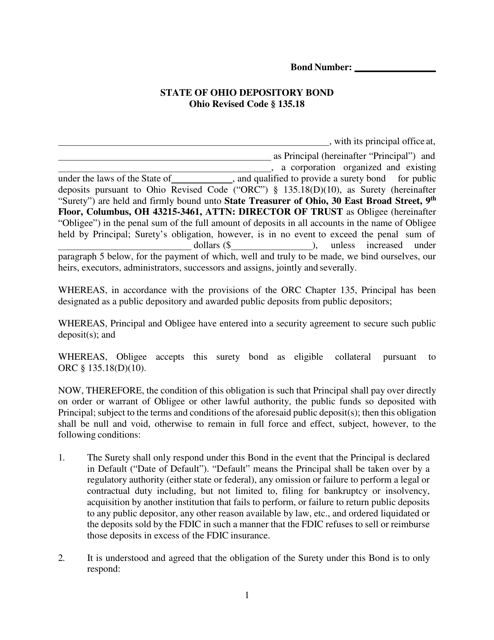

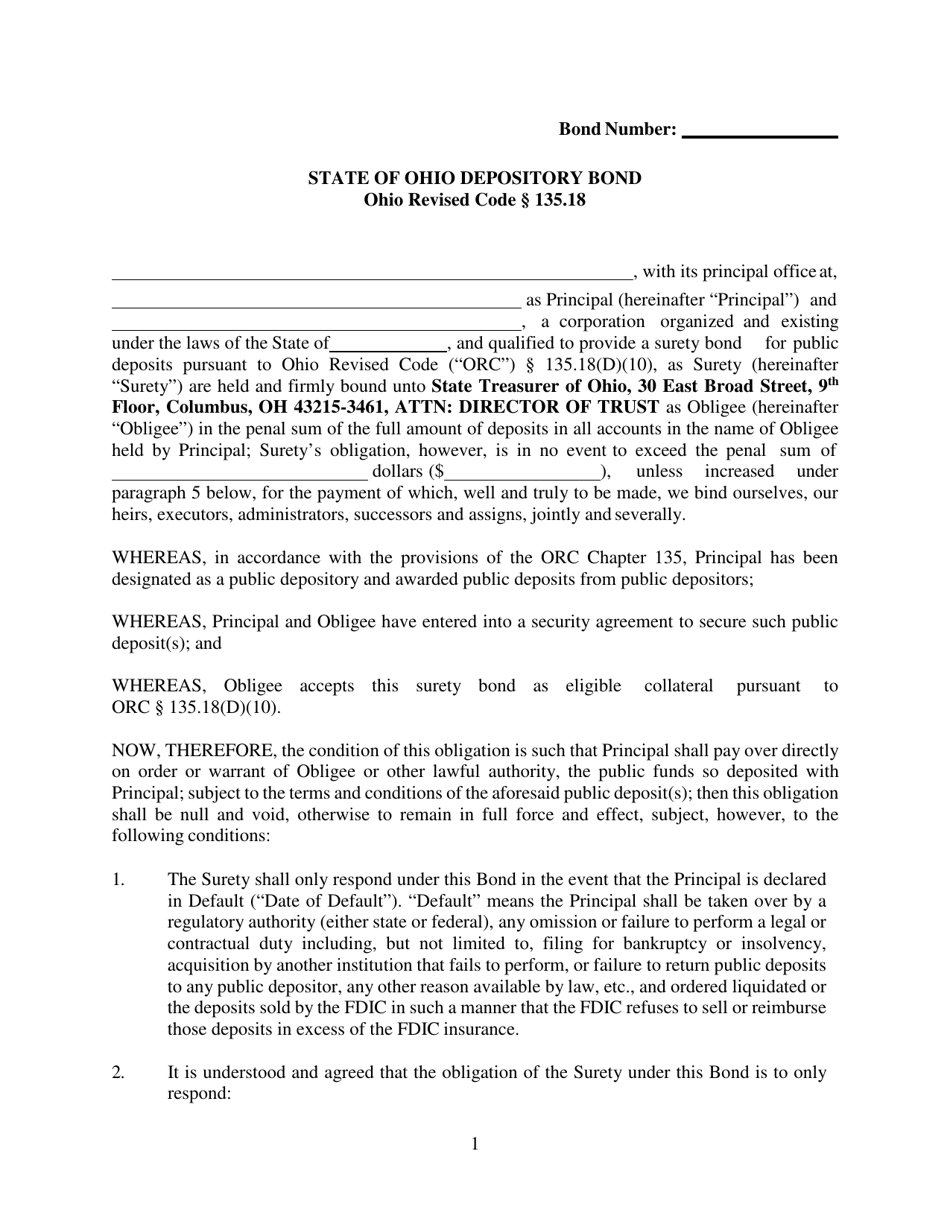

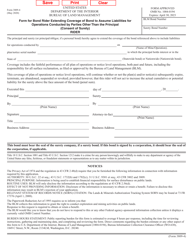

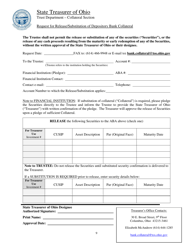

State of Ohio Depository Bond - Ohio

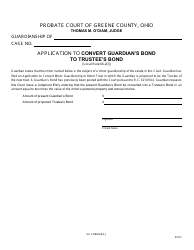

State of Ohio Depository Bond is a legal document that was released by the Office of the Ohio Treasurer - a government authority operating within Ohio.

FAQ

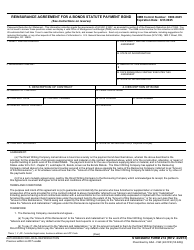

Q: What is a State of Ohio Depository Bond?

A: A State of Ohio Depository Bond is a type of surety bond required by the state of Ohio for banks or financial institutions that want to serve as depositories for public funds.

Q: Who needs a State of Ohio Depository Bond?

A: Banks or financial institutions that want to serve as depositories for public funds in the state of Ohio need to obtain a State of Ohio Depository Bond.

Q: Why is a State of Ohio Depository Bond required?

A: The bond provides financial protection for the state and ensures that public funds are safeguarded.

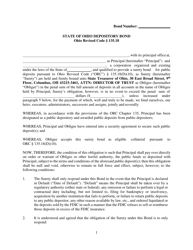

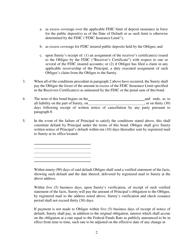

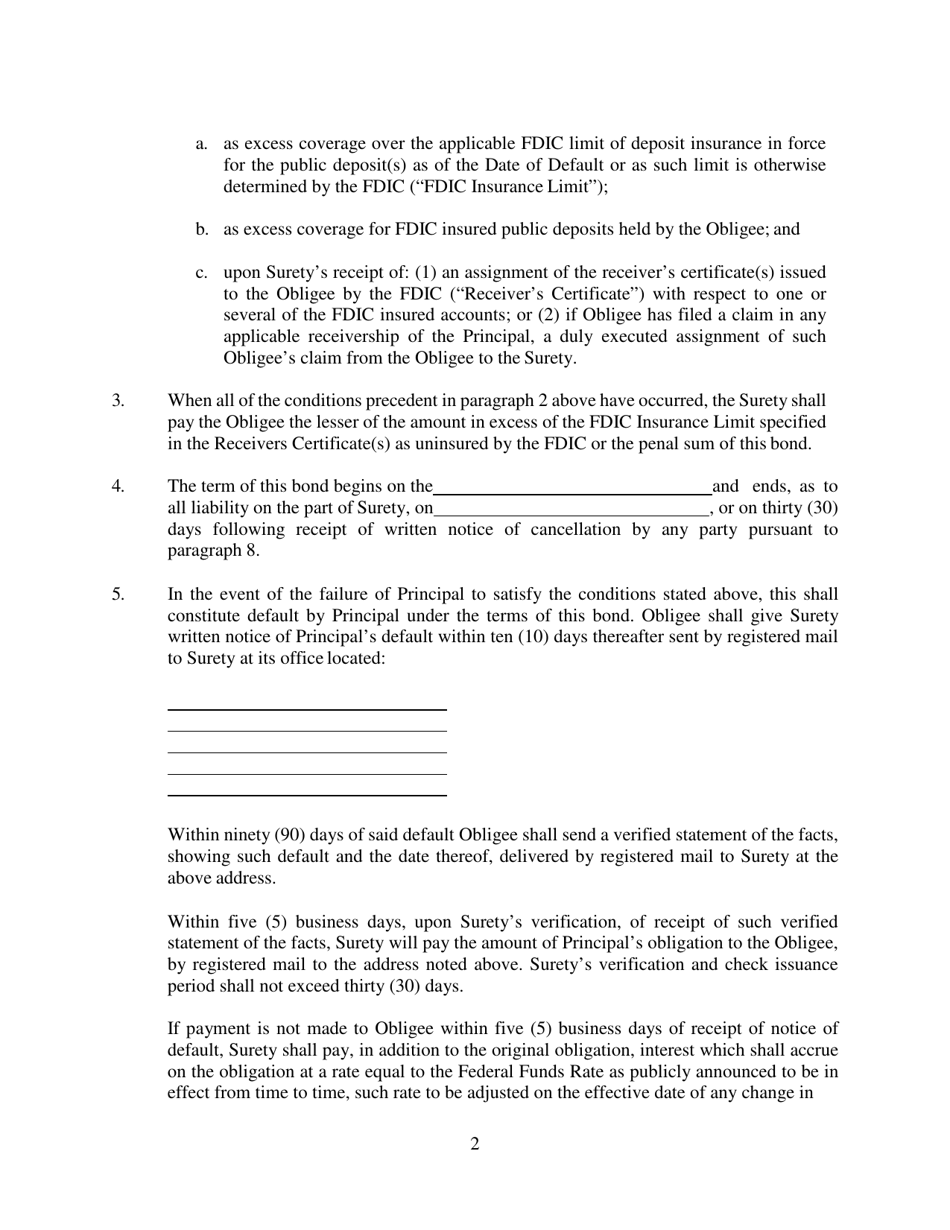

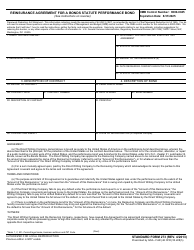

Q: How does a State of Ohio Depository Bond work?

A: If a depository bank fails to fulfill its obligations or misuses public funds, a claim can be filed against the bond to compensate for any resulting financial losses.

Q: How much does a State of Ohio Depository Bond cost?

A: The cost of a State of Ohio Depository Bond varies depending on factors such as the amount of the bond, the financial strength of the bank, and its credit history.

Q: How do I obtain a State of Ohio Depository Bond?

A: To obtain a State of Ohio Depository Bond, a bank or financial institution must work with a licensed surety bond company that operates in Ohio.

Form Details:

- The latest edition currently provided by the Office of the Ohio Treasurer;

- Ready to use and print;

- Easy to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of the form by clicking the link below or browse more documents and templates provided by the Office of the Ohio Treasurer.