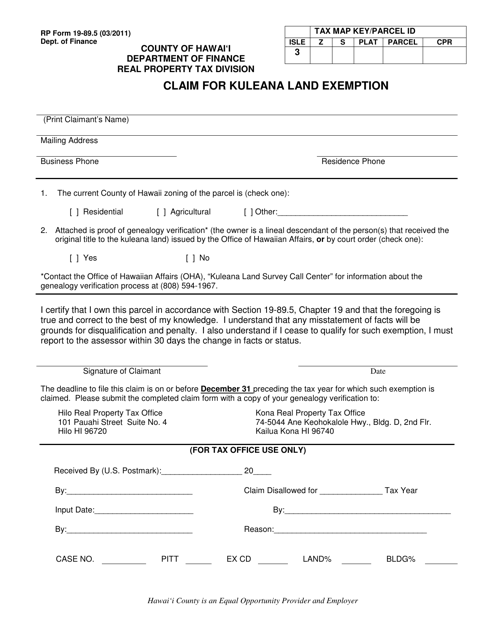

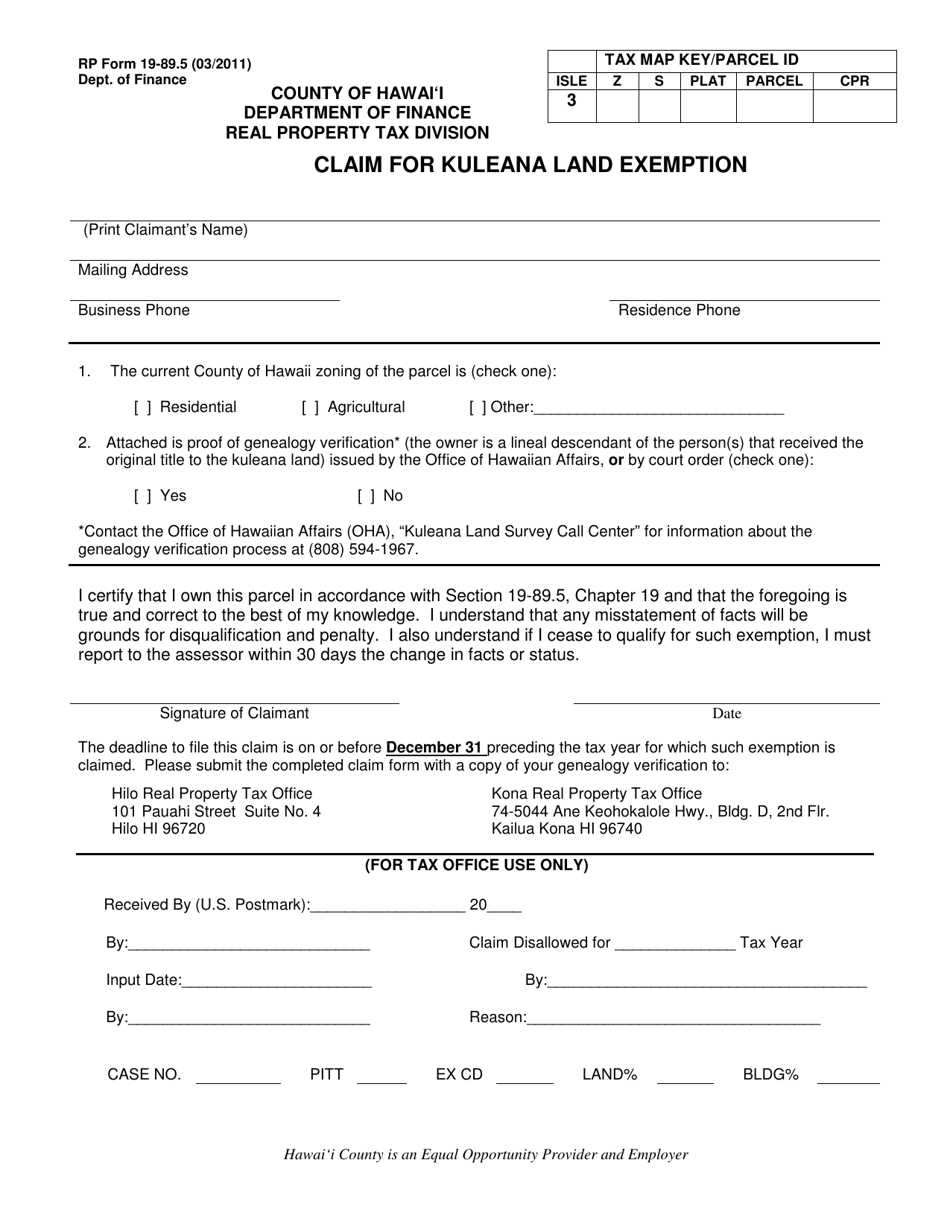

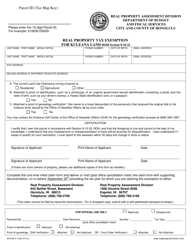

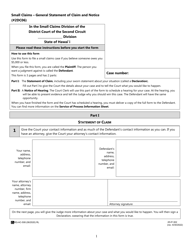

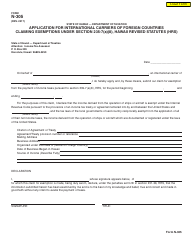

RP Form 19-89.5 Claim for Kuleana Land Exemption - Hawaii

What Is RP Form 19-89.5?

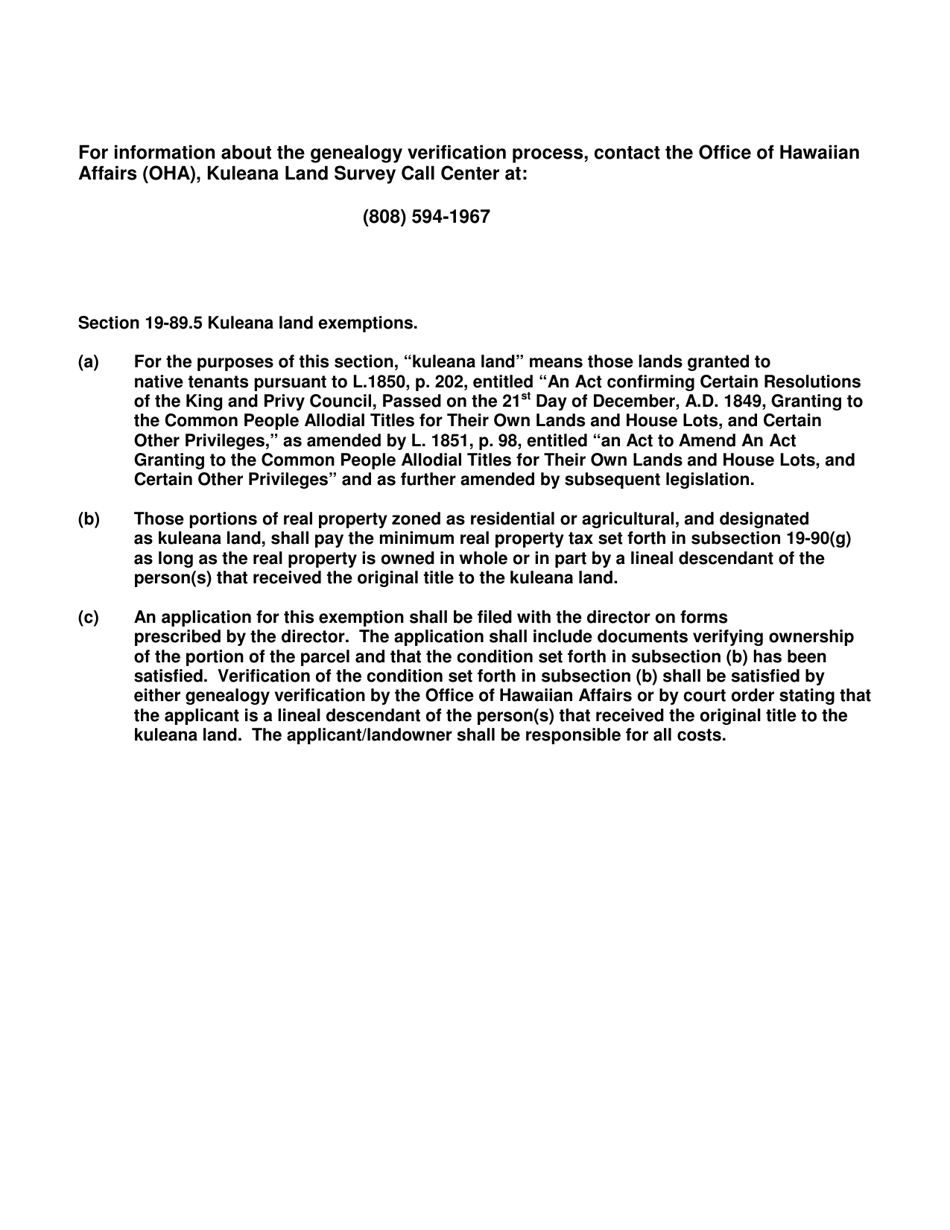

This is a legal form that was released by the Department of Finance - County of Hawaii, Hawaii - a government authority operating within Hawaii. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is RP Form 19-89.5?

A: RP Form 19-89.5 is the Claim for Kuleana Land Exemption form in Hawaii.

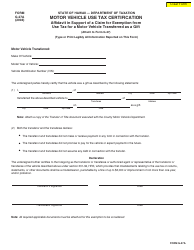

Q: What is Kuleana Land?

A: Kuleana Land refers to ancestral Hawaiian land that has been passed down through generations.

Q: What is the purpose of RP Form 19-89.5?

A: The purpose of RP Form 19-89.5 is to claim the Kuleana Land Exemption in Hawaii.

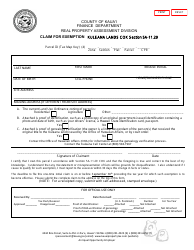

Q: Who can file RP Form 19-89.5?

A: Individuals who hold Kuleana Land in Hawaii can file RP Form 19-89.5.

Q: What does the Kuleana Land Exemption provide?

A: The Kuleana Land Exemption provides certain tax benefits for Kuleana Land owners in Hawaii.

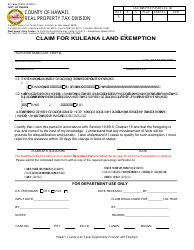

Q: Are there any deadlines for filing RP Form 19-89.5?

A: Yes, there may be specific deadlines for filing RP Form 19-89.5. It is recommended to check with the Hawaii Department of Taxation for the latest information.

Q: Are there any fees associated with filing RP Form 19-89.5?

A: There may be fees associated with filing RP Form 19-89.5. Details regarding fees can be obtained from the Hawaii Department of Taxation.

Q: What supporting documents are required for RP Form 19-89.5?

A: The specific supporting documents required for RP Form 19-89.5 can be found in the instructions provided by the Hawaii Department of Taxation.

Q: Can I get assistance in completing RP Form 19-89.5?

A: Yes, you can seek assistance from the Hawaii Department of Taxation or consult with a tax professional for help in completing RP Form 19-89.5.

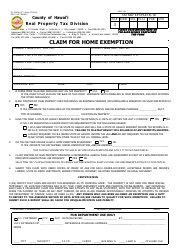

Form Details:

- Released on March 1, 2011;

- The latest edition provided by the Department of Finance - County of Hawaii, Hawaii;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a printable version of RP Form 19-89.5 by clicking the link below or browse more documents and templates provided by the Department of Finance - County of Hawaii, Hawaii.