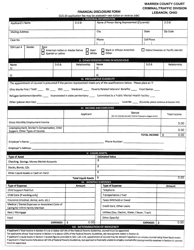

This version of the form is not currently in use and is provided for reference only. Download this version of

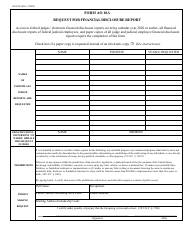

Form OPD-206R

for the current year.

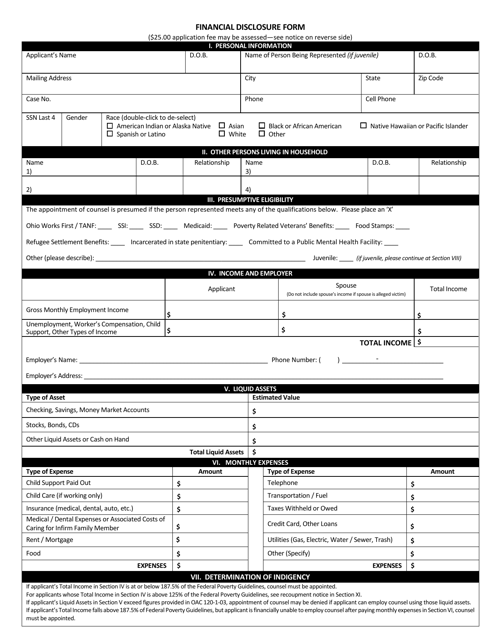

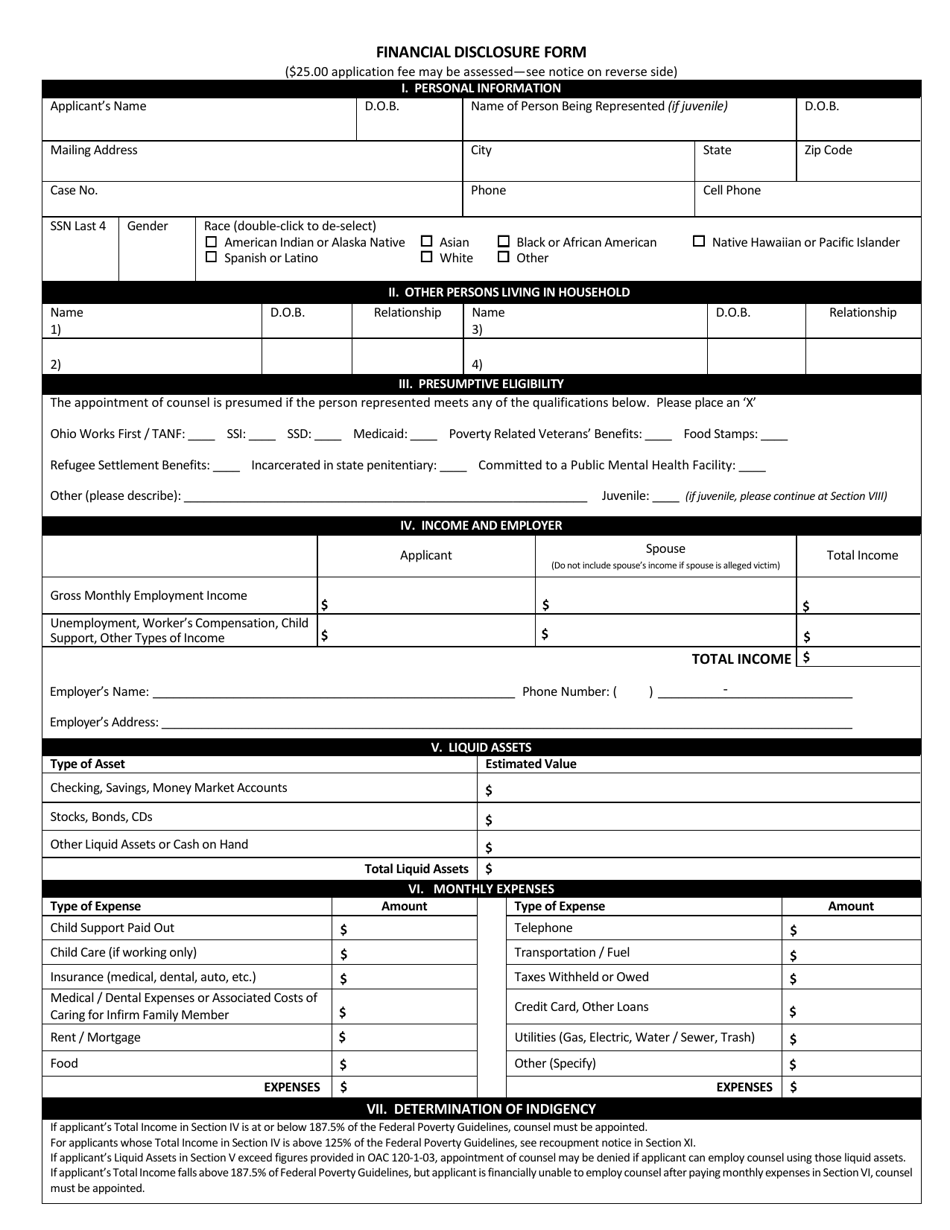

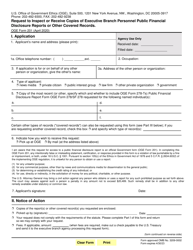

Form OPD-206R Financial Disclosure Form - Ohio

What Is Form OPD-206R?

This is a legal form that was released by the Office of the Ohio Public Defender - a government authority operating within Ohio. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is the Form OPD-206R?

A: The Form OPD-206R is the Financial Disclosure Form used in Ohio.

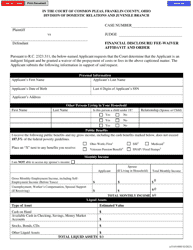

Q: Who needs to fill out the Form OPD-206R?

A: Government officials and employees in Ohio who are required to disclose their financial interests.

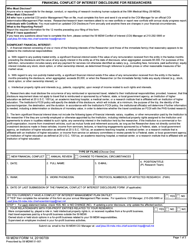

Q: What is the purpose of the Form OPD-206R?

A: The purpose of the Form OPD-206R is to promote transparency and prevent conflicts of interest by public officials.

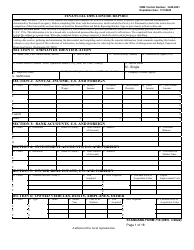

Q: What kind of information is required on the Form OPD-206R?

A: The form requires information about the public official's financial interests, including sources of income, investments, and business relationships.

Q: When is the Form OPD-206R due?

A: The due date for the Form OPD-206R varies depending on the specific requirements of the government agency, but it is typically required on an annual basis.

Q: Are there any penalties for not filing the Form OPD-206R?

A: Yes, failure to file the form or providing false information can result in penalties, including fines and potential legal consequences.

Q: Can the information on the Form OPD-206R be accessed by the public?

A: Yes, in Ohio, the financial disclosure statements are public records and can be accessed by the public upon request.

Q: Is the Form OPD-206R used only in Ohio?

A: Yes, the Form OPD-206R is specific to Ohio and is not used in other states or countries.

Form Details:

- Released on January 1, 2019;

- The latest edition provided by the Office of the Ohio Public Defender;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form OPD-206R by clicking the link below or browse more documents and templates provided by the Office of the Ohio Public Defender.