This version of the form is not currently in use and is provided for reference only. Download this version of

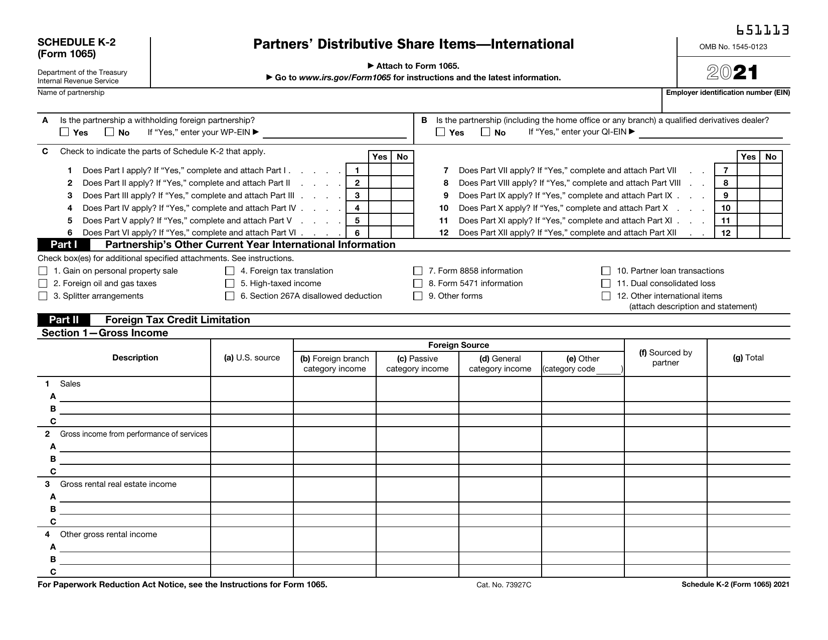

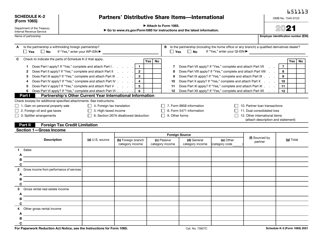

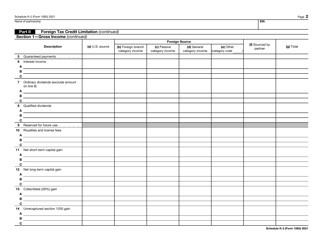

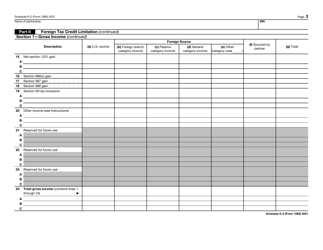

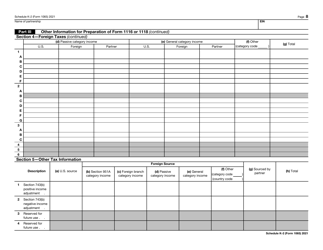

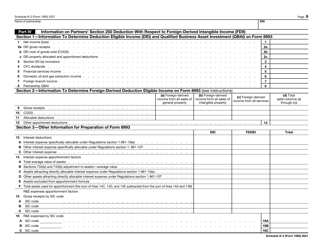

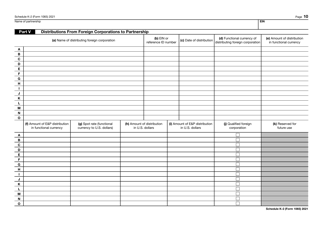

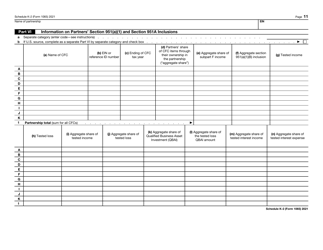

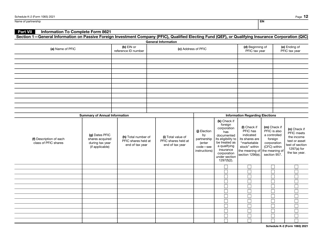

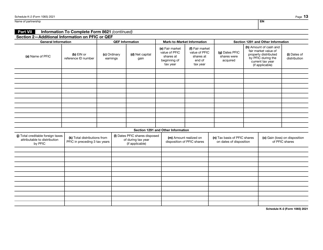

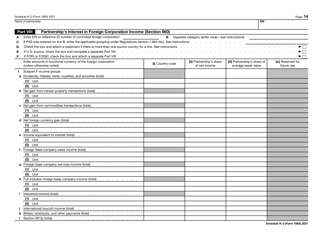

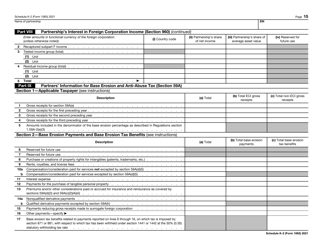

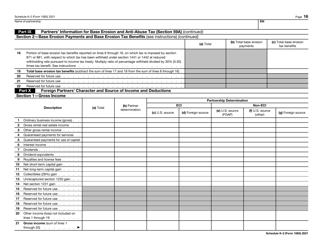

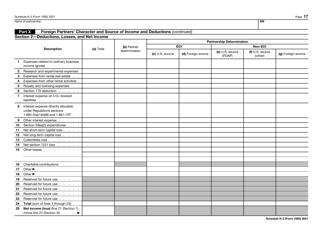

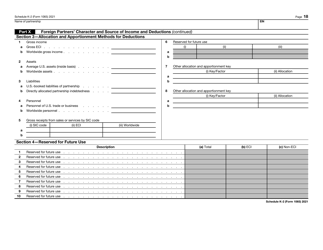

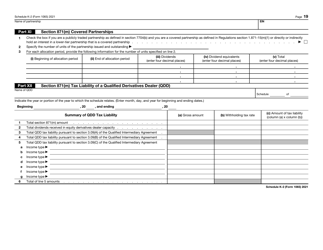

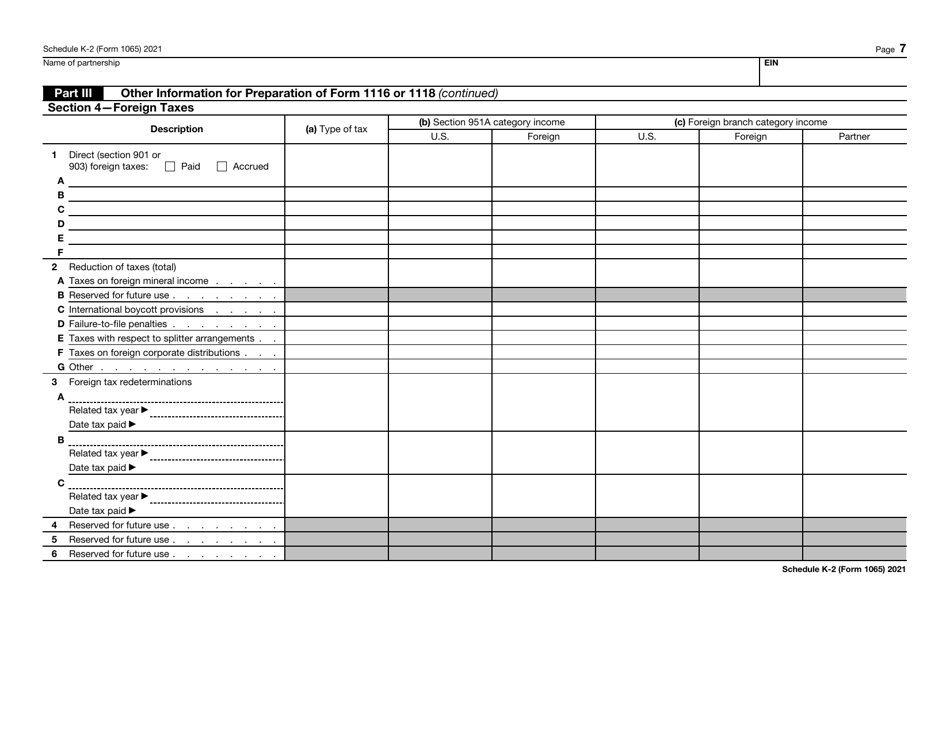

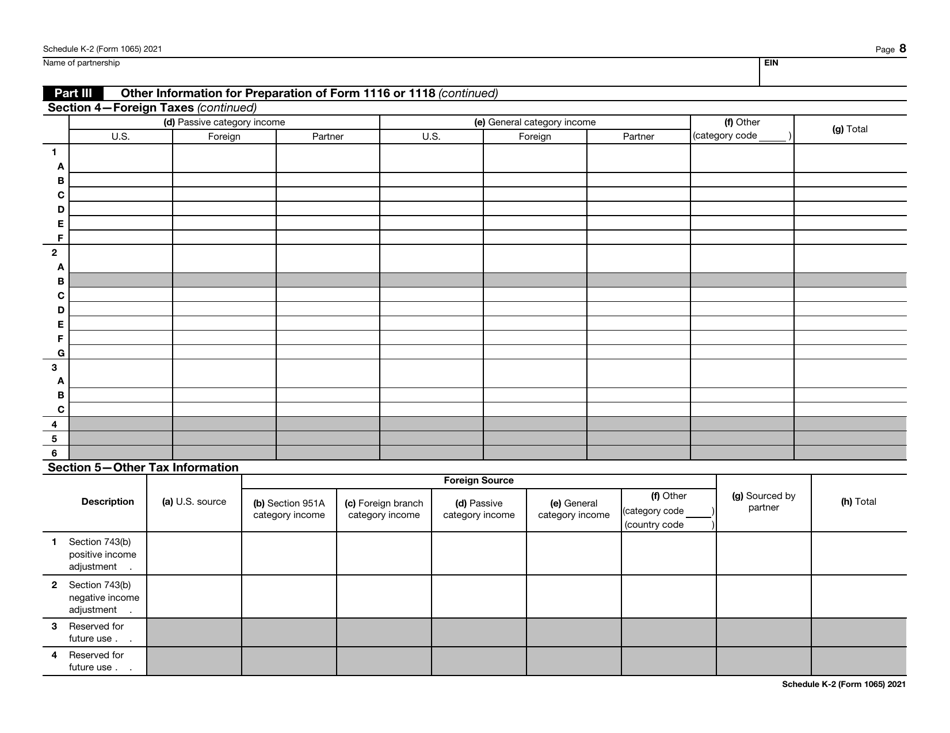

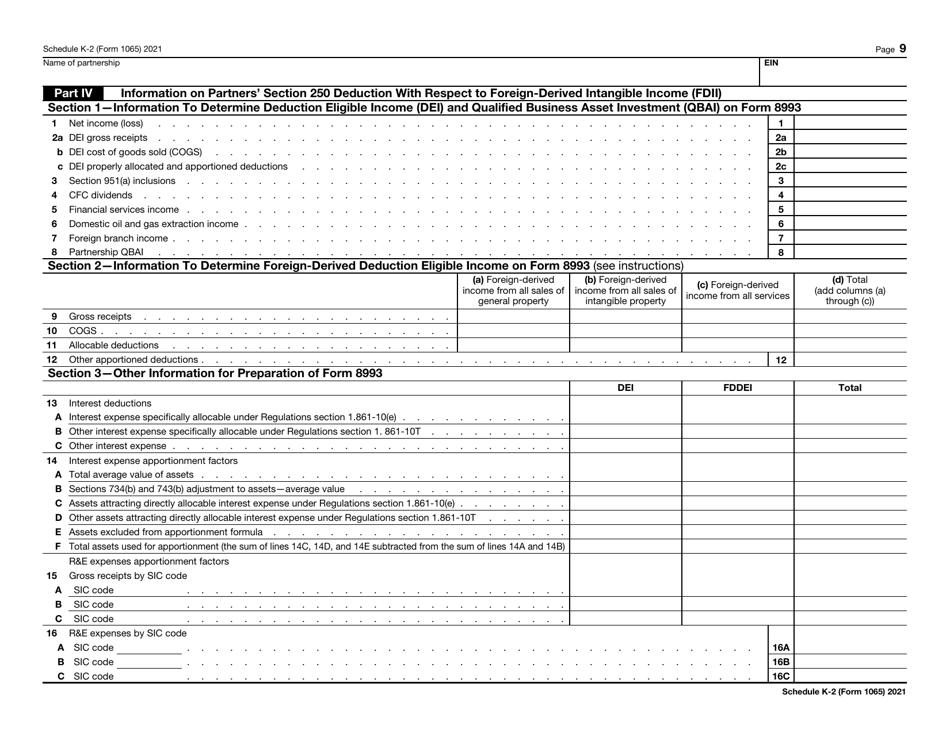

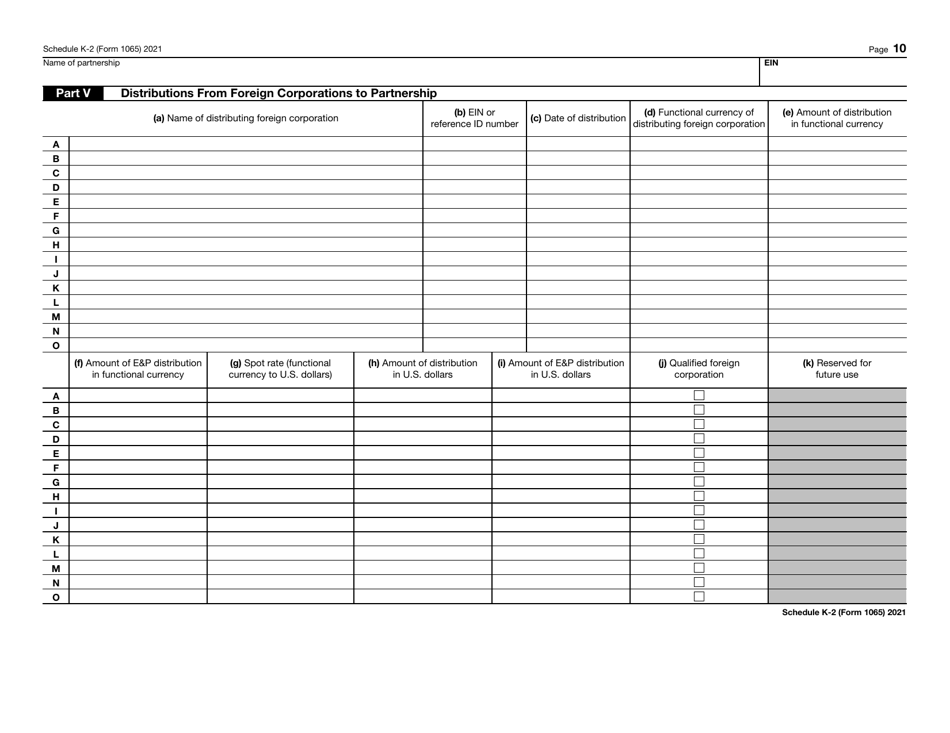

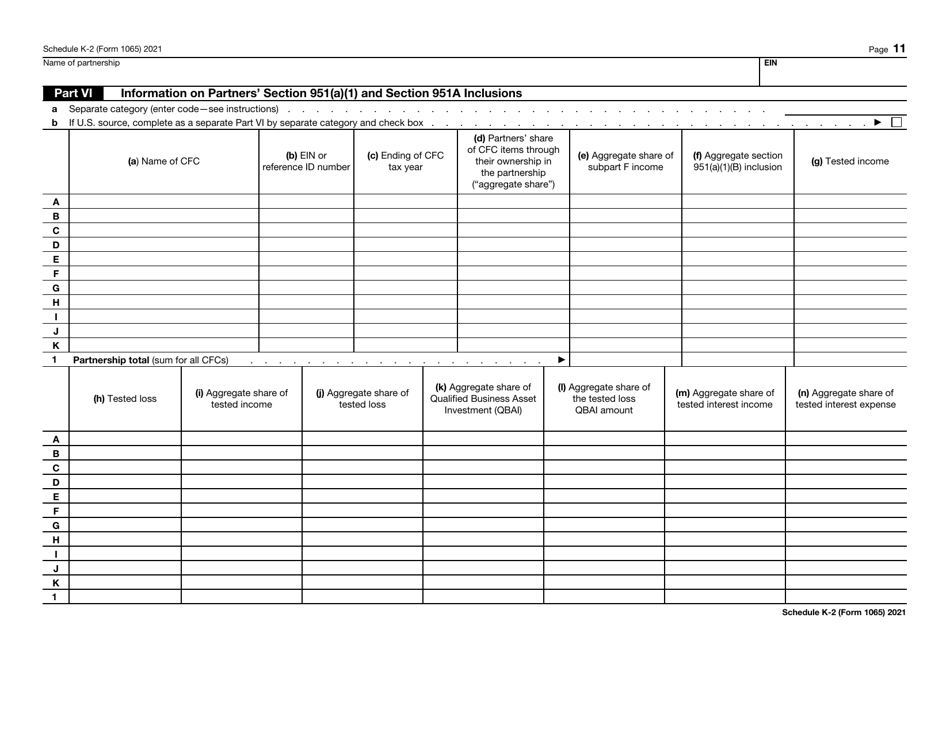

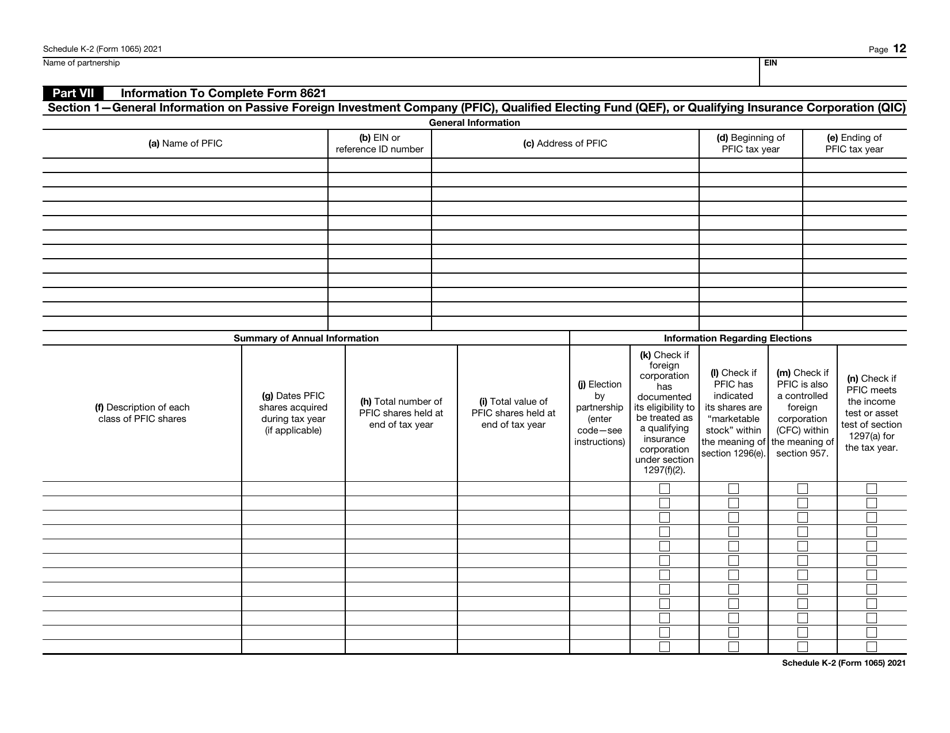

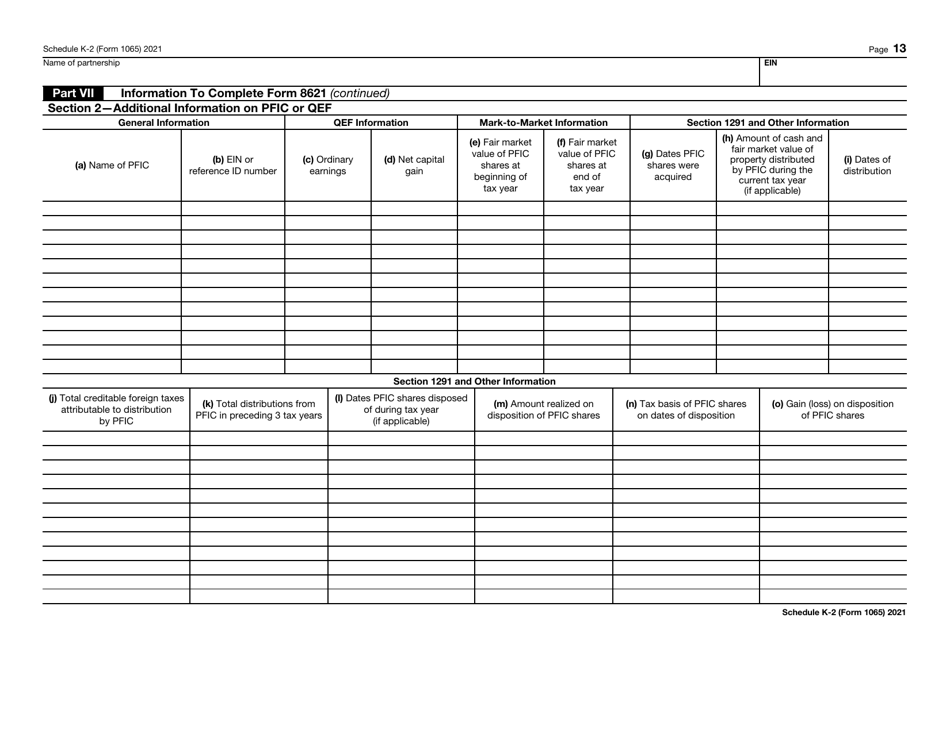

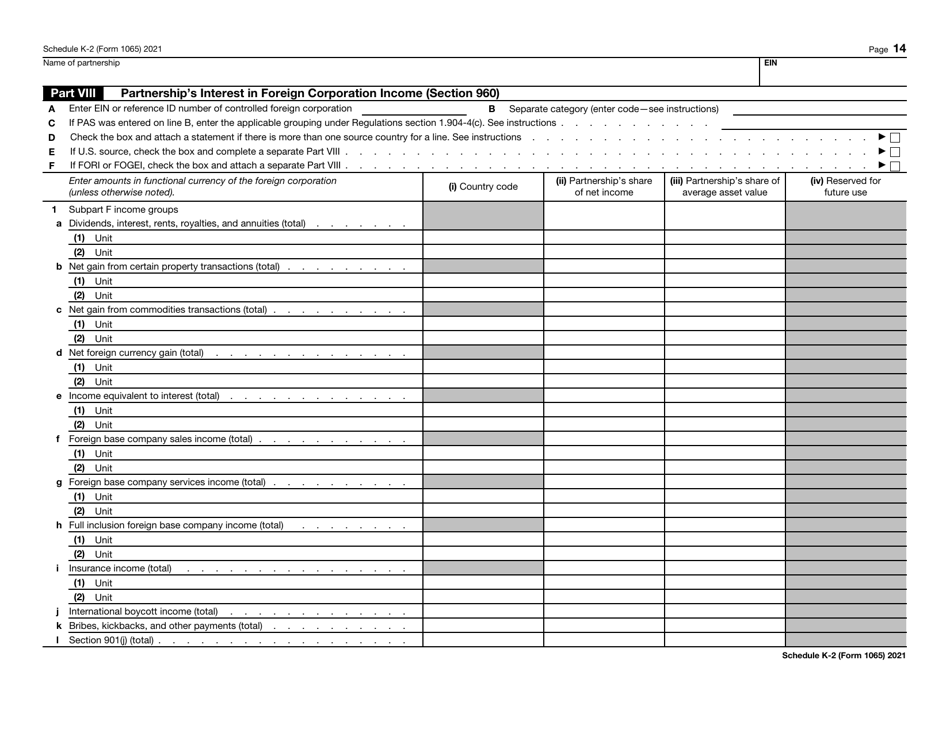

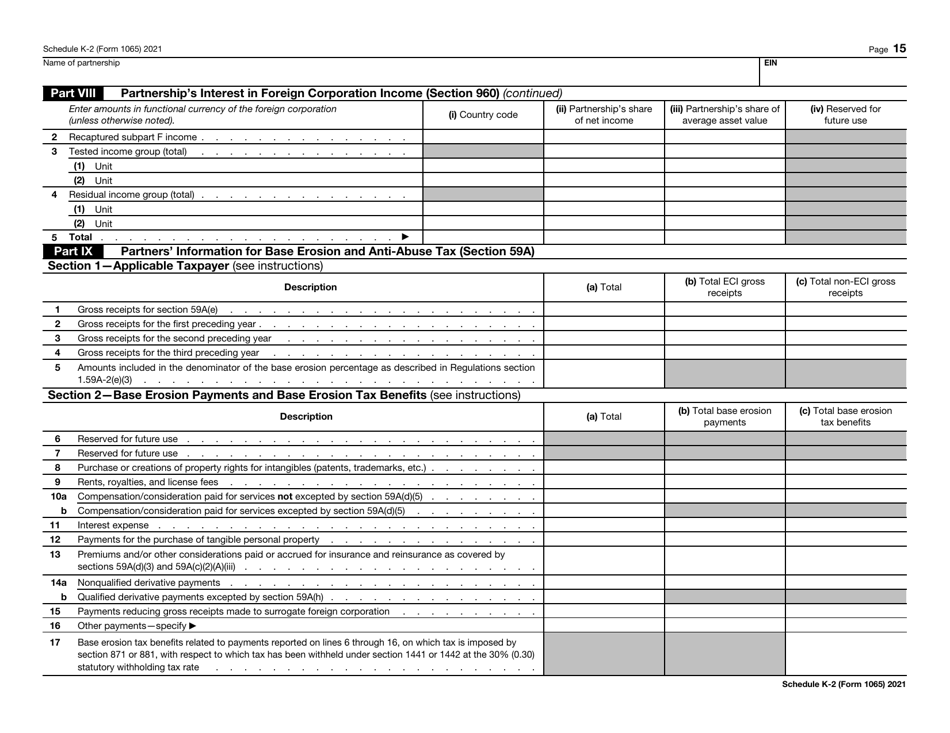

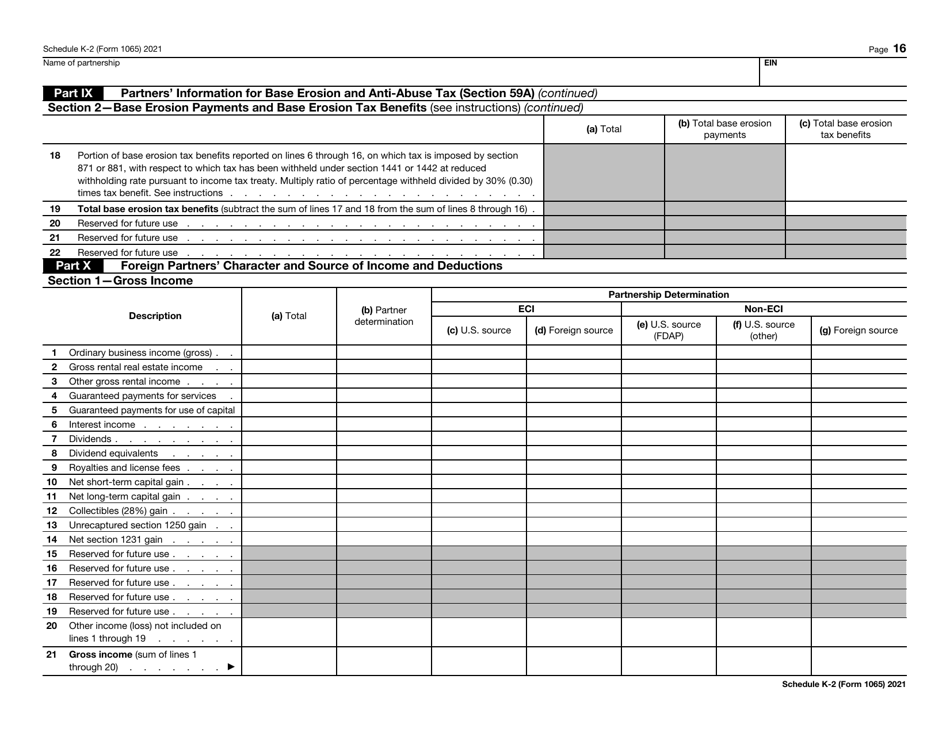

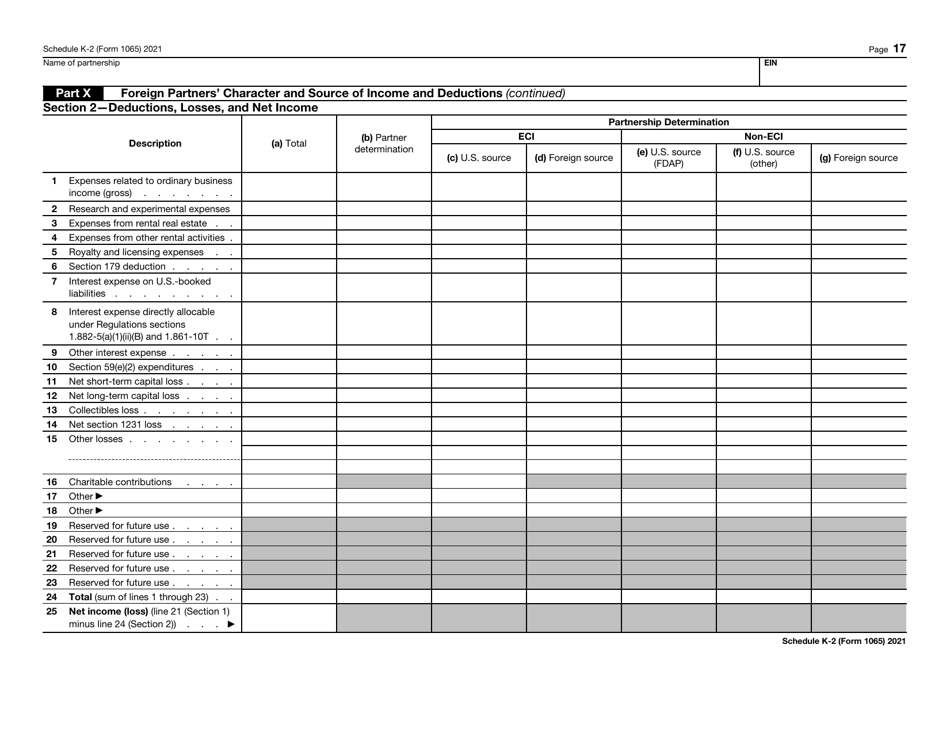

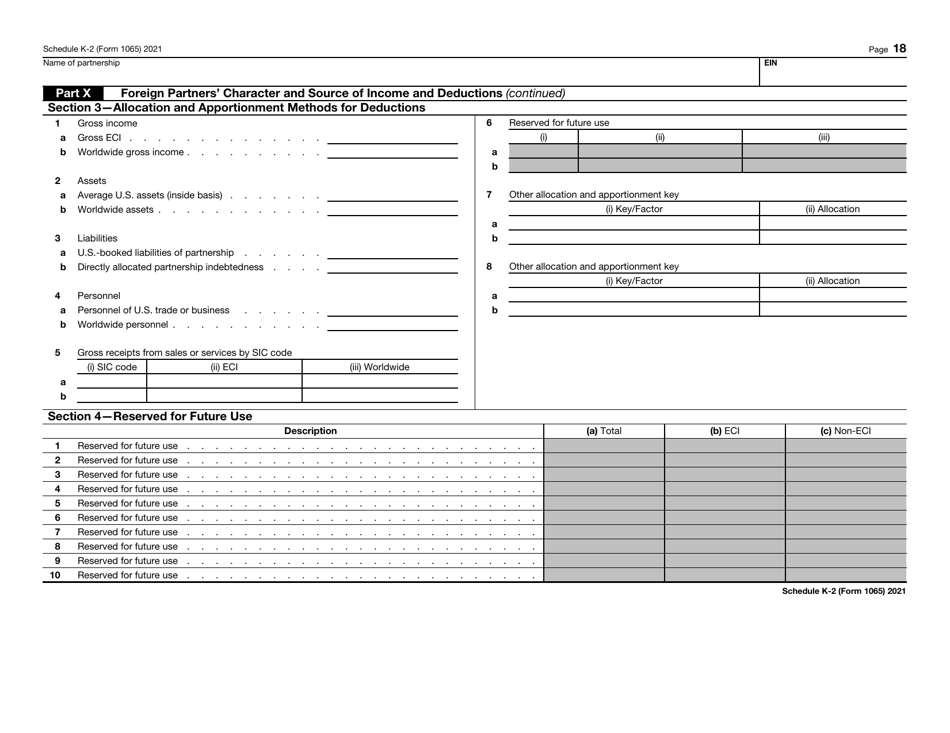

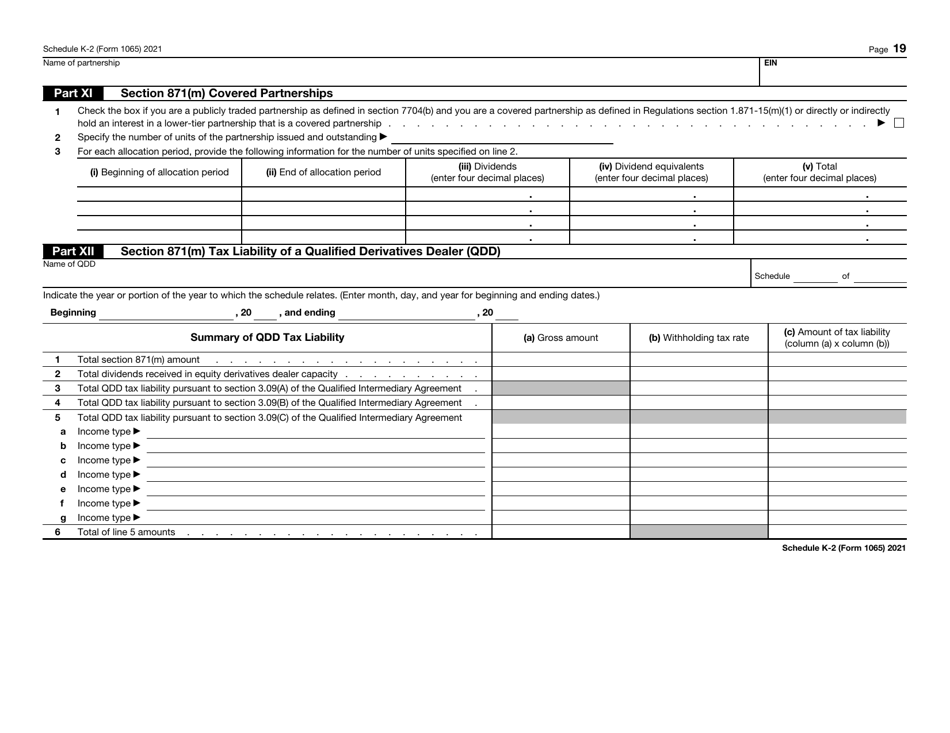

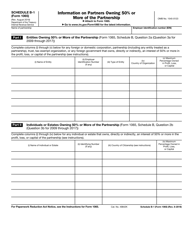

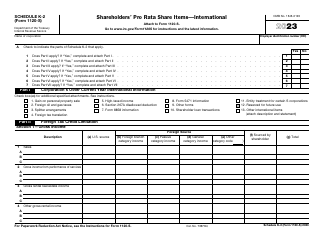

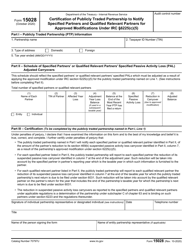

IRS Form 1065 Schedule K-2

for the current year.

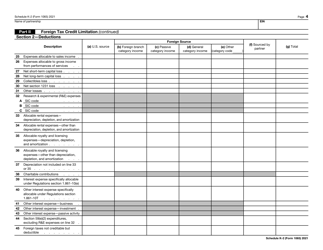

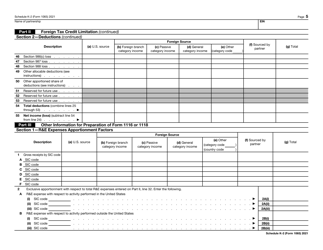

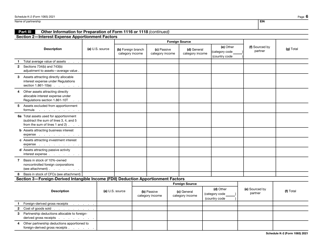

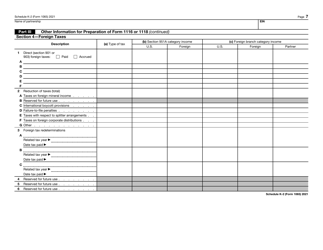

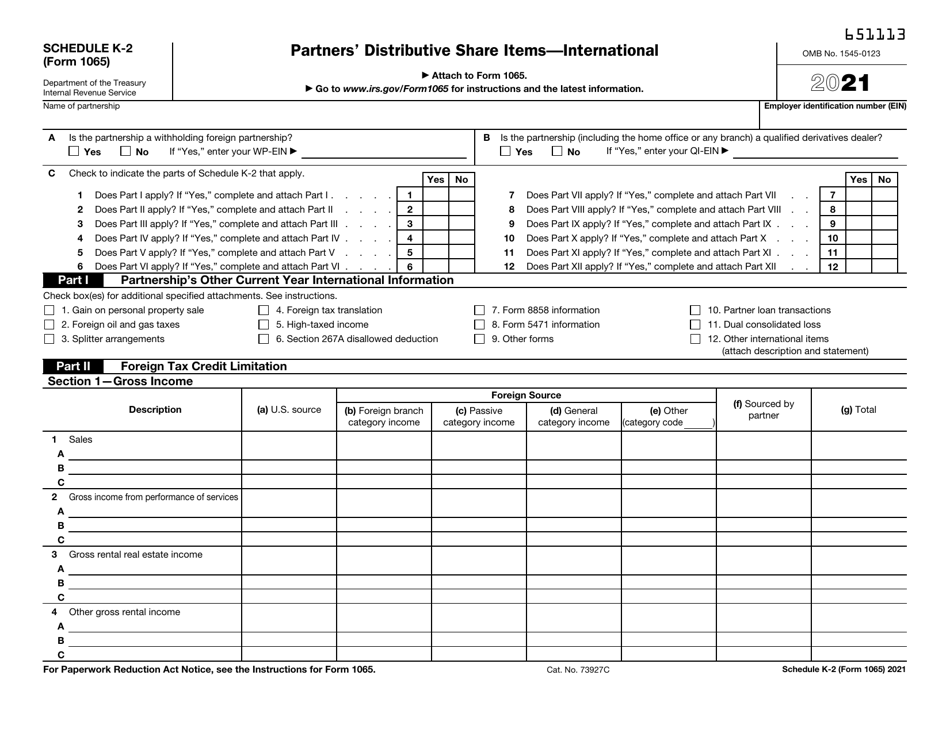

IRS Form 1065 Schedule K-2 Partners' Distributive Share Items - International

What Is IRS Form 1065 Schedule K-2?

This is a tax form that was released by the Internal Revenue Service (IRS) - a subdivision of the U.S. Department of the Treasury. The document is a supplement to IRS Form 1065, U.S. Return of Partnership Income. As of today, no separate filing guidelines for the form are provided by the IRS.

FAQ

Q: What is IRS Form 1065 Schedule K-2?

A: IRS Form 1065 Schedule K-2 is a form used by partnerships to report international partners' distributive share items.

Q: What are distributive share items?

A: Distributive share items are the share of partnership income, deductions, and credits that are allocated to each partner.

Q: Who needs to file IRS Form 1065 Schedule K-2?

A: Partnerships with international partners who have distributive share items need to file IRS Form 1065 Schedule K-2.

Q: What information is reported on IRS Form 1065 Schedule K-2?

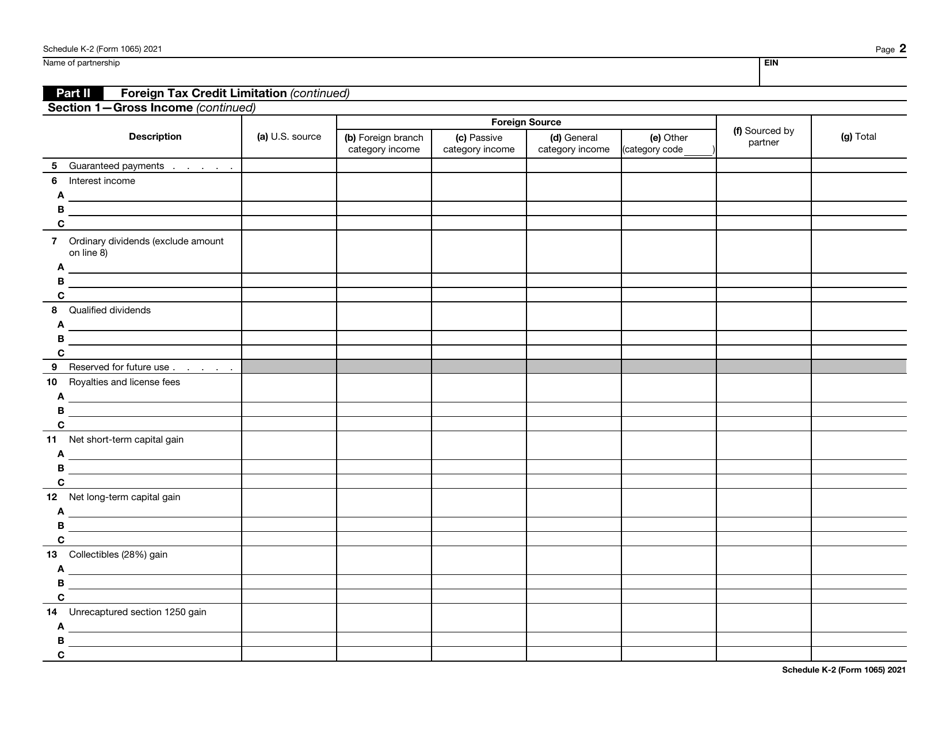

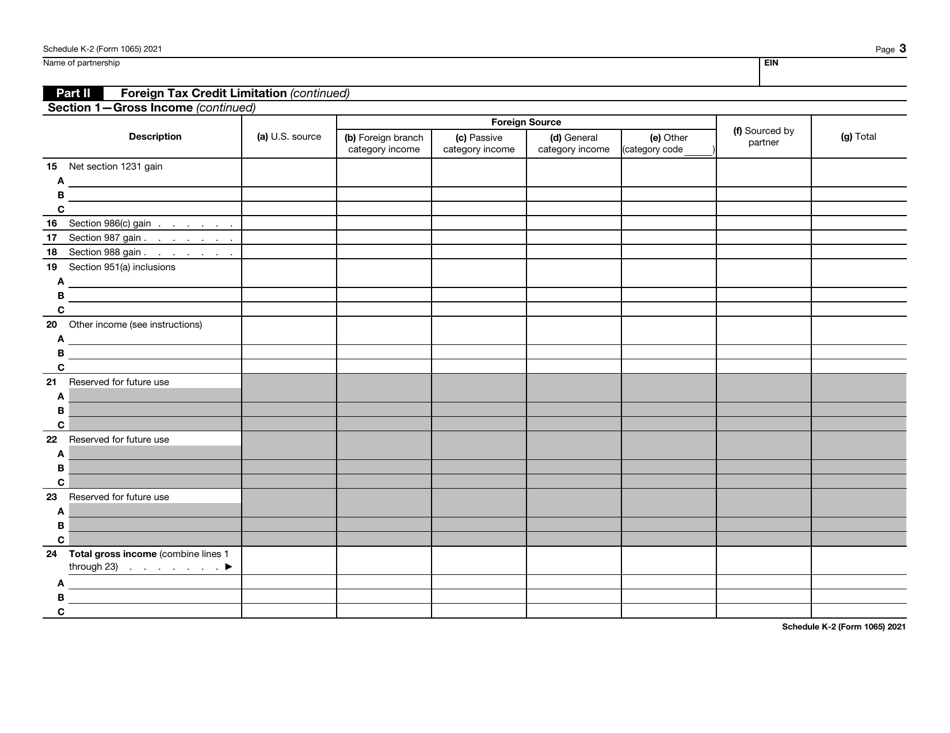

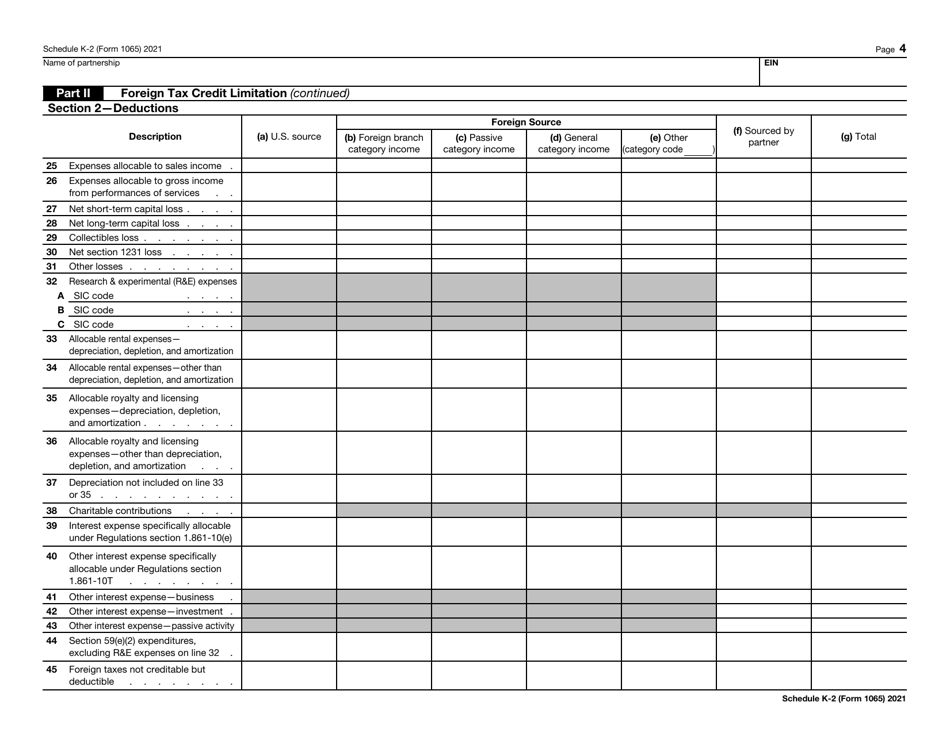

A: IRS Form 1065 Schedule K-2 reports information on each international partner's distributive share of partnership income, deductions, and credits.

Q: When is the deadline to file IRS Form 1065 Schedule K-2?

A: The deadline to file IRS Form 1065 Schedule K-2 is the same as the deadline to file the partnership return, which is usually March 15th.

Q: Are there any penalties for not filing IRS Form 1065 Schedule K-2?

A: Yes, there can be penalties for not filing IRS Form 1065 Schedule K-2, so it's important to file it on time if required.

Q: Is IRS Form 1065 Schedule K-2 required for domestic partners?

A: No, IRS Form 1065 Schedule K-2 is specifically for reporting international partners' distributive share items.

Form Details:

- A 19-page form available for download in PDF;

- This form cannot be used to file taxes for the current year. Choose a more recent version to file for the current tax year;

- Editable, printable, and free;

- Fill out the form in our online filing application.

Download a fillable version of IRS Form 1065 Schedule K-2 through the link below or browse more documents in our library of IRS Forms.