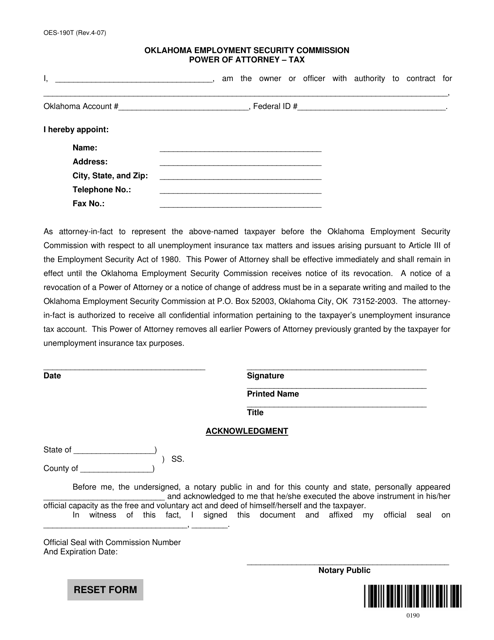

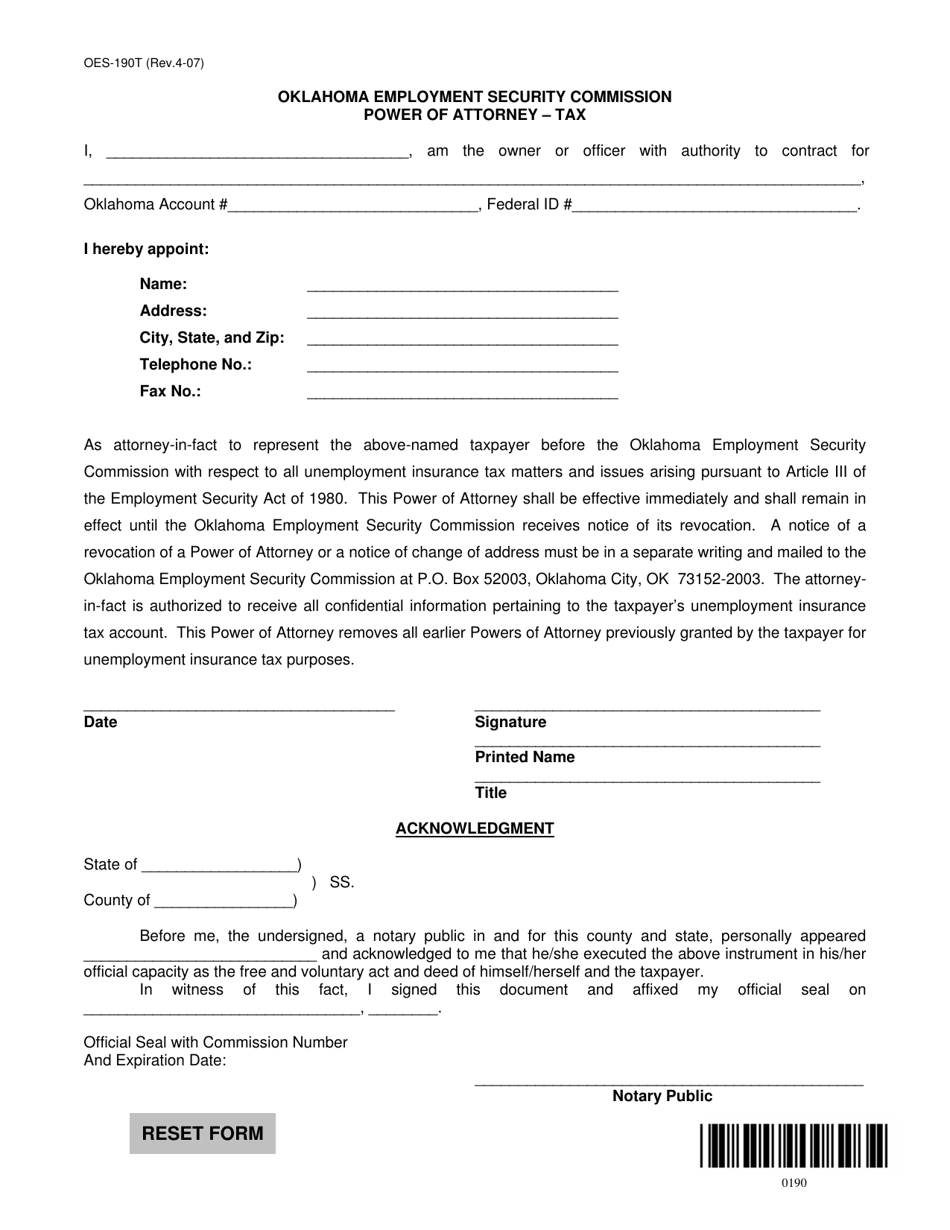

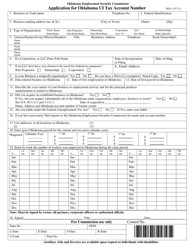

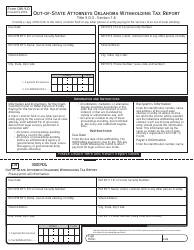

Form OES-190T Power of Attorney - Tax - Oklahoma

What Is Form OES-190T?

This is a legal form that was released by the Oklahoma Employment Security Commission - a government authority operating within Oklahoma. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is Form OES-190T?

A: Form OES-190T is a Power of Attorney form specifically for tax purposes in Oklahoma.

Q: What is a Power of Attorney?

A: A Power of Attorney is a legal document that allows someone else to act on your behalf in legal, financial, or tax matters.

Q: Who can use Form OES-190T?

A: Form OES-190T can be used by individuals or businesses who want to authorize another person or entity to represent them in tax matters with the Oklahoma Tax Commission.

Q: What information is required on Form OES-190T?

A: Form OES-190T requires the taxpayer's identifying information, the authorized representative's information, and tax-specific details.

Q: Do I need to submit Form OES-190T every year?

A: Form OES-190T generally remains valid until revoked or terminated by the taxpayer, so it doesn't need to be submitted every year unless there are changes in representation.

Q: Can I use Form OES-190T for both individual and business taxes?

A: Yes, Form OES-190T can be used for both personal and business tax matters.

Q: Can I appoint more than one representative using Form OES-190T?

A: Yes, Form OES-190T allows the appointment of multiple representatives, but separate forms should be submitted for each representative.

Q: Is Form OES-190T specific to Oklahoma tax matters only?

A: Yes, Form OES-190T is specifically designed for tax matters with the Oklahoma Tax Commission and cannot be used for other states.

Form Details:

- Released on April 1, 2007;

- The latest edition provided by the Oklahoma Employment Security Commission;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form OES-190T by clicking the link below or browse more documents and templates provided by the Oklahoma Employment Security Commission.