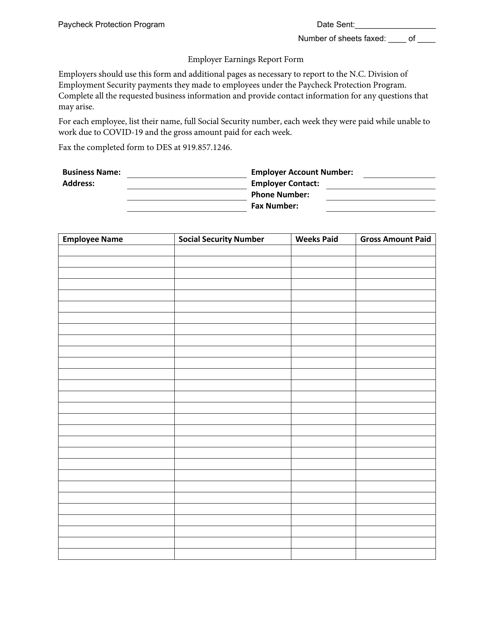

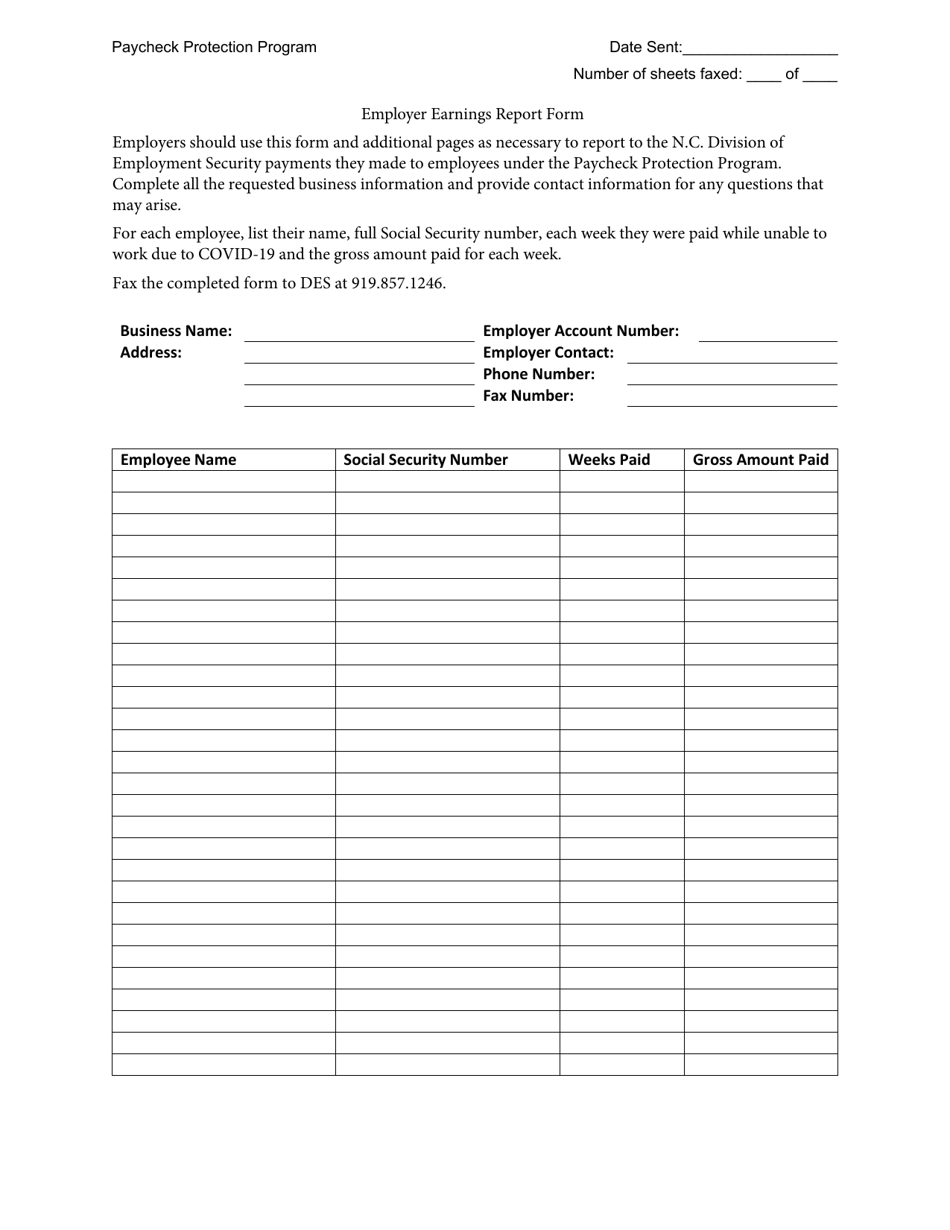

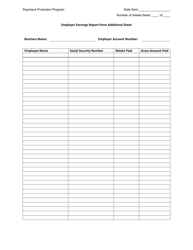

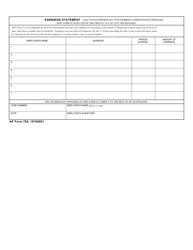

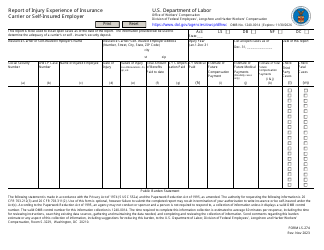

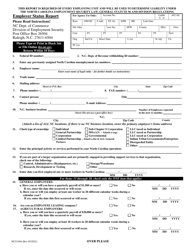

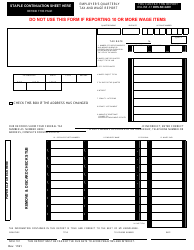

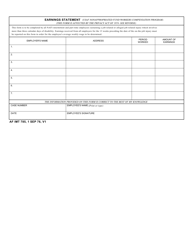

Employer Earnings Report Form - North Carolina

Employer Earnings Report Form is a legal document that was released by the North Carolina Department of Commerce - a government authority operating within North Carolina.

FAQ

Q: What is an Employer Earnings Report Form?

A: The Employer Earnings Report Form is a document used in North Carolina to report an employer's earnings.

Q: Who is required to complete the Employer Earnings Report Form?

A: All employers in North Carolina are required to complete the Employer Earnings Report Form.

Q: When is the Employer Earnings Report Form due?

A: The Employer Earnings Report Form is due by the end of January each year.

Q: What information is required to complete the Employer Earnings Report Form?

A: The form requires information such as the employer's name, address, federal employer identification number, and total earnings for the year.

Q: Are there any penalties for not filing the Employer Earnings Report Form?

A: Yes, failure to file the form or filing it late can result in penalties and interest charges.

Q: Is the information on the Employer Earnings Report Form confidential?

A: Yes, the information provided on the form is confidential and used for tax purposes only.

Q: What if there are changes to the information reported on the Employer Earnings Report Form?

A: If there are changes to the information reported, you should notify the North Carolina Department of Revenue as soon as possible.

Q: Are nonprofit organizations required to file the Employer Earnings Report Form?

A: Yes, nonprofit organizations are also required to file the Employer Earnings Report Form.

Form Details:

- The latest edition currently provided by the North Carolina Department of Commerce;

- Ready to use and print;

- Easy to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of the form by clicking the link below or browse more documents and templates provided by the North Carolina Department of Commerce.