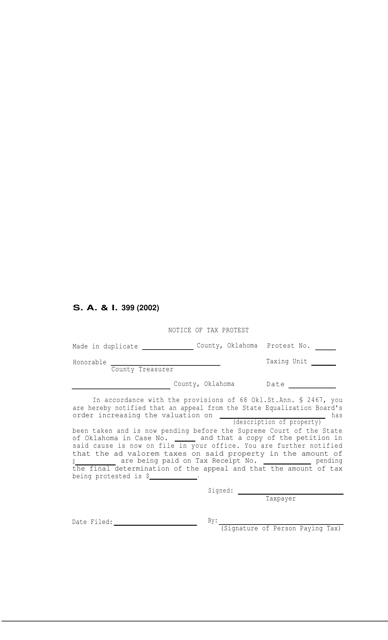

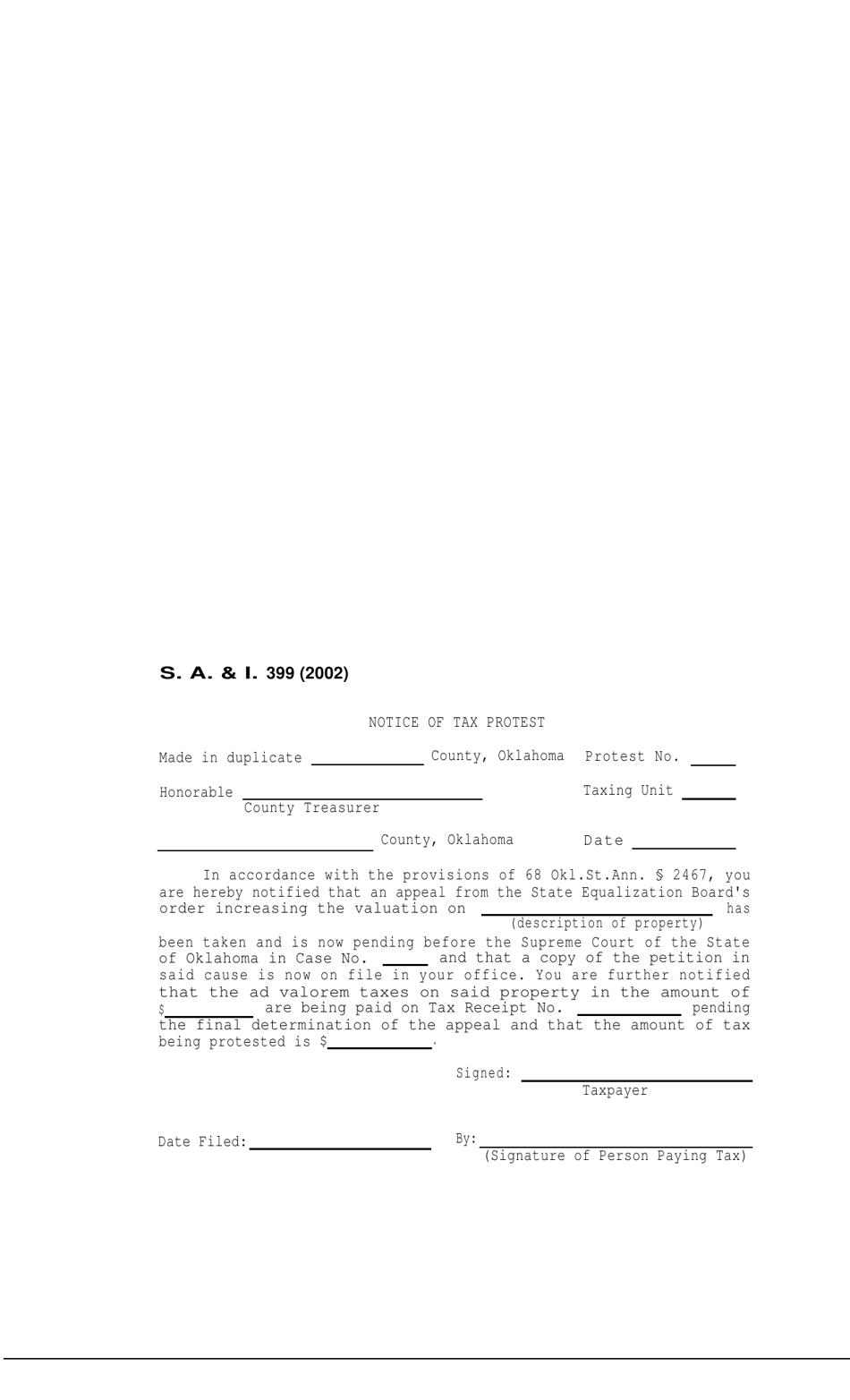

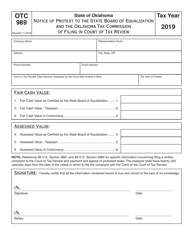

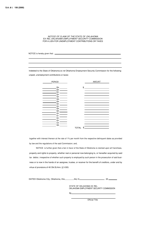

Form S.A.& I.399 Notice of Tax Protest - Oklahoma

What Is Form S.A.& I.399?

This is a legal form that was released by the Oklahoma State Auditor and Inspector - a government authority operating within Oklahoma. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is Form S.A.& I.399?

A: Form S.A.& I.399 is a Notice of Tax Protest specific to Oklahoma.

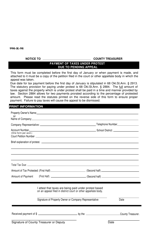

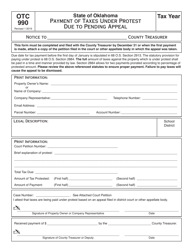

Q: What is the purpose of Form S.A.& I.399?

A: The purpose of Form S.A.& I.399 is to initiate the process of protesting a tax assessment in Oklahoma.

Q: Do I need to fill out Form S.A.& I.399 if I want to protest a tax assessment in Oklahoma?

A: Yes, you need to fill out Form S.A.& I.399 in order to properly protest a tax assessment in Oklahoma.

Q: Are there any deadlines for submitting Form S.A.& I.399?

A: Yes, there are specific deadlines for submitting Form S.A.& I.399. It is important to check the instructions on the form or consult with the Oklahoma Tax Commission to ensure timely submission.

Q: What information do I need to provide on Form S.A.& I.399?

A: On Form S.A.& I.399, you will need to provide your contact information, details about the tax assessment being protested, and the reasons for your protest.

Q: What happens after I submit Form S.A.& I.399?

A: After you submit Form S.A.& I.399, the Oklahoma Tax Commission will review your protest and may schedule a hearing to further evaluate your case.

Q: Can I appeal the decision made after submitting Form S.A.& I.399?

A: Yes, if you disagree with the decision made after submitting Form S.A.& I.399, you have the option to appeal to the Oklahoma Tax Commission's Board of Equalization.

Q: Is there a fee for filing Form S.A.& I.399?

A: There is no fee for filing Form S.A.& I.399.

Q: Can I get assistance in filling out Form S.A.& I.399?

A: Yes, you can reach out to the Oklahoma Tax Commission for assistance in filling out Form S.A.& I.399 or consult with a tax professional.

Form Details:

- Released on January 1, 2002;

- The latest edition provided by the Oklahoma State Auditor and Inspector;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a printable version of Form S.A.& I.399 by clicking the link below or browse more documents and templates provided by the Oklahoma State Auditor and Inspector.