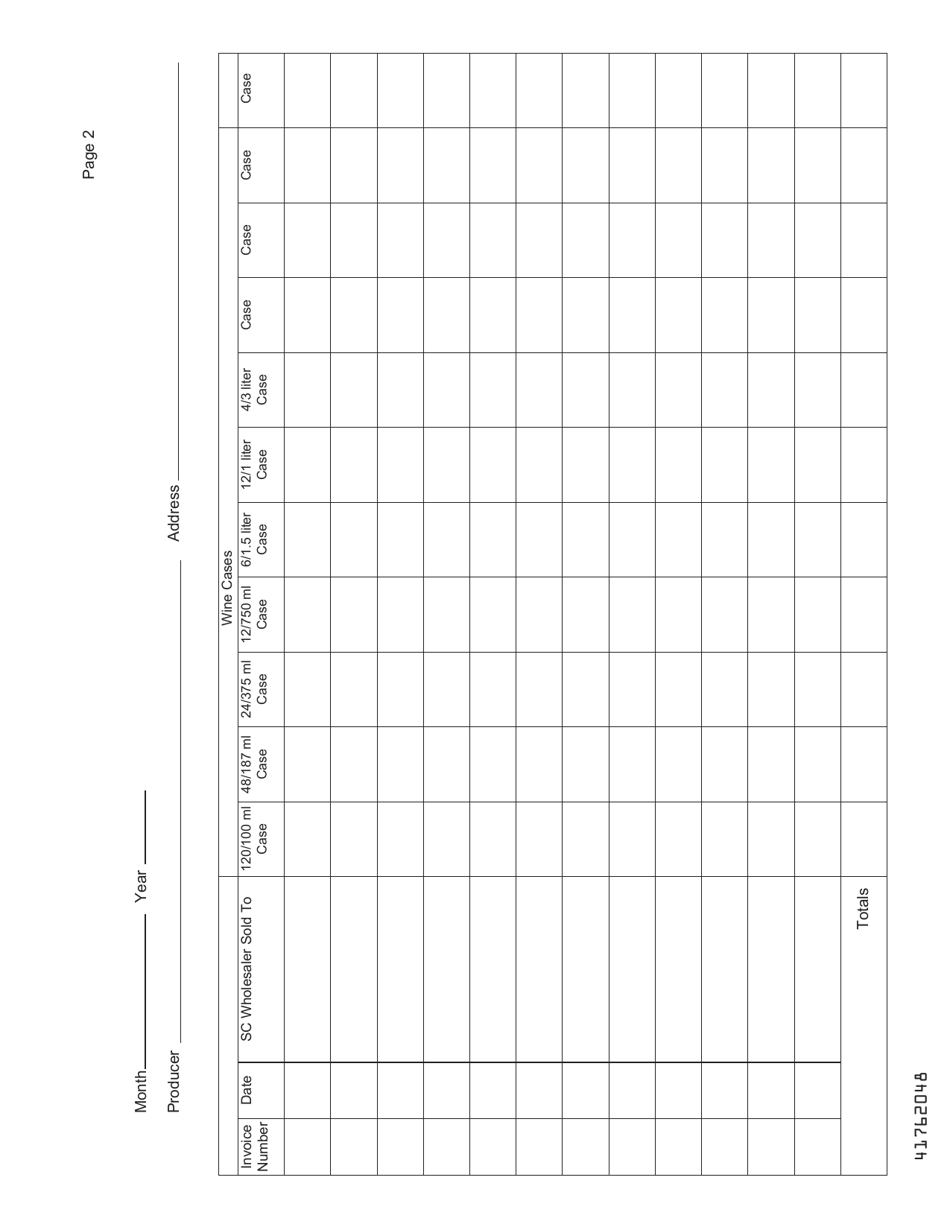

This version of the form is not currently in use and is provided for reference only. Download this version of

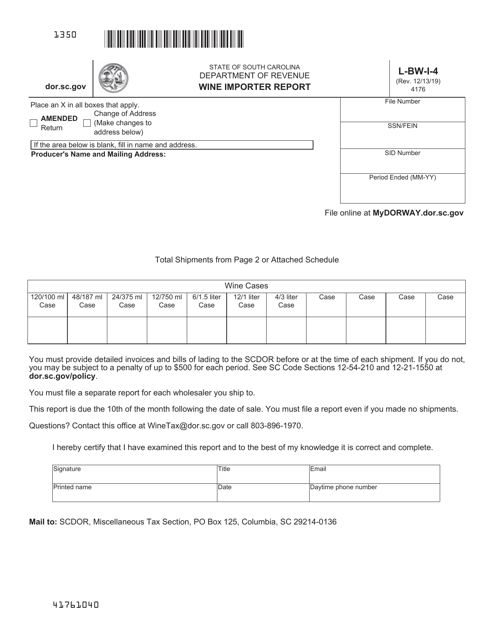

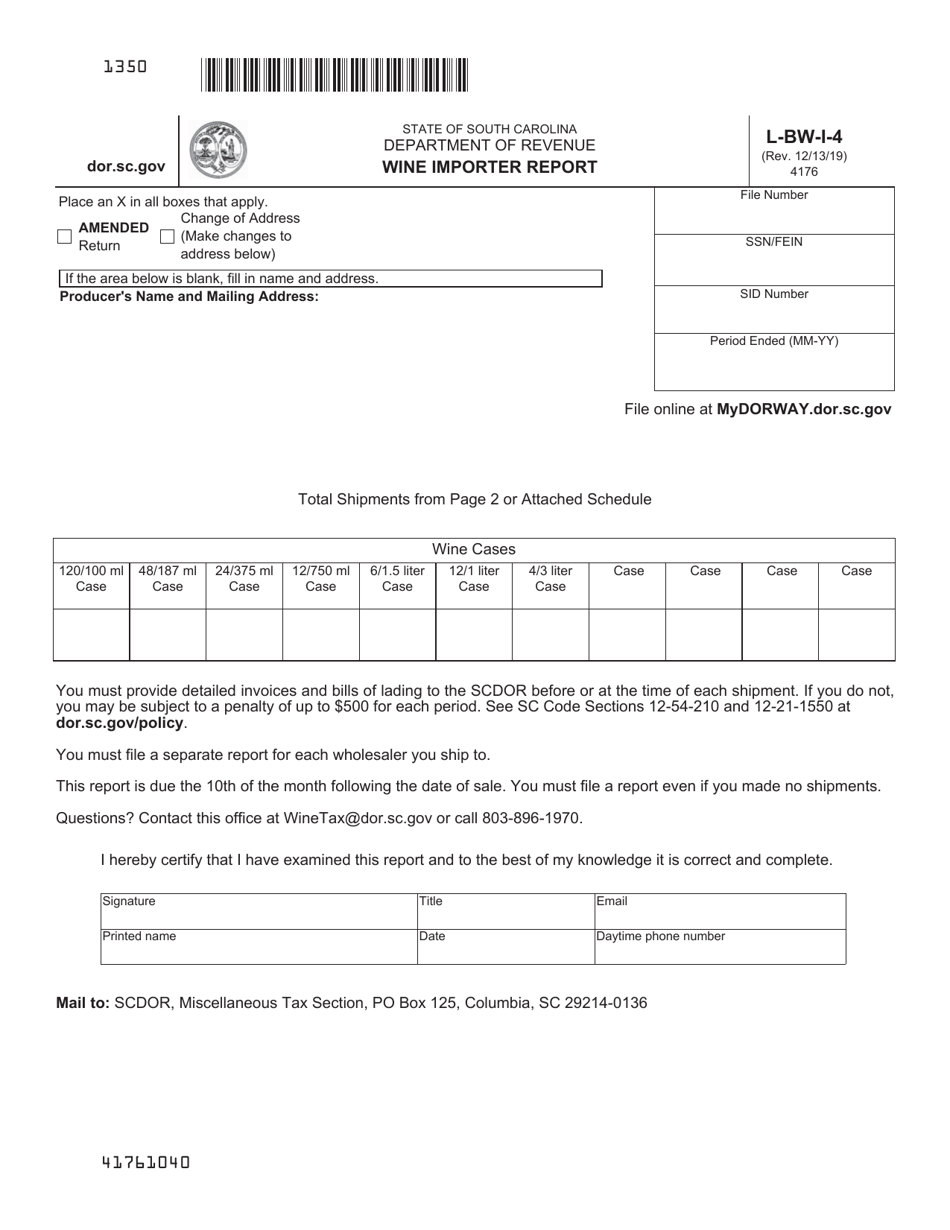

Form L-BW-I-4

for the current year.

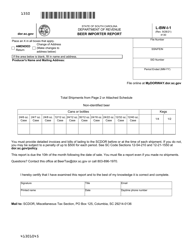

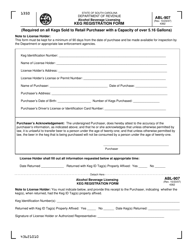

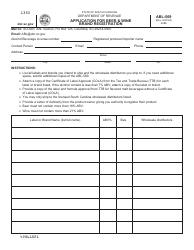

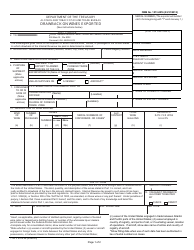

Form L-BW-I-4 Wine Importer Report - South Carolina

What Is Form L-BW-I-4?

This is a legal form that was released by the South Carolina Department of Revenue - a government authority operating within South Carolina. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is Form L-BW-I-4?

A: Form L-BW-I-4 is the Wine Importer Report.

Q: Who is required to file Form L-BW-I-4?

A: Wine importers in South Carolina are required to file Form L-BW-I-4.

Q: What is the purpose of Form L-BW-I-4?

A: The purpose of Form L-BW-I-4 is to report imported wine sales in South Carolina.

Q: When is Form L-BW-I-4 due?

A: Form L-BW-I-4 is due on or before the 20th day of each month.

Q: Are there any penalties for late filing of Form L-BW-I-4?

A: Yes, there are penalties for late filing of Form L-BW-I-4. The penalty is $5 per calendar day for each month that the report is late.

Q: Are there any exemptions to filing Form L-BW-I-4?

A: Yes, small importers with annual sales of less than $10,000 are exempt from filing Form L-BW-I-4.

Form Details:

- Released on December 13, 2019;

- The latest edition provided by the South Carolina Department of Revenue;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a printable version of Form L-BW-I-4 by clicking the link below or browse more documents and templates provided by the South Carolina Department of Revenue.