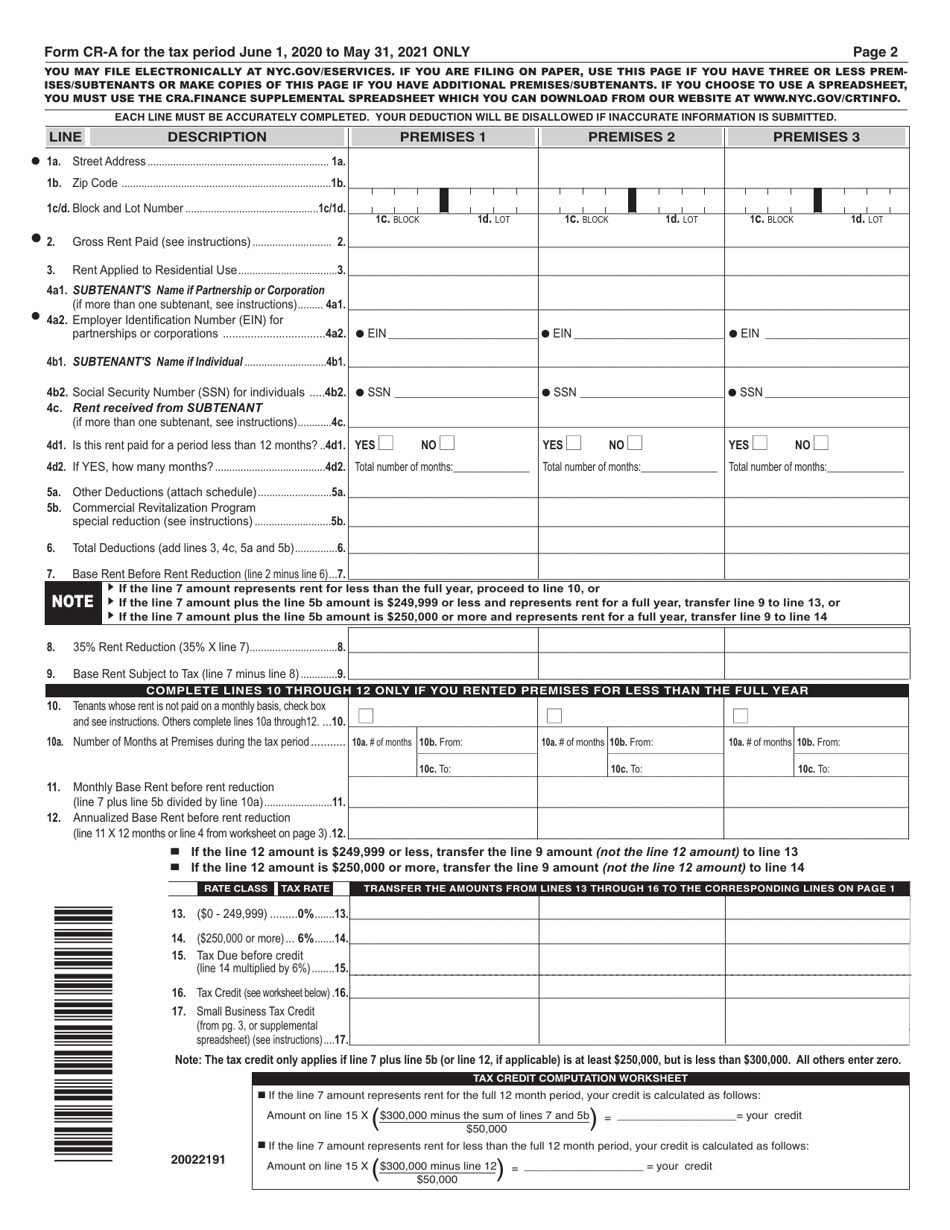

Q: What information do I need to complete the Form CR-A?

A: You will need information about your rental activities, including the amount of rent received and expenses related to the rental property.

Q: When is the Form CR-A Commercial Rent Tax Return due?

A: The Form CR-A is generally due on an annual basis on June 20th.

Form Details:

- The latest edition provided by the New York City Department of Finance;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a printable version of Form CR-A by clicking the link below or browse more documents and templates provided by the New York City Department of Finance.