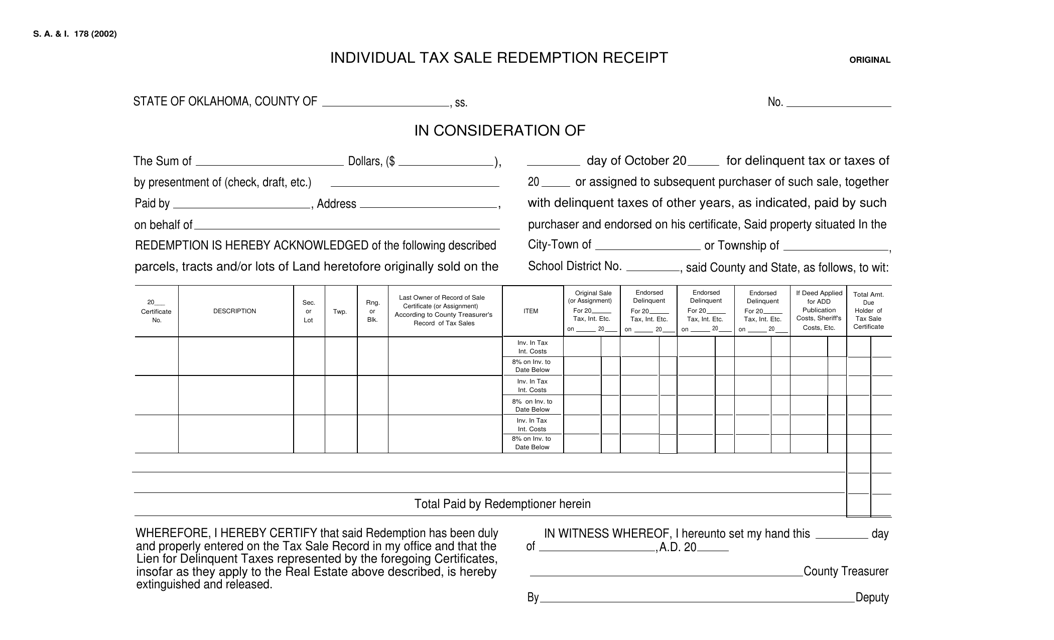

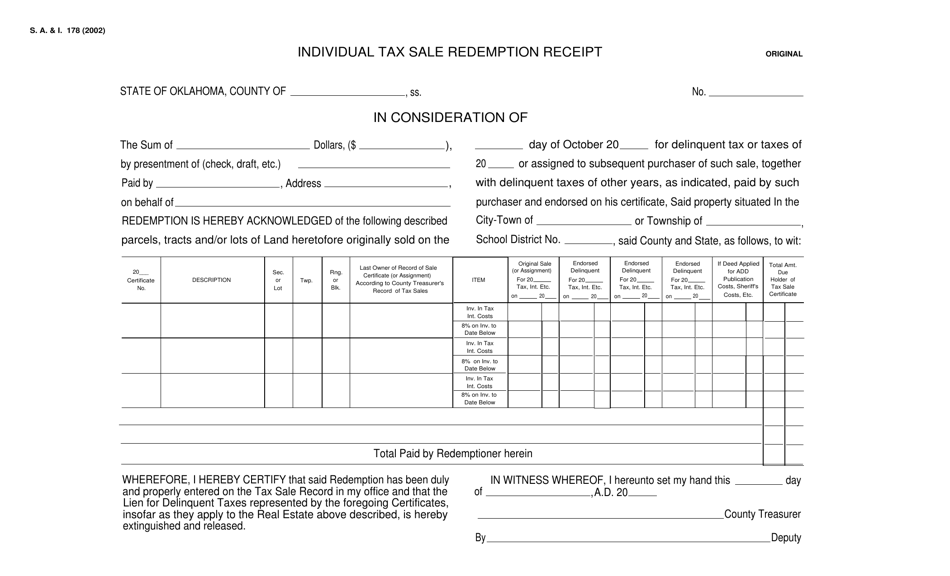

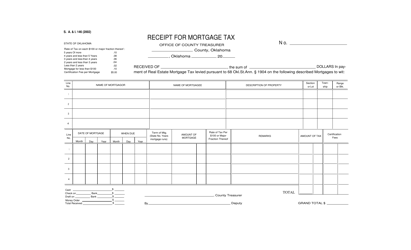

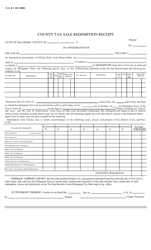

Form S.A.& I.178 Individual Tax Sale Redemption Receipt - Oklahoma

What Is Form S.A.& I.178?

This is a legal form that was released by the Oklahoma State Auditor and Inspector - a government authority operating within Oklahoma. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is Form S.A.& I.178?

A: Form S.A.& I.178 is an Individual Tax Sale Redemption Receipt in Oklahoma.

Q: What is the purpose of Form S.A.& I.178?

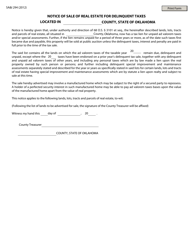

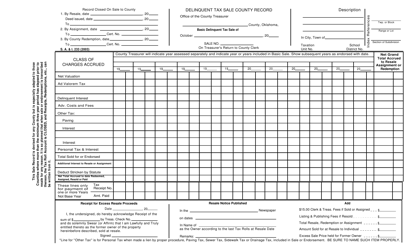

A: The purpose of Form S.A.& I.178 is to provide a receipt for the redemption of property sold at a tax sale in Oklahoma.

Q: Who needs to file Form S.A.& I.178?

A: The individual who is redeeming property sold at a tax sale in Oklahoma needs to file Form S.A.& I.178.

Q: Is there a deadline for filing Form S.A.& I.178?

A: Yes, Form S.A.& I.178 must be filed within three years from the date of the tax sale.

Q: What information is required on Form S.A.& I.178?

A: Form S.A.& I.178 requires information such as the property owner's name, tax sale information, and the amount paid for redemption.

Q: Are there any fees associated with filing Form S.A.& I.178?

A: Yes, there is a filing fee of $10 for each Form S.A.& I.178.

Q: What should I do with the completed Form S.A.& I.178?

A: The completed Form S.A.& I.178 should be submitted to the county treasurer's office or the Oklahoma Tax Commission.

Form Details:

- Released on January 1, 2002;

- The latest edition provided by the Oklahoma State Auditor and Inspector;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form S.A.& I.178 by clicking the link below or browse more documents and templates provided by the Oklahoma State Auditor and Inspector.