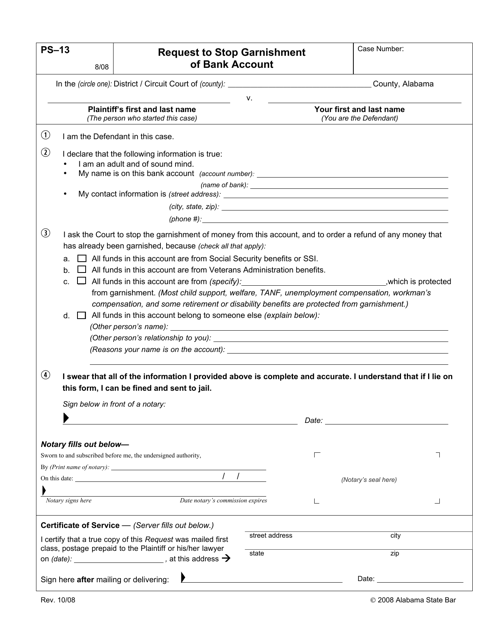

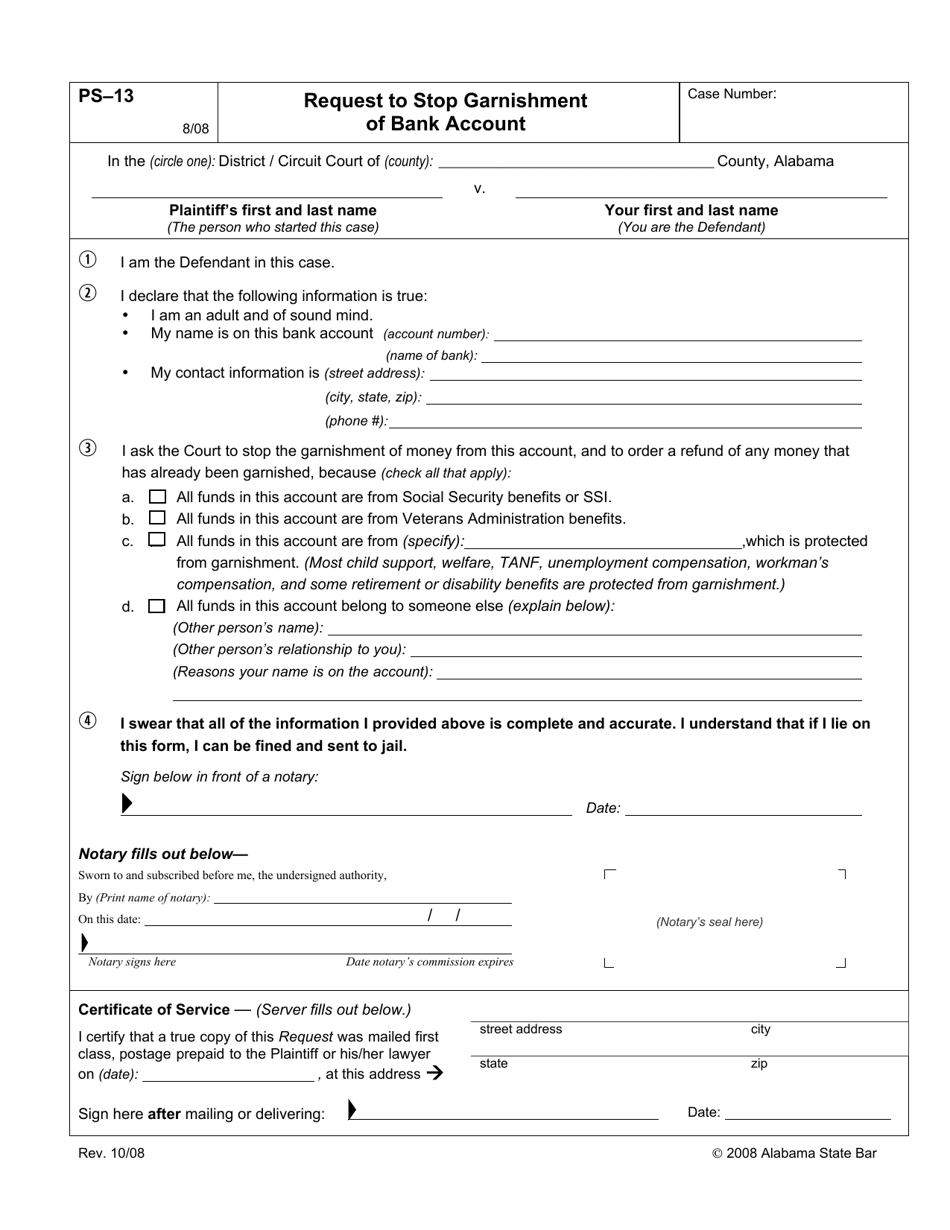

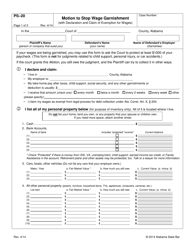

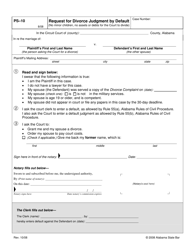

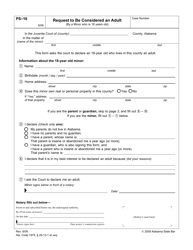

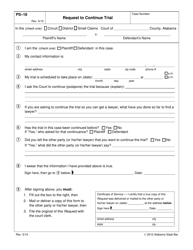

Form PS-13 Request to Stop Garnishment of Bank Account - Alabama

What Is Form PS-13?

This is a legal form that was released by the Alabama Judicial System - a government authority operating within Alabama. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is Form PS-13?

A: Form PS-13 is a document used in Alabama to request the stopping of a garnishment on a bank account.

Q: How do I use Form PS-13?

A: You will need to fill out the form with your personal information and provide the necessary details about the garnishment.

Q: Is there a fee to file Form PS-13?

A: The filing fee for Form PS-13 may vary depending on the county. Contact the clerk of court for more information.

Q: What happens after I submit Form PS-13?

A: After you submit the form, the court will review your request and determine whether to stop the garnishment.

Q: Can I stop a garnishment on my own without using Form PS-13?

A: It is recommended to use Form PS-13 to formally request the stopping of a garnishment. However, you should consult with an attorney for specific advice regarding your situation.

Q: Can I use Form PS-13 for garnishments in states other than Alabama?

A: No, Form PS-13 is specific to Alabama. Other states may have different forms and procedures.

Q: How long does it take to stop a garnishment after submitting Form PS-13?

A: The time it takes to stop a garnishment after submitting Form PS-13 can vary. Contact the clerk of court for more information on the timeline.

Q: What should I do if my bank account is garnished and I haven't received notice?

A: If your bank account is garnished and you haven't received notice, you should contact the court clerk immediately to inquire about the garnishment and seek guidance on how to proceed.

Q: Can I appeal a decision made on Form PS-13?

A: Yes, if your request to stop the garnishment is denied, you may have the option to appeal the decision. Consult with an attorney for guidance on the appeals process.

Q: Is legal representation required to fill out Form PS-13?

A: Legal representation is not required to fill out Form PS-13. However, it is recommended to seek legal advice if you have any questions or concerns.

Q: Are there any other forms or documents that I need to submit with Form PS-13?

A: Contact the court clerk to inquire about any additional forms or documents that may be required to be submitted along with Form PS-13.

Q: Can a bank freeze my account without a court order?

A: Under certain circumstances, a bank may freeze your account without a court order, such as in cases of suspected fraud or illegal activity. Consult with an attorney for specific advice regarding your situation.

Q: Can I stop a garnishment by negotiating with the creditor?

A: It is possible to negotiate with the creditor to stop a garnishment. However, it is recommended to consult with an attorney or a credit counseling agency to help with the negotiation process.

Q: What should I do if I believe the garnishment is in error?

A: If you believe the garnishment is in error, you should immediately contact the clerk of court and provide any supporting documentation to dispute the garnishment.

Q: Can I use Form PS-13 to stop other types of garnishments?

A: Form PS-13 is specifically for garnishments on bank accounts. For other types of garnishments, consult with an attorney or the appropriate court for the necessary forms and procedures.

Q: Is Form PS-13 available in languages other than English?

A: The availability of Form PS-13 in languages other than English may vary. Contact the court clerk or an attorney for assistance in obtaining translations if needed.

Q: Can the garnishment be reinstated after it has been stopped?

A: In certain circumstances, a garnishment can be reinstated after it has been stopped. Contact the court clerk for more information on the specific procedures.

Q: What should I do if my bank account is still being garnished after submitting Form PS-13?

A: If your bank account is still being garnished after submitting Form PS-13, you should contact the court clerk immediately to inquire about the status of your request and seek guidance on how to proceed.

Q: Can I use Form PS-13 to stop a wage garnishment?

A: No, Form PS-13 is specifically for garnishments on bank accounts. For wage garnishments, consult with an attorney or the appropriate court for the necessary forms and procedures.

Q: Can I use Form PS-13 for garnishments from the federal government?

A: No, Form PS-13 is for garnishments in the state of Alabama and may not be applicable for garnishments from the federal government. Consult with an attorney for guidance on federal garnishments.

Q: What should I do if I need help filling out Form PS-13?

A: If you need assistance filling out Form PS-13, consider reaching out to an attorney or a legal aid organization that can provide guidance and support.

Q: Can I file Form PS-13 electronically?

A: The electronic filing options for Form PS-13 may vary depending on the county. Contact the court clerk for more information on electronic filing procedures.

Q: How long does a garnishment stay on your record?

A: The duration of a garnishment on your record can vary depending on the circumstances. Contact the court clerk or an attorney for more information on the specific timeframes.

Q: Can I use Form PS-13 to stop multiple garnishments?

A: Yes, you can use Form PS-13 to stop multiple garnishments on different bank accounts. You will need to submit separate forms for each garnishment.

Q: What should I do if I receive a notice of garnishment from a bank?

A: If you receive a notice of garnishment from a bank, you should review the notice carefully, gather any necessary documentation, and contact an attorney or the court clerk for guidance on how to respond.

Q: Can I stop a garnishment by declaring bankruptcy?

A: Declaring bankruptcy may be an option to stop a garnishment. Consult with a bankruptcy attorney for specific advice on how bankruptcy may impact your garnishment.

Q: Can I stop a garnishment by making a payment arrangement with the creditor?

A: In some cases, making a payment arrangement with the creditor may lead to the stopping of a garnishment. Consult with an attorney or a credit counseling agency for assistance with negotiation.

Q: Can I stop a garnishment by closing my bank account?

A: Closing your bank account may not necessarily stop a garnishment. Consult with an attorney or the court clerk for guidance on how to handle the situation.

Q: What should I do if I receive a notice of garnishment from the court?

A: If you receive a notice of garnishment from the court, you should review the notice carefully, gather any necessary documentation, and contact an attorney or the court clerk for guidance on how to respond.

Q: Can I stop a garnishment by proving financial hardship?

A: Proving financial hardship may be a potential option to stop a garnishment. Consult with an attorney or a credit counseling agency for guidance on how to demonstrate financial hardship.

Q: What should I do if I disagree with the amount being garnished?

A: If you disagree with the amount being garnished, you should gather any supporting documentation and contact the court clerk to inquire about the process for disputing the garnishment.

Q: Can I use Form PS-13 to stop a tax garnishment?

A: No, Form PS-13 is specifically for garnishments on bank accounts and may not be applicable for tax garnishments. Consult with an attorney or the appropriate agency for guidance on tax garnishments.

Q: Can I use Form PS-13 to stop a child support garnishment?

A: No, Form PS-13 is specifically for garnishments on bank accounts and may not be applicable for child support garnishments. Consult with an attorney or the appropriate agency for guidance on child support garnishments.

Q: Can I stop a garnishment by filing an exemption?

A: Filing an exemption may be an option to stop a garnishment. Contact the court clerk or an attorney for guidance on the specific qualifying criteria and exemption process.

Q: What should I do if I missed the deadline to submit Form PS-13?

A: If you missed the deadline to submit Form PS-13, contact the court clerk immediately to inquire about any available options or alternative forms that may need to be submitted.

Q: Can I use Form PS-13 to stop a garnishment on a joint bank account?

A: Yes, you can use Form PS-13 to stop a garnishment on a joint bank account. Both account holders will need to complete and sign the form.

Q: Can I stop a garnishment by proving that the debt is paid off?

A: Proving that the debt is paid off may be a valid reason to stop a garnishment. Gather any necessary documentation and contact the court clerk for instructions on how to proceed.

Q: Can I use Form PS-13 to stop a garnishment on a prepaid debit card?

A: Form PS-13 may not be applicable for garnishments on prepaid debit cards. Consult with an attorney or the appropriate agency for guidance on how to address the situation.

Q: Can I stop a garnishment by filing a claim of exemption?

A: Filing a claim of exemption may be an option to stop a garnishment. Contact the court clerk or an attorney for guidance on the specific qualifying criteria and exemption process.

Q: Can I use Form PS-13 for garnishments from private creditors?

A: Yes, you can use Form PS-13 to stop garnishments from private creditors on your bank account.

Q: Can I use Form PS-13 to stop a garnishment on my business account?

A: Form PS-13 is specifically for personal bank accounts. For garnishments on business accounts, consult with an attorney or the appropriate agency for guidance.

Q: Can I be arrested if my bank account is garnished?

A: Being garnished does not typically result in arrest. However, failure to comply with a court order related to the garnishment may lead to legal consequences. Consult with an attorney for advice on how to handle your specific situation.

Q: Can I stop a garnishment by proving that the debt is not valid?

A: Proving that the debt is not valid may be a valid reason to stop a garnishment. Gather any supporting documentation and consult with an attorney to determine the best course of action.

Q: Can I use Form PS-13 to stop a garnishment on a savings account?

A: Yes, you can use Form PS-13 to stop a garnishment on a savings account.

Q: Can I stop a garnishment by claiming federal benefits?

A: Claiming federal benefits may be an option to stop a garnishment. Consult with an attorney or the appropriate agency for guidance on how to proceed.

Q: Can I use Form PS-13 for garnishments from the state of Alabama?

A: Form PS-13 is specifically for garnishments on bank accounts and may not be applicable for garnishments from the state of Alabama itself. Consult with an attorney or the appropriate agency for guidance on state garnishments.

Q: Can I stop a garnishment by proving that the debt is beyond the statute of limitations?

A: Proving that the debt is beyond the statute of limitations may be a valid reason to stop a garnishment. Gather any supporting documentation and consult with an attorney to determine the best course of action.

Q: Can I use Form PS-13 to stop a garnishment on a credit union account?

A: Yes, you can use Form PS-13 to stop a garnishment on a credit union account.

Q: Can I stop a garnishment by claiming head of household exemption?

A: Claiming head of household exemption may be an option to stop a garnishment. Consult with the court clerk or an attorney for guidance on the specific qualifying criteria and exemption process.

Q: Can I stop a garnishment by claiming social security exemption?

A: Claiming social security exemption may be an option to stop a garnishment. Consult with the court clerk or an attorney for guidance on the specific qualifying criteria and exemption process.

Q: Can I use Form PS-13 to stop a garnishment on a retirement account?

A: Form PS-13 may not be applicable for garnishments on retirement accounts. Consult with an attorney or the appropriate agency for guidance on how to address the situation.

Q: Can I stop a garnishment by claiming military service exemption?

A: Claiming military service exemption may be an option to stop a garnishment. Consult with the court clerk or an attorney for guidance on the specific qualifying criteria and exemption process.

Q: Can I use Form PS-13 to stop a garnishment on a brokerage account?

A: Form PS-13 may not be applicable for garnishments on brokerage accounts. Consult with an attorney or the appropriate agency for guidance on how to address the situation.

Q: Can I stop a garnishment by proving that the debt was discharged in bankruptcy?

A: Proving that the debt was discharged in bankruptcy may be a valid reason to stop a garnishment. Gather any necessary documentation and consult with an attorney for guidance on how to proceed.

Q: Can I use Form PS-13 to stop a garnishment on a trust account?

A: Form PS-13 may not be applicable for garnishments on trust accounts. Consult with an attorney or the appropriate agency for guidance on how to address the situation.

Q: Can I stop a garnishment by claiming exemption on federal benefits?

A: Claiming exemption on federal benefits may be an option to stop a garnishment. Consult with the court clerk or an attorney for guidance on the specific qualifying criteria and exemption process.

Q: Can I use Form PS-13 to stop a garnishment on a joint account with someone other than my spouse?

A: Yes, you can use Form PS-13 to stop a garnishment on a joint account with someone other than your spouse. Both account holders will need to complete and sign the form.

Q: Can I stop a garnishment by claiming exemption on state benefits?

A: Claiming exemption on state benefits may be an option to stop a garnishment. Consult with the court clerk or an attorney for guidance on the specific qualifying criteria and exemption process.

Q: Can I use Form PS-13 to stop a garnishment on a business checking account?

A: Form PS-13 is specifically for personal bank accounts. For garnishments on business accounts, consult with an attorney or the appropriate agency for guidance.

Q: Can I stop a garnishment by proving that I am a student?

A: Proving that you are a student may be a valid reason to stop a garnishment. Gather any necessary documentation and consult with the court clerk or an attorney for guidance on how to proceed.

Q: Can I use Form PS-13 to stop a garnishment on an investment account?

A: Form PS-13 may not be applicable for garnishments on investment accounts. Consult with an attorney or the appropriate agency for guidance on how to address the situation.

Q: Can I stop a garnishment by proving that I am receiving public assistance?

A: Proving that you are receiving public assistance may be a valid reason to stop a garnishment. Gather any necessary documentation and consult with the court clerk or an attorney for guidance on how to proceed.

Q: Can I use Form PS-13 to stop a garnishment on a health savings account (HSA)?

A: Form PS-13 may not be applicable for garnishments on health savings accounts (HSAs). Consult with an attorney or the appropriate agency for guidance on how to address the situation.

Q: Can I stop a garnishment by proving that I am unemployed?

A: Proving that you are unemployed may be a valid reason to stop a garnishment. Gather any necessary documentation and consult with the court clerk or an attorney for guidance on how to proceed.

Q: Can I use Form PS-13 to stop a garnishment on an estate account?

A: Form PS-13 may not be applicable for garnishments on estate accounts. Consult with an attorney or the appropriate agency for guidance on how to address the situation.

Q: Can I stop a garnishment by proving that I am experiencing financial hardship?

A: Proving that you are experiencing financial hardship may be a valid reason to stop a garnishment. Gather any necessary documentation and consult with the court clerk or an attorney for guidance on how to proceed.

Form Details:

- Released on October 1, 2008;

- The latest edition provided by the Alabama Judicial System;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form PS-13 by clicking the link below or browse more documents and templates provided by the Alabama Judicial System.