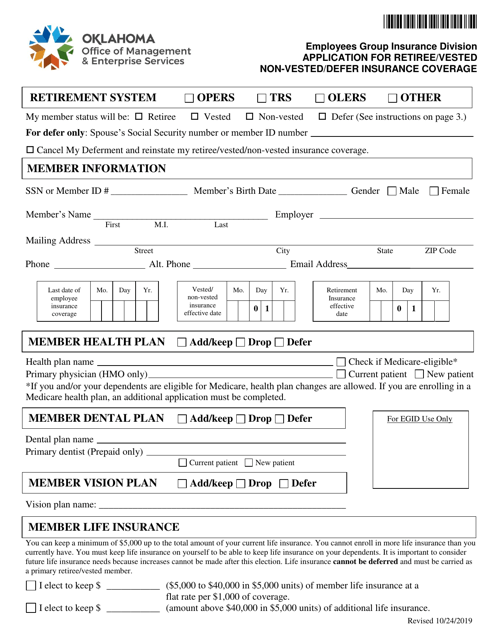

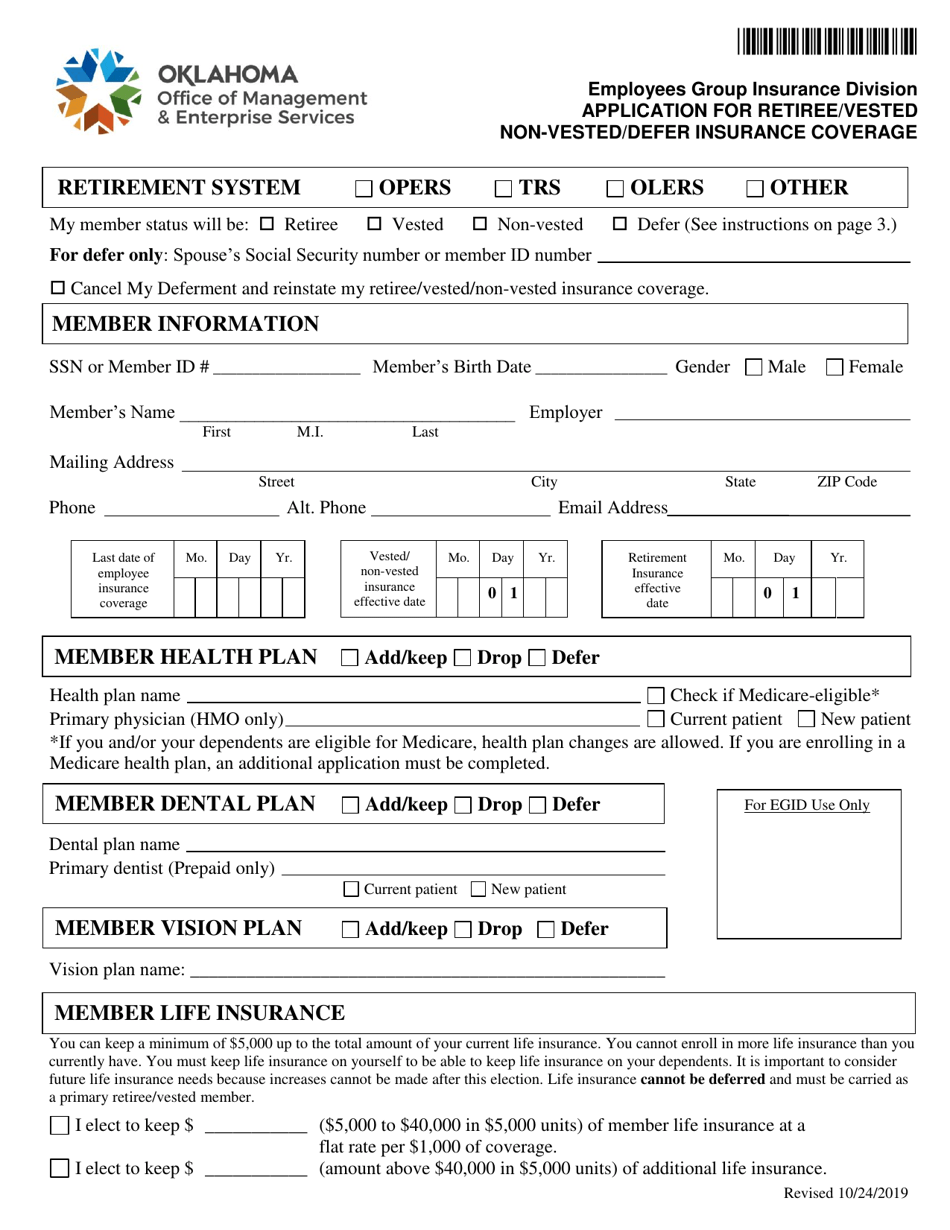

Application for Retiree / Vested Non-vested / Defer Insurance Coverage - Oklahoma

Application for Retiree/Vested Non-vested/Defer Insurance Coverage is a legal document that was released by the Oklahoma Office of Management and Enterprise Services - a government authority operating within Oklahoma.

FAQ

Q: What is an Application for Retiree/Vested Non-vested/Defer Insurance Coverage?

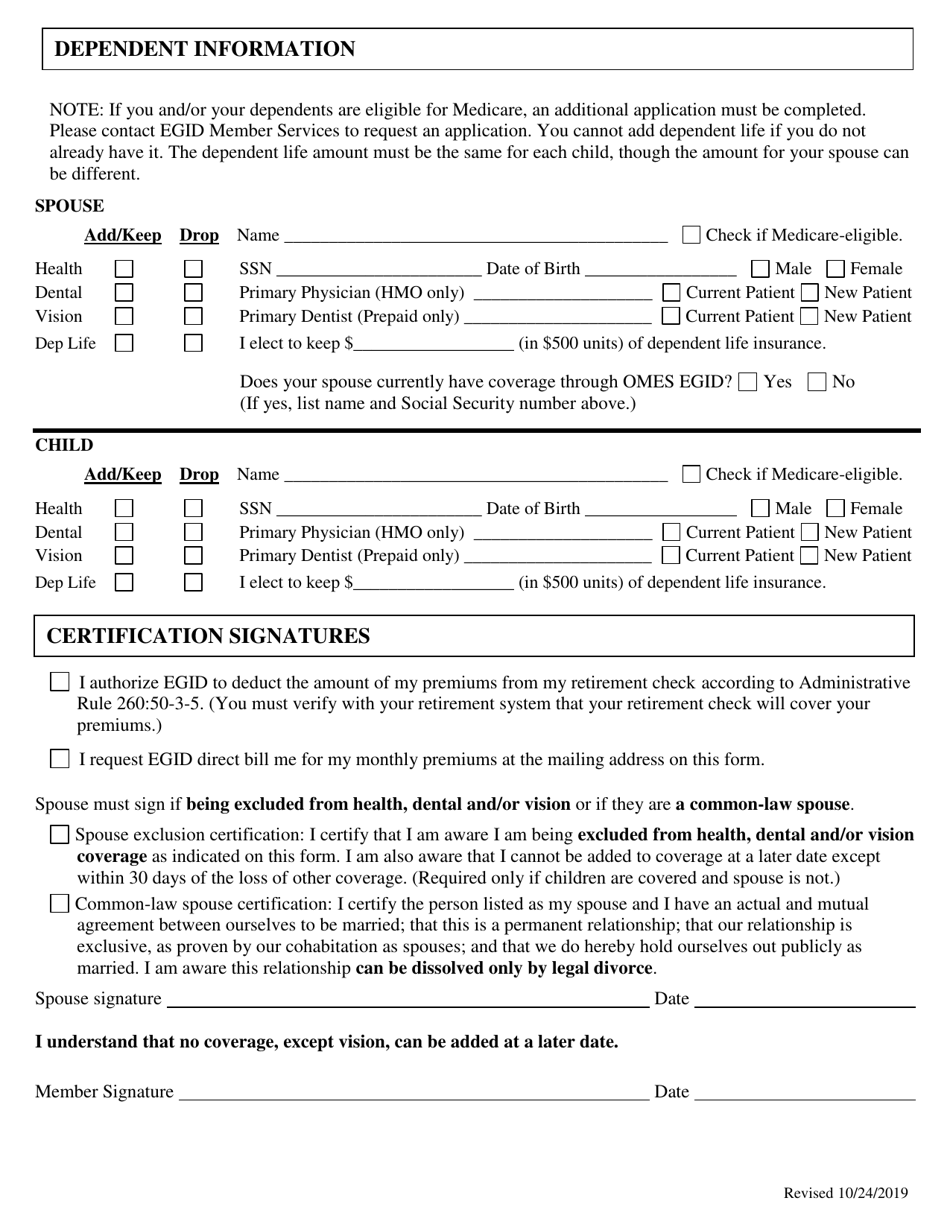

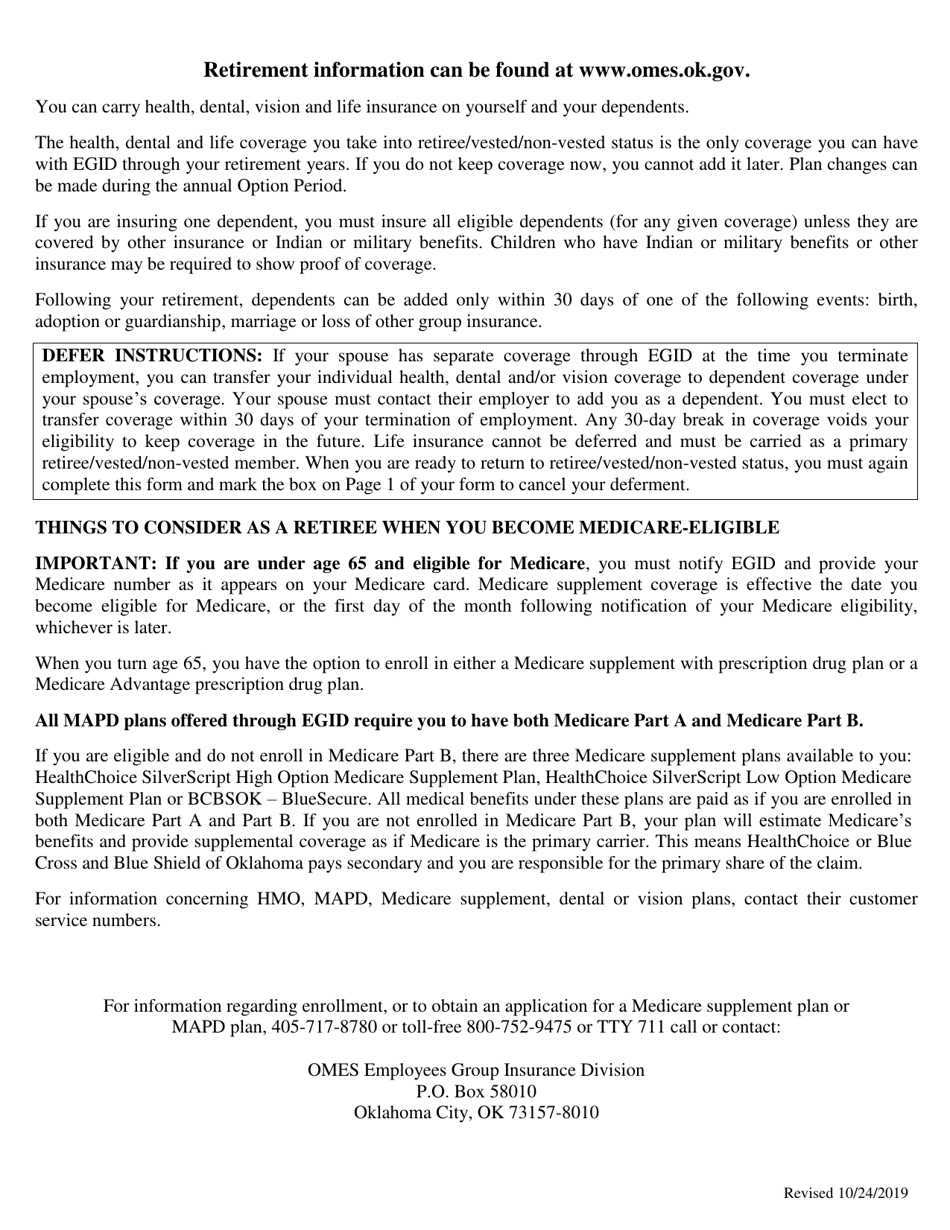

A: It is a form used to apply for insurance coverage for retired or vested/non-vested individuals in Oklahoma.

Q: Who can apply for Retiree/Vested Non-vested/Defer Insurance Coverage?

A: Retired or vested/non-vested individuals in Oklahoma can apply.

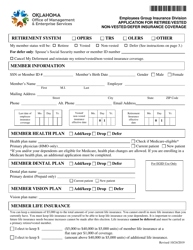

Q: What types of insurance coverage can be obtained through this application?

A: It depends on the specific options available, but common types of coverage include health, dental, and vision insurance.

Q: What does 'vested' and 'non-vested' mean in the context of insurance coverage?

A: Vested refers to individuals who have met the eligibility requirements for certain benefits, while non-vested refers to those who have not yet met those requirements.

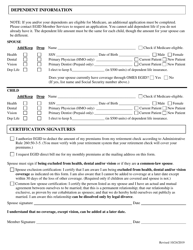

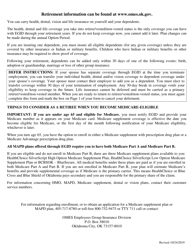

Q: What is the purpose of deferring insurance coverage?

A: Deferring insurance coverage allows individuals to postpone enrolling in coverage until a later date, typically when they retire.

Q: Are there any specific eligibility requirements for obtaining coverage?

A: Eligibility requirements may vary depending on the specific insurance plan and employer.

Q: Can I apply for insurance coverage if I am not retired or vested?

A: If you are not retired or vested, you may not be eligible for certain coverage options. It is best to consult with your employer or the insurance provider to determine your eligibility.

Q: Is there a deadline for submitting the application?

A: Deadlines for submitting the application may vary. It is important to check with your employer or the insurance provider to determine the deadline for your specific situation.

Form Details:

- Released on October 24, 2019;

- The latest edition currently provided by the Oklahoma Office of Management and Enterprise Services;

- Ready to use and print;

- Easy to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a printable version of the form by clicking the link below or browse more documents and templates provided by the Oklahoma Office of Management and Enterprise Services.