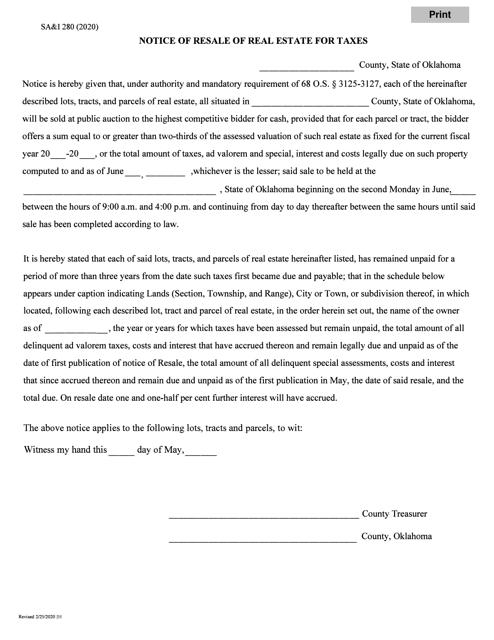

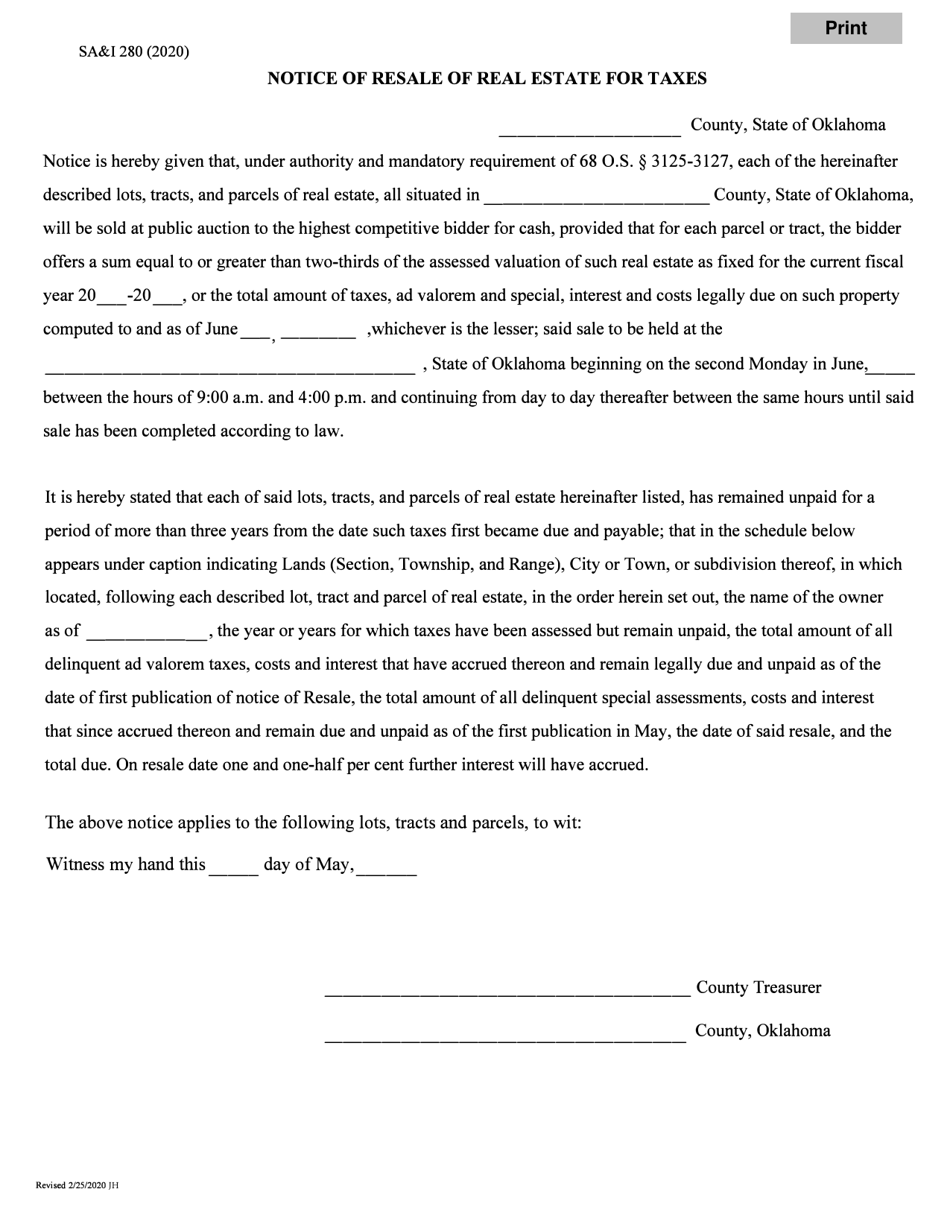

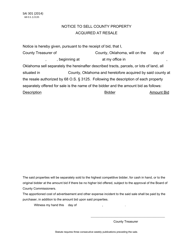

Form S.A.& I.280 Notice of Resale of Real Estate for Taxes - Oklahoma

What Is Form S.A.& I.280?

This is a legal form that was released by the Oklahoma State Auditor and Inspector - a government authority operating within Oklahoma. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is Form S.A.& I.280?

A: Form S.A.& I.280 is a notice of resale of real estate for taxes in Oklahoma.

Q: What is the purpose of Form S.A.& I.280?

A: The purpose of Form S.A.& I.280 is to notify interested parties about the upcoming resale of real estate for unpaid taxes.

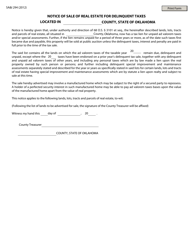

Q: Who is required to file Form S.A.& I.280?

A: The county treasurer or an authorized agent is responsible for filing Form S.A.& I.280.

Q: When should Form S.A.& I.280 be filed?

A: Form S.A.& I.280 should be filed at least 30 days before the scheduled resale of the property.

Q: What information is required on Form S.A.& I.280?

A: Form S.A.& I.280 requires information about the property being resold, the unpaid taxes, and contact information for interested parties.

Form Details:

- Released on February 25, 2020;

- The latest edition provided by the Oklahoma State Auditor and Inspector;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form S.A.& I.280 by clicking the link below or browse more documents and templates provided by the Oklahoma State Auditor and Inspector.