This version of the form is not currently in use and is provided for reference only. Download this version of

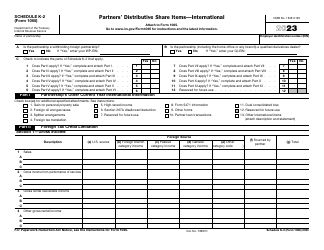

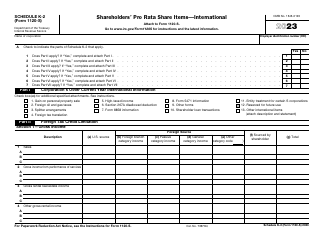

IRS Form 8865 Schedule K-2

for the current year.

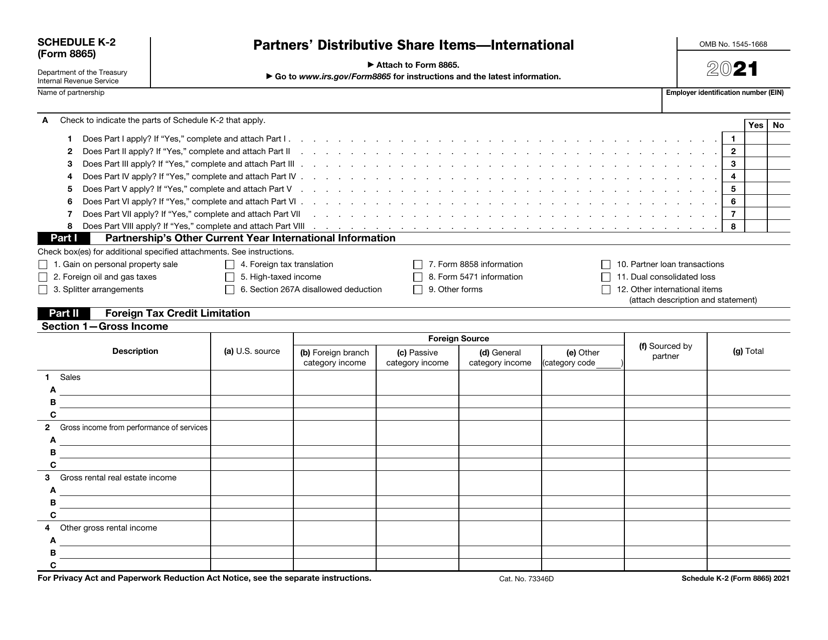

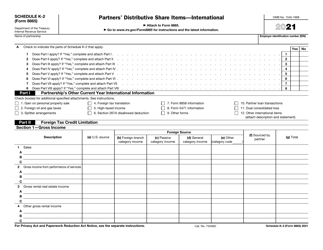

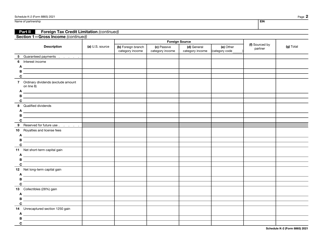

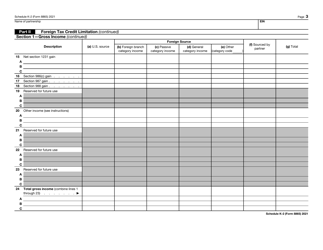

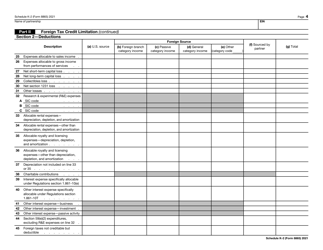

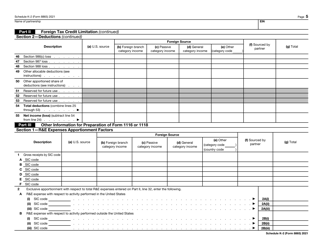

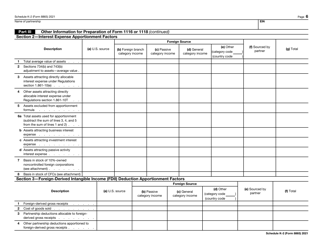

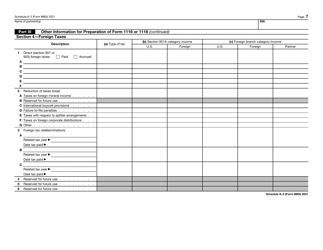

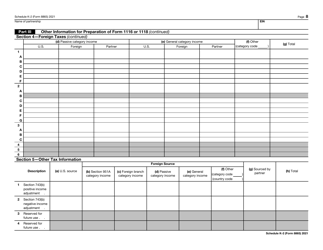

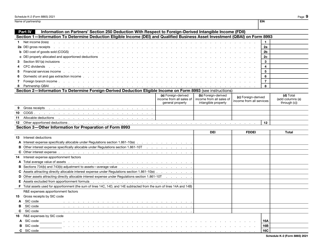

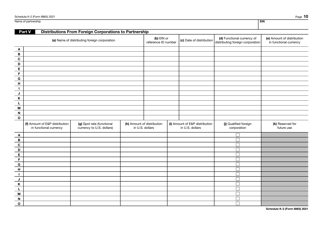

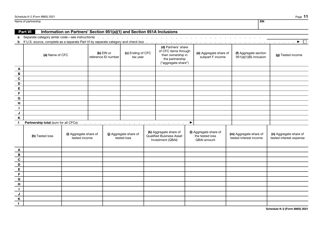

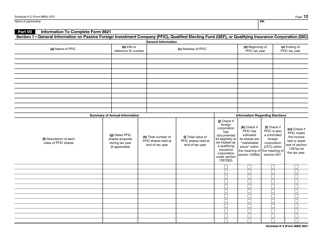

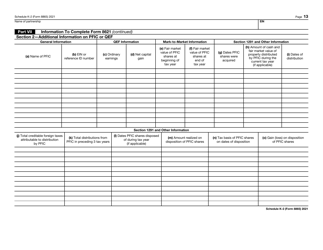

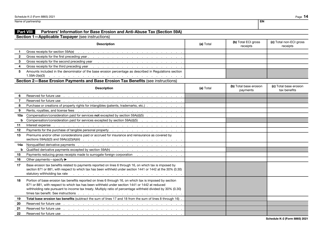

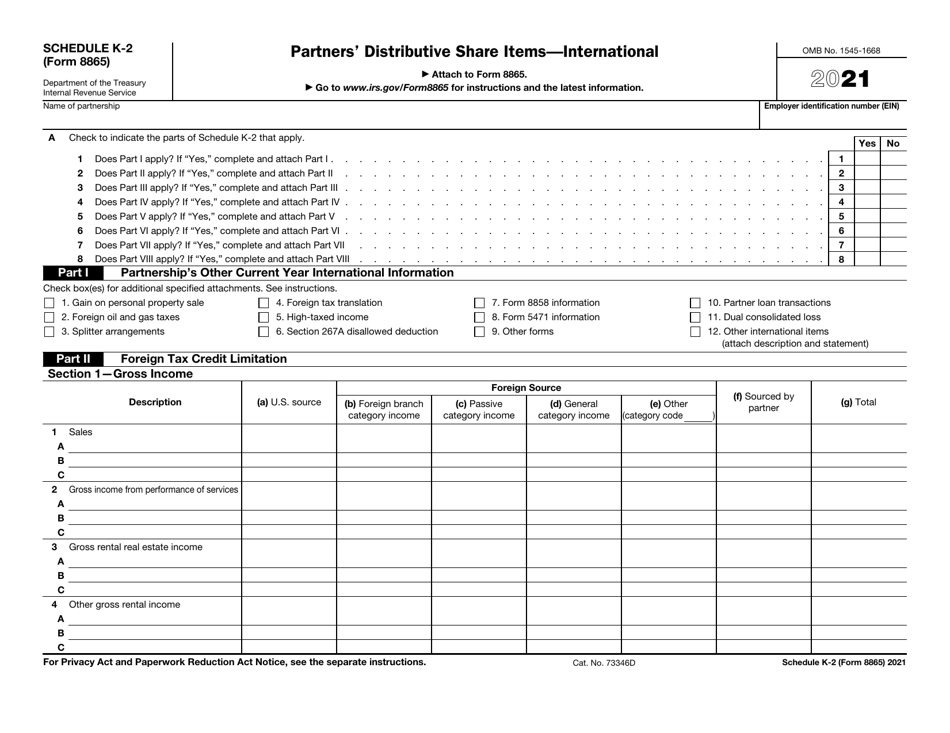

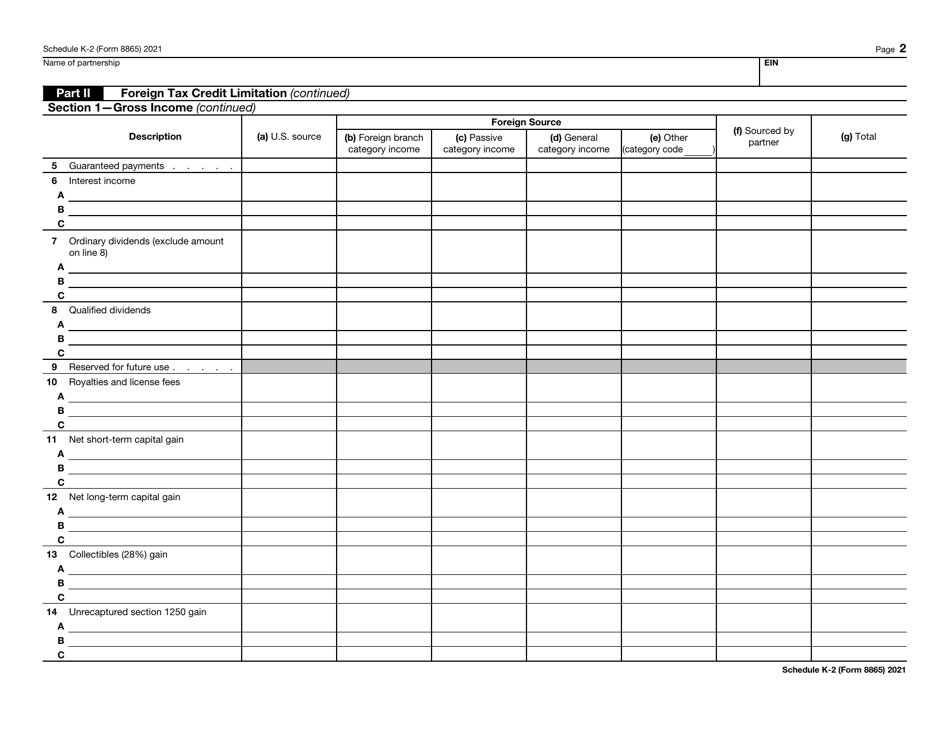

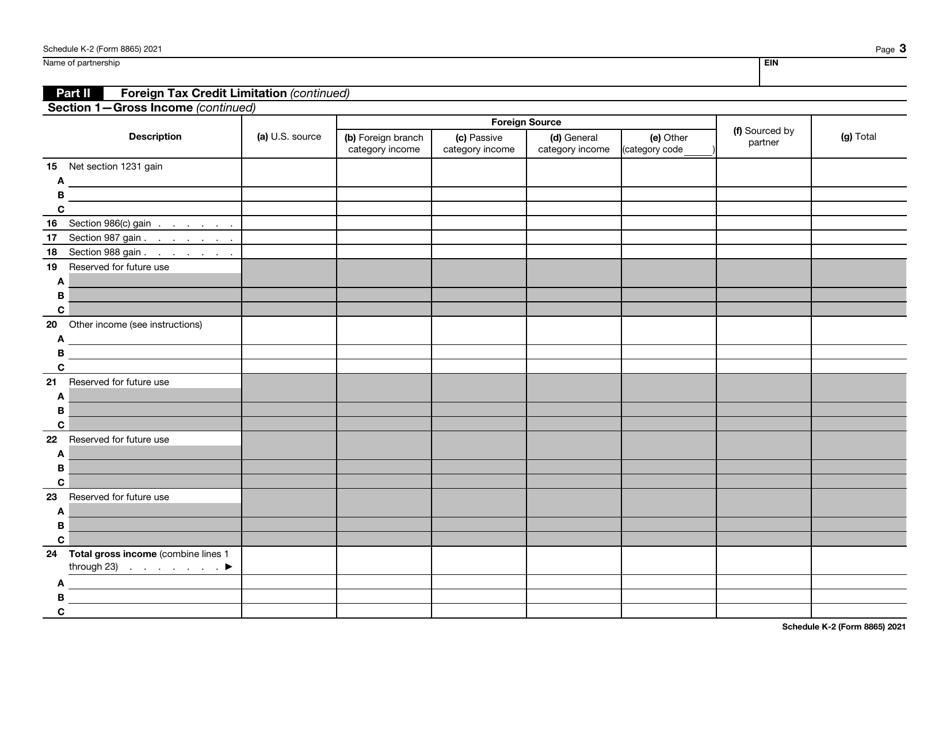

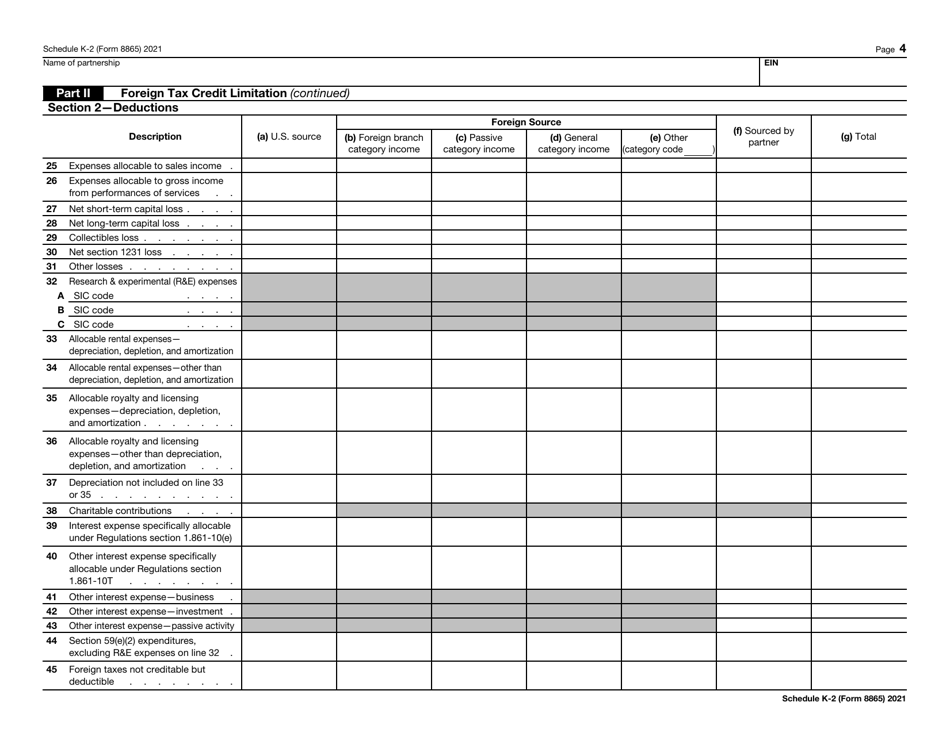

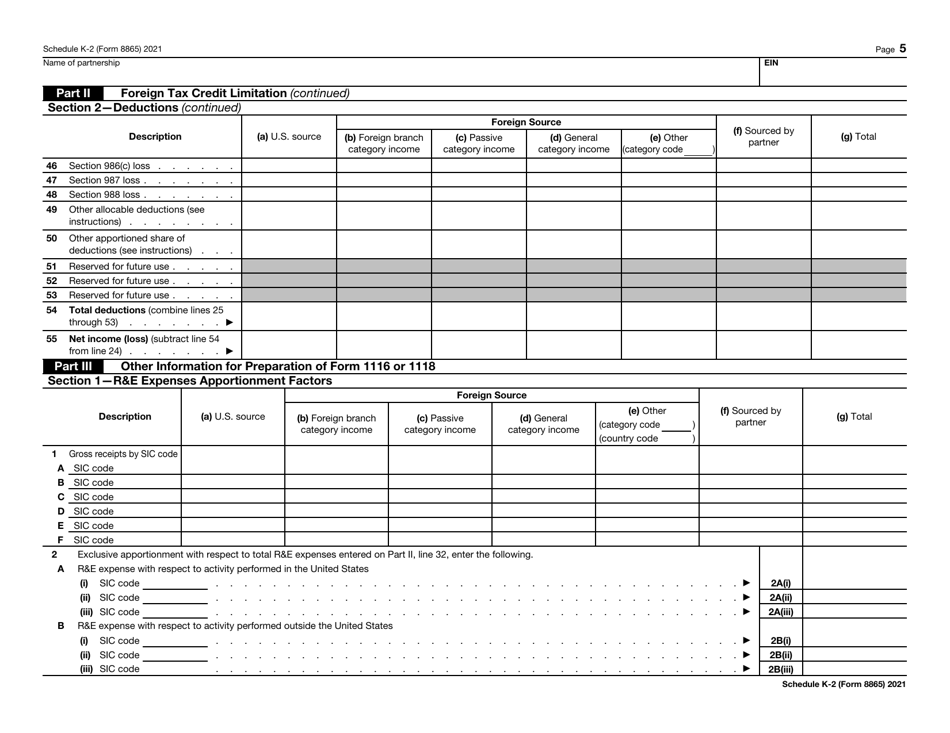

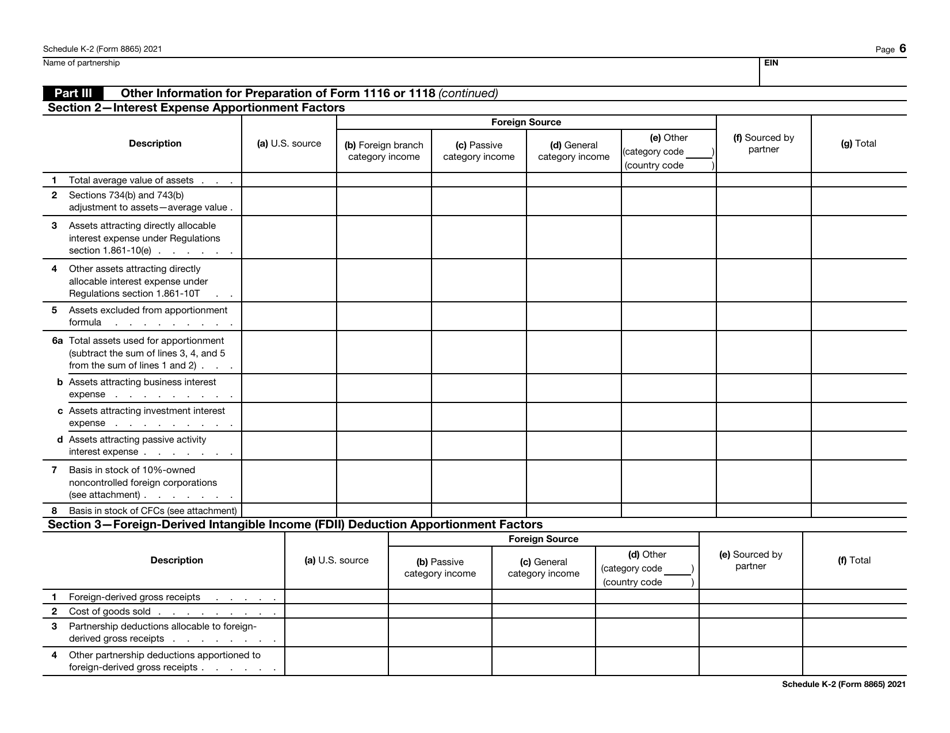

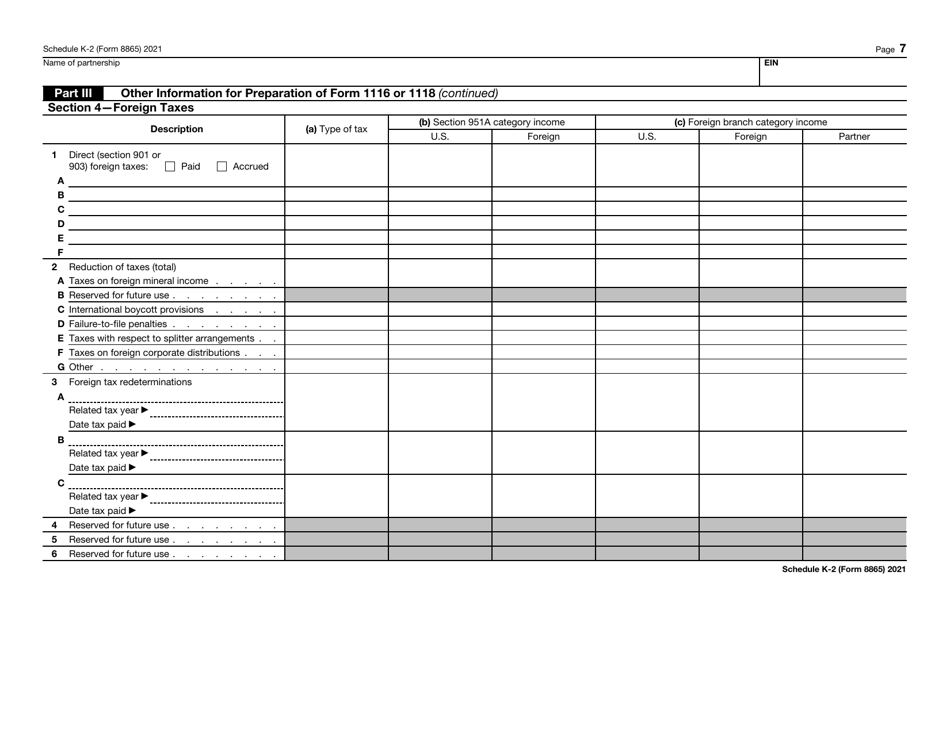

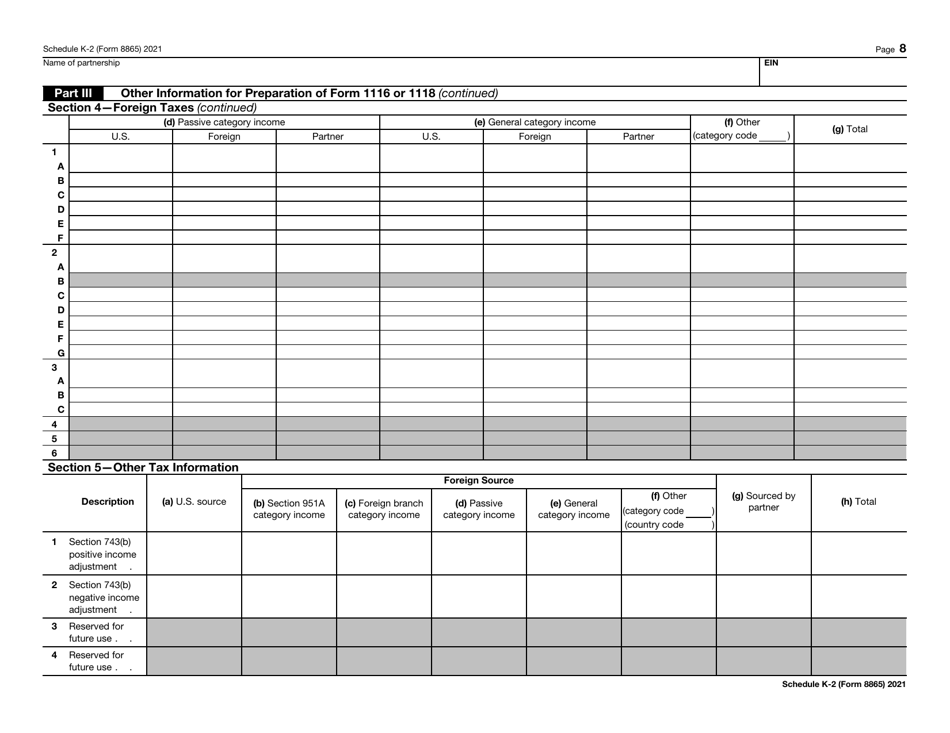

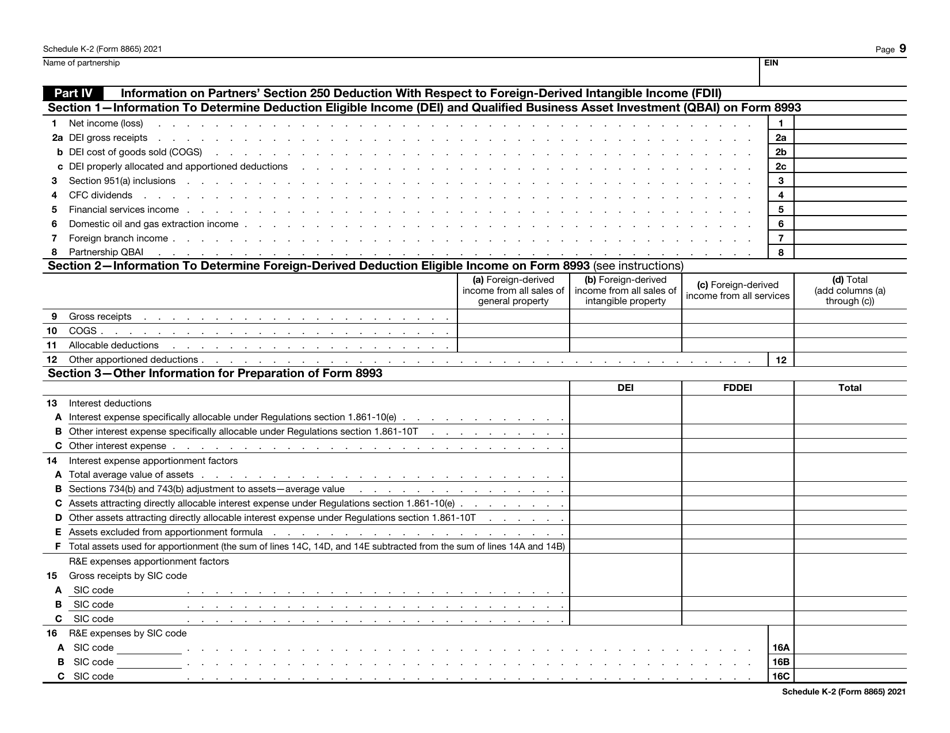

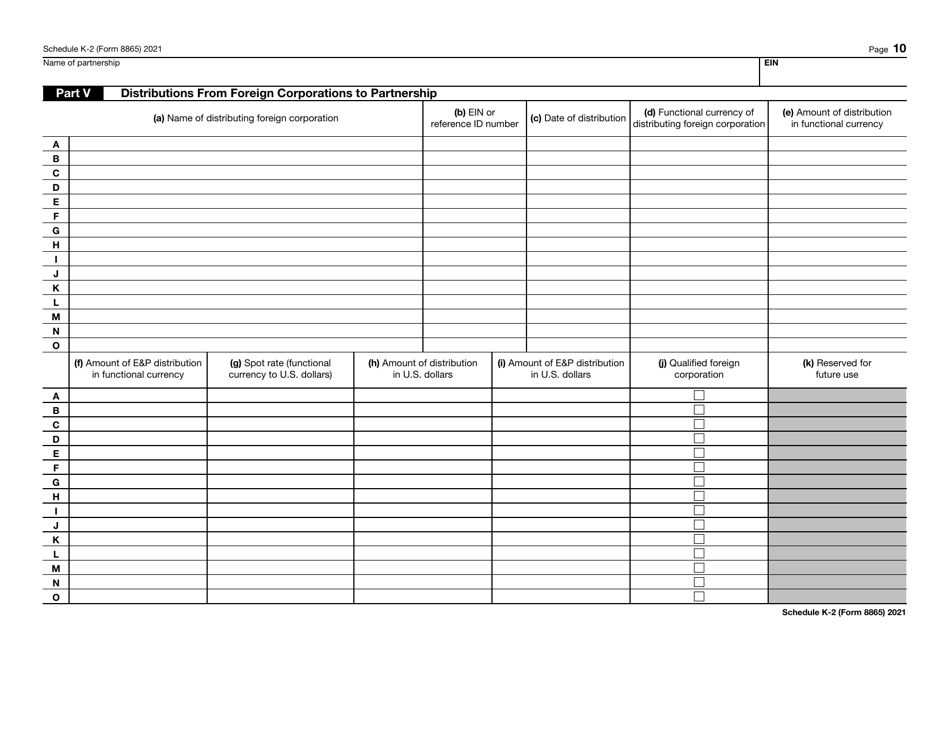

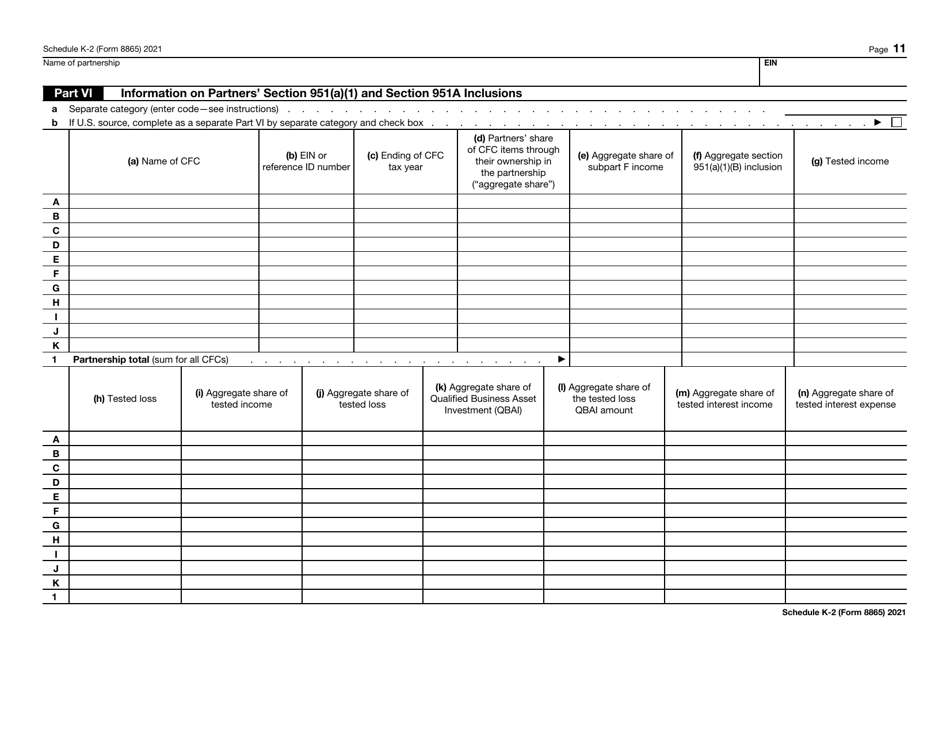

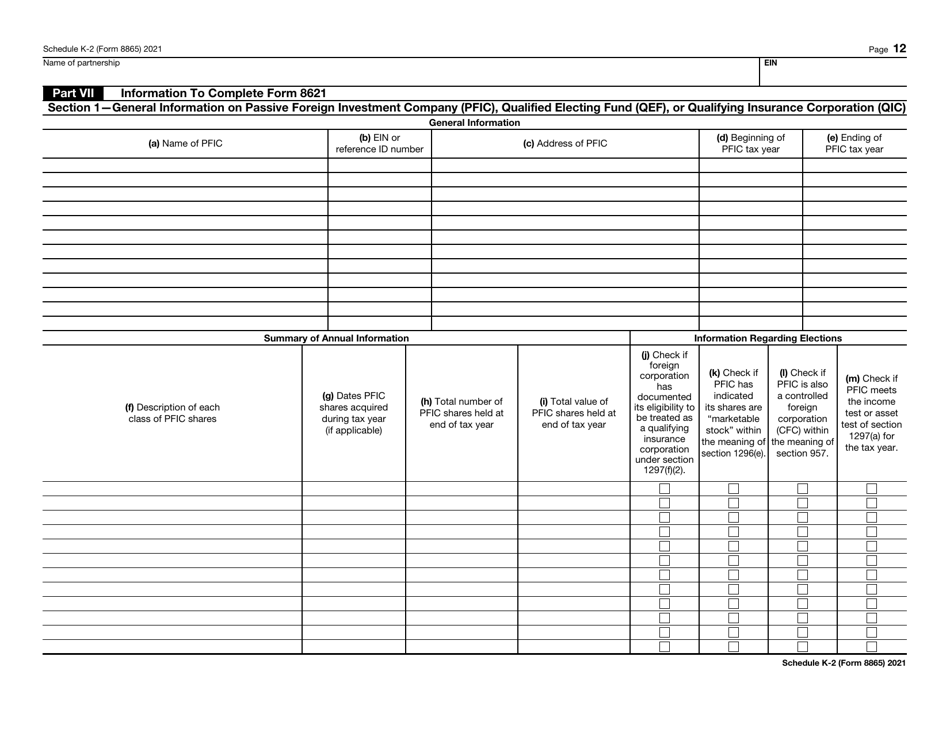

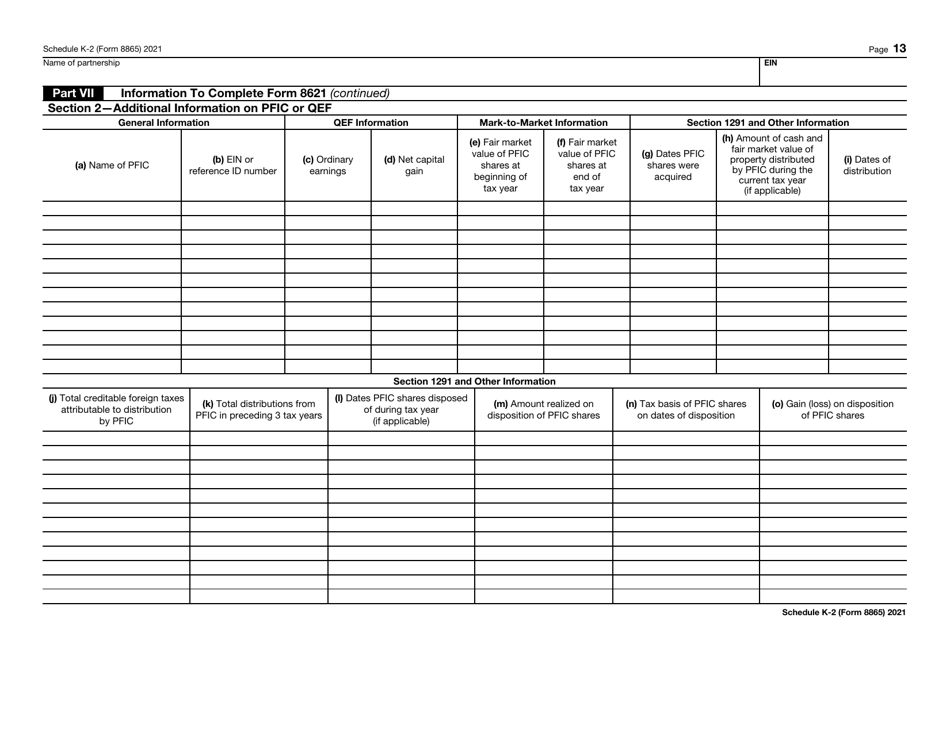

IRS Form 8865 Schedule K-2 Partners' Distributive Share Items - International

What Is IRS Form 8865 Schedule K-2?

This is a tax form that was released by the Internal Revenue Service (IRS) - a subdivision of the U.S. Department of the Treasury. Check the official IRS-issued instructions before completing and submitting the form.

FAQ

Q: What is IRS Form 8865 Schedule K-2?

A: IRS Form 8865 Schedule K-2 is a tax form used by partners in a partnership to report their share of certain international items.

Q: Who needs to fill out IRS Form 8865 Schedule K-2?

A: Partners in a partnership that have certain international items to report need to fill out IRS Form 8865 Schedule K-2.

Q: What are partners' distributive share items?

A: Partners' distributive share items refer to the profits, losses, deductions, and credits that each partner is entitled to based on their ownership percentage in the partnership.

Q: What are international items?

A: International items are items that have an international tax aspect, such as income, expenses, credits, or taxes paid in foreign countries.

Q: What information is reported on IRS Form 8865 Schedule K-2?

A: IRS Form 8865 Schedule K-2 reports the partners' distributive share of certain international items, including income, deductions, and taxes paid or accrued in foreign countries.

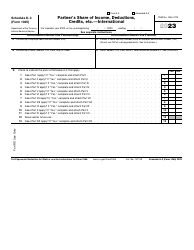

Form Details:

- A 14-page form available for download in PDF;

- This form cannot be used to file taxes for the current year. Choose a more recent version to file for the current tax year;

- Editable, printable, and free;

- Fill out the form in our online filing application.

Download a fillable version of IRS Form 8865 Schedule K-2 through the link below or browse more documents in our library of IRS Forms.