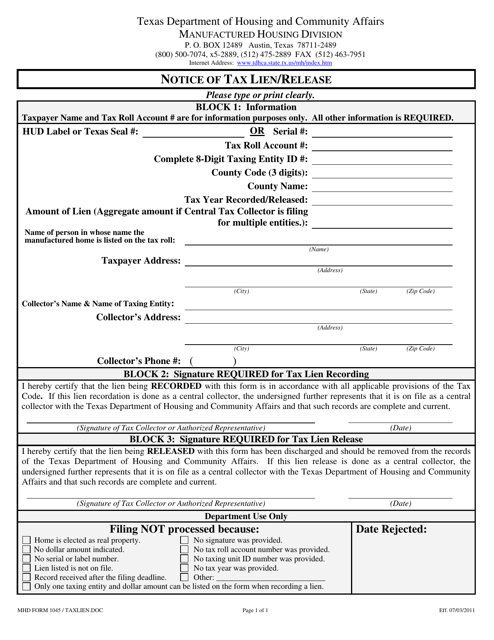

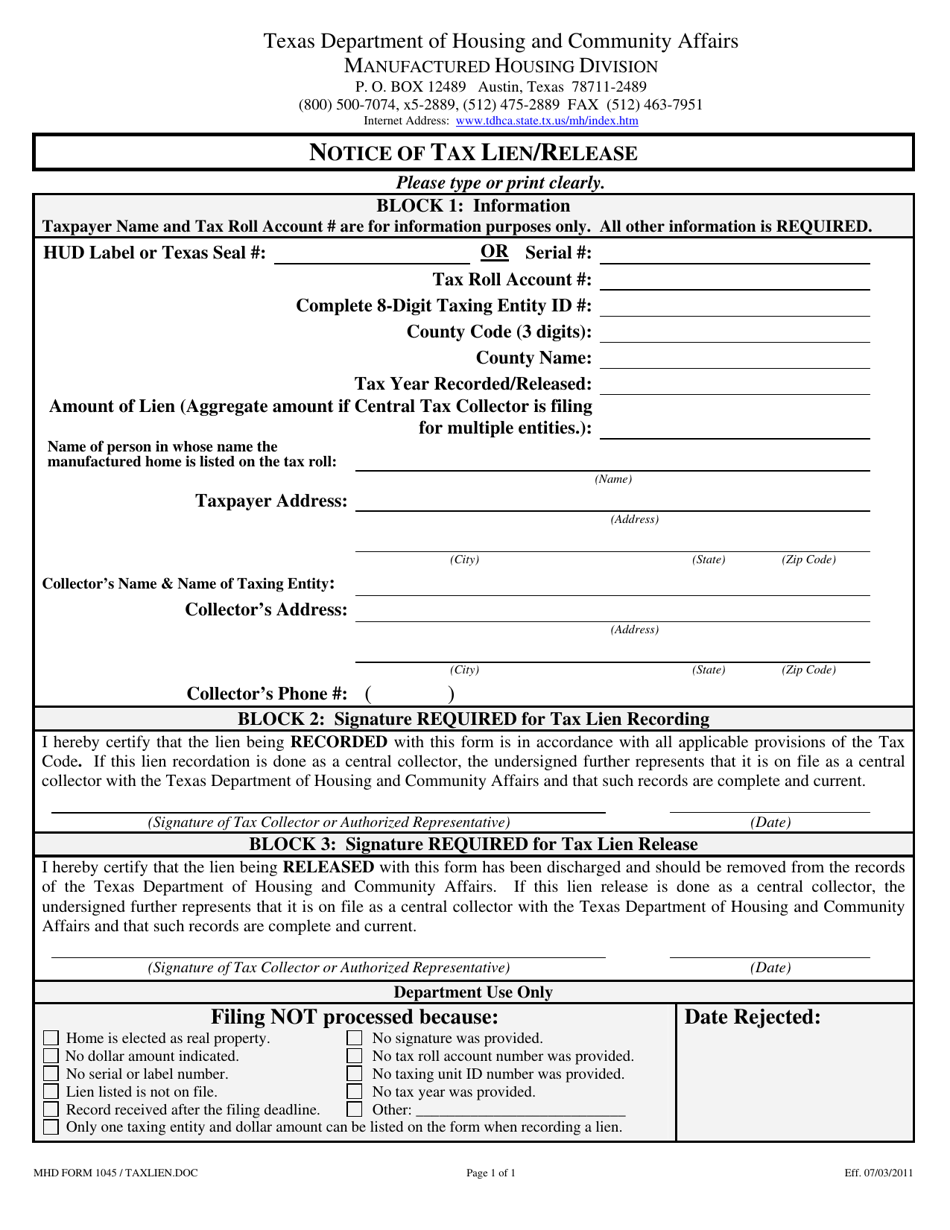

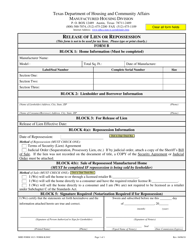

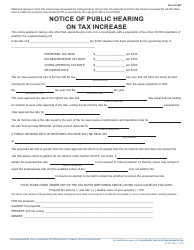

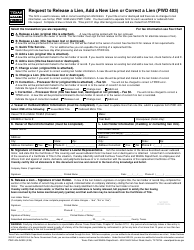

MHD Form 1045 Notice of Tax Lien / Release - Texas

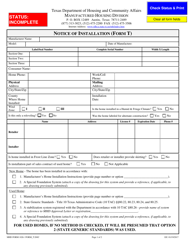

What Is MHD Form 1045?

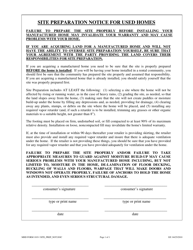

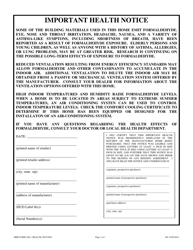

This is a legal form that was released by the Texas Department of Housing and Community Affairs - Manufactured Housing Division - a government authority operating within Texas. Check the official instructions before completing and submitting the form.

FAQ

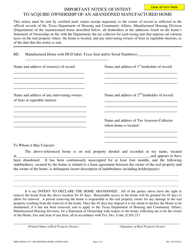

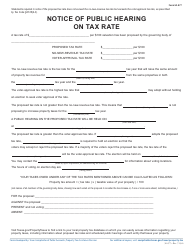

Q: What is Form 1045 Notice of Tax Lien/Release in Texas?

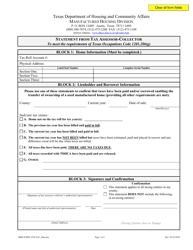

A: Form 1045 is a notice used by the Texas Comptroller to file and release tax liens on properties.

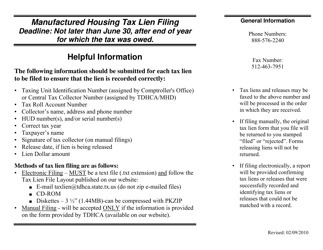

Q: When is Form 1045 Notice of Tax Lien/Release used?

A: Form 1045 is used when a tax lien is filed on a property to secure unpaid taxes or other debts.

Q: Who can file Form 1045 Notice of Tax Lien/Release?

A: The Texas Comptroller's office files Form 1045 to establish a tax lien on a property.

Q: What happens when a tax lien is filed on a property?

A: When a tax lien is filed, it becomes a public record and can affect the property owner's ability to sell or refinance the property.

Q: How can a tax lien be released?

A: A tax lien can be released by paying off the outstanding taxes or debts or by meeting certain requirements set by the Texas Comptroller's office.

Q: How long does a tax lien stay on a property in Texas?

A: In Texas, tax liens generally stay on a property until the underlying tax debt is fully paid or released by the Texas Comptroller's office.

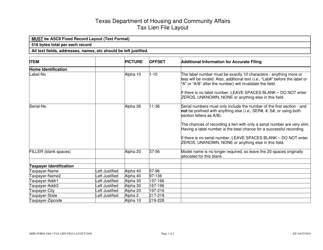

Form Details:

- Released on July 3, 2011;

- The latest edition provided by the Texas Department of Housing and Community Affairs - Manufactured Housing Division;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of MHD Form 1045 by clicking the link below or browse more documents and templates provided by the Texas Department of Housing and Community Affairs - Manufactured Housing Division.