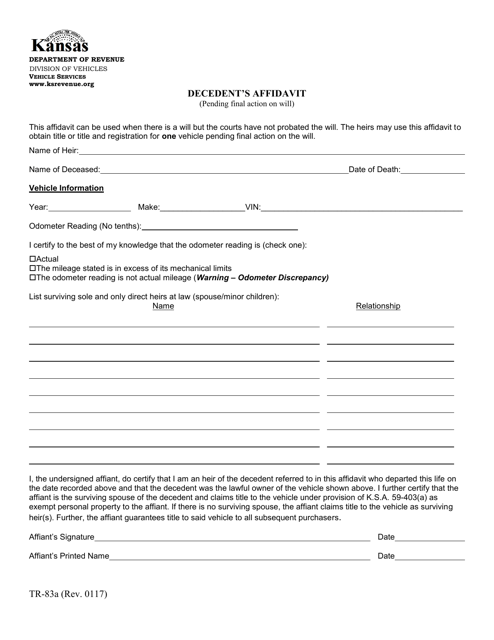

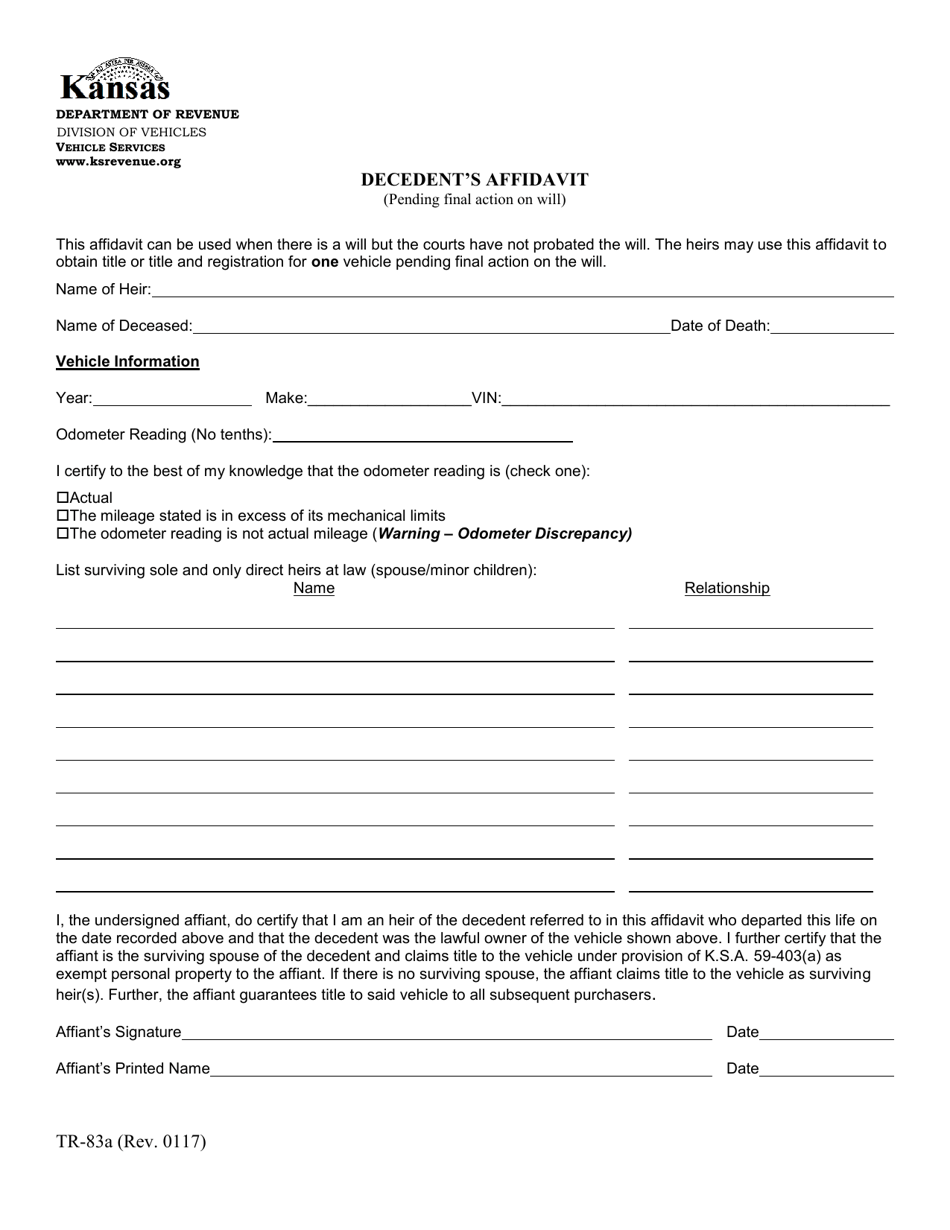

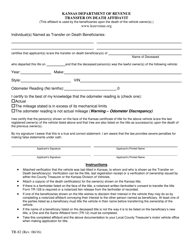

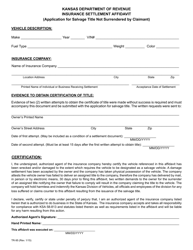

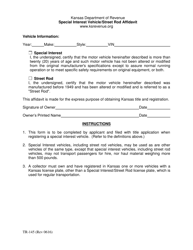

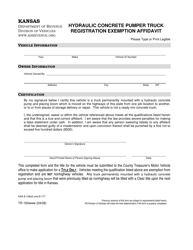

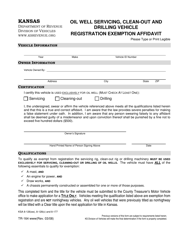

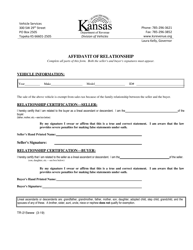

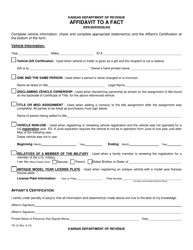

Form TR-83A Decedent's Affidavit - Kansas

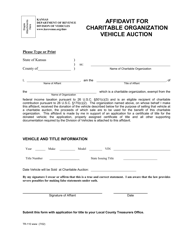

What Is Form TR-83A?

This is a legal form that was released by the Kansas Department of Revenue - a government authority operating within Kansas. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

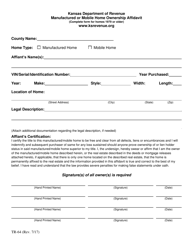

Q: What is Form TR-83A?

A: Form TR-83A is the Decedent's Affidavit used in Kansas.

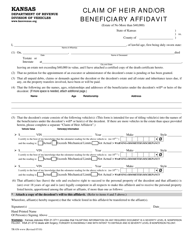

Q: Who should use Form TR-83A?

A: Form TR-83A should be used by the personal representative of the decedent's estate.

Q: What is the purpose of Form TR-83A?

A: The purpose of Form TR-83A is to provide information about the decedent's assets and liabilities.

Q: When should Form TR-83A be filed?

A: Form TR-83A should be filed within nine months from the date of the decedent's death.

Q: What information is required on Form TR-83A?

A: Form TR-83A requires information about the decedent's personal information, assets, liabilities, and beneficiaries.

Q: Are there any fees associated with filing Form TR-83A?

A: Yes, there is a filing fee associated with filing Form TR-83A.

Q: What happens after I file Form TR-83A?

A: After you file Form TR-83A, the information will be used to determine the decedent's estate tax liability, if applicable.

Q: Is Form TR-83A confidential?

A: No, Form TR-83A is not confidential and may be subject to public inspection.

Form Details:

- Released on January 1, 2017;

- The latest edition provided by the Kansas Department of Revenue;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form TR-83A by clicking the link below or browse more documents and templates provided by the Kansas Department of Revenue.