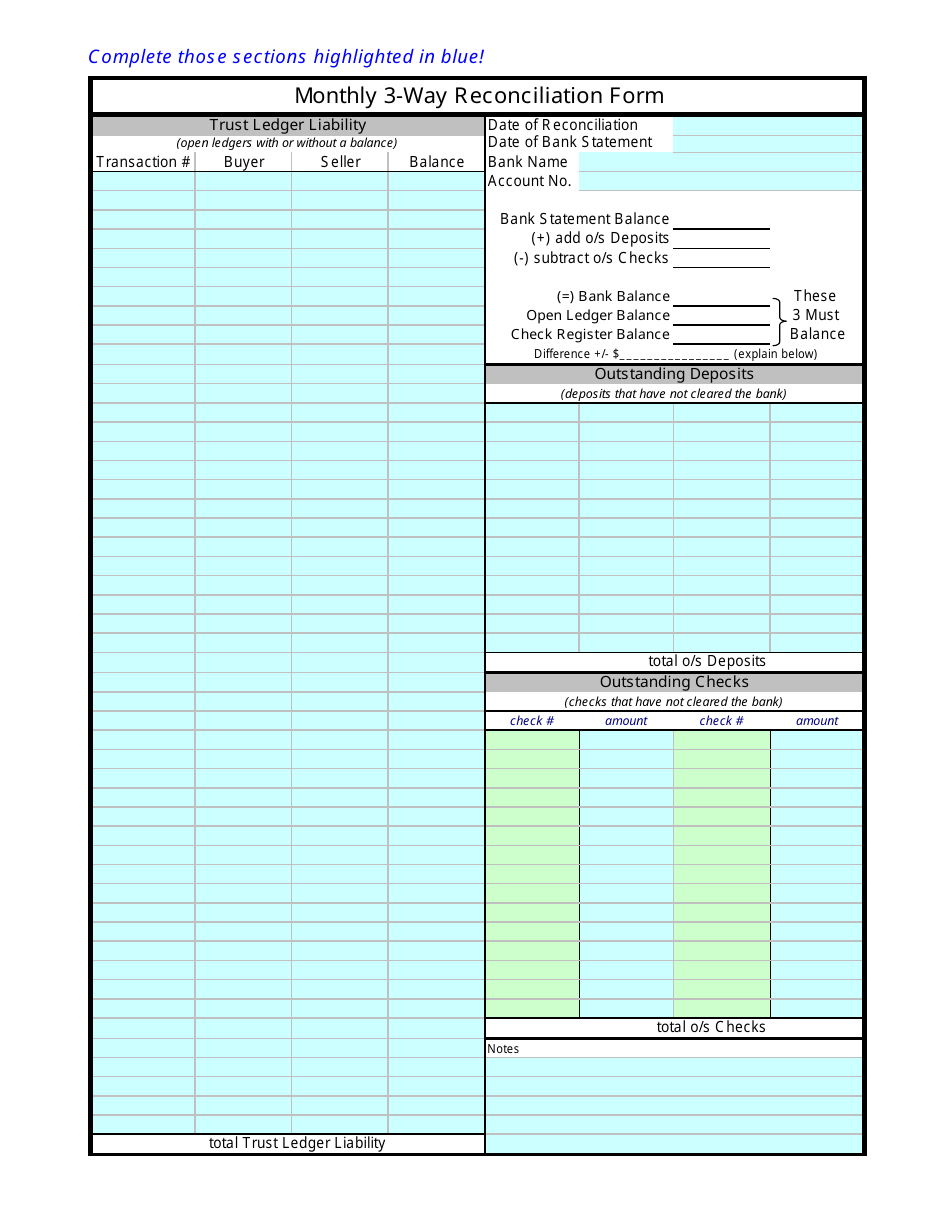

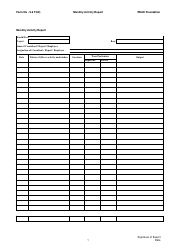

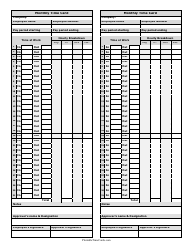

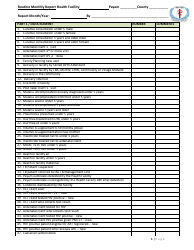

Monthly 3-way Reconciliation Form

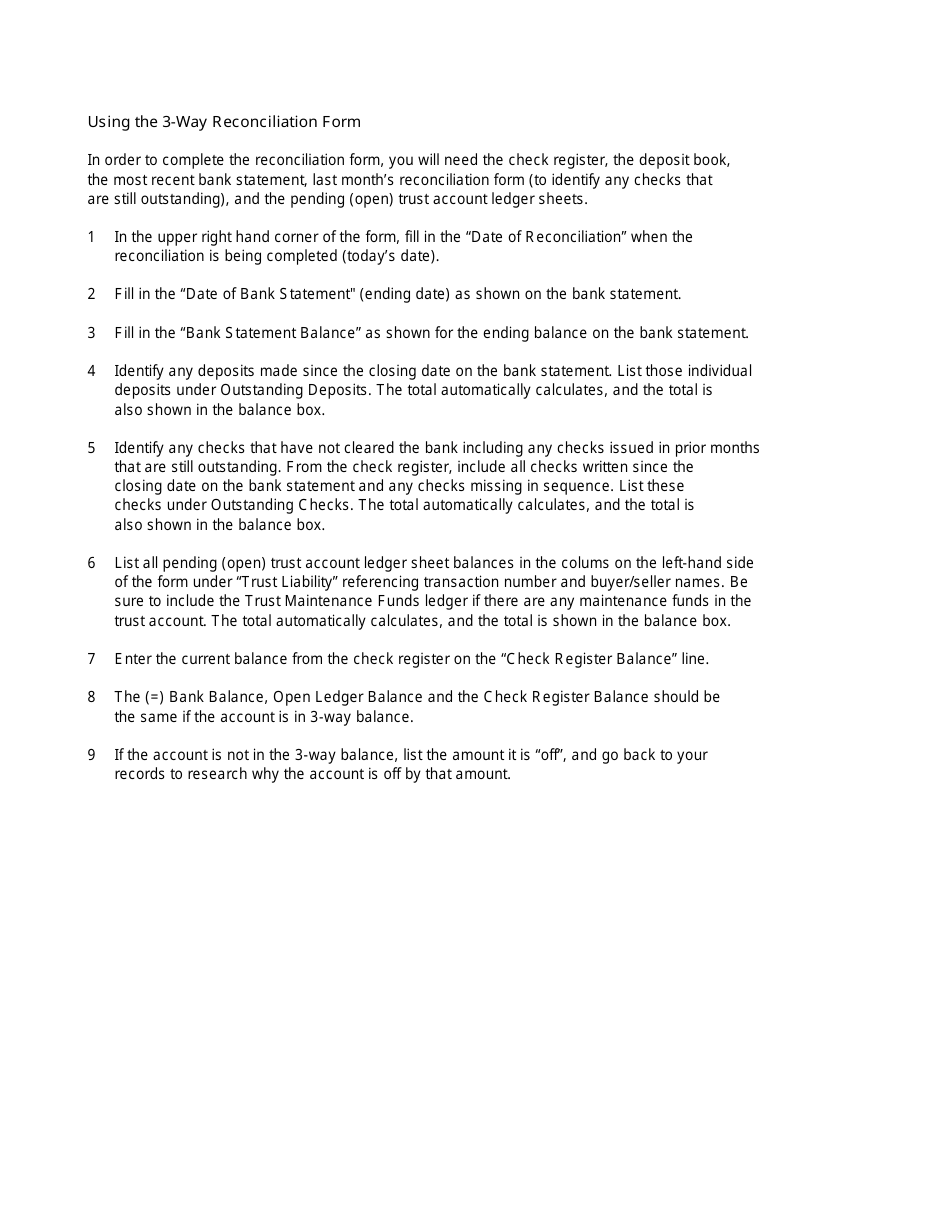

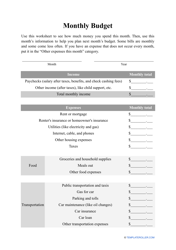

The Monthly 3-way Reconciliation Form is used to compare and reconcile three sets of financial records - the company's bank statement, general ledger, and physical cash on hand. It helps ensure that all financial transactions are accurately recorded and accounted for.

In the United States, the monthly 3-way reconciliation form is usually filed by businesses, organizations, or individuals who need to reconcile their bank statements, accounts receivable, and accounts payable records.

FAQ

Q: What is a Monthly 3-way Reconciliation Form?

A: It is a form used to reconcile three sets of financial records - bank statements, general ledger, and accounts payable/receivable - to ensure they all match.

Q: Why is a Monthly 3-way Reconciliation Form important?

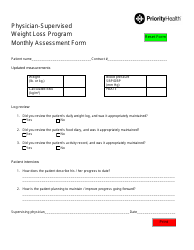

A: It helps identify any discrepancies or errors in financial records, ensures accuracy of data, and helps prevent fraud.

Q: Who typically uses a Monthly 3-way Reconciliation Form?

A: It is commonly used by businesses, accounting departments, and financial institutions.

Q: What information is required for a Monthly 3-way Reconciliation Form?

A: Typically, the form will require the opening and closing balances of each account, as well as any transactions during the period being reconciled.

Q: How often should a Monthly 3-way Reconciliation Form be done?

A: As the name suggests, it should be done on a monthly basis to ensure ongoing accuracy of financial records.