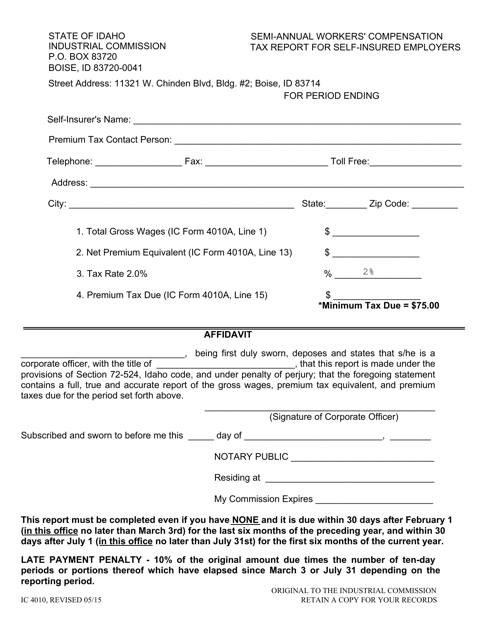

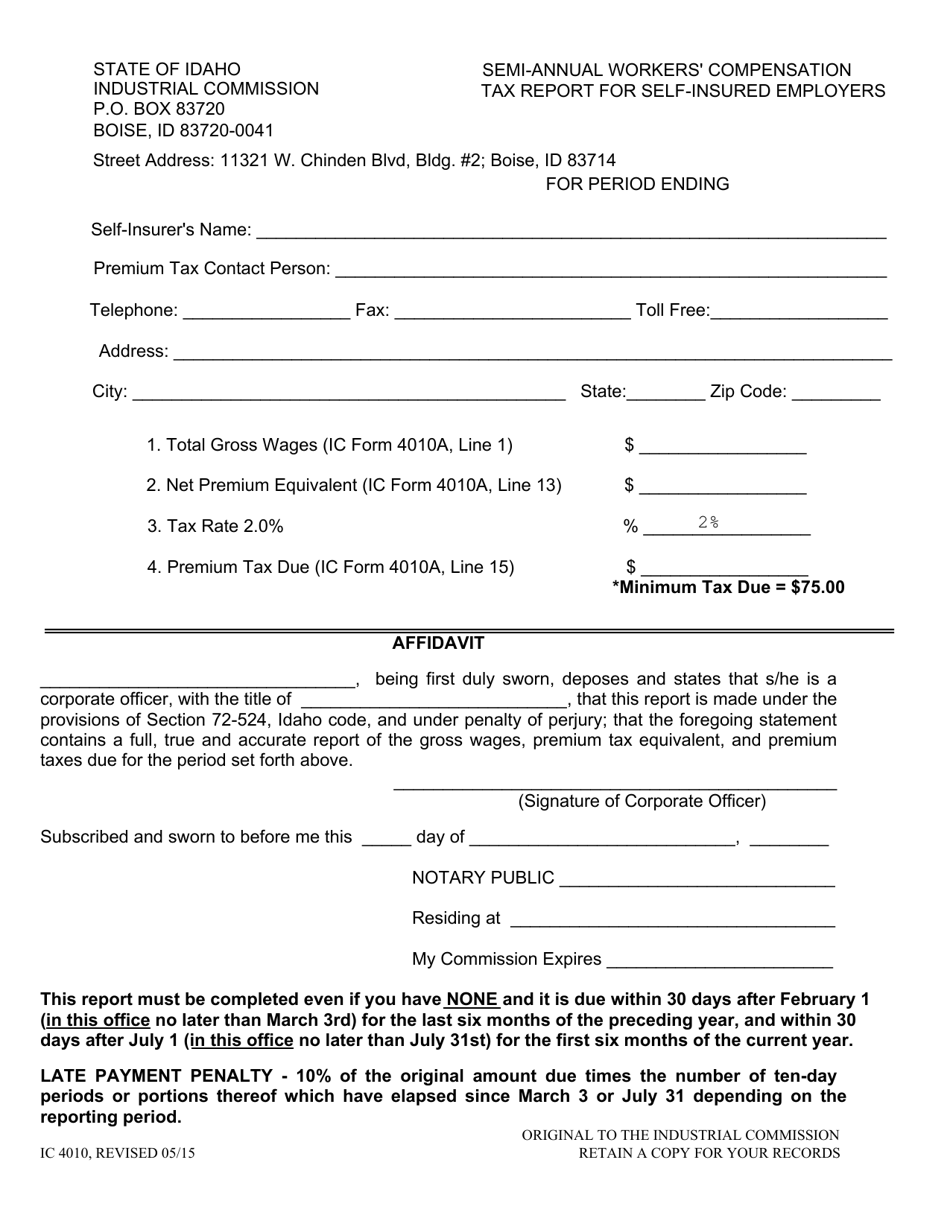

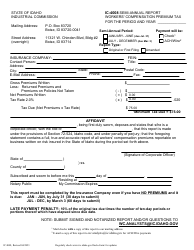

Form IC-4010 Semi-annual Workers' Compensation Tax Report for Self-insured Employers - Idaho

What Is Form IC-4010?

This is a legal form that was released by the Idaho Industrial Commission - a government authority operating within Idaho. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is Form IC-4010?

A: Form IC-4010 is the Semi-annual Workers' Compensation Tax Report for Self-insured Employers in Idaho.

Q: Who is required to file Form IC-4010?

A: Self-insured employers in Idaho are required to file Form IC-4010.

Q: What information is required on Form IC-4010?

A: Form IC-4010 requires self-insured employers to provide information about their quarterly workers' compensation tax liability, including payroll and tax payments.

Q: When is Form IC-4010 due?

A: Form IC-4010 is due on or before the last day of the month following the end of each calendar quarter.

Q: Are there any penalties for late filing of Form IC-4010?

A: Yes, late filing of Form IC-4010 may result in penalties and interest.

Q: Is there a fee for filing Form IC-4010?

A: There is no fee for filing Form IC-4010.

Form Details:

- Released on May 1, 2015;

- The latest edition provided by the Idaho Industrial Commission;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form IC-4010 by clicking the link below or browse more documents and templates provided by the Idaho Industrial Commission.