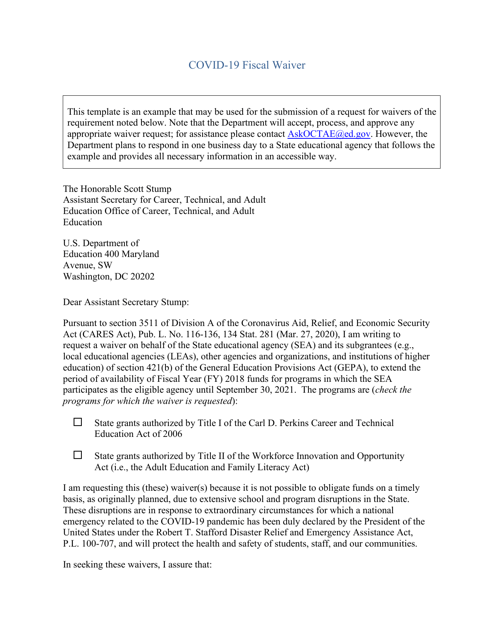

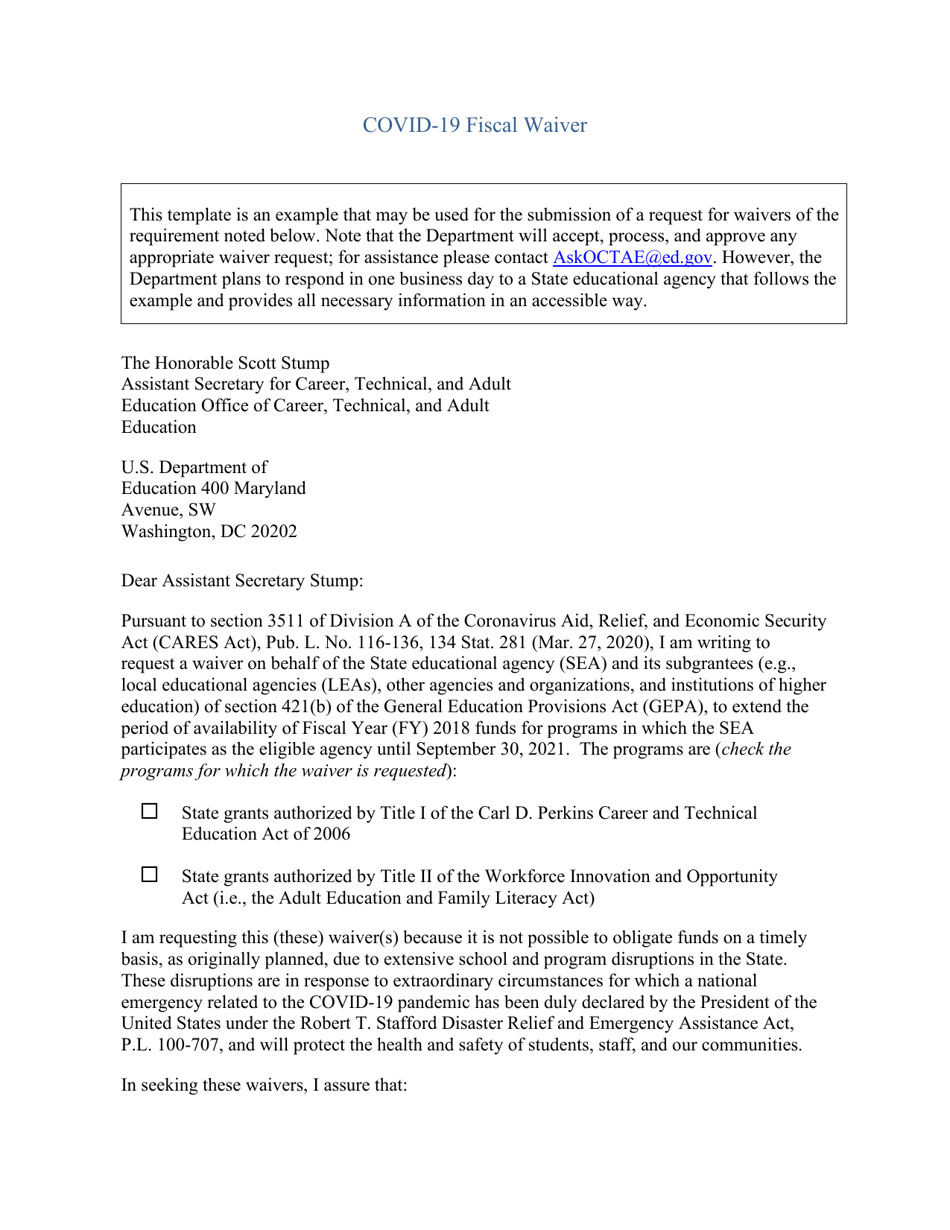

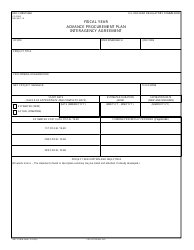

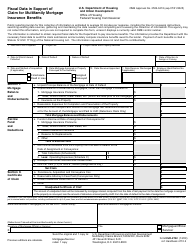

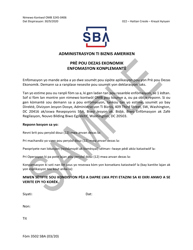

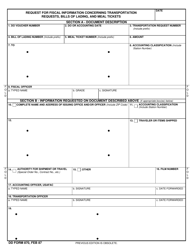

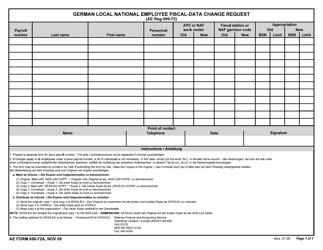

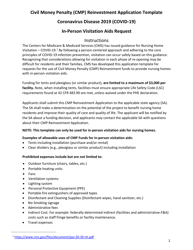

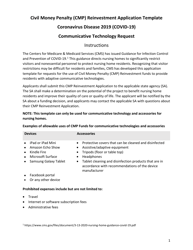

Covid-19 Fiscal Waiver

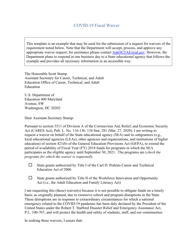

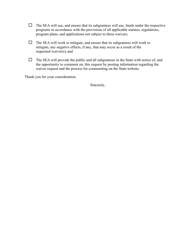

Covid-19 Fiscal Waiver is a 3-page legal document that was released by the U.S. Department of Education and used nation-wide.

FAQ

Q: What is the Covid-19 Fiscal Waiver?

A: The Covid-19 Fiscal Waiver is a temporary measure put in place by the government to provide financial relief and flexibility during the Covid-19 pandemic.

Q: Who is eligible for the Covid-19 Fiscal Waiver?

A: Eligibility for the Covid-19 Fiscal Waiver depends on specific criteria set by the government. It is typically available to individuals, businesses, and other entities affected by the pandemic.

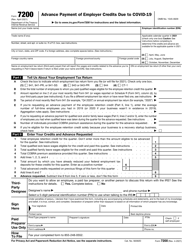

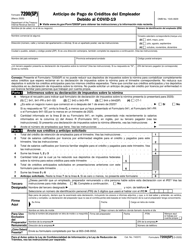

Q: What types of financial relief does the Covid-19 Fiscal Waiver offer?

A: The Covid-19 Fiscal Waiver may offer various forms of financial relief, including tax credits, loan forgiveness, grants, and other measures to help alleviate the economic impact of the pandemic.

Q: How long will the Covid-19 Fiscal Waiver be in effect?

A: The duration of the Covid-19 Fiscal Waiver varies and is typically determined by the government. It may be in effect for a specific timeframe or until certain conditions are met.

Q: How can I apply for the Covid-19 Fiscal Waiver?

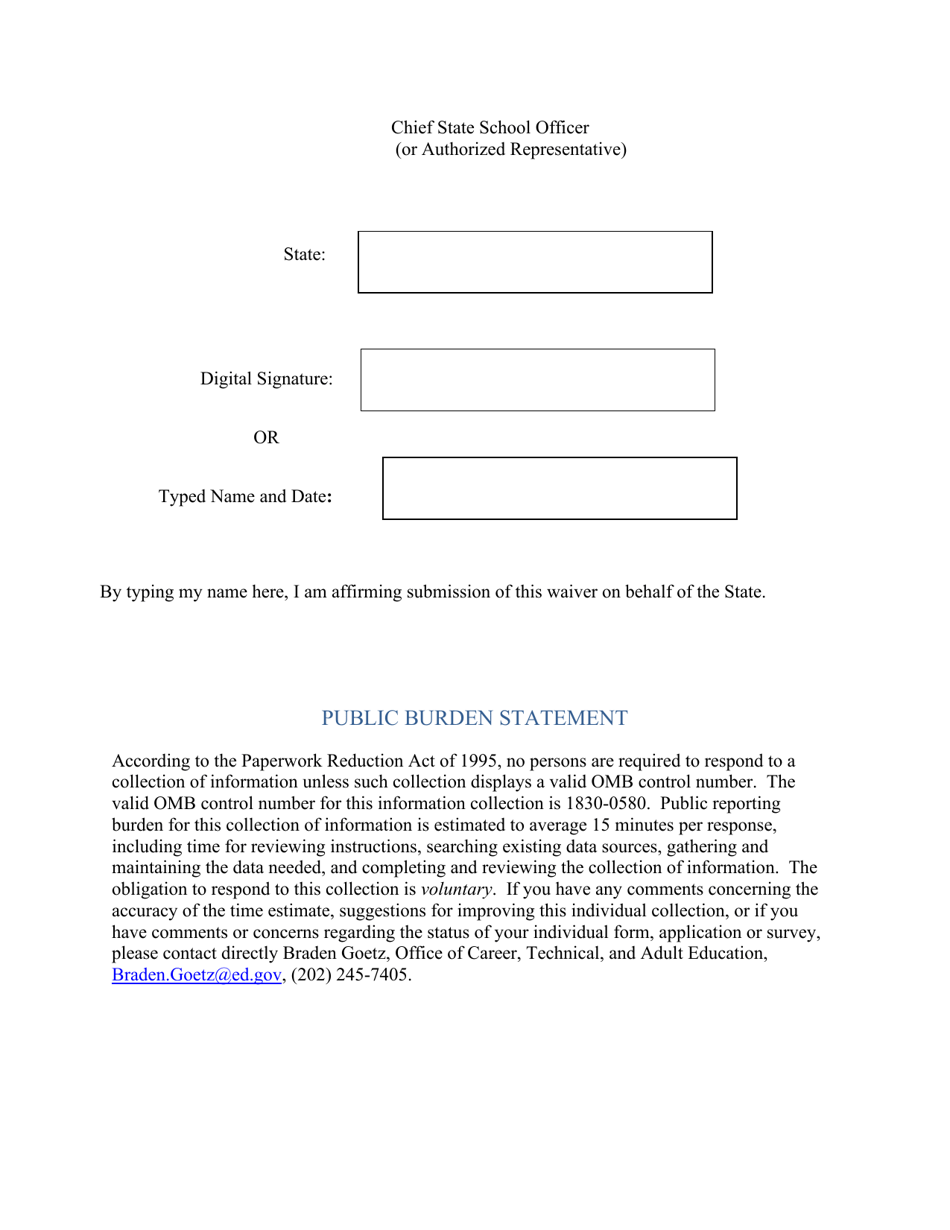

A: To apply for the Covid-19 Fiscal Waiver, individuals and businesses typically need to follow a specific application process outlined by the government. This may involve providing documentation and meeting certain requirements.

Q: Are there any limitations to the Covid-19 Fiscal Waiver?

A: Yes, there may be limitations to the Covid-19 Fiscal Waiver, such as income thresholds, specific industries or sectors that qualify, and other eligibility criteria set by the government.

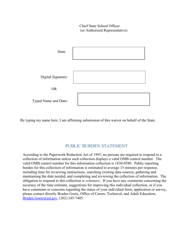

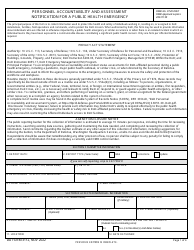

Form Details:

- The latest edition currently provided by the U.S. Department of Education;

- Ready to use and print;

- Easy to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of the form by clicking the link below or browse more legal forms and templates provided by the issuing department.