This version of the form is not currently in use and is provided for reference only. Download this version of

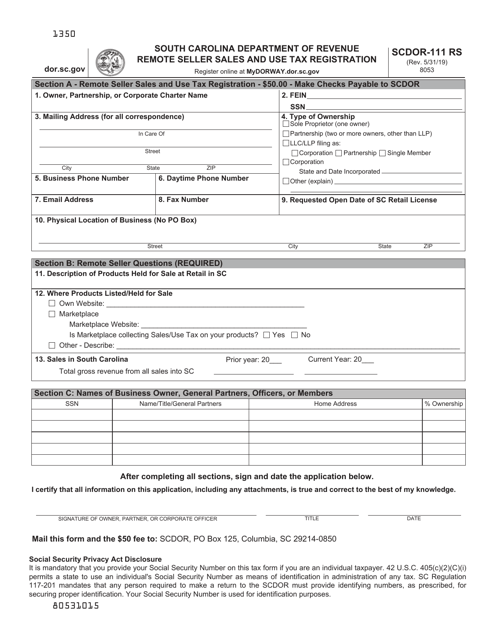

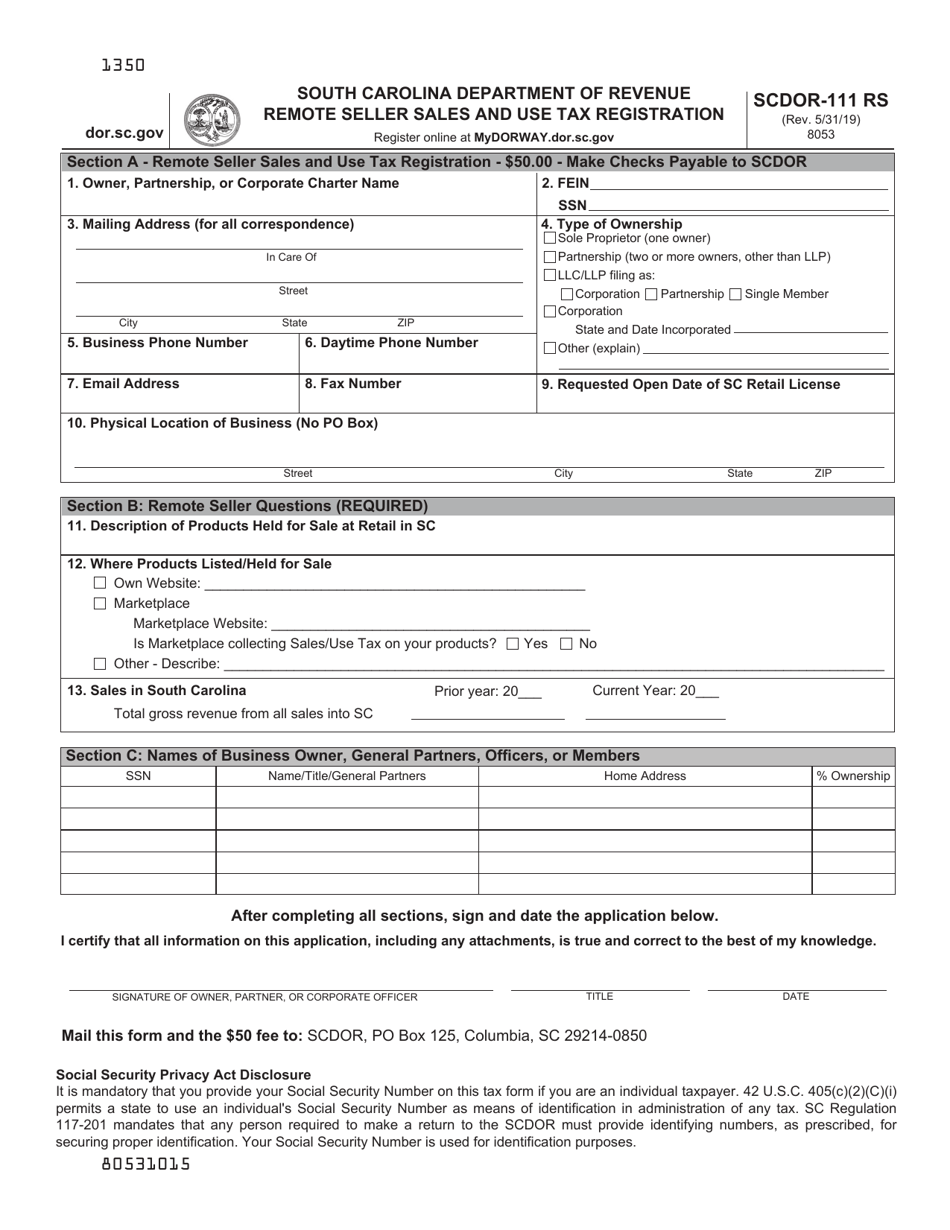

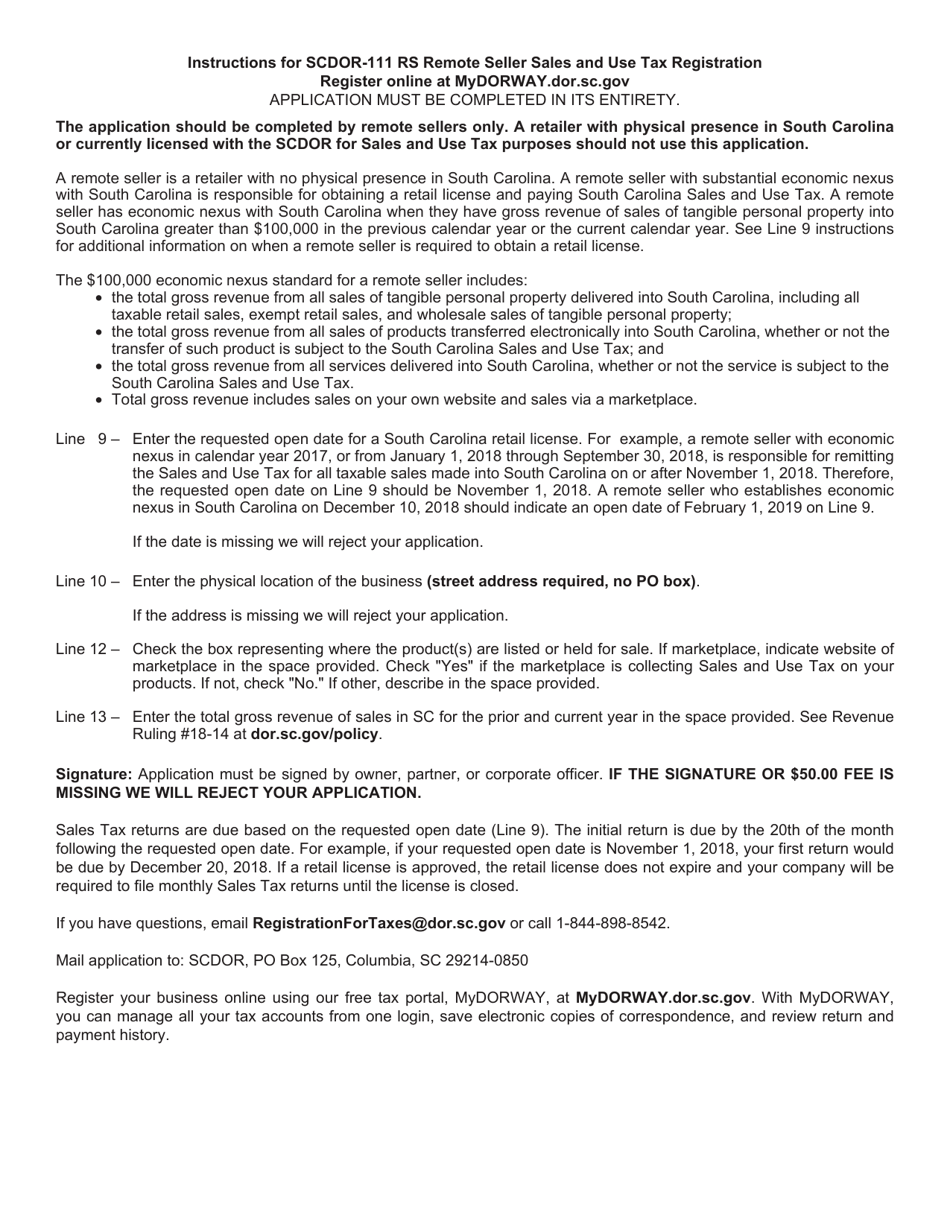

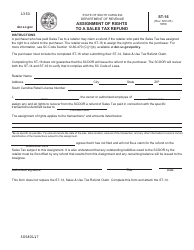

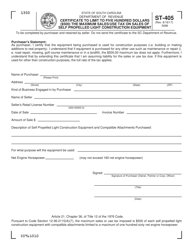

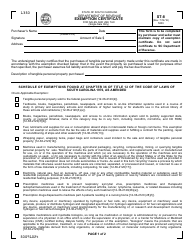

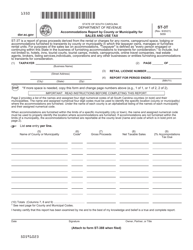

Form SCDOR-111 RS

for the current year.

Form SCDOR-111 RS Remote Seller Sales and Use Tax Registration - South Carolina

What Is Form SCDOR-111 RS?

This is a legal form that was released by the South Carolina Department of Revenue - a government authority operating within South Carolina. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is Form SCDOR-111 RS?

A: Form SCDOR-111 RS is a registration form for remote sellers to register for sales and use tax in South Carolina.

Q: Who needs to file Form SCDOR-111 RS?

A: Remote sellers who meet the threshold for sales tax collection in South Carolina need to file Form SCDOR-111 RS.

Q: What is a remote seller?

A: A remote seller refers to businesses or individuals who make sales to customers in South Carolina but do not have a physical presence in the state.

Q: What is the purpose of Form SCDOR-111 RS?

A: The purpose of Form SCDOR-111 RS is to register remote sellers for sales and use tax in South Carolina.

Q: Is Form SCDOR-111 RS mandatory?

A: Yes, remote sellers who meet the threshold for sales tax collection in South Carolina are required to file Form SCDOR-111 RS.

Q: What information is required on Form SCDOR-111 RS?

A: Form SCDOR-111 RS requires information such as business details, sales volume, and nexus information.

Q: When should Form SCDOR-111 RS be filed?

A: Form SCDOR-111 RS should be filed before making any sales that meet the threshold for sales tax collection in South Carolina.

Q: Are there any penalties for not filing Form SCDOR-111 RS?

A: Failure to file Form SCDOR-111 RS can result in penalties and interest charges by the South Carolina Department of Revenue.

Form Details:

- Released on May 31, 2019;

- The latest edition provided by the South Carolina Department of Revenue;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a printable version of Form SCDOR-111 RS by clicking the link below or browse more documents and templates provided by the South Carolina Department of Revenue.