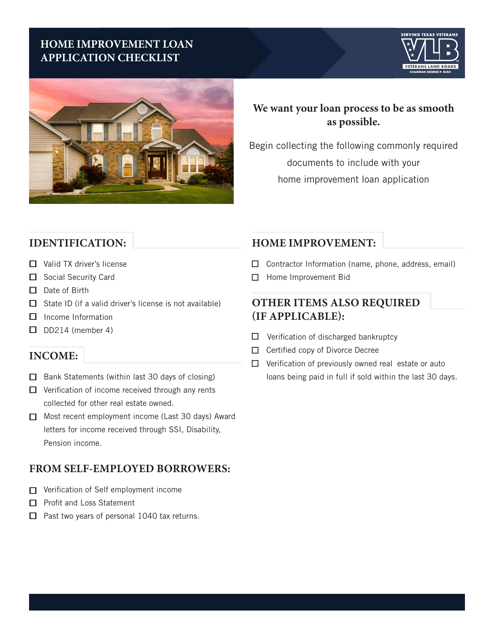

Home Improvement Loan Application Checklis - Texas

Home Improvement Loan Application Checklis is a legal document that was released by the Texas Veterans Land Board - a government authority operating within Texas.

FAQ

Q: What is a home improvement loan?

A: A home improvement loan is a type of loan specifically designed to finance home renovations and repairs.

Q: How can I qualify for a home improvement loan?

A: Qualifications for a home improvement loan vary depending on the lender, but generally, you need a good credit score, proof of income, and equity in your home.

Q: What can I use a home improvement loan for?

A: You can use a home improvement loan to fund a variety of projects, such as kitchen remodeling, bathroom renovations, or adding a new room to your home.

Q: Are there any specific requirements for getting a home improvement loan in Texas?

A: Some lenders in Texas may have specific requirements, but generally, the qualifications are similar to those in other states.

Q: How much can I borrow with a home improvement loan?

A: The amount you can borrow with a home improvement loan varies depending on the lender, your creditworthiness, and the value of your home.

Q: How long do I have to repay a home improvement loan?

A: Repayment terms for home improvement loans can vary, but they typically range from three to 20 years.

Q: What interest rate can I expect for a home improvement loan?

A: The interest rate for a home improvement loan depends on various factors, including your credit score and the lender's terms. It's best to shop around and compare rates from different lenders.

Form Details:

- The latest edition currently provided by the Texas Veterans Land Board;

- Ready to use and print;

- Easy to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a printable version of the form by clicking the link below or browse more documents and templates provided by the Texas Veterans Land Board.