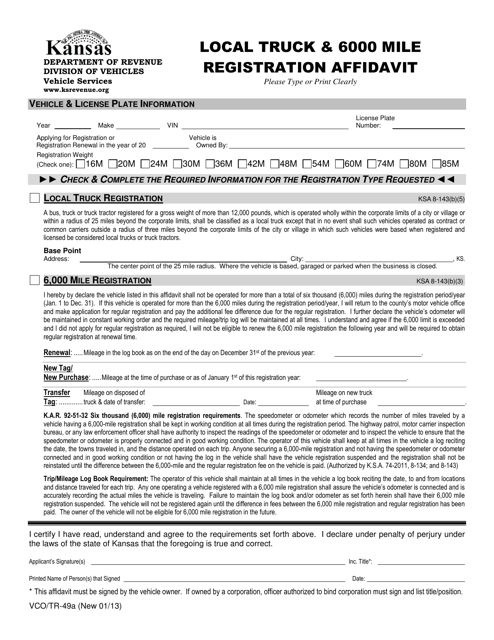

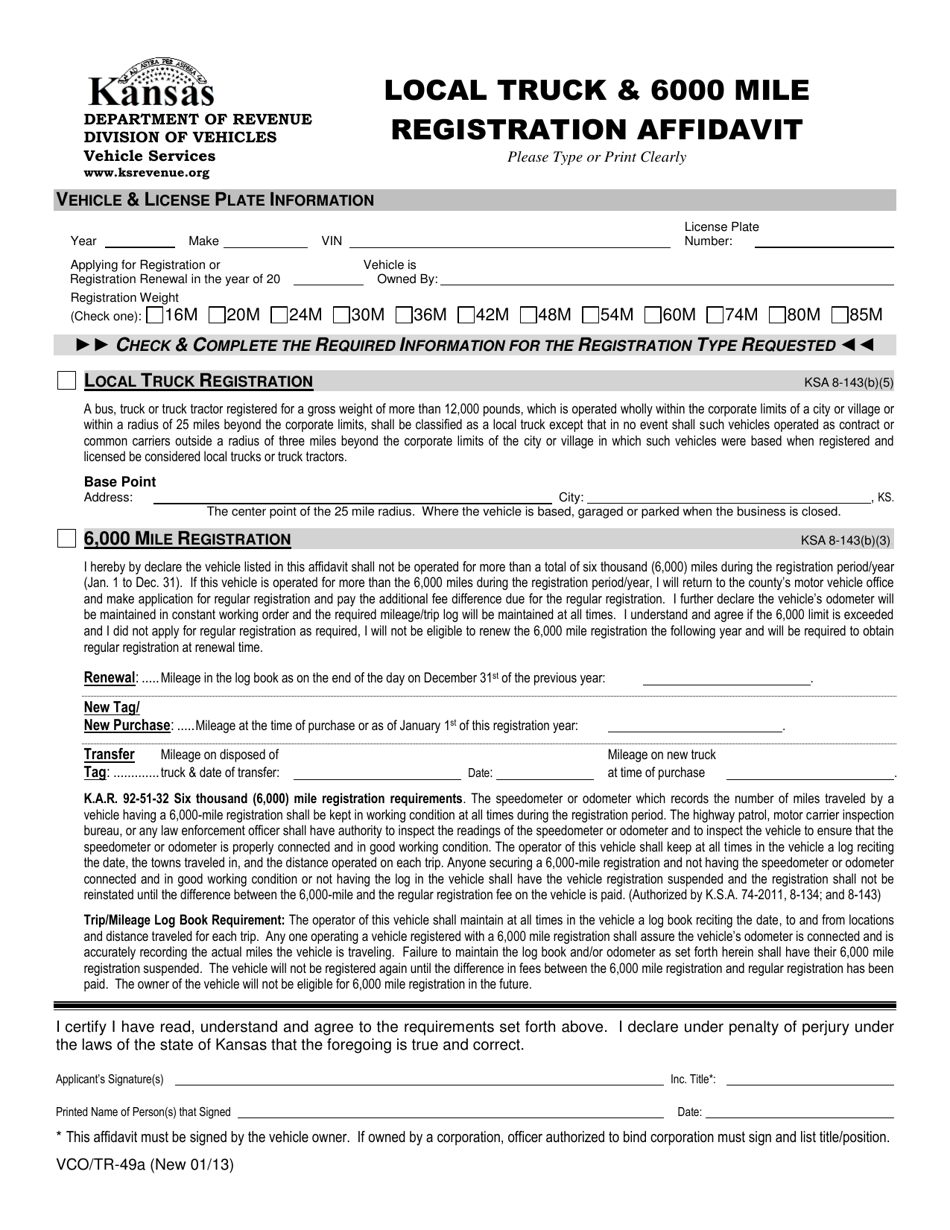

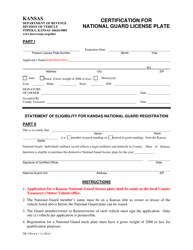

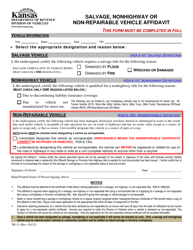

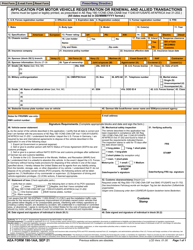

Form TR-49A Local Truck & 6000 Mile Registration Affidavit - Kansas

What Is Form TR-49A?

This is a legal form that was released by the Kansas Department of Revenue - a government authority operating within Kansas. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is Form TR-49A?

A: Form TR-49A is the Local Truck & 6000 Mile Registration Affidavit.

Q: What is the purpose of Form TR-49A?

A: The purpose of Form TR-49A is to register local trucks and report mileage in the state of Kansas.

Q: Who needs to file Form TR-49A?

A: Owners or operators of local trucks in Kansas need to file Form TR-49A.

Q: What information is required on Form TR-49A?

A: Form TR-49A requires information such as vehicle details, owner/operator details, and mileage information.

Q: Is there a fee for filing Form TR-49A?

A: Yes, there is a fee for filing Form TR-49A. The fee amount can vary and is based on factors such as vehicle weight and mileage.

Q: When is Form TR-49A due?

A: Form TR-49A is typically due by the end of February each year.

Q: Are there any penalties for late filing of Form TR-49A?

A: Yes, there may be penalties for late filing of Form TR-49A, including potential late fees and legal consequences.

Q: Are there any exemptions or exclusions for Form TR-49A?

A: Yes, certain exemptions and exclusions may apply. It is best to consult the Kansas Department of Revenue or the instructions for Form TR-49A for more information.

Form Details:

- Released on January 1, 2013;

- The latest edition provided by the Kansas Department of Revenue;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a printable version of Form TR-49A by clicking the link below or browse more documents and templates provided by the Kansas Department of Revenue.