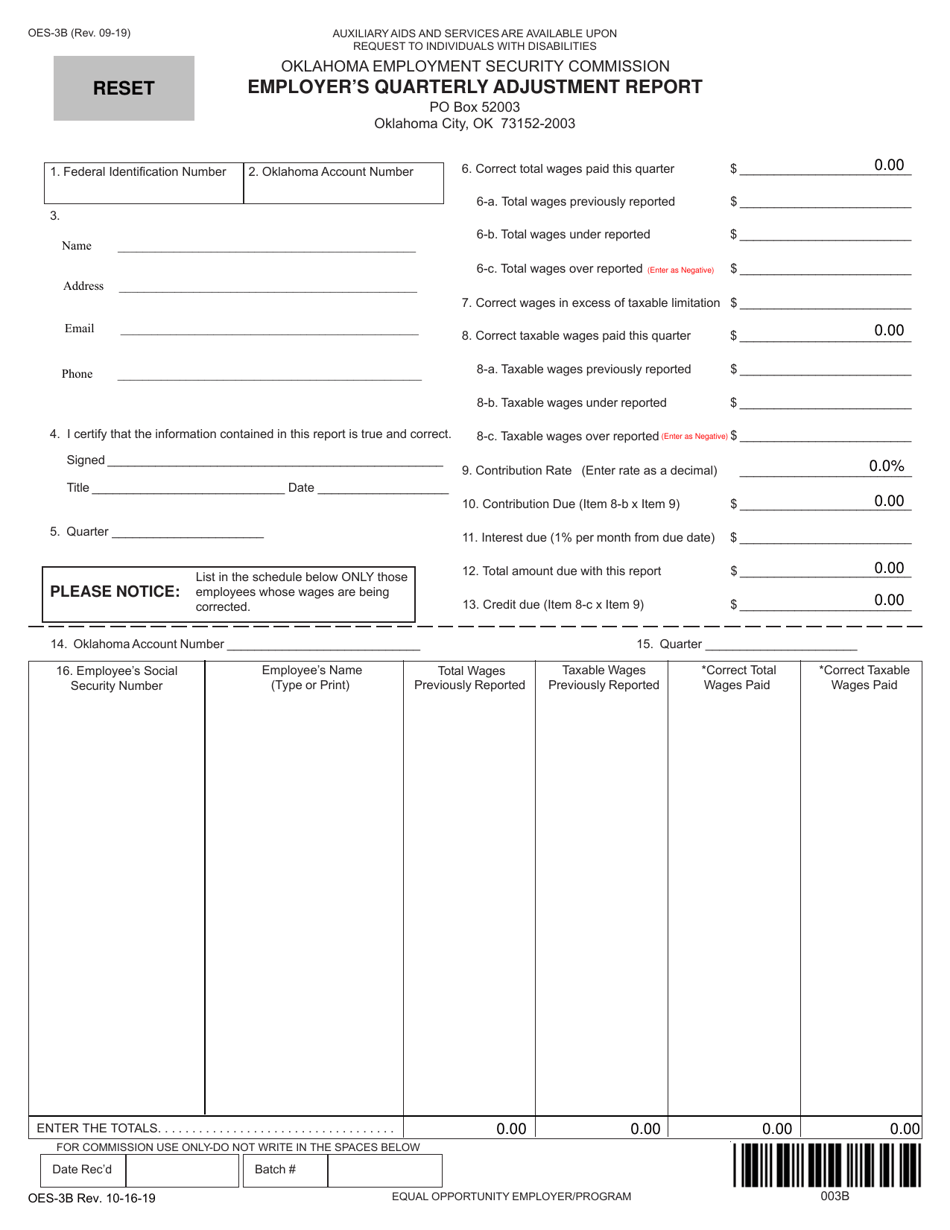

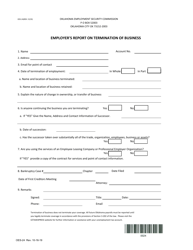

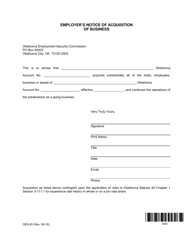

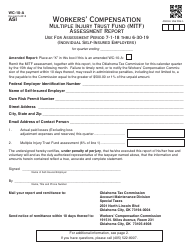

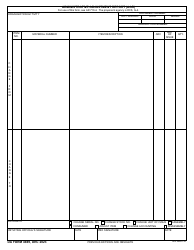

Form OES-3B Employer's Quarterly Adjustment Report - Oklahoma

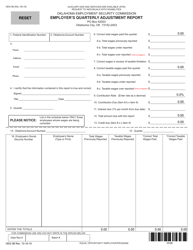

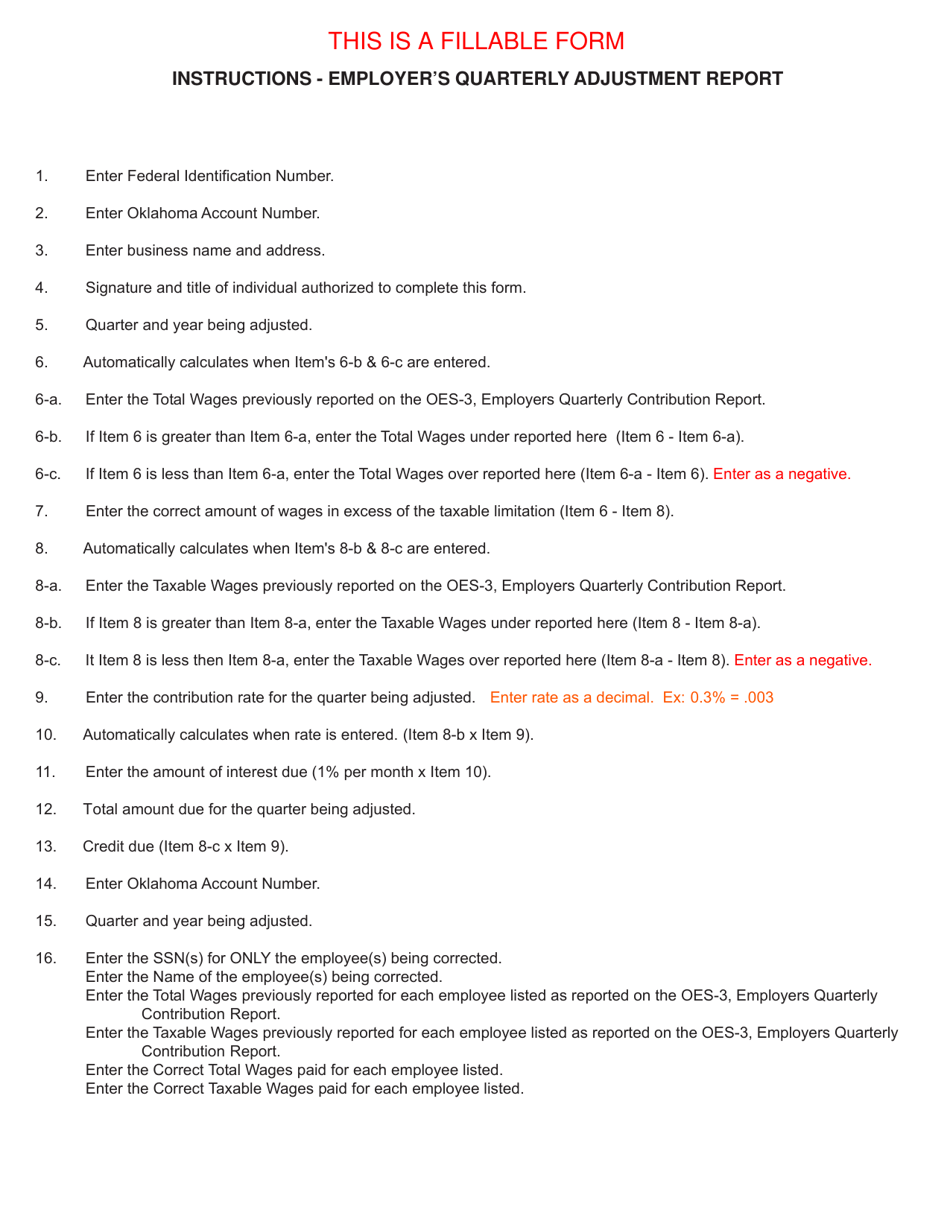

What Is Form OES-3B?

This is a legal form that was released by the Oklahoma Employment Security Commission - a government authority operating within Oklahoma. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

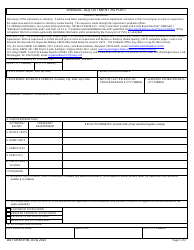

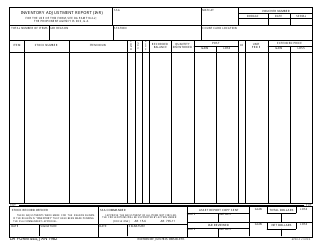

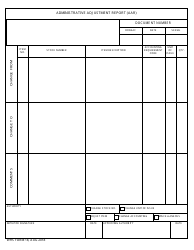

Q: What is Form OES-3B?

A: Form OES-3B is the Employer's Quarterly Adjustment Report used in Oklahoma.

Q: Who needs to file Form OES-3B?

A: Employers in Oklahoma who need to make adjustments to their unemployment tax reports for the quarter.

Q: What is the purpose of Form OES-3B?

A: The purpose of Form OES-3B is to report changes or adjustments to previously filed unemployment tax reports.

Q: When is Form OES-3B due?

A: Form OES-3B is due on or before the last day of the month following the end of the quarter.

Q: Is there a penalty for late filing of Form OES-3B?

A: Yes, there may be penalties for late filing or failure to file Form OES-3B.

Form Details:

- Released on September 1, 2019;

- The latest edition provided by the Oklahoma Employment Security Commission;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form OES-3B by clicking the link below or browse more documents and templates provided by the Oklahoma Employment Security Commission.