This version of the form is not currently in use and is provided for reference only. Download this version of

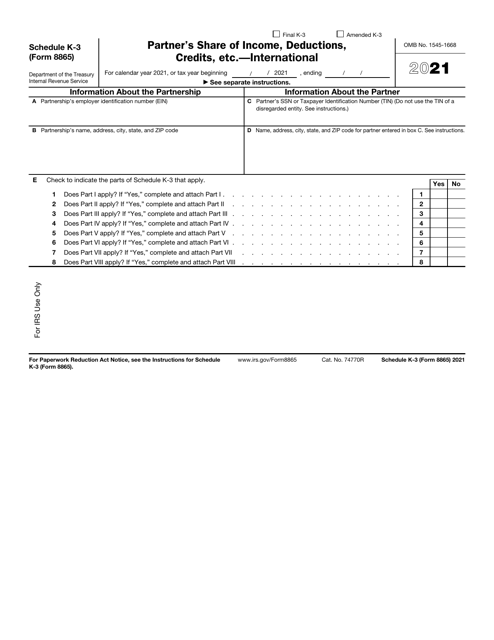

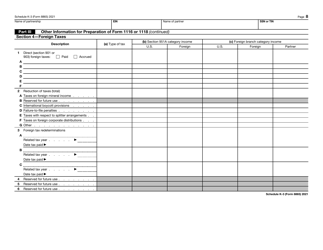

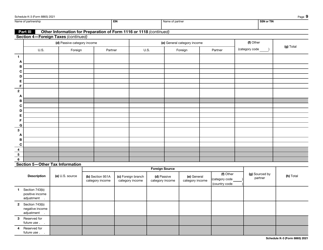

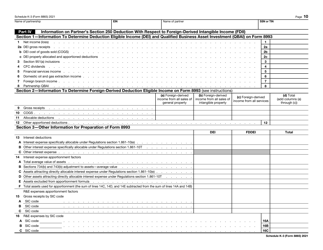

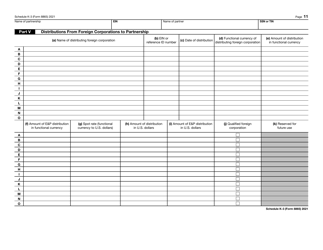

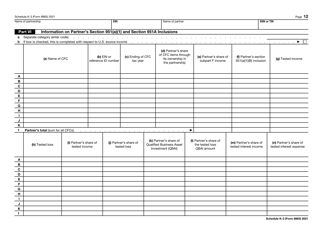

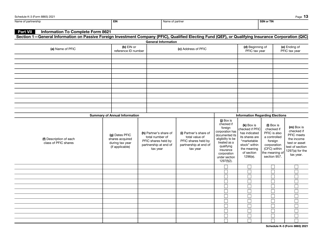

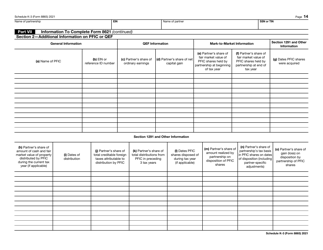

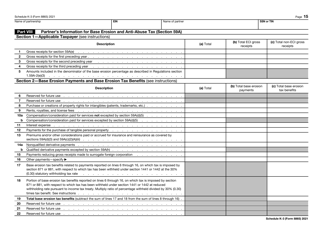

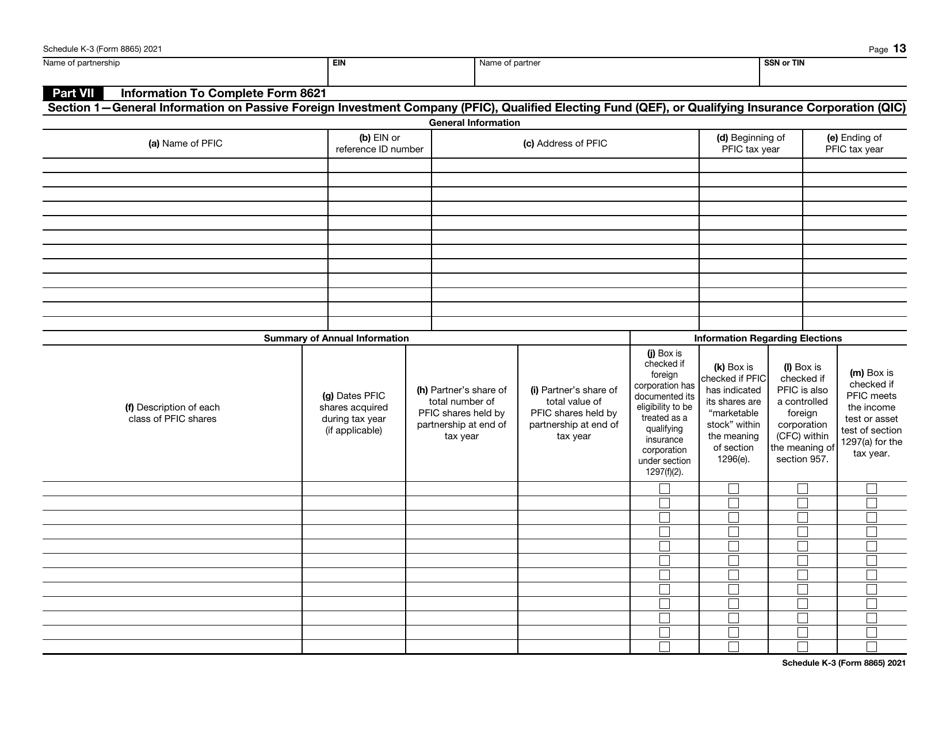

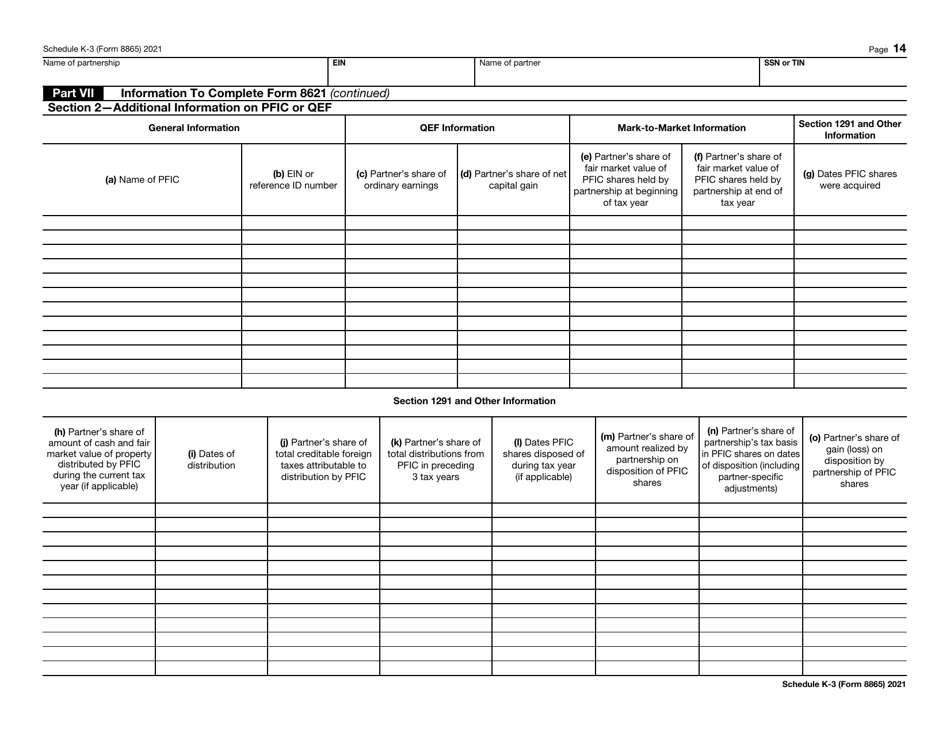

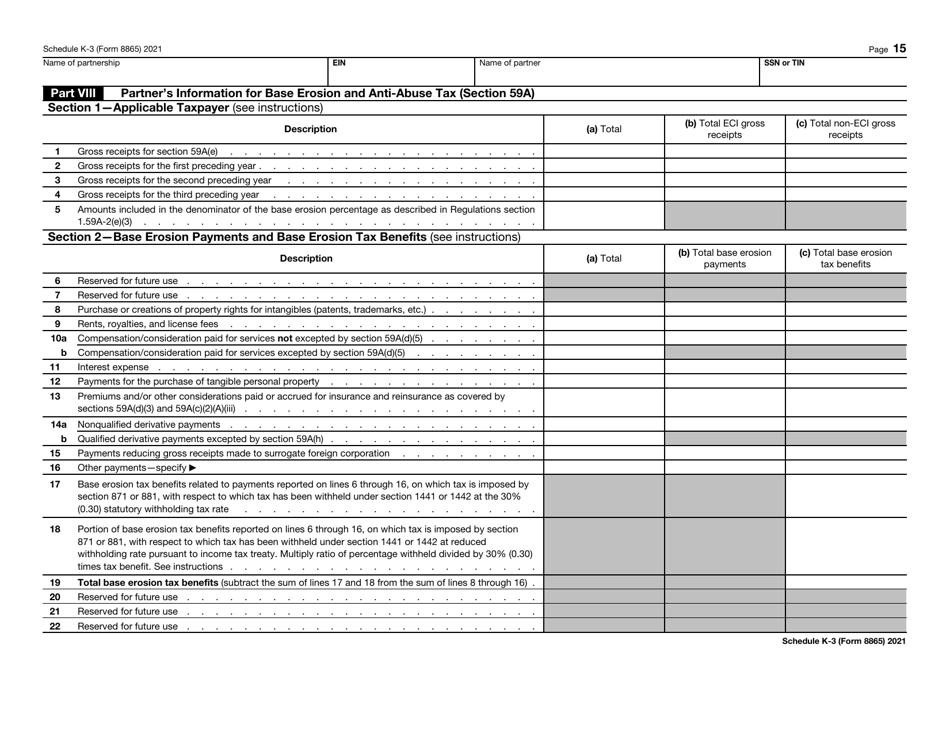

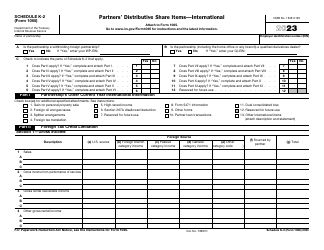

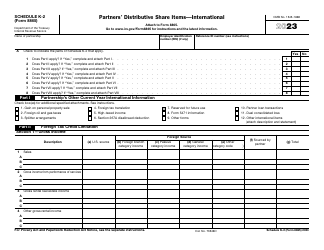

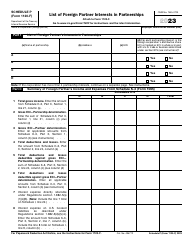

IRS Form 8865 Schedule K-3

for the current year.

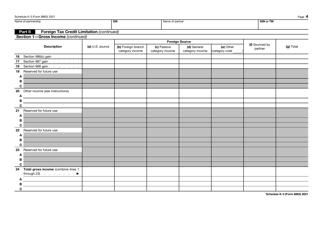

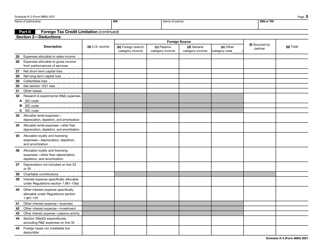

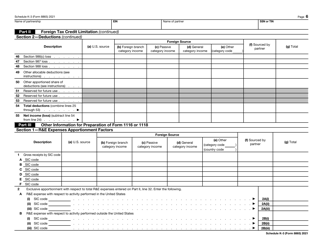

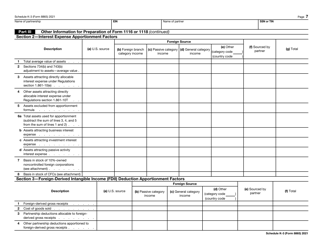

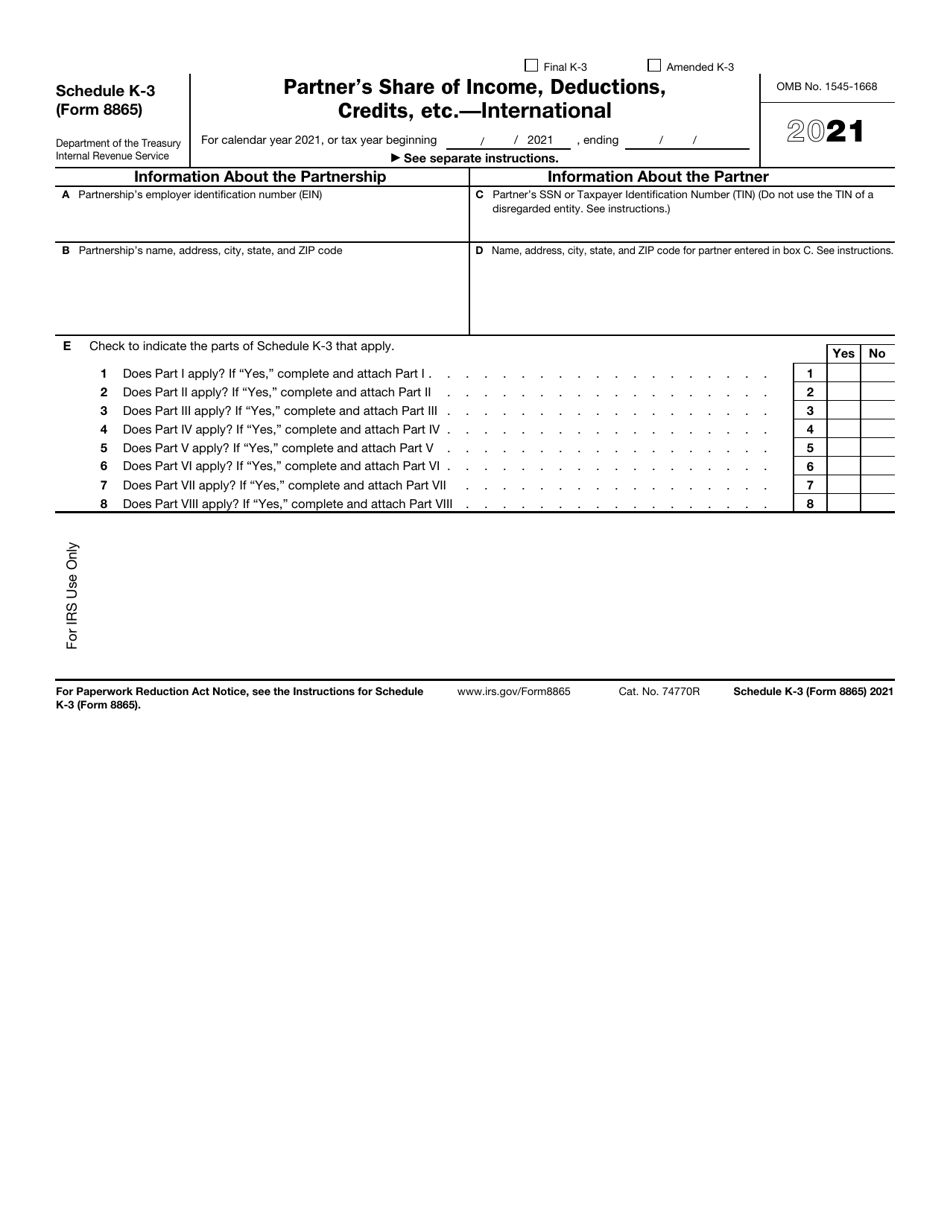

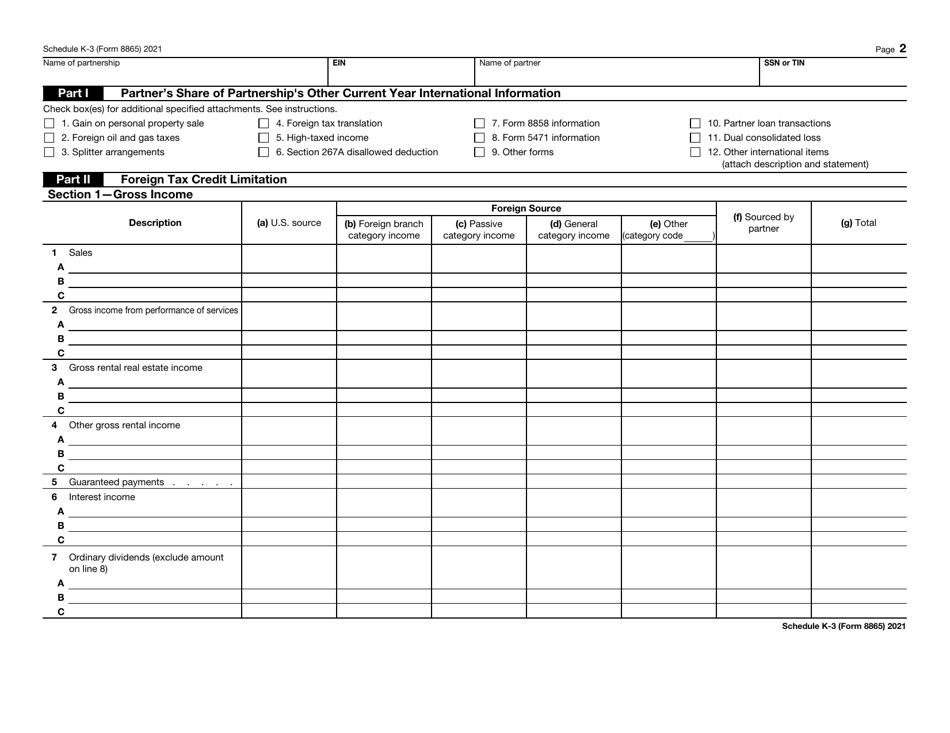

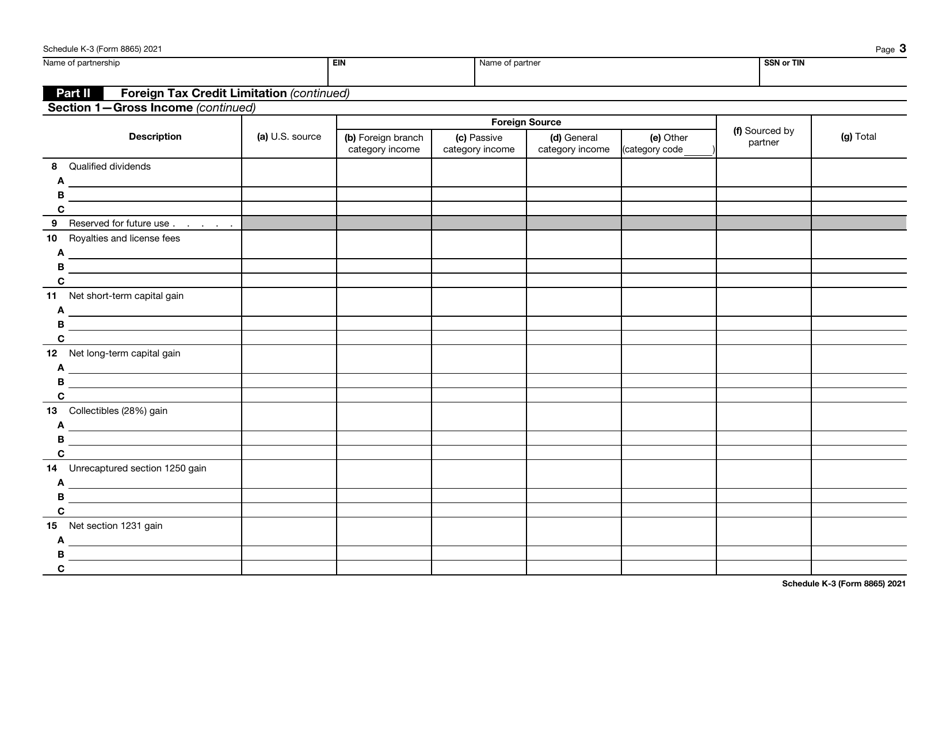

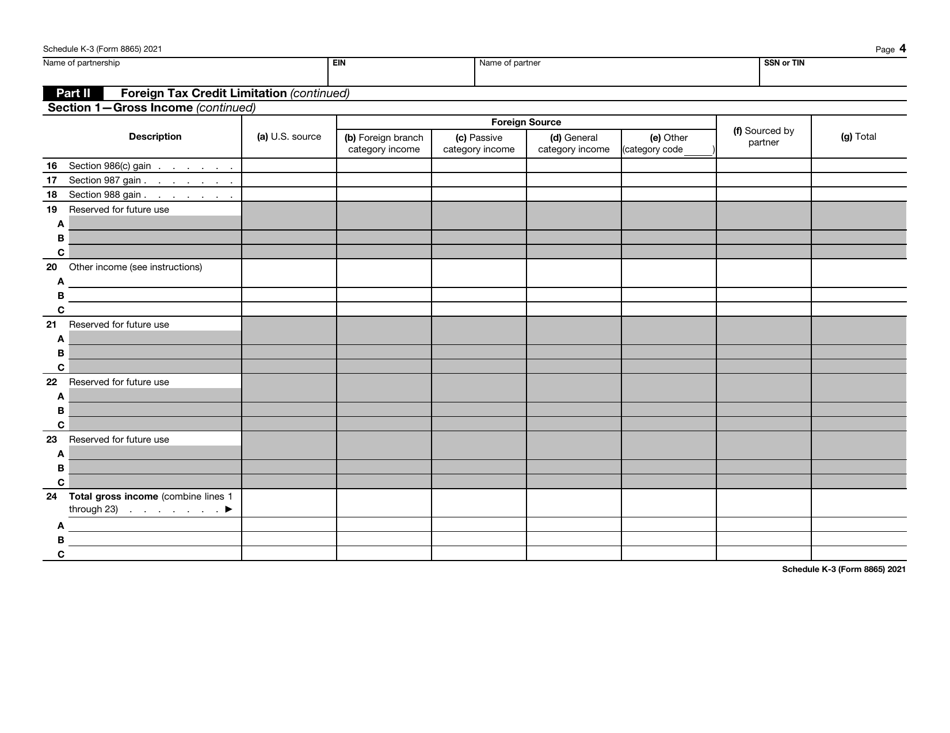

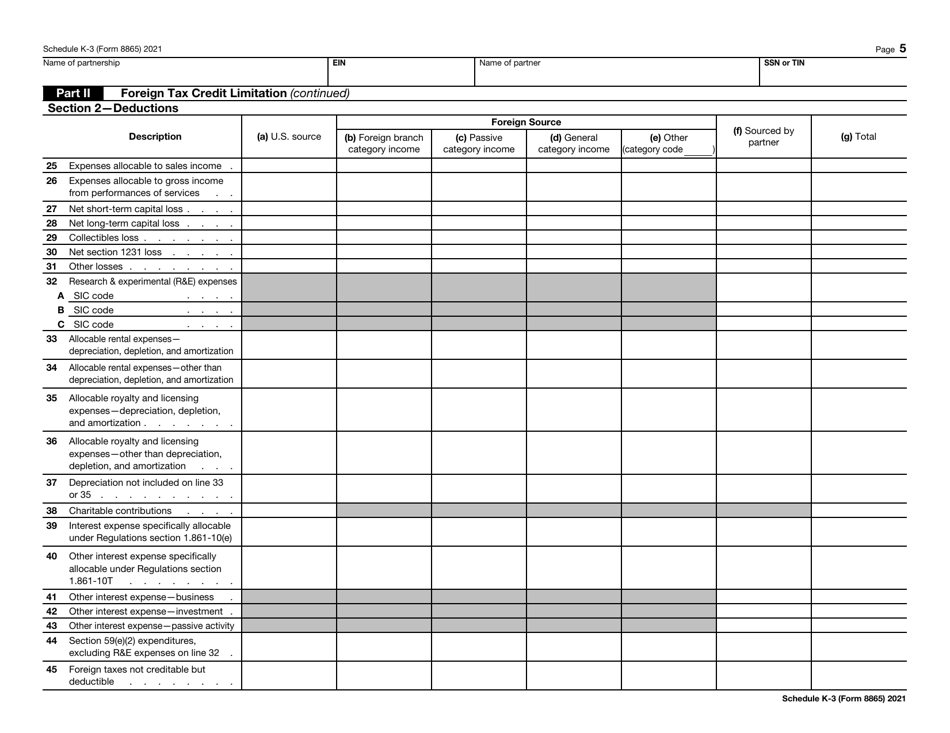

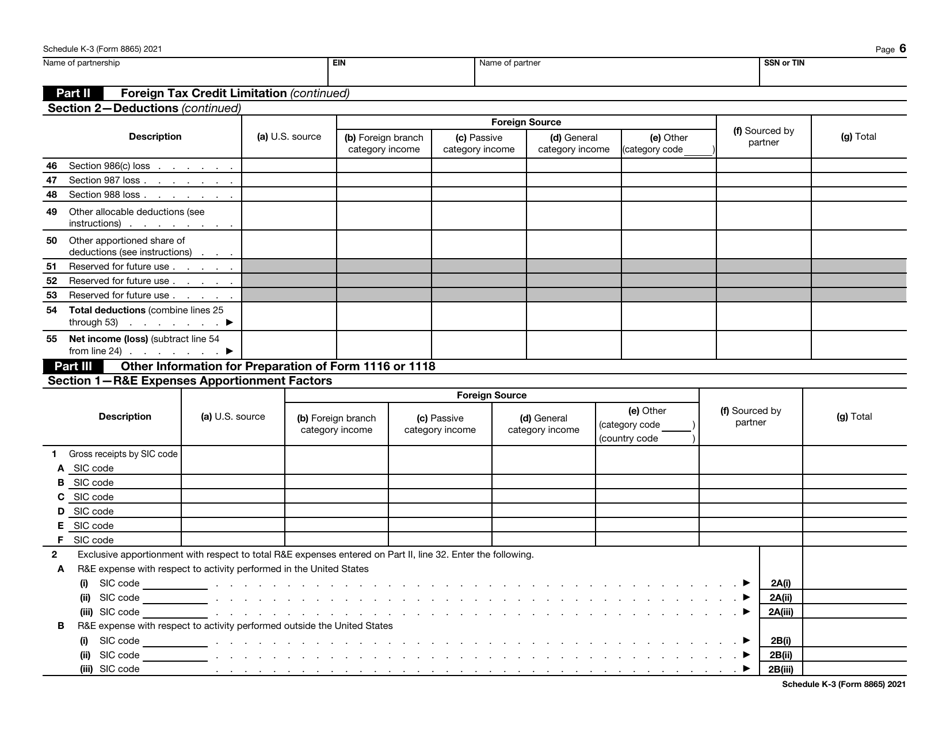

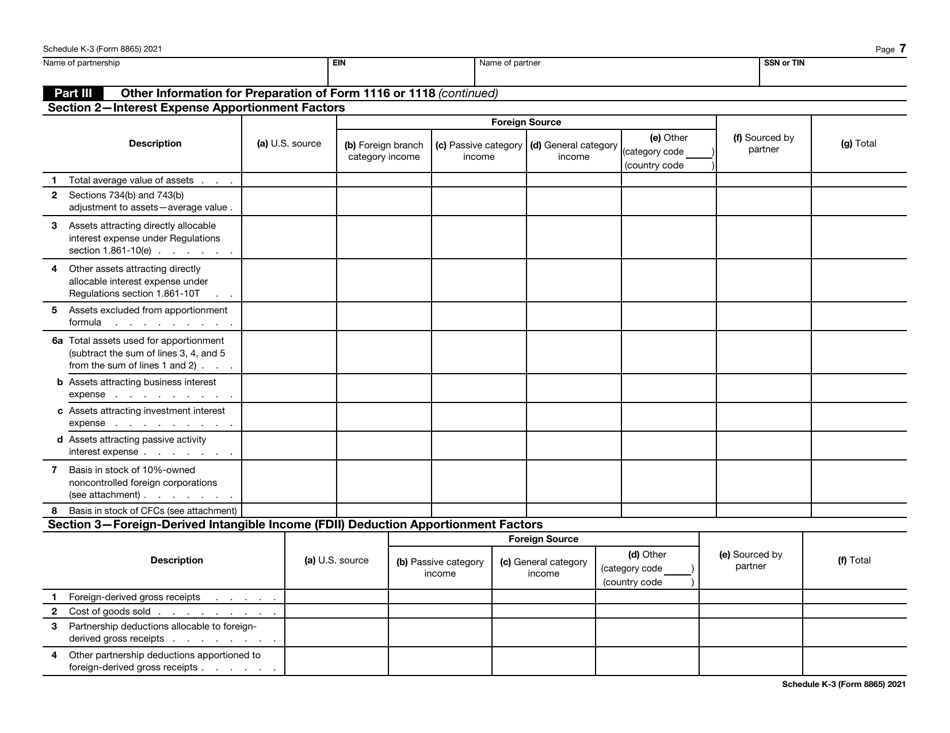

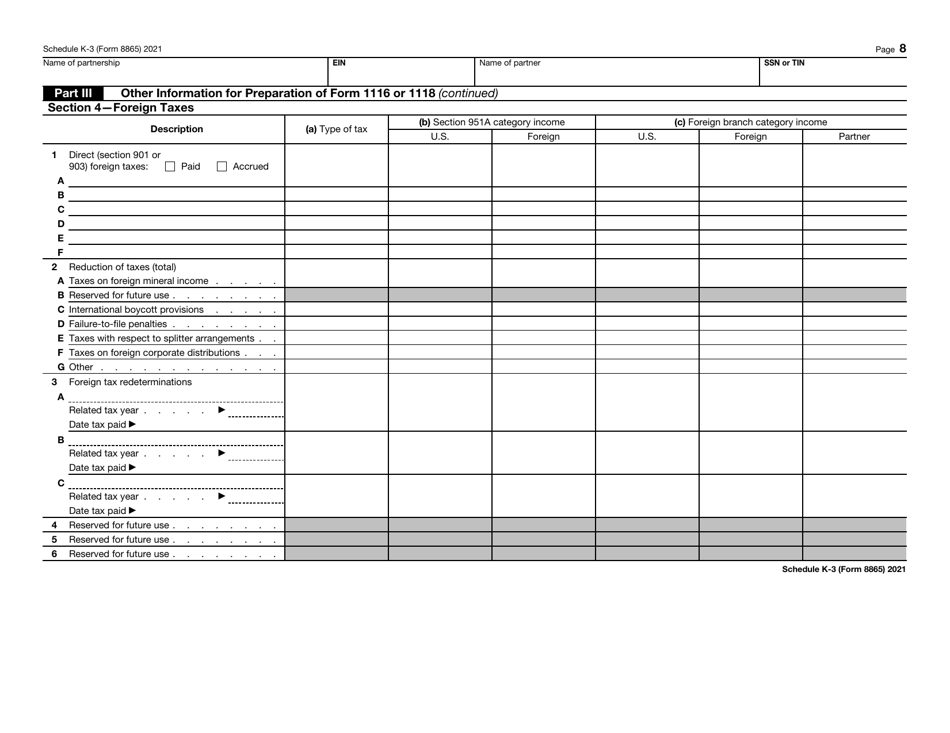

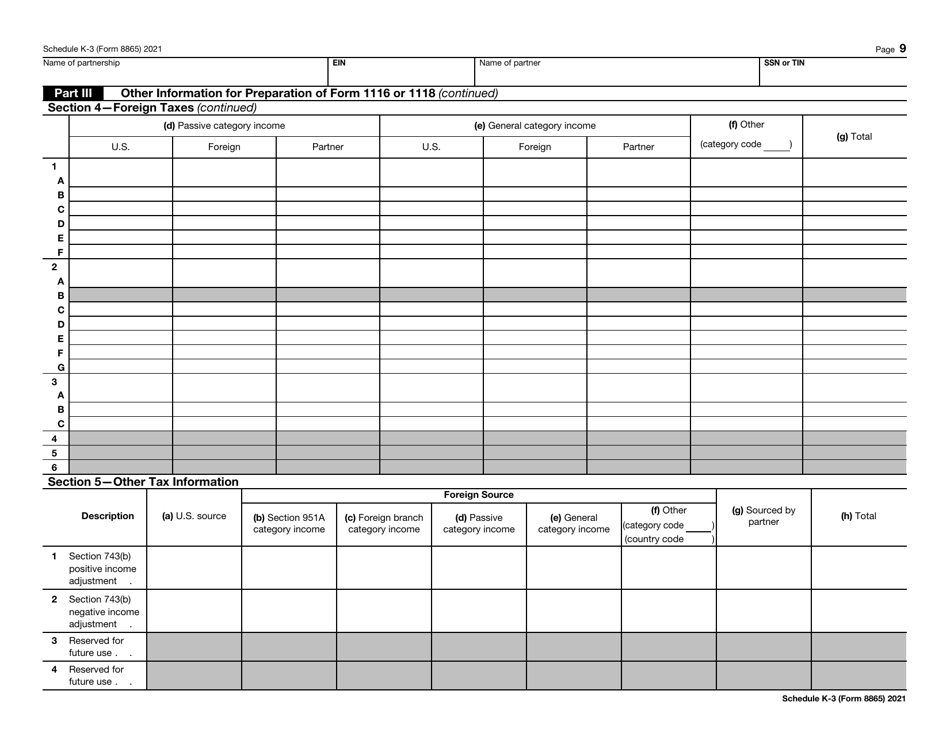

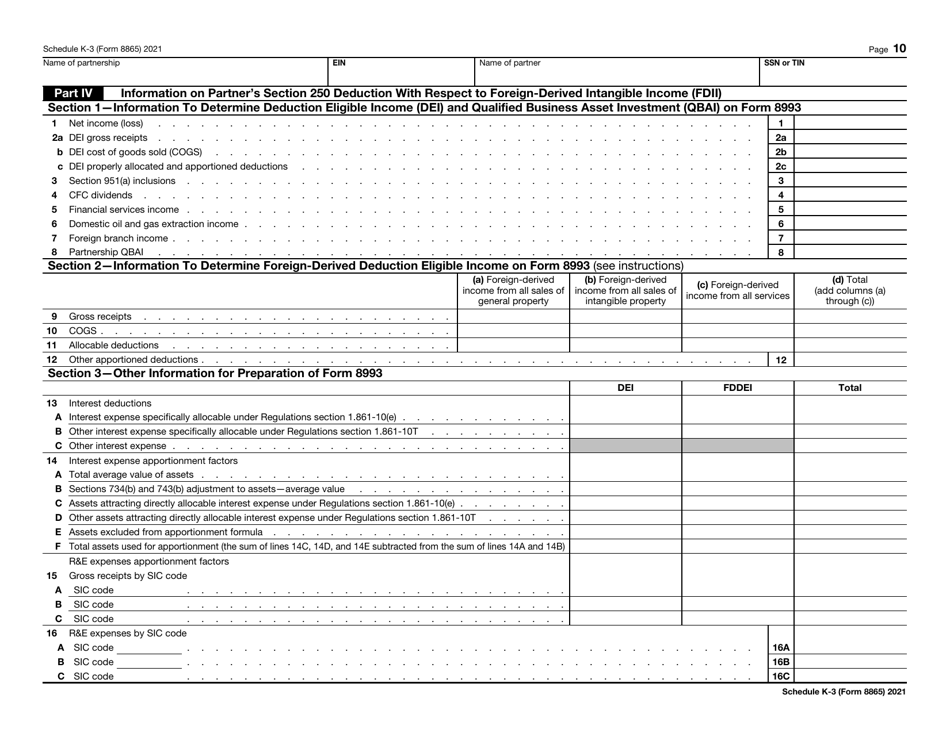

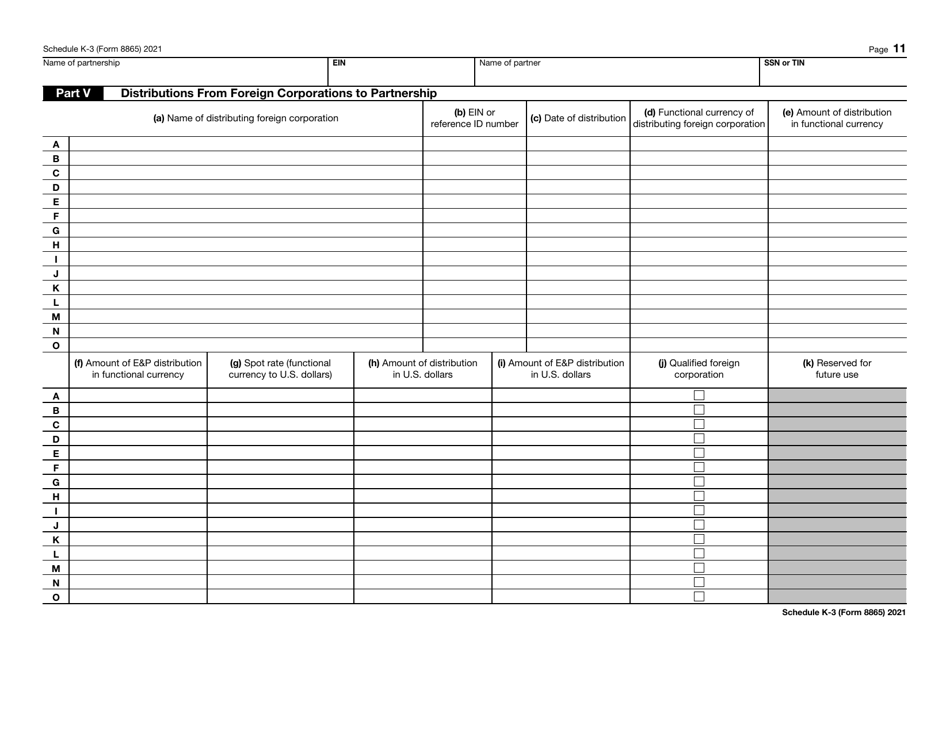

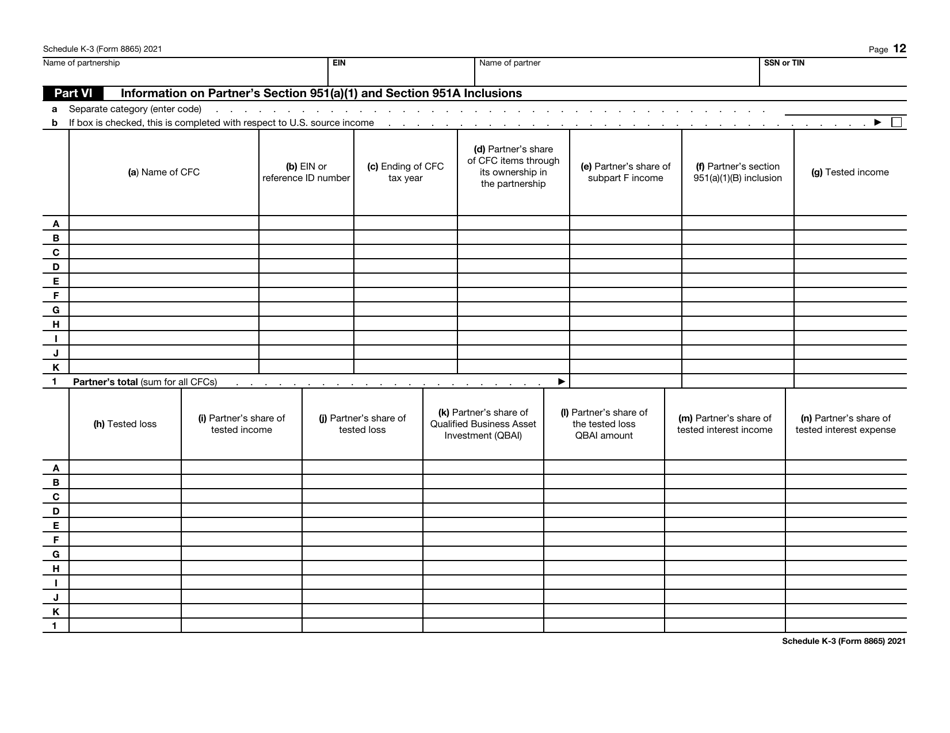

IRS Form 8865 Schedule K-3 Partner's Share of Income, Deductions, Credits, Etc. - International

What Is IRS Form 8865 Schedule K-3?

This is a tax form that was released by the Internal Revenue Service (IRS) - a subdivision of the U.S. Department of the Treasury. Check the official IRS-issued instructions before completing and submitting the form.

FAQ

Q: What is IRS Form 8865 Schedule K-3?

A: IRS Form 8865 Schedule K-3 is a tax form used by partners of a partnership to report their share of income, deductions, credits, and other information related to international transactions.

Q: Who needs to file IRS Form 8865 Schedule K-3?

A: Partners of a partnership engaged in international transactions need to file IRS Form 8865 Schedule K-3.

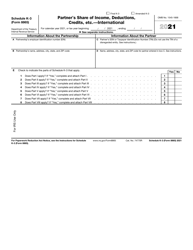

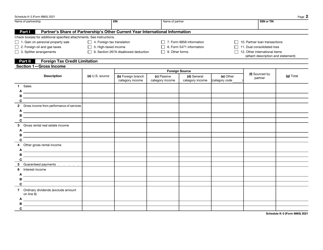

Q: What information is reported on IRS Form 8865 Schedule K-3?

A: IRS Form 8865 Schedule K-3 reports the partner's share of income, deductions, credits, etc., specifically related to international transactions.

Q: Is IRS Form 8865 Schedule K-3 required for domestic transactions?

A: No, IRS Form 8865 Schedule K-3 is specifically for reporting international transactions.

Q: When is the deadline for filing IRS Form 8865 Schedule K-3?

A: The deadline for filing IRS Form 8865 Schedule K-3 is generally the same as the deadline for filing the partnership's tax return, which is the 15th day of the third month following the end of the partnership's tax year.

Form Details:

- A 15-page form available for download in PDF;

- This form cannot be used to file taxes for the current year. Choose a more recent version to file for the current tax year;

- Editable, printable, and free;

- Fill out the form in our online filing application.

Download a fillable version of IRS Form 8865 Schedule K-3 through the link below or browse more documents in our library of IRS Forms.