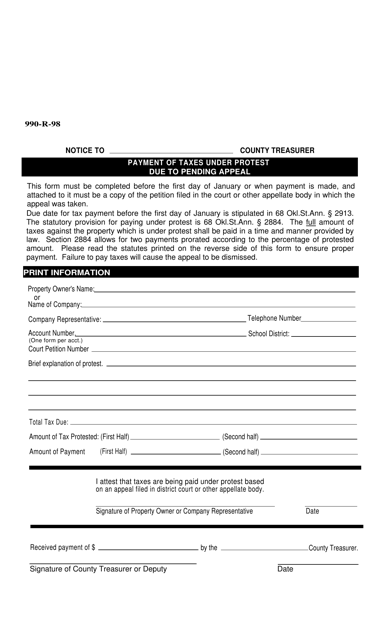

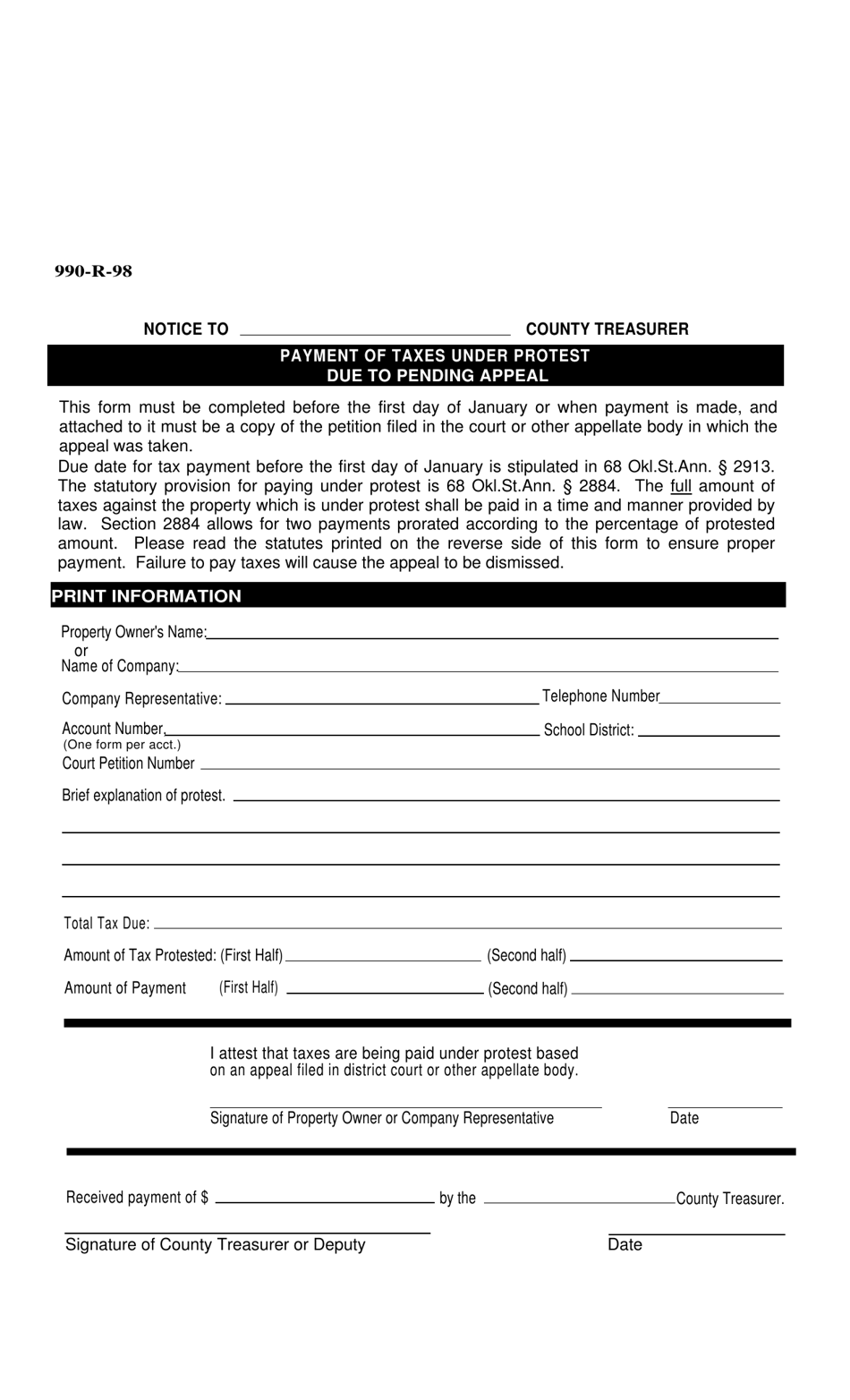

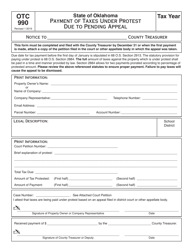

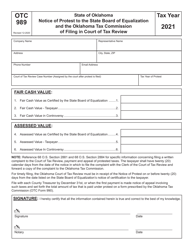

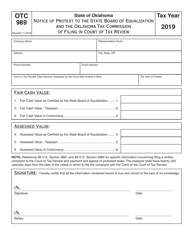

Form 0990R Payment of Taxes Under Protest Due to Pending Appeal - Oklahoma

What Is Form 0990R?

This is a legal form that was released by the Oklahoma State Auditor and Inspector - a government authority operating within Oklahoma. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is Form 0990R?

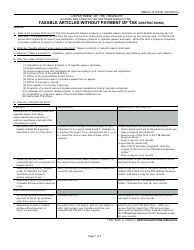

A: Form 0990R is a form used to pay taxes under protest due to a pending appeal in Oklahoma.

Q: When should I use Form 0990R?

A: You should use Form 0990R when you want to pay your taxes under protest while you have a pending appeal in Oklahoma.

Q: What does it mean to pay taxes under protest?

A: Paying taxes under protest means that you are paying your taxes, but you are disputing the amount or legality of the taxes and you want to reserve your right to challenge them.

Q: How do I fill out Form 0990R?

A: You will need to provide your personal information, tax information, and explanations for why you are paying the taxes under protest. The form has instructions on how to fill it out.

Q: Do I have to pay the taxes while my appeal is pending?

A: Yes, you are required to pay the taxes while your appeal is pending. Using Form 0990R allows you to pay the taxes under protest and reserve your right to challenge them.

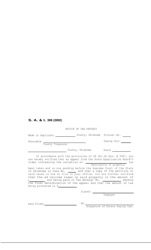

Q: What happens after I submit Form 0990R?

A: Once you submit Form 0990R, the Oklahoma Tax Commission will review your submission and may take appropriate action based on the information provided.

Q: Can I get a refund if my appeal is successful?

A: If your appeal is successful and you have paid the taxes under protest, you may be eligible for a refund of the amount you overpaid.

Form Details:

- Released on January 1, 1998;

- The latest edition provided by the Oklahoma State Auditor and Inspector;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a printable version of Form 0990R by clicking the link below or browse more documents and templates provided by the Oklahoma State Auditor and Inspector.