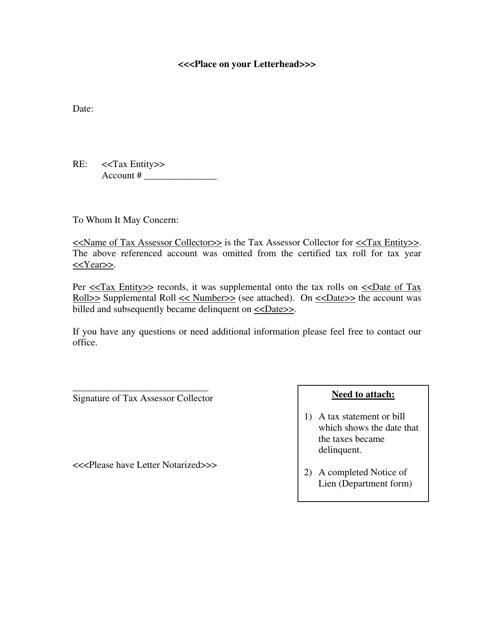

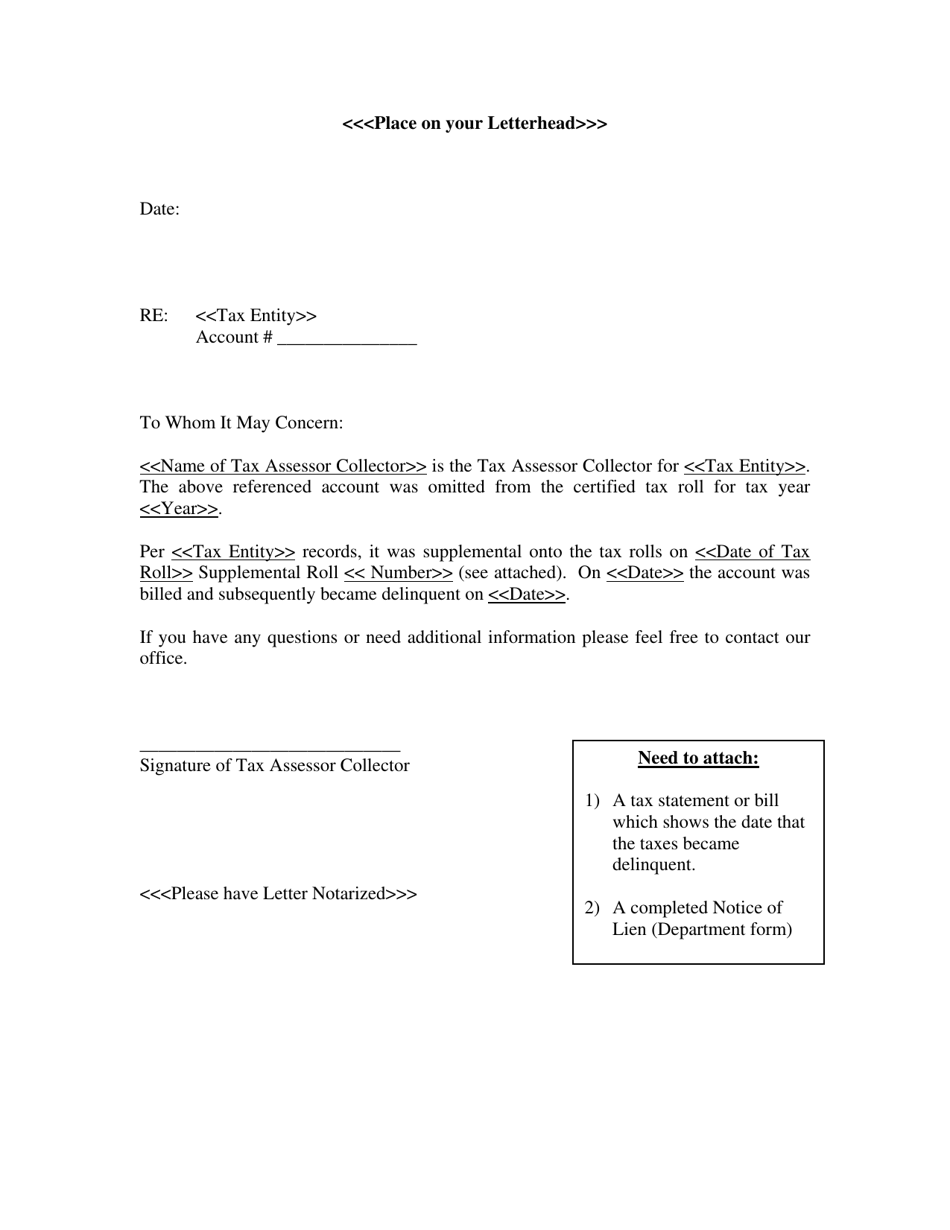

Omitted Tax Sample Letter - Texas

Omitted Tax Sample Letter is a legal document that was released by the Texas Department of Housing and Community Affairs - Manufactured Housing Division - a government authority operating within Texas.

FAQ

Q: What is an omitted tax?

A: Omitted tax refers to the unpaid taxes or taxes that were not accurately reported.

Q: Why would I receive an omitted tax sample letter in Texas?

A: You may receive an omitted tax sample letter in Texas if the state's tax authorities have identified discrepancies or errors in your tax filings.

Q: What should I do if I receive an omitted tax sample letter?

A: If you receive an omitted tax sample letter, you should carefully review the information and contact the Texas tax authorities to address any discrepancies or errors.

Q: Can I ignore an omitted tax sample letter?

A: No, it is not advisable to ignore an omitted tax sample letter. It is important to address any discrepancies or errors in your tax filings to avoid penalties or legal consequences.

Form Details:

- The latest edition currently provided by the Texas Department of Housing and Community Affairs - Manufactured Housing Division;

- Ready to use and print;

- Easy to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a printable version of the form by clicking the link below or browse more documents and templates provided by the Texas Department of Housing and Community Affairs - Manufactured Housing Division.