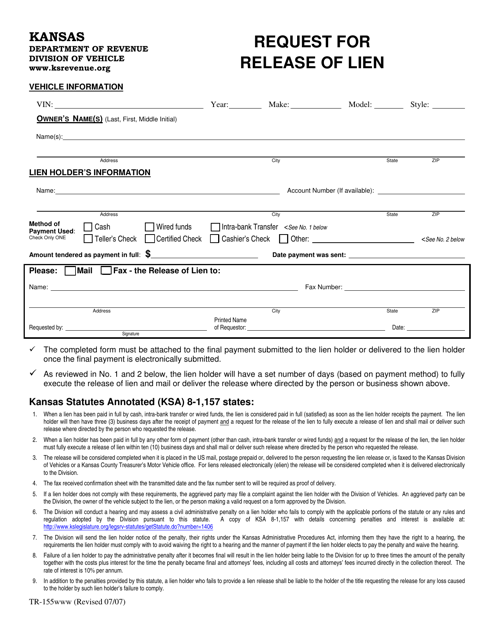

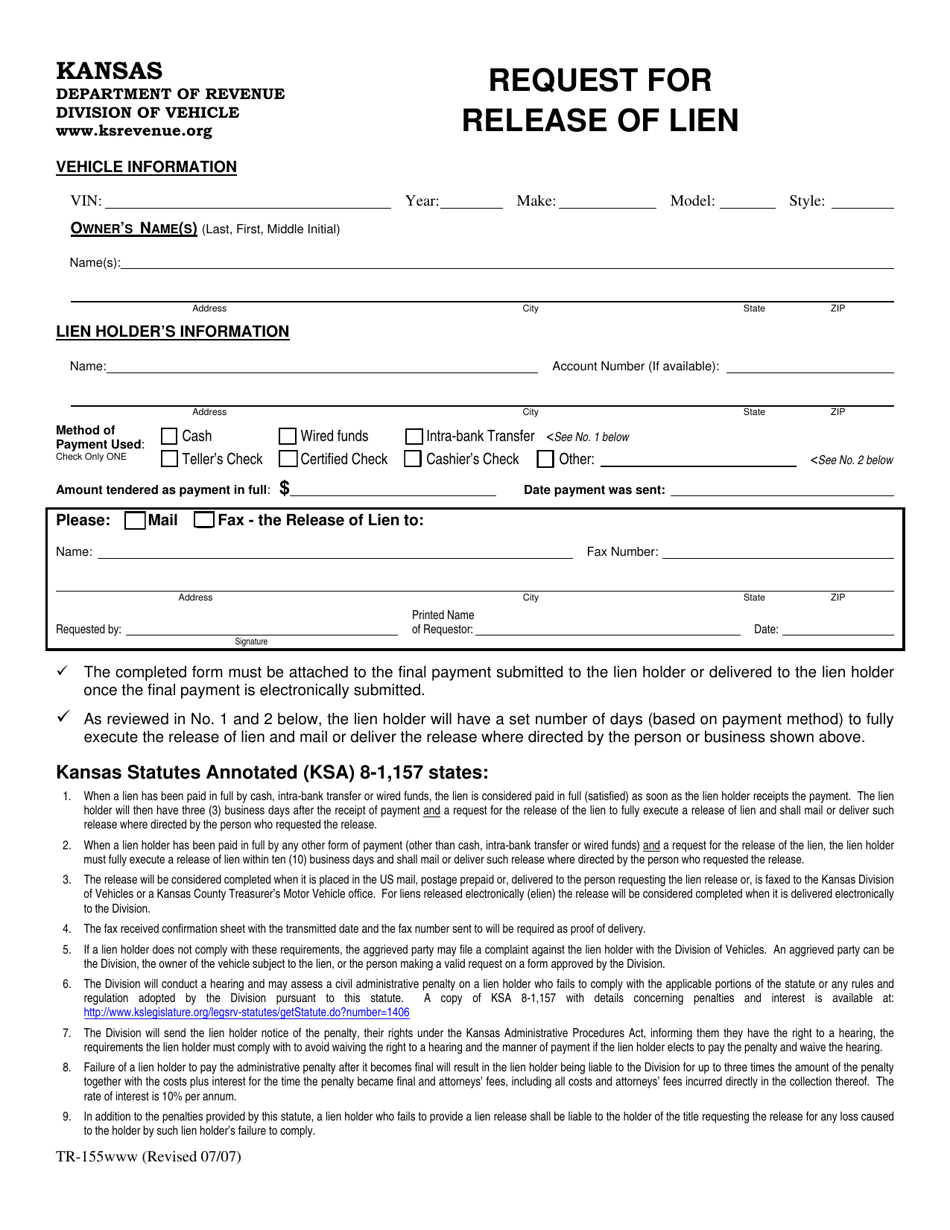

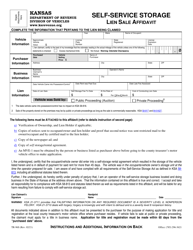

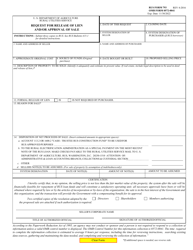

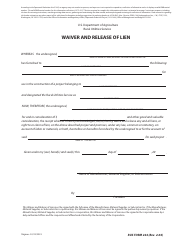

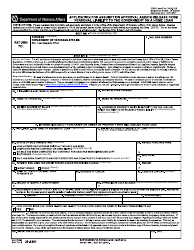

Form TR-155 Request for Release of Lien - Kansas

What Is Form TR-155?

This is a legal form that was released by the Kansas Department of Revenue - a government authority operating within Kansas. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is Form TR-155?

A: Form TR-155 is the Request for Release of Lien specific to Kansas.

Q: Who uses Form TR-155?

A: Form TR-155 is used by individuals or entities in Kansas to request the release of a lien.

Q: What is the purpose of Form TR-155?

A: The purpose of Form TR-155 is to request the release of a lien that has been placed on a property or asset.

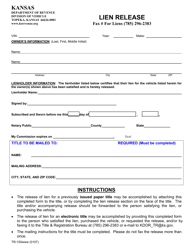

Q: What information is required on Form TR-155?

A: Form TR-155 requires information such as the lienholder's name, the property or asset information, and the reason for the release request.

Q: Are there any fees associated with filing Form TR-155?

A: There may be fees associated with filing Form TR-155, depending on the county and the specific circumstances. It is best to check with your local county clerk's office for more information.

Form Details:

- Released on July 1, 2007;

- The latest edition provided by the Kansas Department of Revenue;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form TR-155 by clicking the link below or browse more documents and templates provided by the Kansas Department of Revenue.