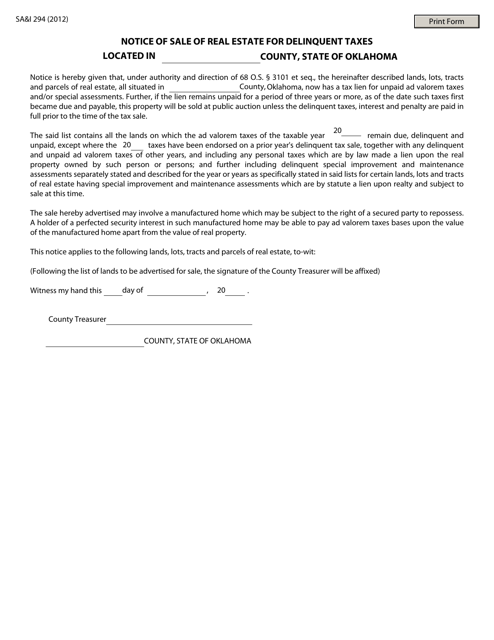

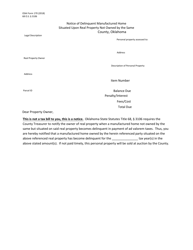

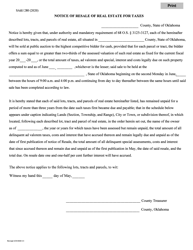

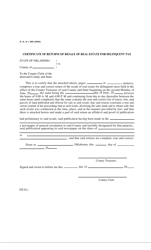

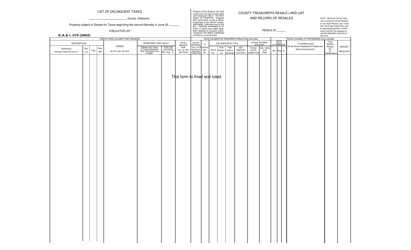

Form S.A.& I.294 Notice of Sale of Real Estate for Delinquent Taxes - Oklahoma

What Is Form S.A.& I.294?

This is a legal form that was released by the Oklahoma State Auditor and Inspector - a government authority operating within Oklahoma. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is Form S.A.& I.294?

A: Form S.A.& I.294 is the Notice of Sale of Real Estate for Delinquent Taxes in Oklahoma.

Q: What is the purpose of Form S.A.& I.294?

A: The purpose of Form S.A.& I.294 is to inform property owners in Oklahoma that their real estate will be sold due to delinquent taxes.

Q: Who is required to file Form S.A.& I.294?

A: The county treasurer or tax collector is responsible for filing Form S.A.& I.294 in Oklahoma.

Q: When is Form S.A.& I.294 filed?

A: Form S.A.& I.294 is typically filed when property owners in Oklahoma are delinquent on their tax payments.

Q: What information is included in Form S.A.& I.294?

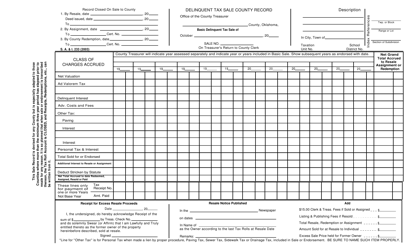

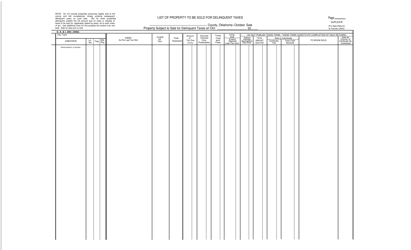

A: Form S.A.& I.294 includes details about the delinquent taxes owed, the property being sold, and the date and location of the sale.

Q: What should property owners do upon receiving Form S.A.& I.294?

A: Property owners should take immediate action to address their delinquent taxes to prevent the sale of their real estate.

Q: Can the sale of real estate for delinquent taxes be stopped?

A: Yes, property owners in Oklahoma have the opportunity to redeem their property before the scheduled sale by paying the delinquent taxes and any additional fees.

Q: What happens if the property is not redeemed?

A: If the property is not redeemed, it will be sold at a public auction to the highest bidder.

Q: What rights do property owners have during the sale process?

A: Property owners have the right to attend the auction and bid on their own property in Oklahoma.

Form Details:

- Released on January 1, 2012;

- The latest edition provided by the Oklahoma State Auditor and Inspector;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form S.A.& I.294 by clicking the link below or browse more documents and templates provided by the Oklahoma State Auditor and Inspector.