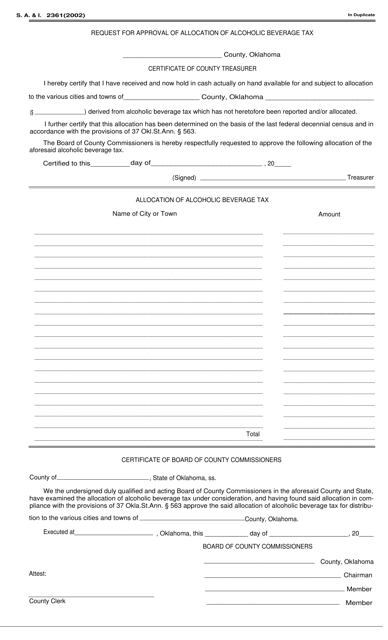

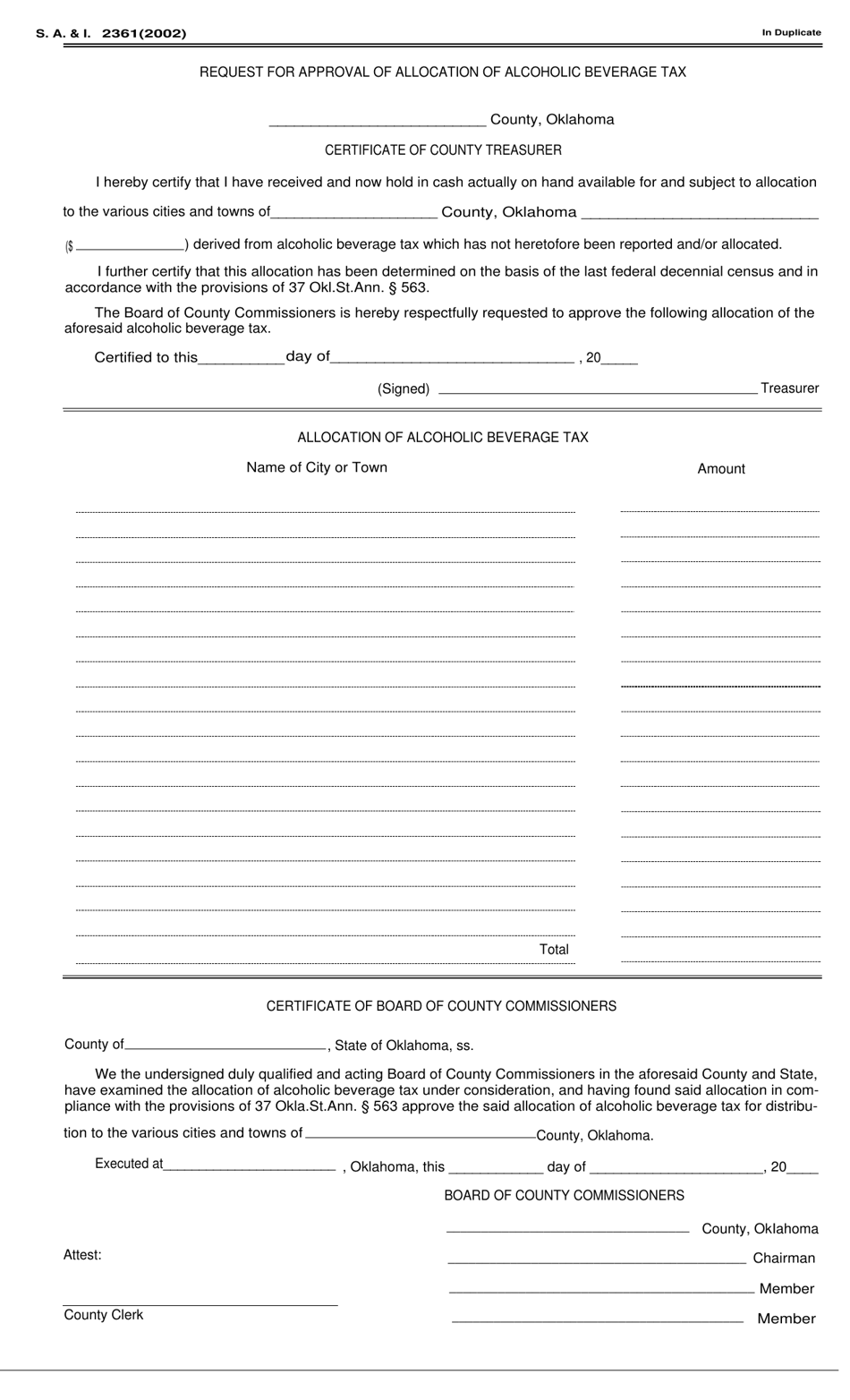

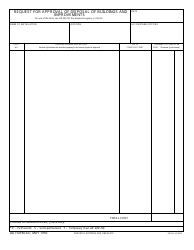

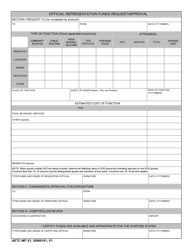

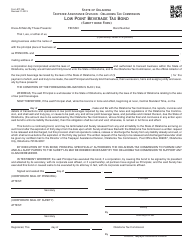

Form S.A.& I.2361 Request for Approval of Allocation of Alcoholic Beverage Tax - Oklahoma

What Is Form S.A.& I.2361?

This is a legal form that was released by the Oklahoma State Auditor and Inspector - a government authority operating within Oklahoma. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is Form S.A.& I.2361?

A: Form S.A.& I.2361 is a request for approval of allocation of alcoholic beverage tax in Oklahoma.

Q: Who needs to fill out Form S.A.& I.2361?

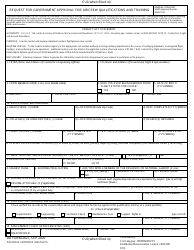

A: Any individual or entity involved in the sale, distribution, or manufacturing of alcoholic beverages in Oklahoma may need to fill out this form.

Q: What is the purpose of Form S.A.& I.2361?

A: The purpose of this form is to request approval for the allocation of alcoholic beverage tax funds in Oklahoma.

Q: Is there a fee to submit Form S.A.& I.2361?

A: There is no fee required to submit Form S.A.& I.2361.

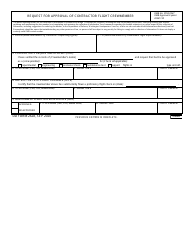

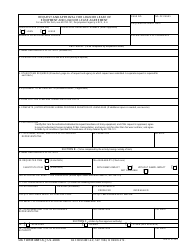

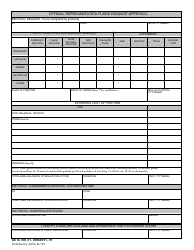

Q: What information is needed to fill out Form S.A.& I.2361?

A: You will need to provide information about your business, details of alcohol sales, and the proposed allocation of tax funds.

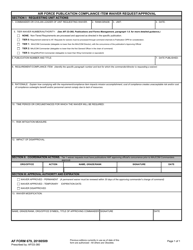

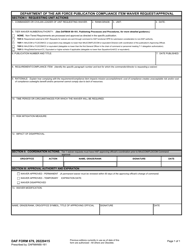

Q: How do I submit Form S.A.& I.2361?

A: You can submit Form S.A.& I.2361 by mail or in person to the Oklahoma Tax Commission.

Q: When should I submit Form S.A.& I.2361?

A: Form S.A.& I.2361 should be submitted at least 30 days before the proposed allocation period.

Q: Who should I contact for more information about Form S.A.& I.2361?

A: For more information about Form S.A.& I.2361, you can contact the Oklahoma Tax Commission.

Form Details:

- Released on January 1, 2002;

- The latest edition provided by the Oklahoma State Auditor and Inspector;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form S.A.& I.2361 by clicking the link below or browse more documents and templates provided by the Oklahoma State Auditor and Inspector.