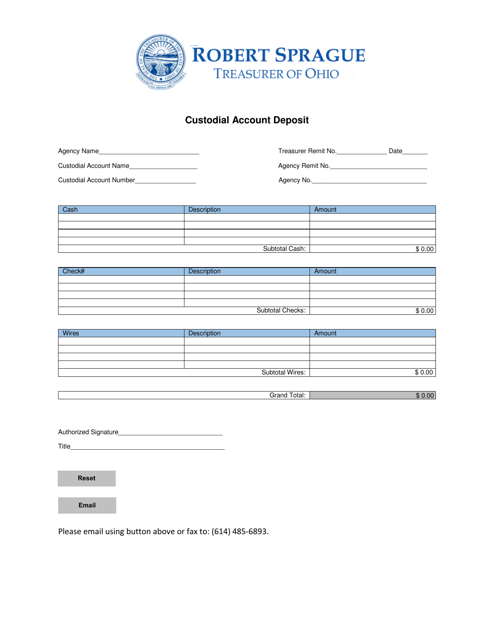

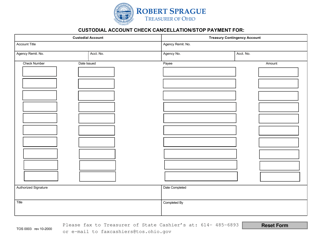

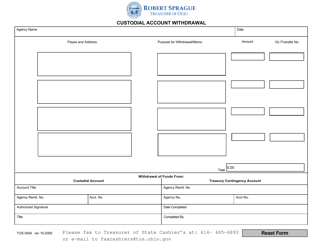

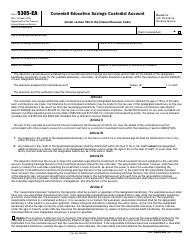

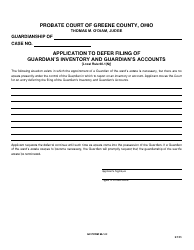

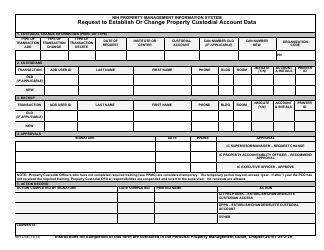

Custodial Account Deposit - Ohio

Custodial Account Deposit is a legal document that was released by the Office of the Ohio Treasurer - a government authority operating within Ohio.

FAQ

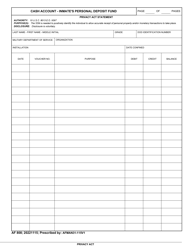

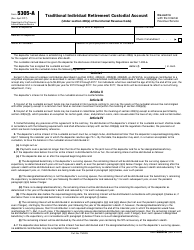

Q: What is a custodial account deposit?

A: A custodial account deposit is a type of account where an adult manages and controls assets on behalf of a minor.

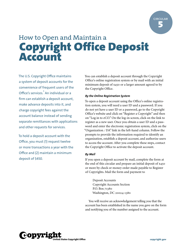

Q: Who can open a custodial account deposit in Ohio?

A: In Ohio, custodial accounts can be opened by parents or legal guardians on behalf of minors.

Q: What can be deposited into a custodial account deposit?

A: Money, securities, and other assets can be deposited into a custodial account deposit.

Q: Are there any restrictions on how the funds in a custodial account deposit can be used?

A: Yes, the funds in a custodial account deposit must be used for the minor's benefit and cannot be spent on the custodian's own expenses.

Q: When can the minor access the funds in a custodial account deposit?

A: The minor can access the funds in a custodial account deposit when they reach the age of majority, which is usually 18 or 21 years old, depending on the state.

Q: What happens to the funds in a custodial account deposit if the minor passes away?

A: If the minor passes away, the funds in a custodial account deposit typically become part of the minor's estate and are distributed according to their will or state laws of intestacy.

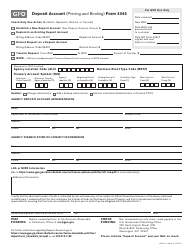

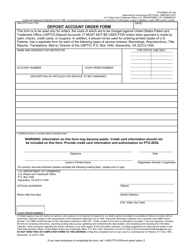

Form Details:

- The latest edition currently provided by the Office of the Ohio Treasurer;

- Ready to use and print;

- Easy to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of the form by clicking the link below or browse more documents and templates provided by the Office of the Ohio Treasurer.