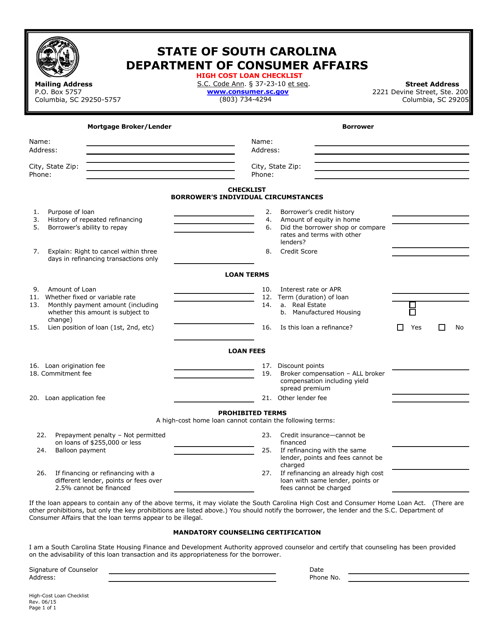

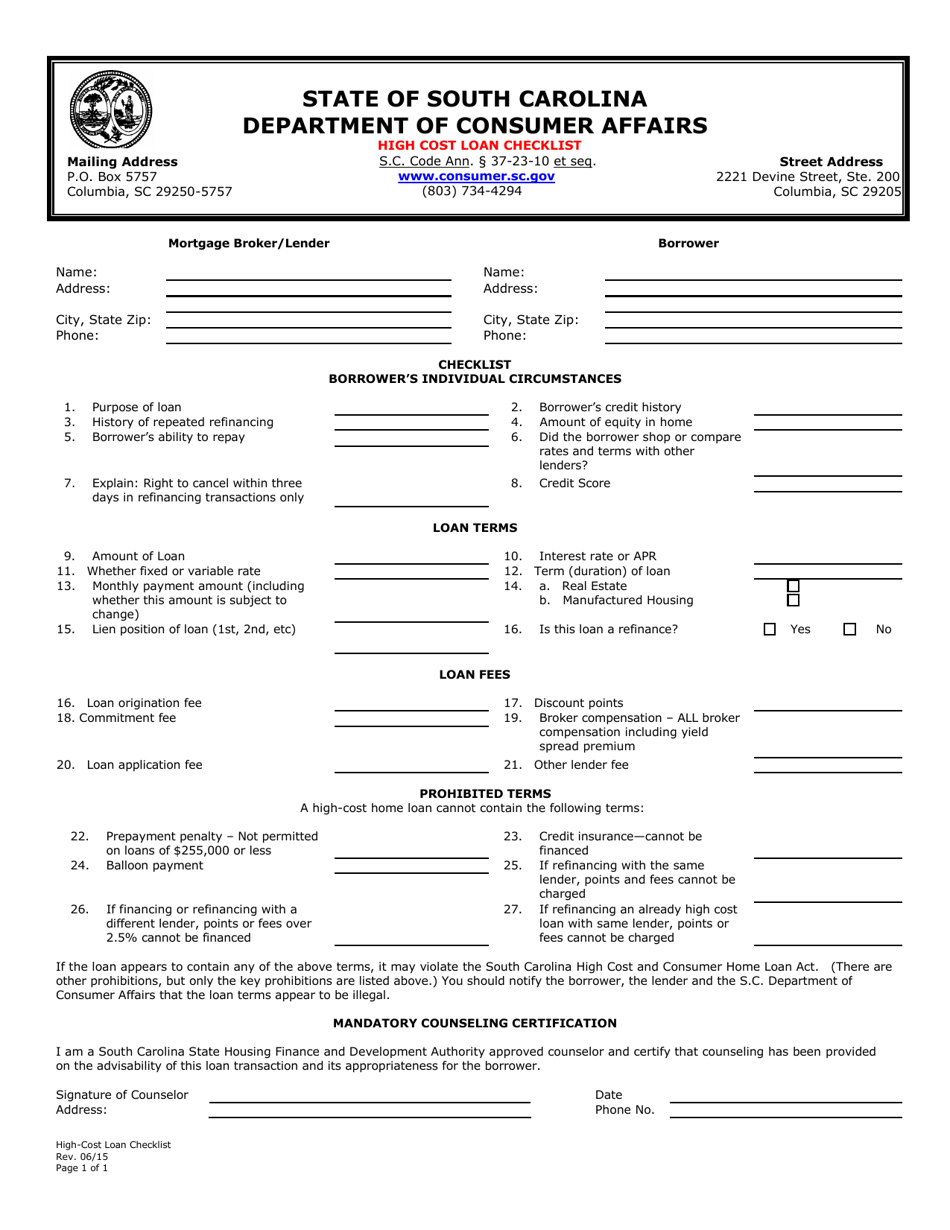

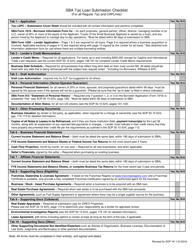

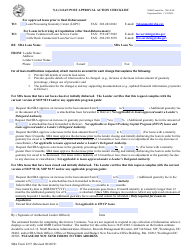

High Cost Loan Checklist - South Carolina

High Cost Loan Checklist is a legal document that was released by the South Carolina Department of Consumer Affairs - a government authority operating within South Carolina.

FAQ

Q: What is the High Cost Loan Checklist?

A: The High Cost Loan Checklist is a document required by South Carolina law for certain high-cost loans.

Q: Which loans require the High Cost Loan Checklist?

A: The High Cost Loan Checklist is required for certain high-cost loans, as defined by South Carolina law.

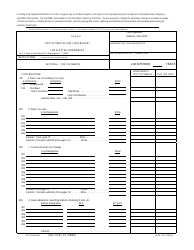

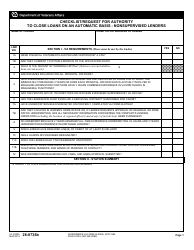

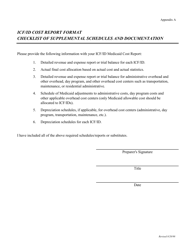

Q: What information is included in the High Cost Loan Checklist?

A: The High Cost Loan Checklist includes information about the loan terms, fees, and costs associated with the loan.

Q: Why is the High Cost Loan Checklist important?

A: The High Cost Loan Checklist is important because it provides transparency and helps borrowers understand the terms and costs of high-cost loans.

Q: What should I do if I have questions about the High Cost Loan Checklist?

A: If you have questions about the High Cost Loan Checklist, you should contact your lender or seek legal advice.

Q: Is the High Cost Loan Checklist required in all states?

A: No, the High Cost Loan Checklist is specific to South Carolina and may not be required in other states.

Q: What should I do if I believe a lender has not provided the High Cost Loan Checklist?

A: If you believe a lender has not provided the High Cost Loan Checklist when required, you should report it to the appropriate regulatory authorities.

Q: Can I refuse to sign the High Cost Loan Checklist?

A: While you have the right to refuse to sign the High Cost Loan Checklist, it is important to understand the implications of doing so and seek legal advice if necessary.

Q: How can I protect myself when applying for a high-cost loan?

A: To protect yourself when applying for a high-cost loan, you should review the loan terms and costs, ask questions, and consider seeking advice from a trusted source, such as a financial counselor or attorney.

Form Details:

- Released on June 1, 2015;

- The latest edition currently provided by the South Carolina Department of Consumer Affairs;

- Ready to use and print;

- Easy to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a printable version of the form by clicking the link below or browse more documents and templates provided by the South Carolina Department of Consumer Affairs.