This version of the form is not currently in use and is provided for reference only. Download this version of

ETA Form 9061

for the current year.

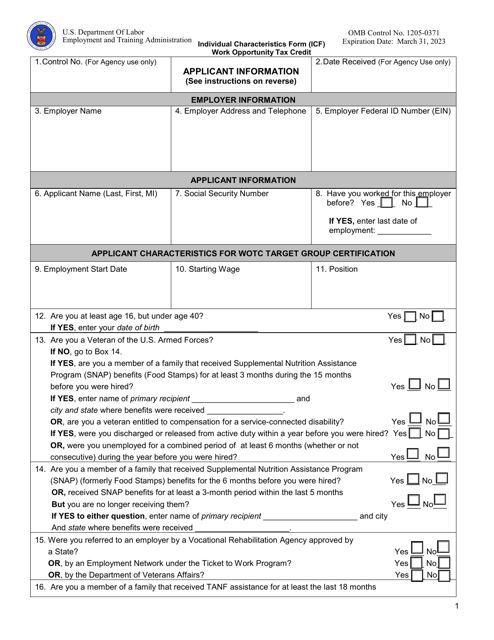

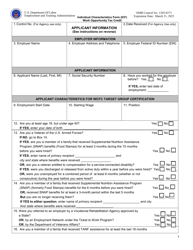

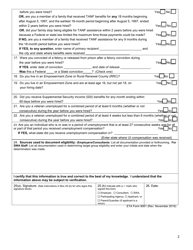

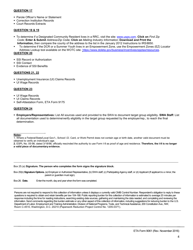

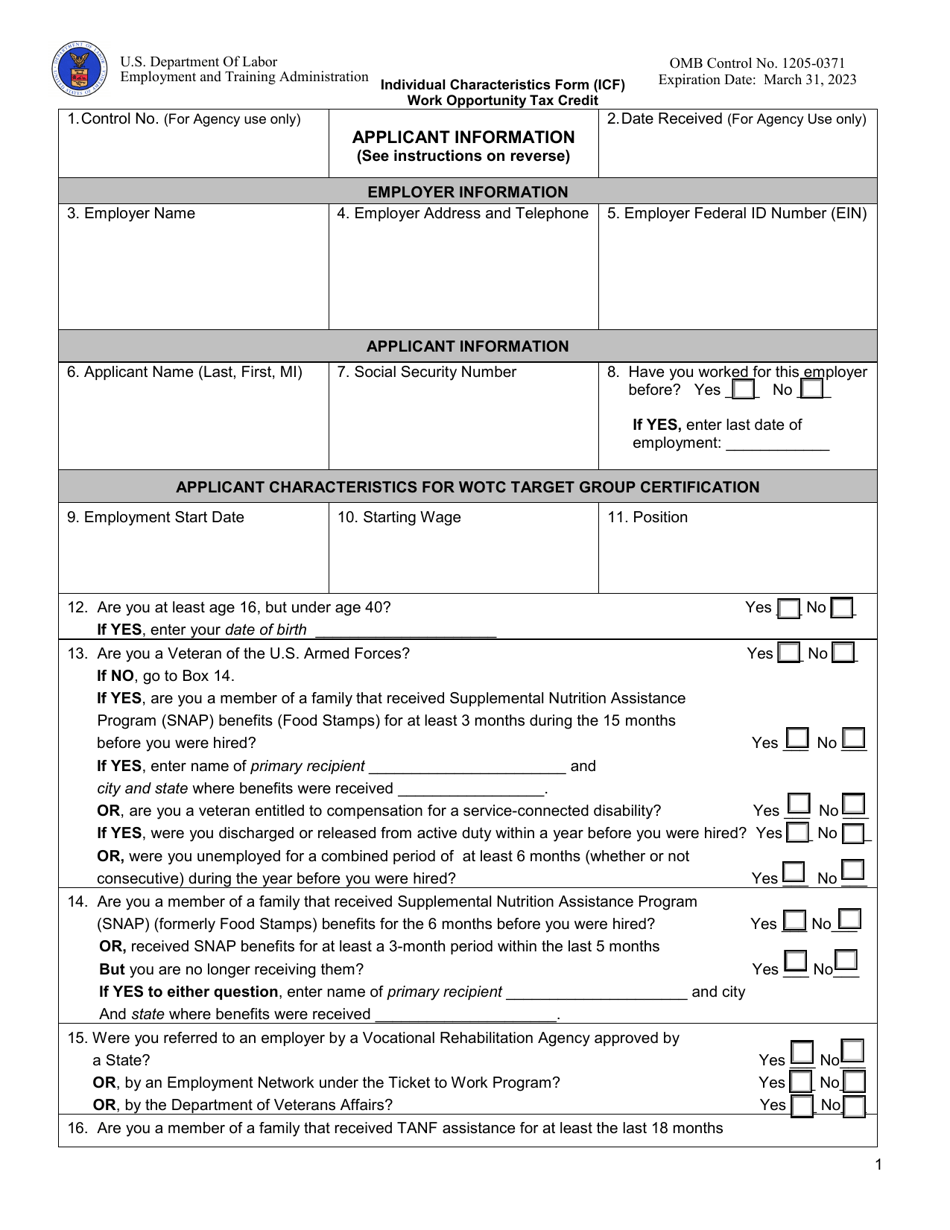

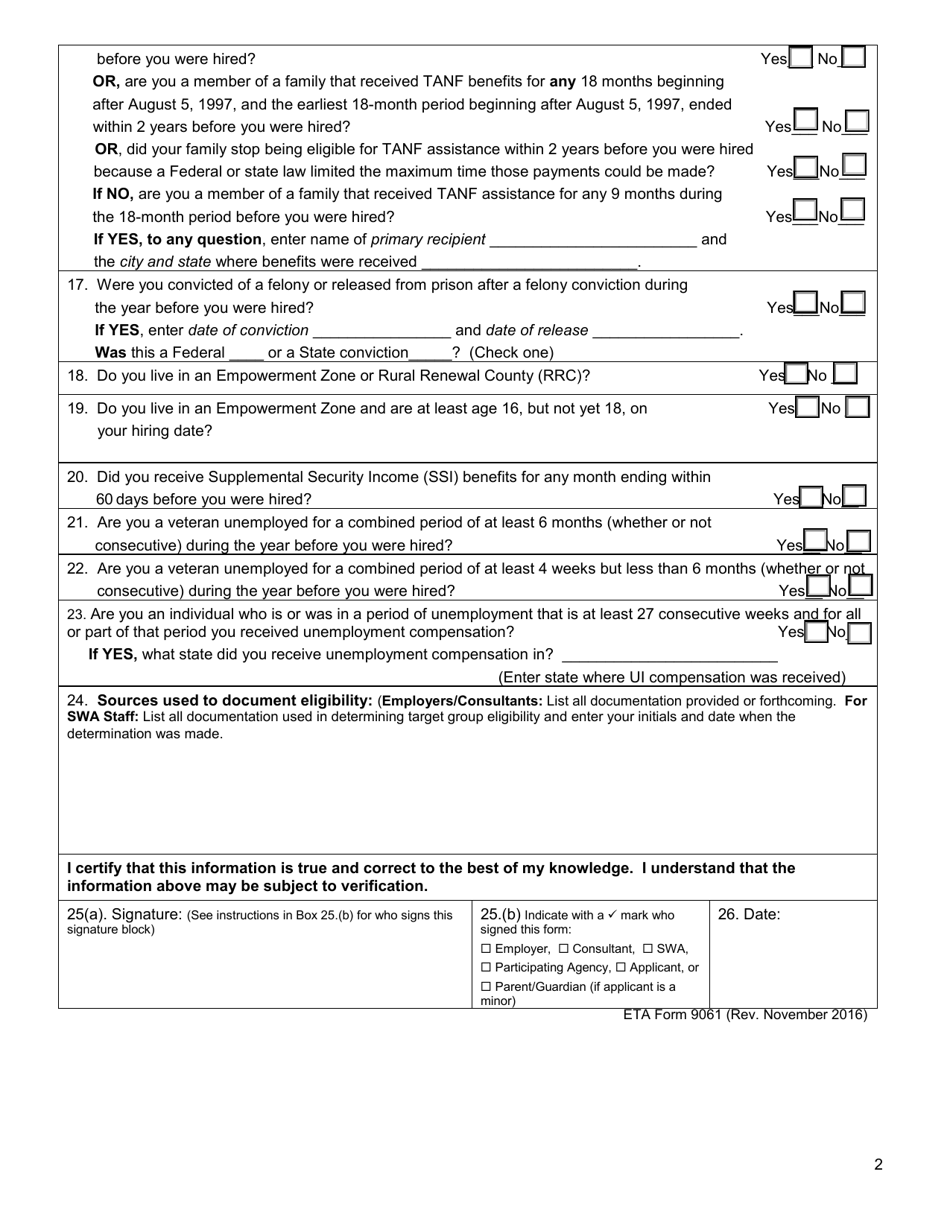

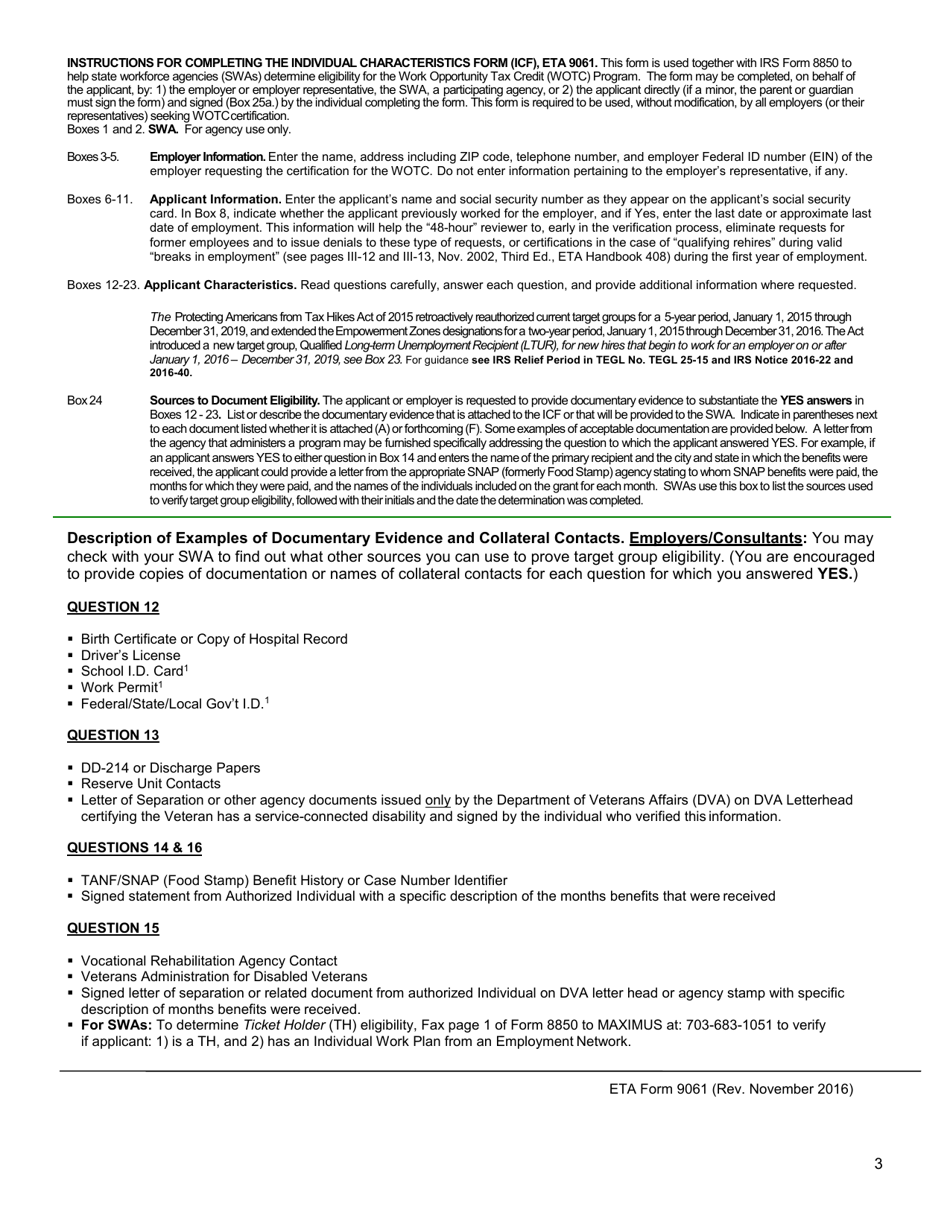

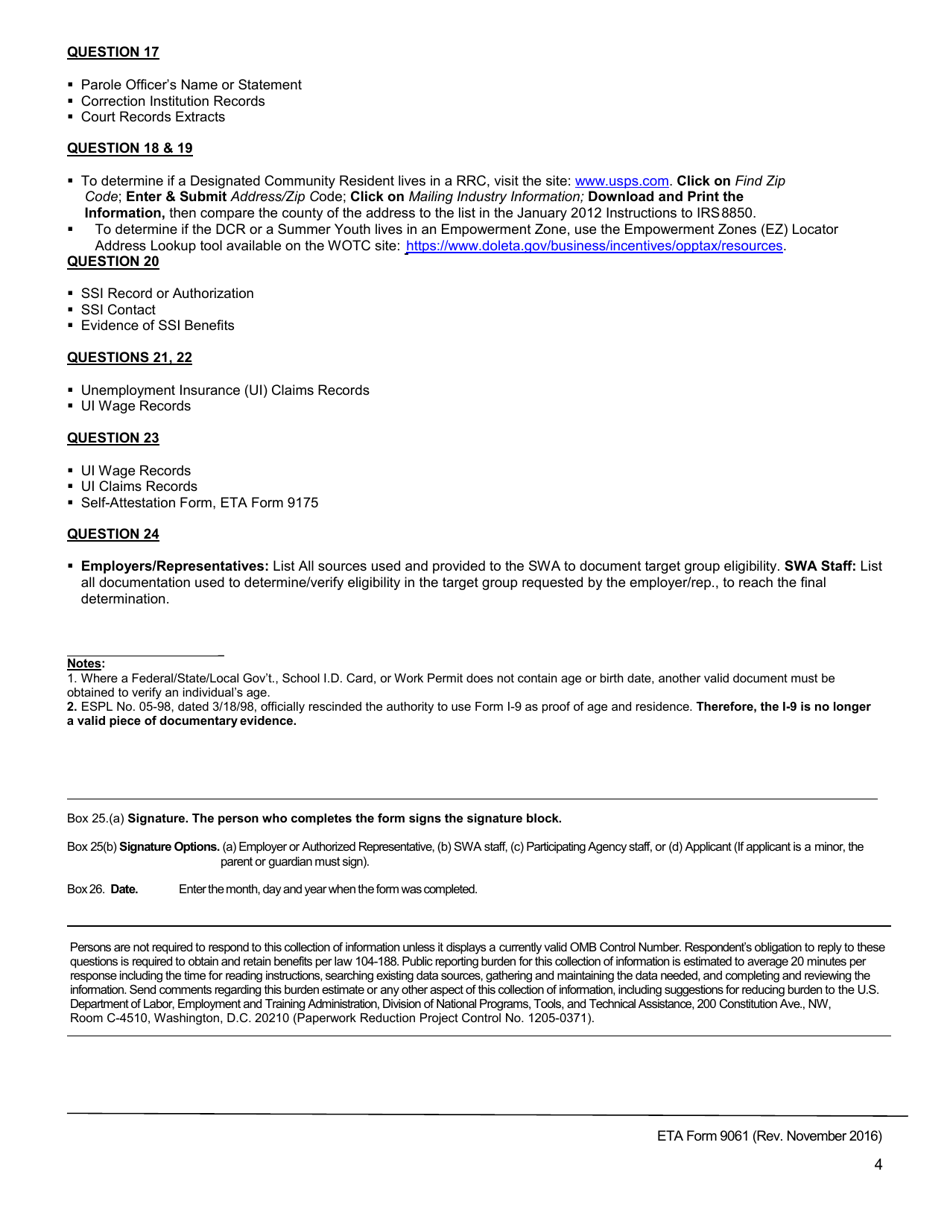

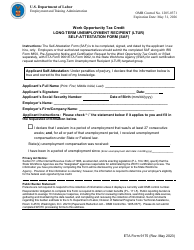

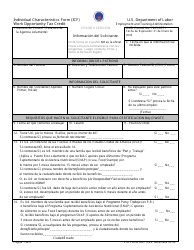

ETA Form 9061 Individual Characteristics Form (Icf) - Work Opportunity Tax Credit

What Is ETA Form 9061?

This is a legal form that was released by the U.S. Department of Labor - Employment & Training Administration on November 1, 2016 and used country-wide. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is the ETA Form 9061?

A: The ETA Form 9061 is the Individual Characteristics Form (ICF) used for the Work Opportunity Tax Credit.

Q: What is the Work Opportunity Tax Credit?

A: The Work Opportunity Tax Credit (WOTC) is a federal tax credit available to employers who hire individuals from certain target groups who have faced employment barriers.

Q: What is the purpose of the ETA Form 9061?

A: The purpose of the ETA Form 9061 is to gather information about an individual's eligibility for the Work Opportunity Tax Credit.

Q: Who should fill out the ETA Form 9061?

A: The ETA Form 9061 should be filled out by the job applicant, or by the employer with input from the applicant.

Q: What information is collected on the ETA Form 9061?

A: The ETA Form 9061 collects information such as the individual's personal details, education, employment history, and eligibility for the WOTC.

Form Details:

- Released on November 1, 2016;

- The latest available edition released by the U.S. Department of Labor - Employment & Training Administration;

- Easy to use and ready to print;

- Yours to fill out and keep for your records;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of ETA Form 9061 by clicking the link below or browse more documents and templates provided by the U.S. Department of Labor - Employment & Training Administration.