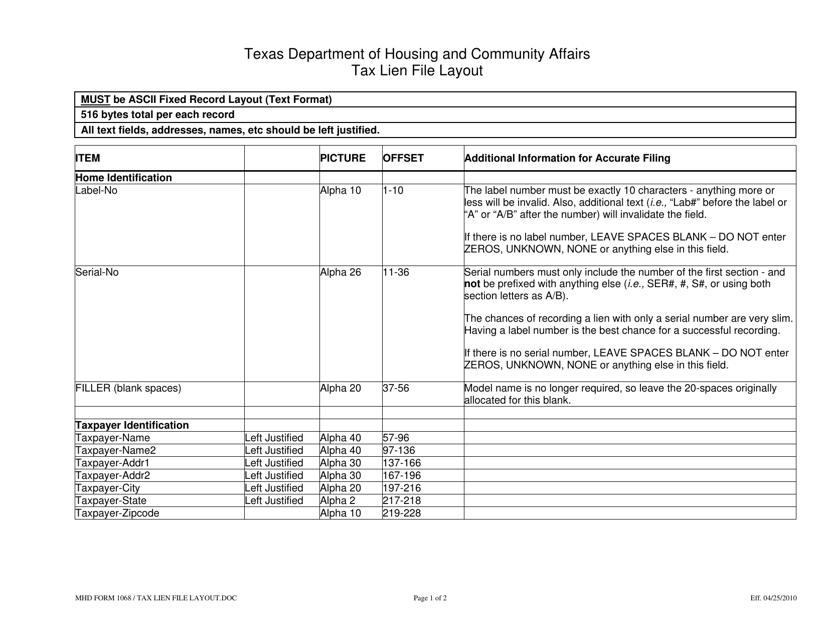

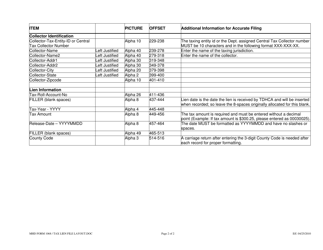

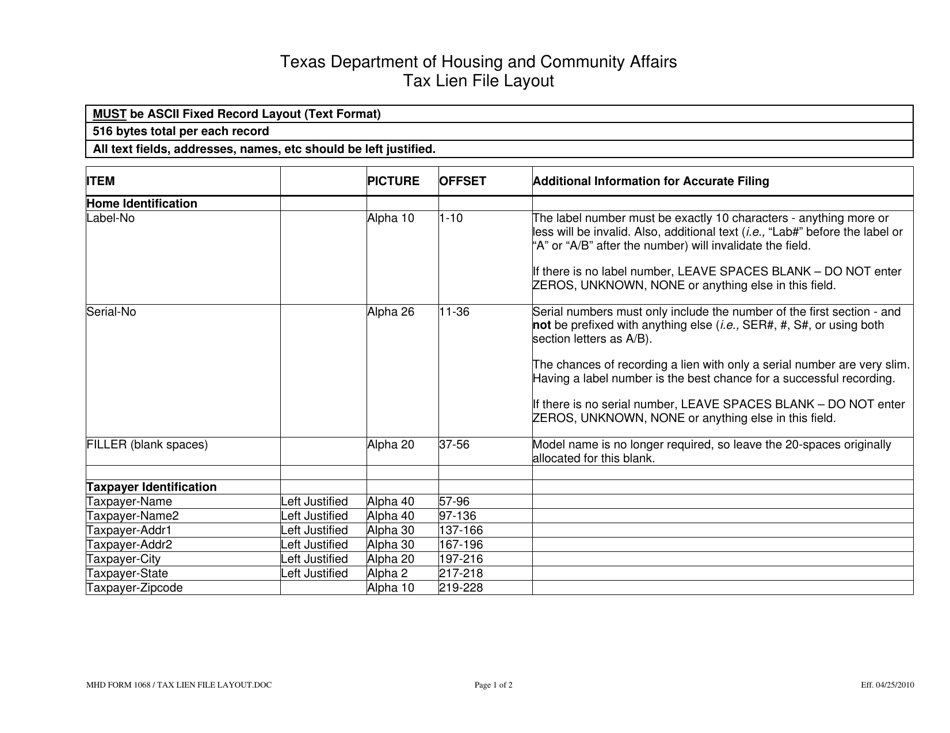

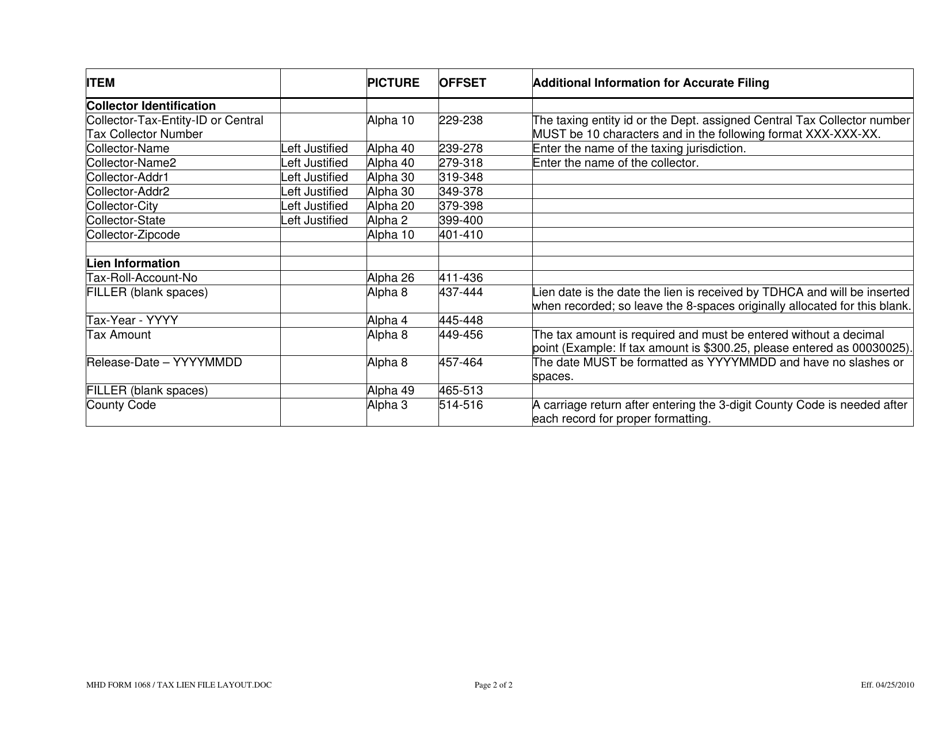

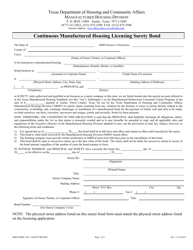

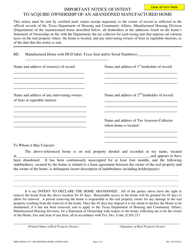

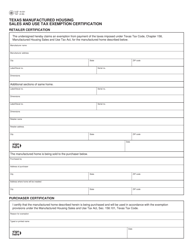

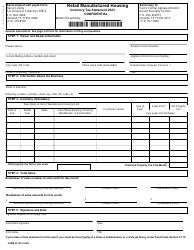

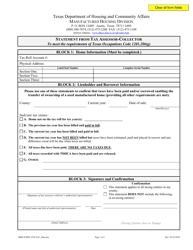

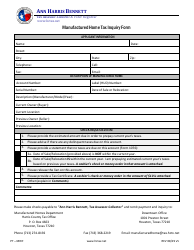

MHD Form 1068 Manufactured Housing Tax Lien Layout Example - Texas

What Is MHD Form 1068?

This is a legal form that was released by the Texas Department of Housing and Community Affairs - Manufactured Housing Division - a government authority operating within Texas. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is MHD Form 1068?

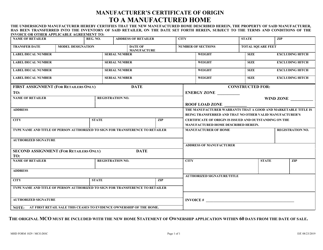

A: MHD Form 1068 is a document used for reporting manufactured housing tax liens in Texas.

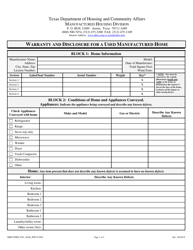

Q: What is a manufactured housing tax lien?

A: A manufactured housing tax lien is a legal claim on a manufactured home in Texas for unpaid taxes.

Q: Why is MHD Form 1068 important?

A: MHD Form 1068 is important because it provides an example layout for reporting manufactured housing tax liens in Texas.

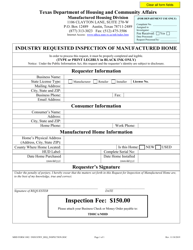

Q: Who uses MHD Form 1068?

A: MHD Form 1068 is used by individuals, businesses, and government agencies involved in the assessment and collection of manufactured housing taxes in Texas.

Q: Are there specific requirements for filling out MHD Form 1068?

A: Yes, there are specific requirements for filling out MHD Form 1068, including providing detailed information about the manufactured home and the tax lien.

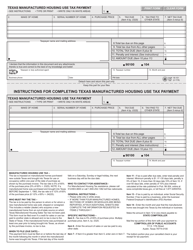

Form Details:

- Released on April 25, 2010;

- The latest edition provided by the Texas Department of Housing and Community Affairs - Manufactured Housing Division;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a printable version of MHD Form 1068 by clicking the link below or browse more documents and templates provided by the Texas Department of Housing and Community Affairs - Manufactured Housing Division.