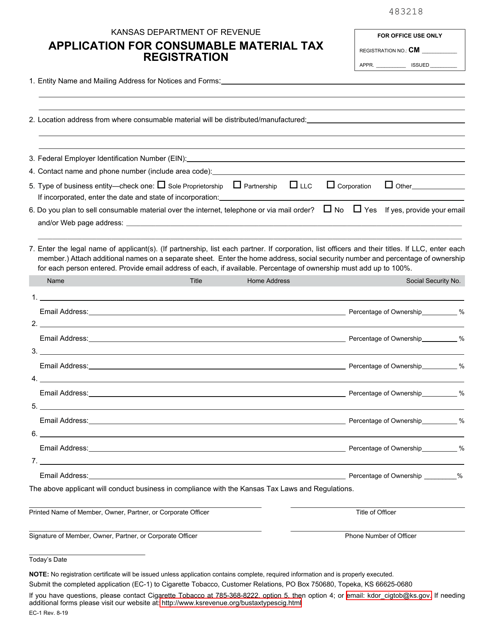

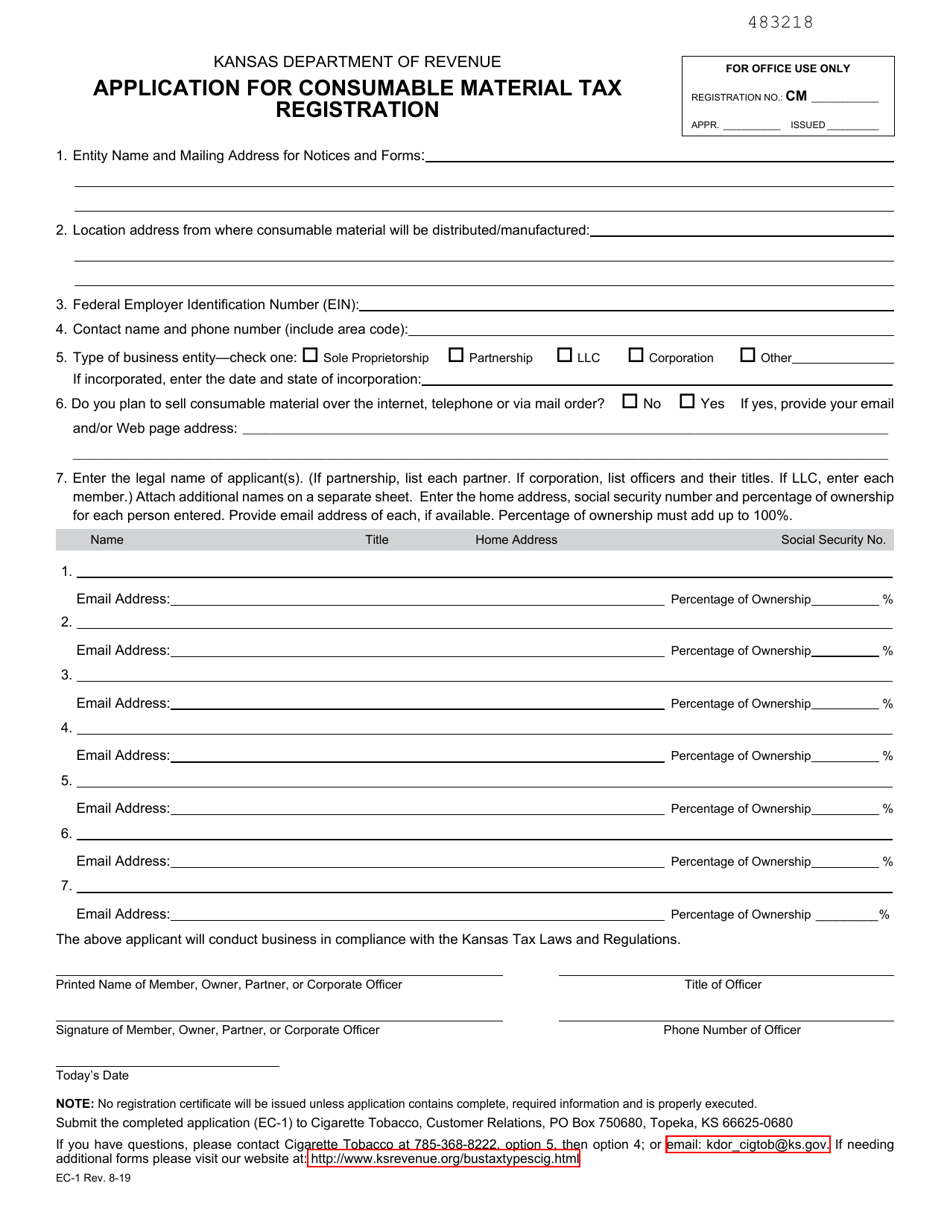

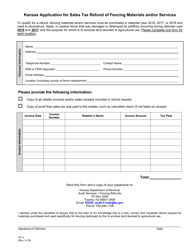

Form EC-1 Application for Consumable Material Tax Registration - Kansas

What Is Form EC-1?

This is a legal form that was released by the Kansas Department of Revenue - a government authority operating within Kansas. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is Form EC-1?

A: Form EC-1 is an application form for consumable material tax registration in Kansas.

Q: What is consumable material tax?

A: Consumable material tax is a tax levied on the sale of tangible personal property that is used or consumed directly in the production of a product for resale.

Q: Who needs to fill out Form EC-1?

A: Businesses that sell tangible personal property that is used or consumed directly in the production of a product for resale in Kansas need to fill out Form EC-1.

Q: What information is required on Form EC-1?

A: Form EC-1 requires information such as the business name, address, federal tax identification number, description of the business activities, and estimated taxable sales.

Q: Is there a fee for submitting Form EC-1?

A: No, there is no fee for submitting Form EC-1.

Q: Is there a deadline for submitting Form EC-1?

A: Form EC-1 should be filed within 10 days of commencing business or beginning to make sales of consumable material in Kansas.

Q: What are the consequences of not filling out Form EC-1?

A: Failure to register for consumable material tax may result in penalties and interest charges on the tax due.

Form Details:

- Released on August 1, 2019;

- The latest edition provided by the Kansas Department of Revenue;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form EC-1 by clicking the link below or browse more documents and templates provided by the Kansas Department of Revenue.