This version of the form is not currently in use and is provided for reference only. Download this version of

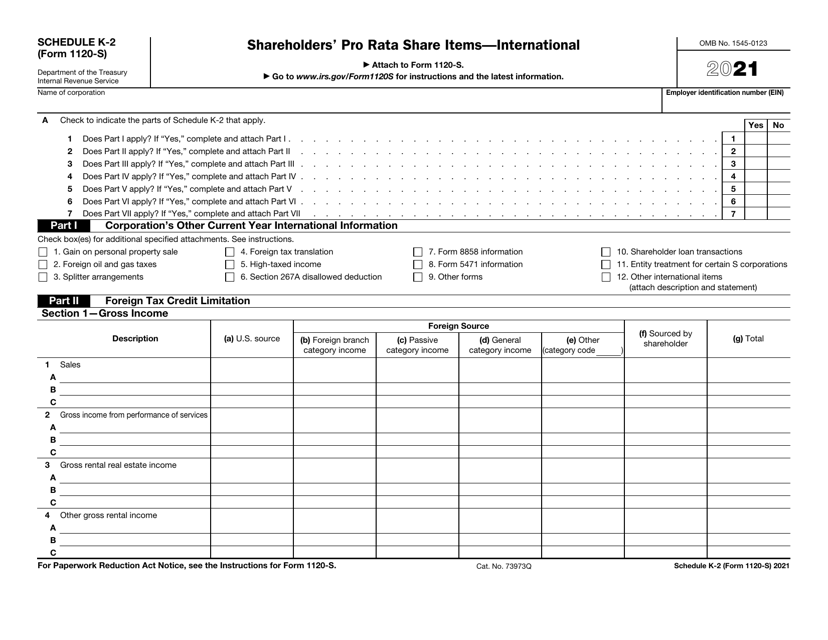

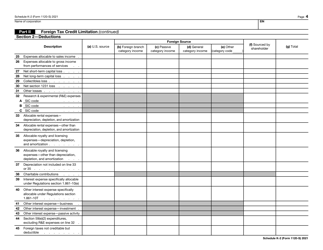

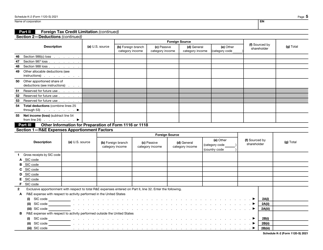

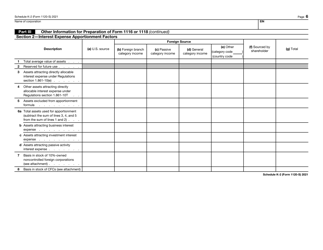

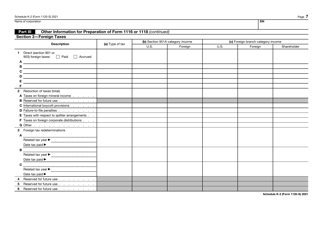

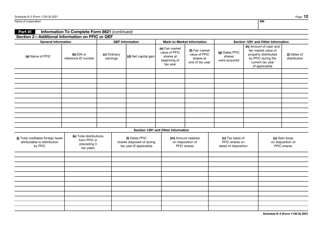

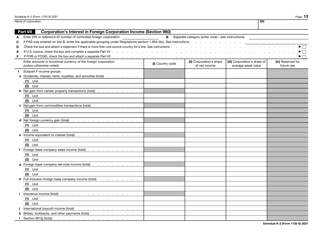

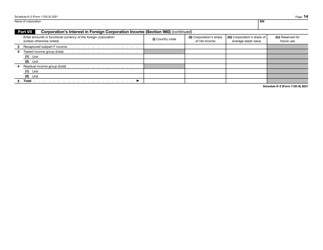

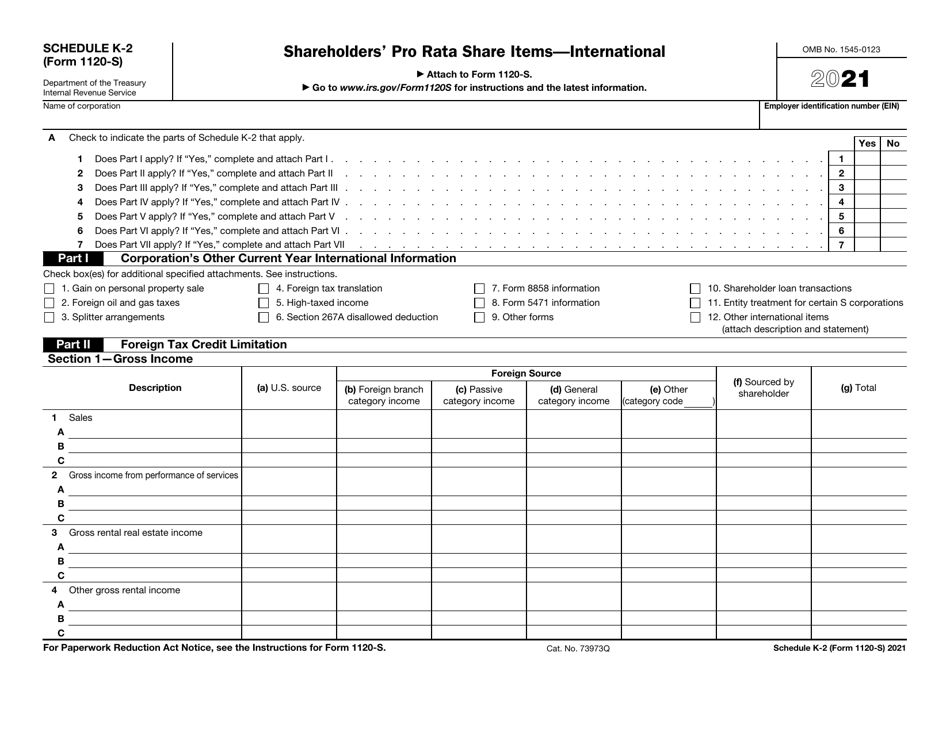

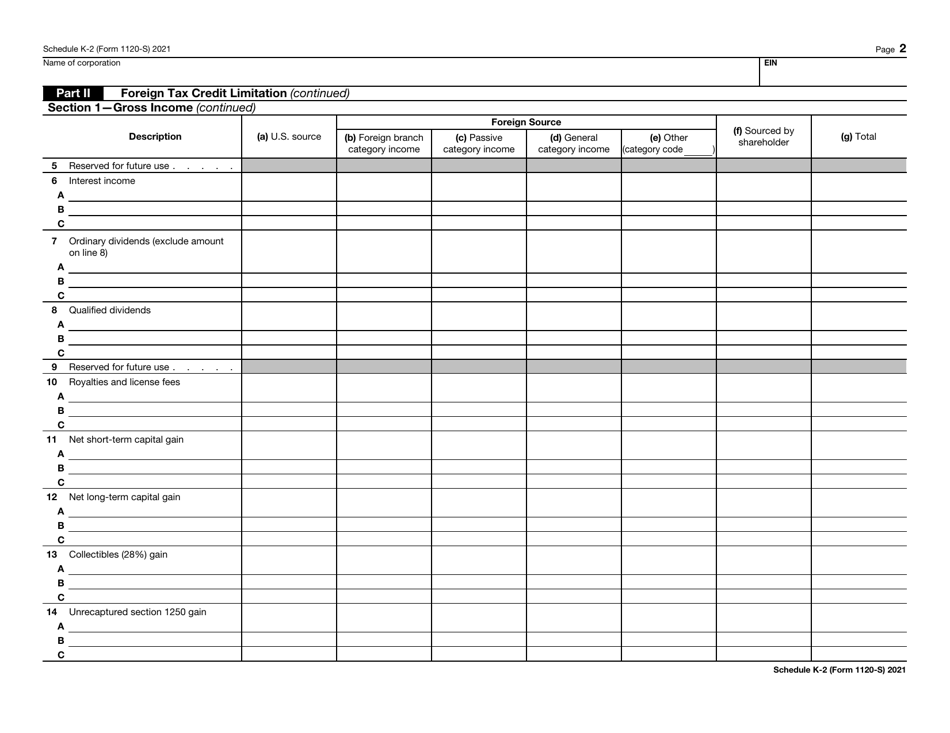

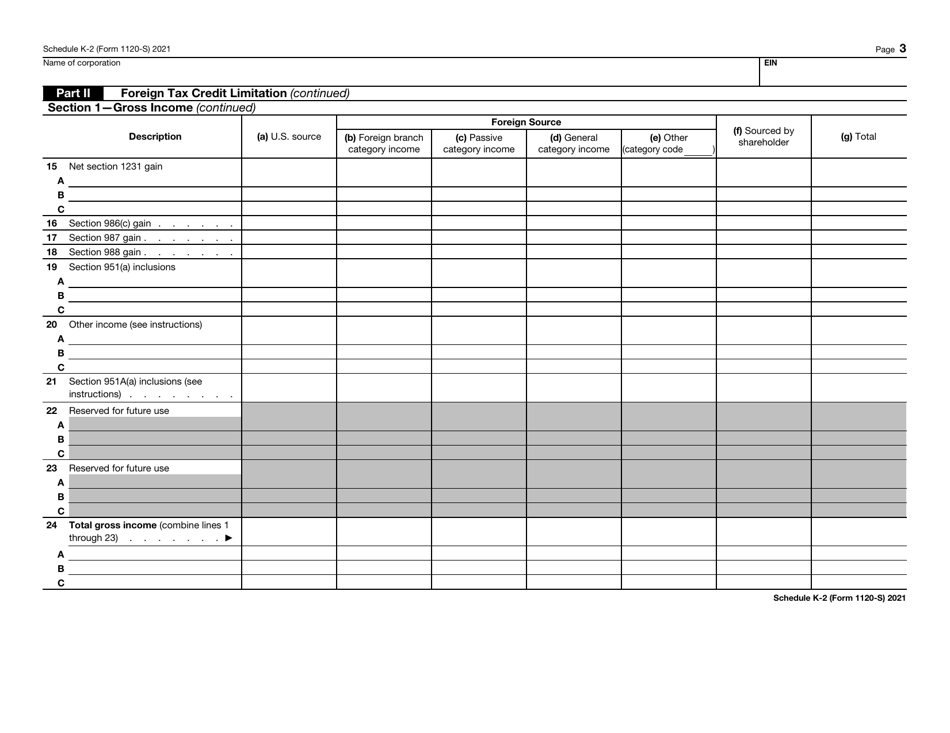

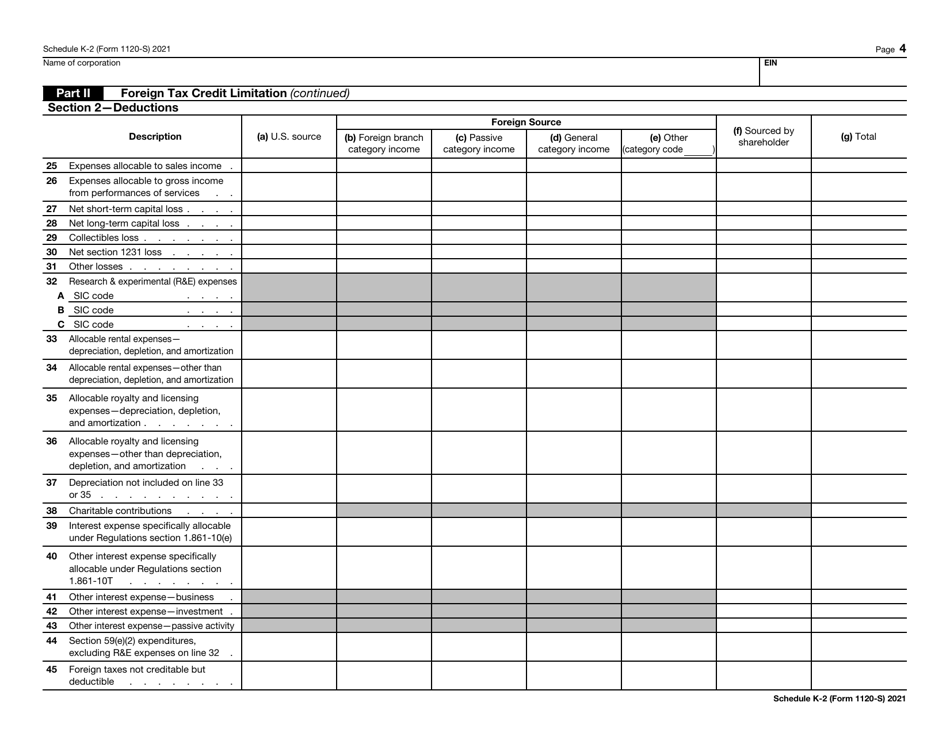

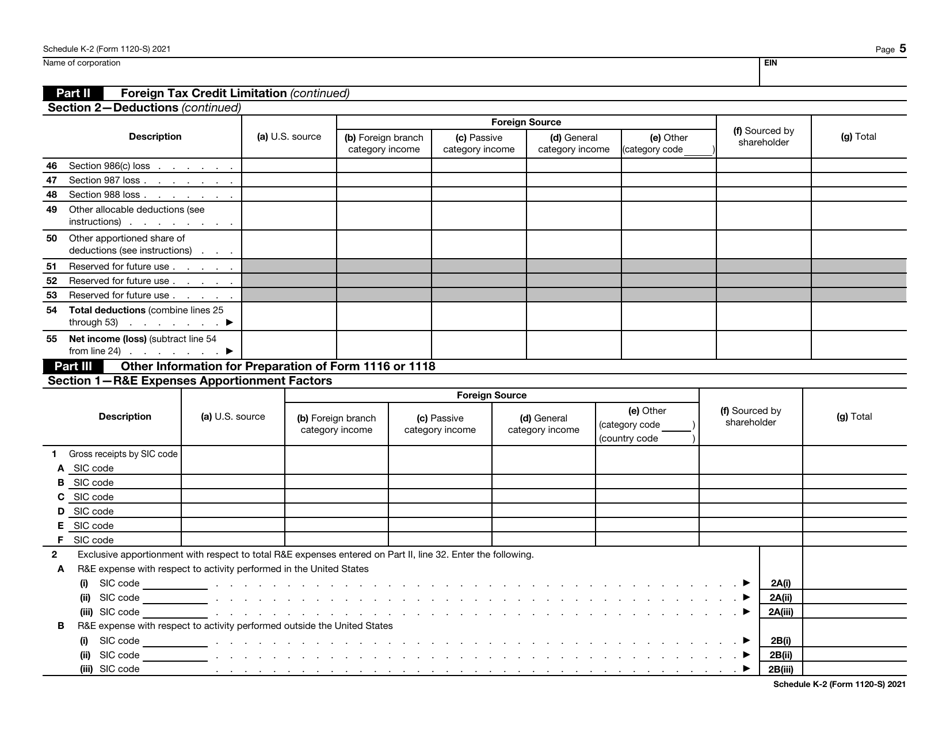

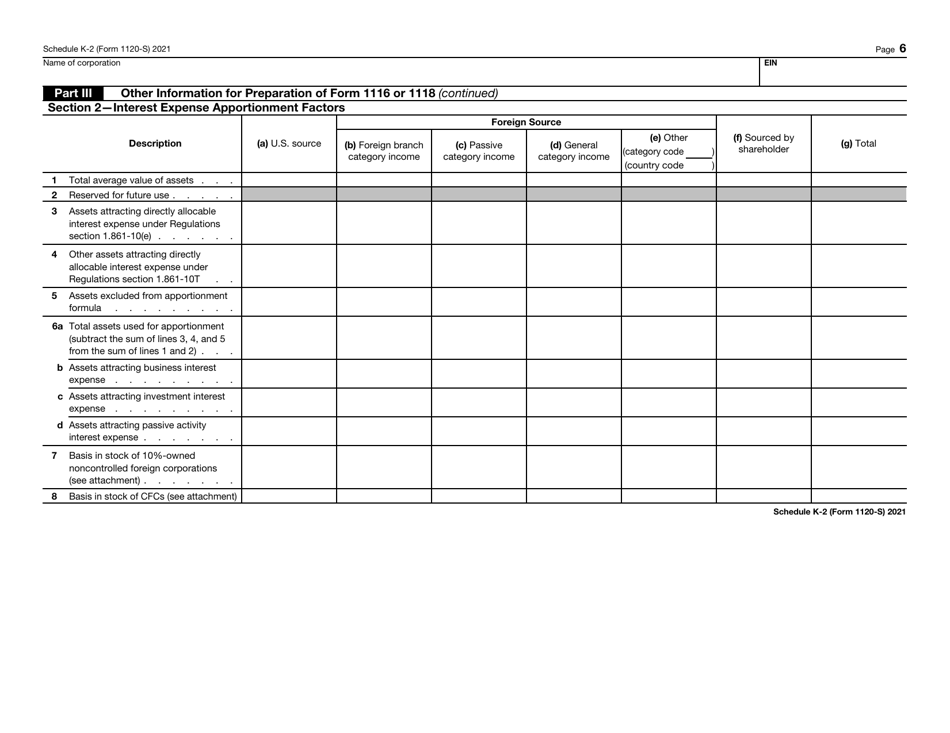

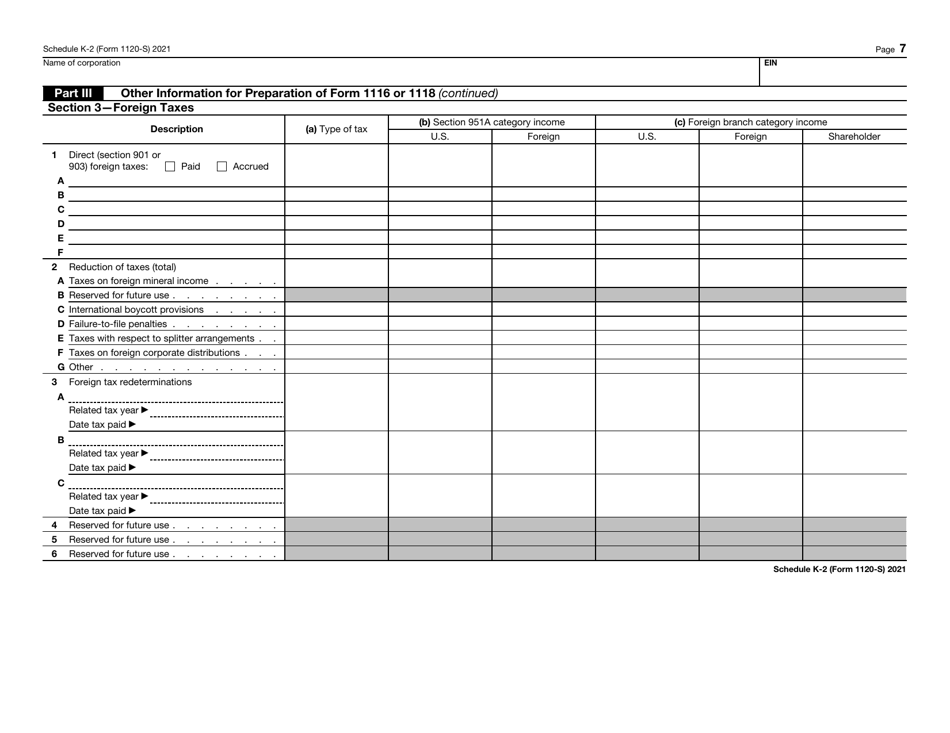

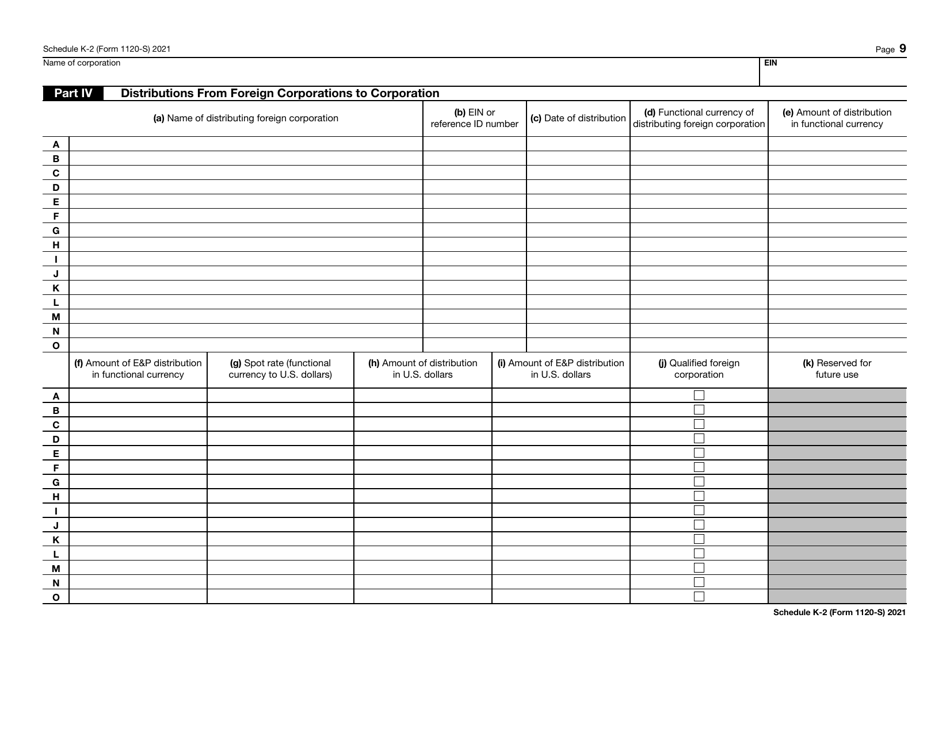

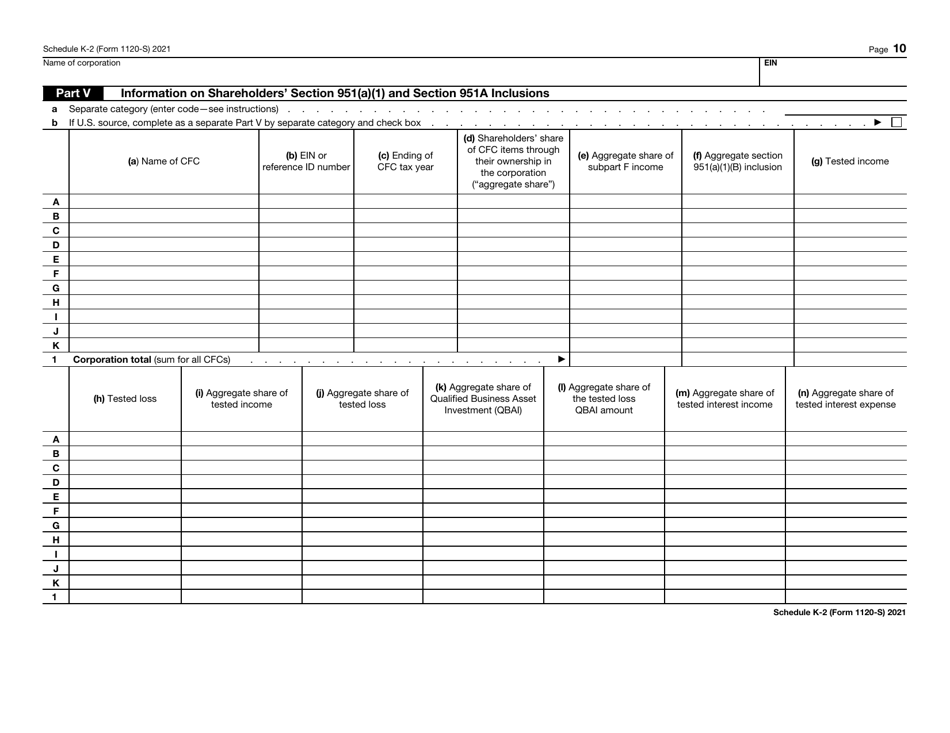

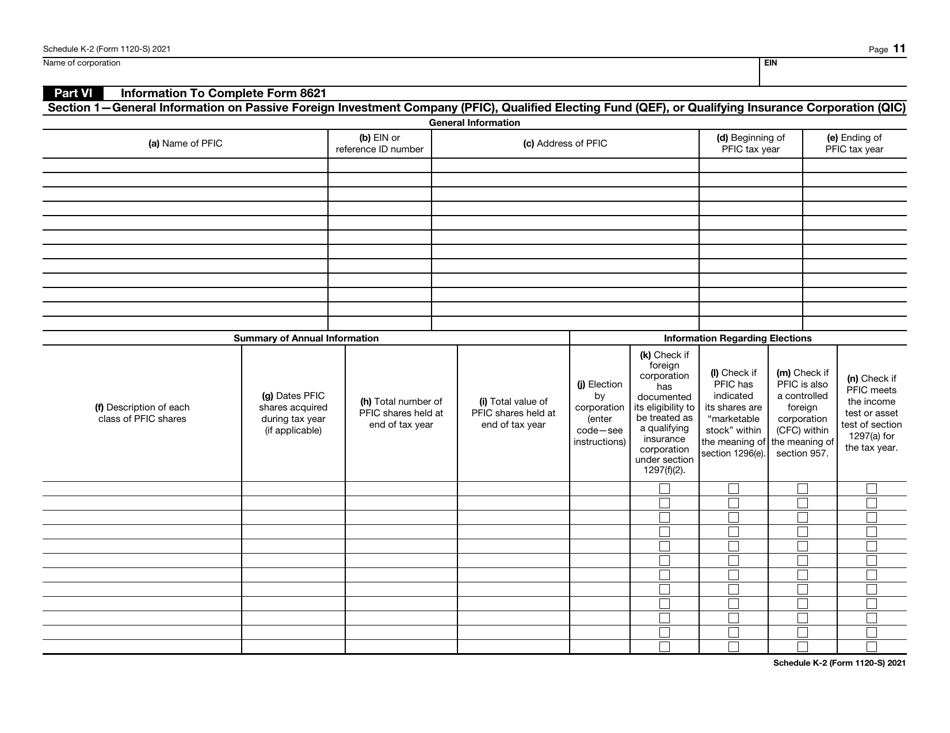

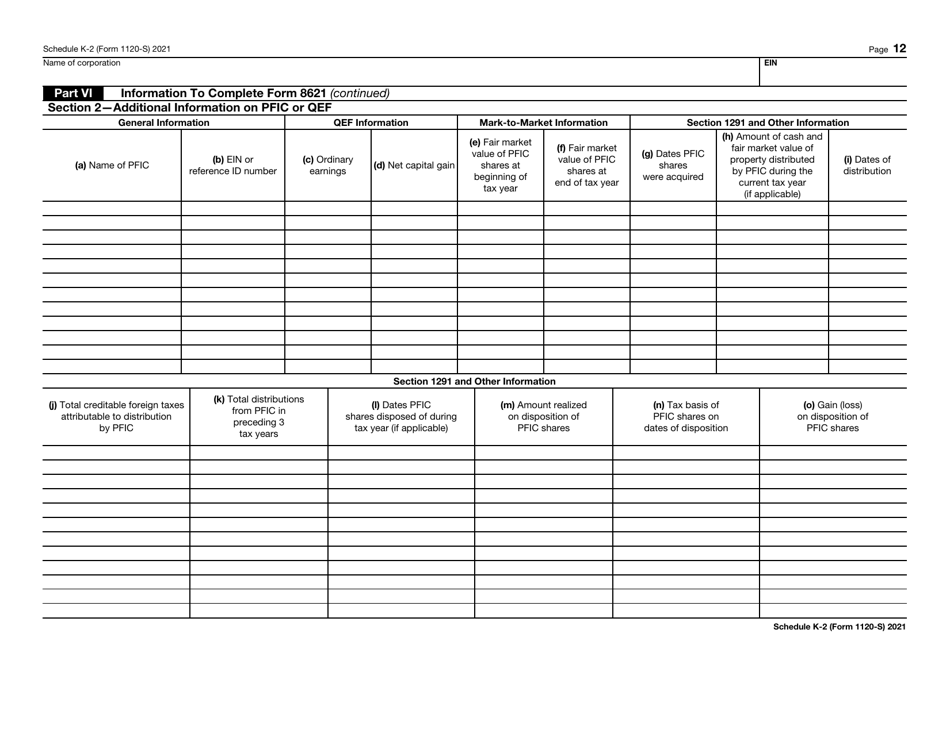

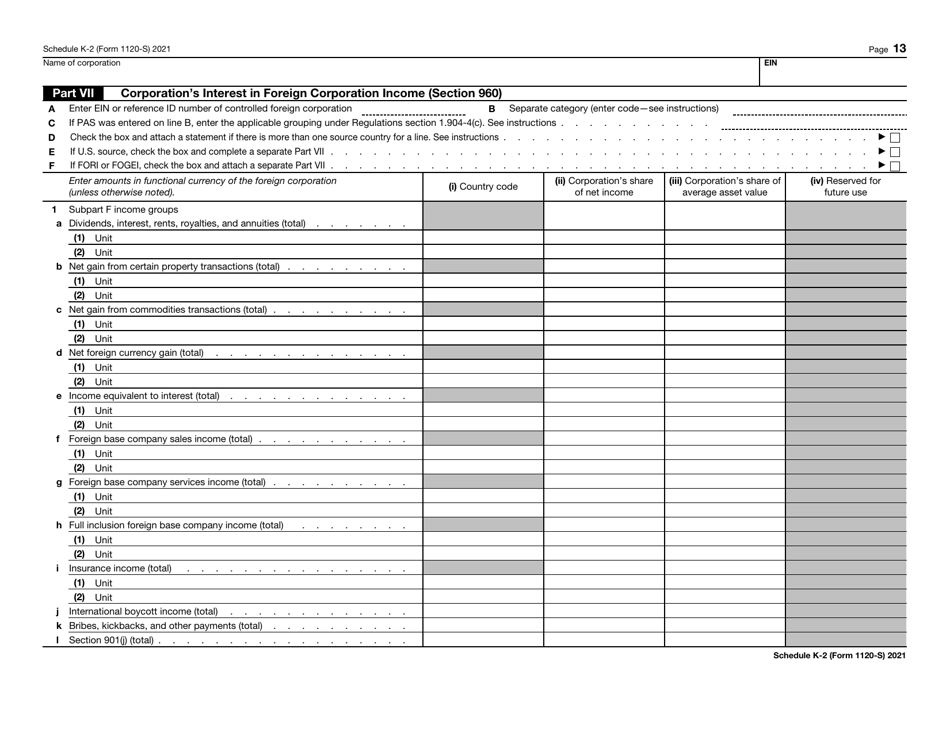

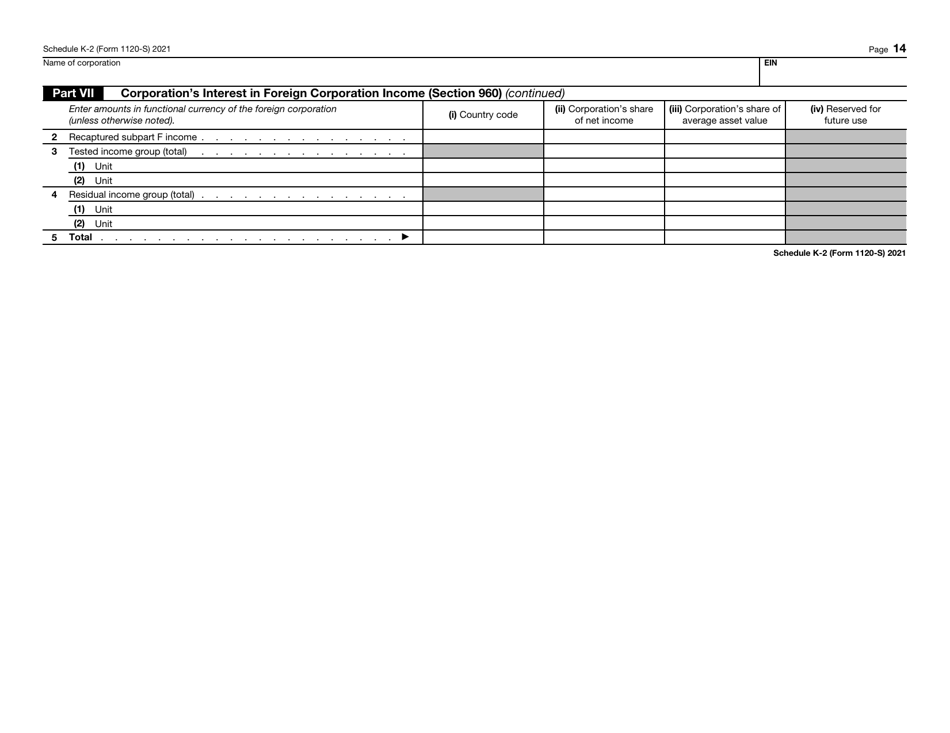

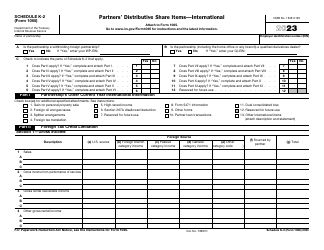

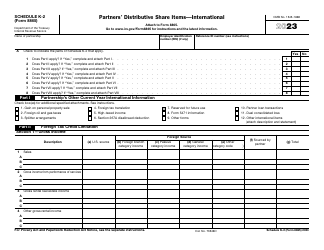

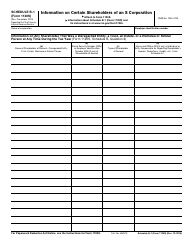

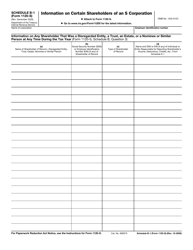

IRS Form 1120-S Schedule K-2

for the current year.

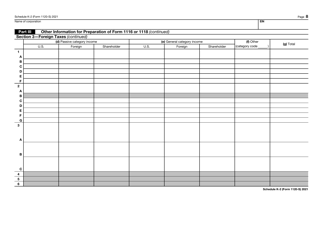

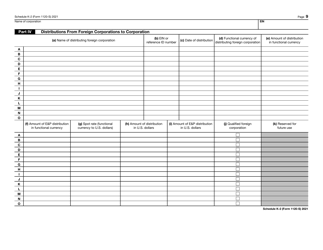

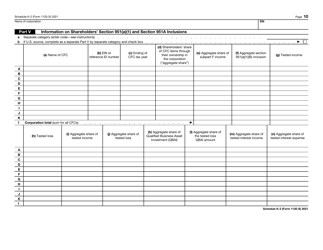

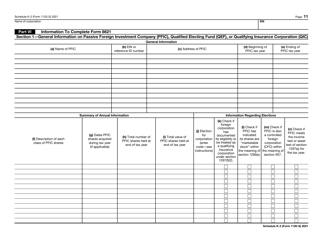

IRS Form 1120-S Schedule K-2 Shareholders' Pro Rata Share Items - International

What Is IRS Form 1120-S Schedule K-2?

This is a tax form that was released by the Internal Revenue Service (IRS) - a subdivision of the U.S. Department of the Treasury. Check the official IRS-issued instructions before completing and submitting the form.

FAQ

Q: What is IRS Form 1120-S Schedule K-2?

A: IRS Form 1120-S Schedule K-2 is a form used by S corporations to report the shareholders' pro-rata share items.

Q: What are shareholders' pro-rata share items?

A: Shareholders' pro-rata share items refer to the income, deductions, and credits that are allocated to the shareholders of an S corporation based on their ownership percentage.

Q: When is IRS Form 1120-S Schedule K-2 used?

A: IRS Form 1120-S Schedule K-2 is used when an S corporation has international activities and needs to report the shareholders' pro-rata share of international income, deductions, and credits.

Q: Who needs to file IRS Form 1120-S Schedule K-2?

A: S corporations that have international activities and need to report the shareholders' pro-rata share of international income, deductions, and credits must file IRS Form 1120-S Schedule K-2.

Q: Are there any specific requirements for filing IRS Form 1120-S Schedule K-2?

A: Yes, there are specific requirements for filing IRS Form 1120-S Schedule K-2. S corporations must meet certain criteria, including having international activities and having shareholders with pro-rata share items.

Q: Do I need to include IRS Form 1120-S Schedule K-2 when filing my personal tax return?

A: No, IRS Form 1120-S Schedule K-2 is not filed with an individual's personal tax return. It is filed by S corporations to report the shareholders' pro-rata share items.

Q: What should I do if I have more questions about IRS Form 1120-S Schedule K-2?

A: If you have more questions about IRS Form 1120-S Schedule K-2, you should consult a tax professional or refer to the instructions provided by the IRS.

Form Details:

- A 14-page form available for download in PDF;

- This form cannot be used to file taxes for the current year. Choose a more recent version to file for the current tax year;

- Editable, printable, and free;

- Fill out the form in our online filing application.

Download a fillable version of IRS Form 1120-S Schedule K-2 through the link below or browse more documents in our library of IRS Forms.