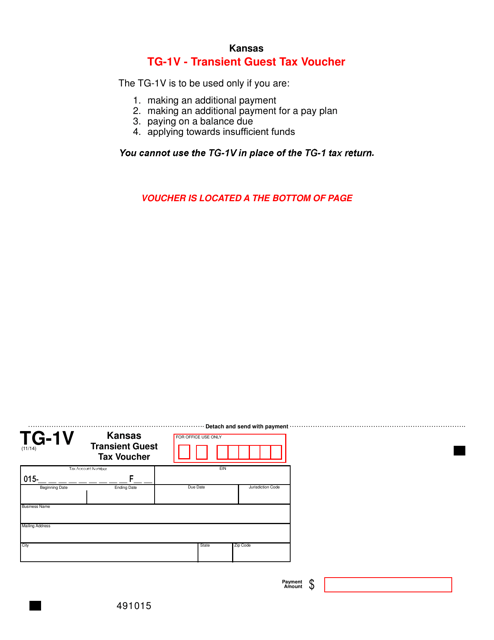

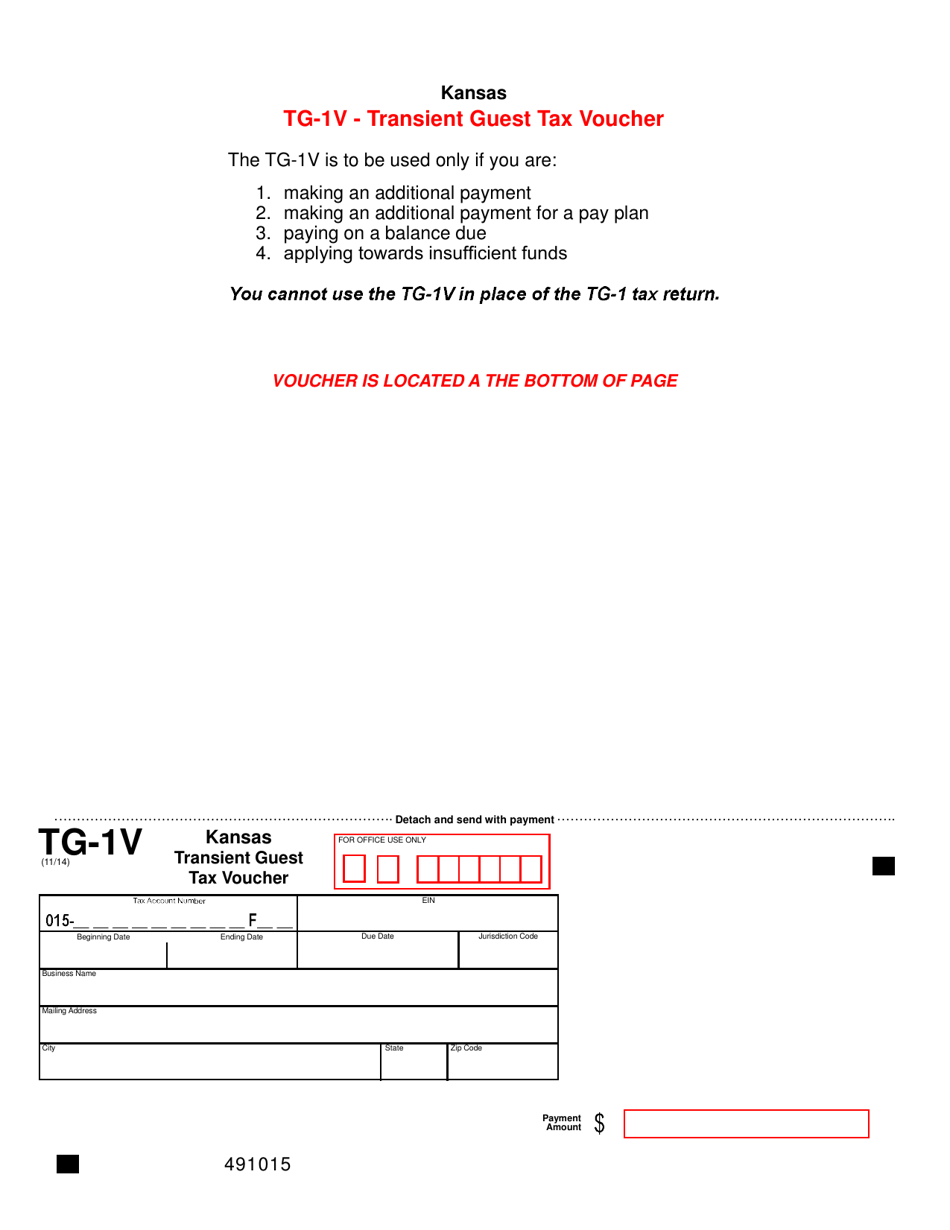

Form TG-1V Kansas Transient Guest Tax Voucher - Kansas

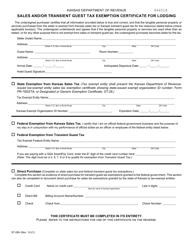

What Is Form TG-1V?

This is a legal form that was released by the Kansas Department of Revenue - a government authority operating within Kansas. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is the TG-1V Kansas Transient Guest Tax Voucher?

A: The TG-1V Kansas Transient Guest Tax Voucher is a form used to report and remit the transient guest tax in Kansas.

Q: Who is required to file the TG-1V Kansas Transient Guest Tax Voucher?

A: Any person or business who operates or owns a transient lodging facility in Kansas is required to file the TG-1V.

Q: What is the transient guest tax?

A: The transient guest tax is a tax imposed on the rental of transient lodging accommodations, such as hotels, motels, and vacation rentals.

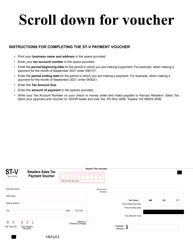

Q: How often do I need to file the TG-1V Kansas Transient Guest Tax Voucher?

A: The TG-1V must be filed monthly, with the tax payment due on or before the 25th day of the following month.

Q: What information do I need to provide on the TG-1V Kansas Transient Guest Tax Voucher?

A: You will need to provide information such as your name or business name, address, gross receipts from transient lodging rentals, and the amount of transient guest tax owed.

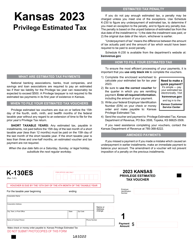

Q: What happens if I don't file the TG-1V or pay the transient guest tax?

A: Failure to file the TG-1V or pay the transient guest tax can result in penalties and interest being assessed by the Kansas Department of Revenue.

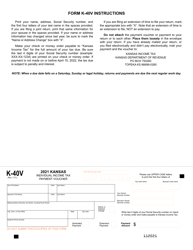

Q: Are there any exemptions or deductions available for the transient guest tax?

A: There are certain exemptions and deductions available for the transient guest tax in Kansas. You should consult the Kansas Department of Revenue or a tax professional for more information.

Q: What if I have additional questions about the TG-1V or the transient guest tax in Kansas?

A: If you have additional questions, you can contact the Kansas Department of Revenue directly for assistance.

Form Details:

- Released on November 1, 2014;

- The latest edition provided by the Kansas Department of Revenue;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form TG-1V by clicking the link below or browse more documents and templates provided by the Kansas Department of Revenue.