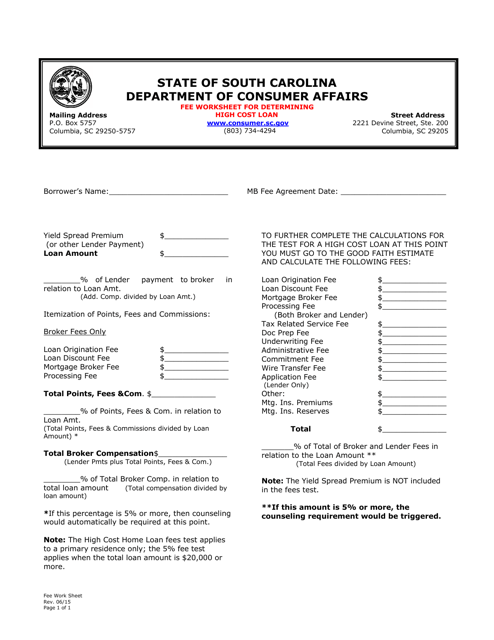

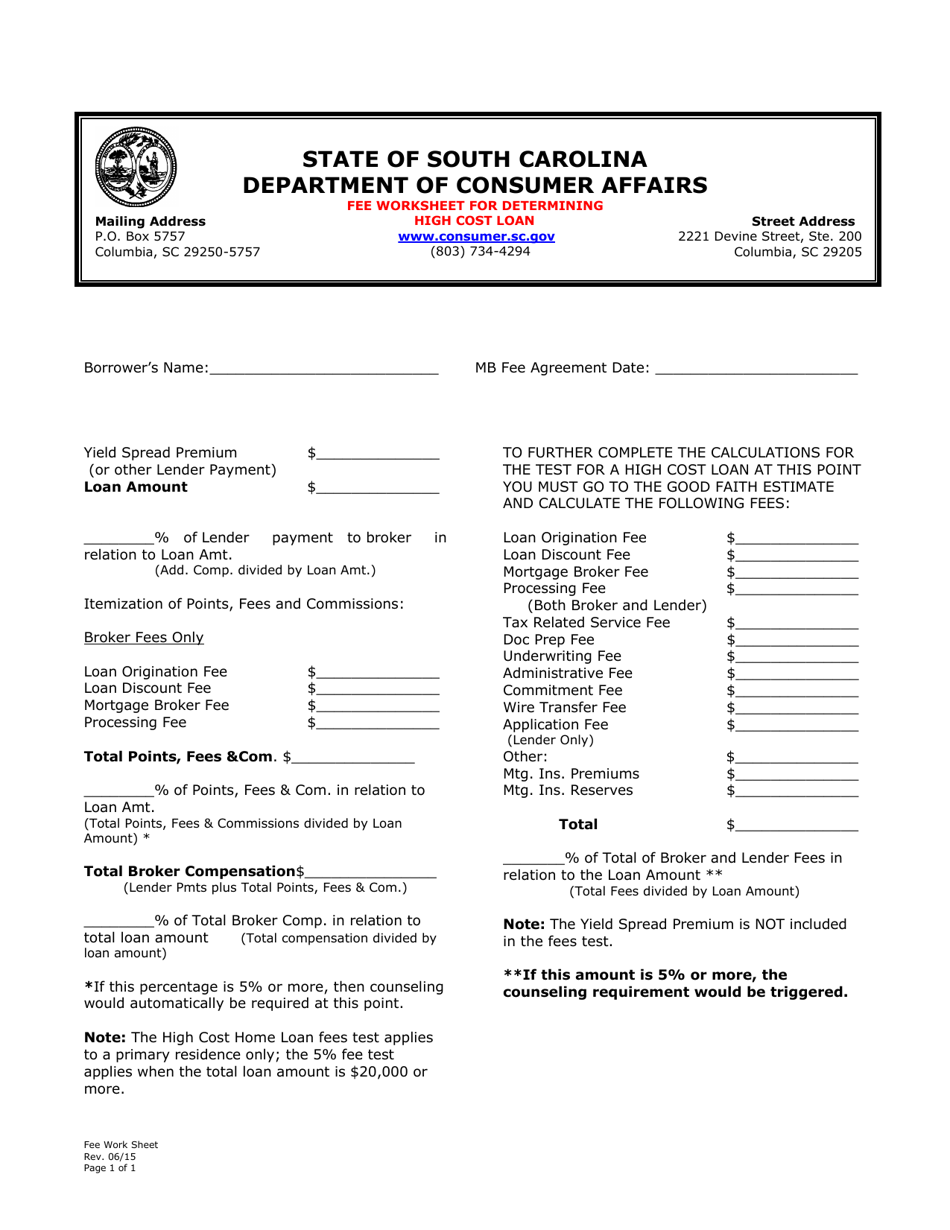

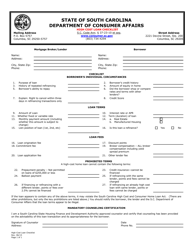

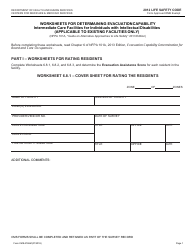

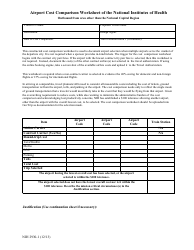

Fee Worksheet for Determining High Cost Loan - South Carolina

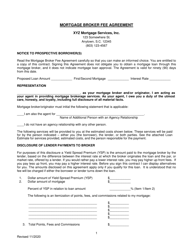

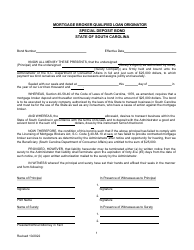

Fee Worksheet for Determining High Cost Loan is a legal document that was released by the South Carolina Department of Consumer Affairs - a government authority operating within South Carolina.

FAQ

Q: What is a high cost loan in South Carolina?

A: A high cost loan in South Carolina is a loan with fees and charges that exceed a certain threshold.

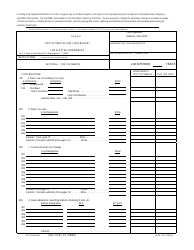

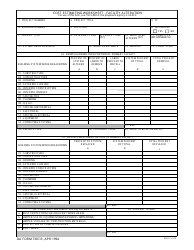

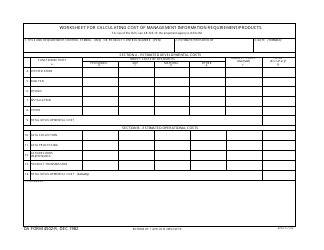

Q: How is a high cost loan determined?

A: A high cost loan is determined by calculating the total points and fees charged on the loan.

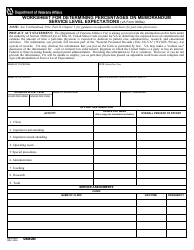

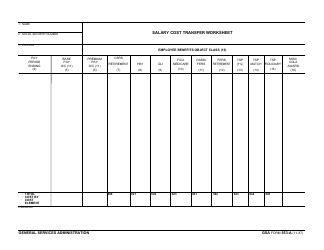

Q: What fees and charges are included in the calculation?

A: Fees and charges such as origination fees, broker fees, appraisal fees, and certain other charges are included in the calculation.

Q: What is the threshold for a high cost loan in South Carolina?

A: The threshold for a high cost loan in South Carolina is currently 6.5% of the total loan amount.

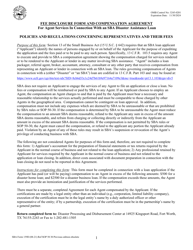

Q: What happens if a loan is considered a high cost loan?

A: If a loan is considered a high cost loan, there may be additional requirements and restrictions placed on the loan.

Form Details:

- Released on June 1, 2015;

- The latest edition currently provided by the South Carolina Department of Consumer Affairs;

- Ready to use and print;

- Easy to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a printable version of the form by clicking the link below or browse more documents and templates provided by the South Carolina Department of Consumer Affairs.