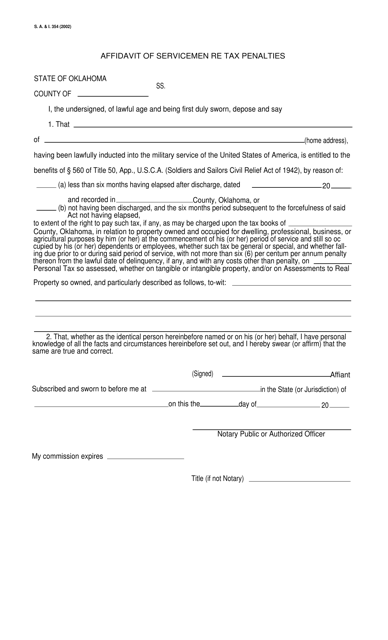

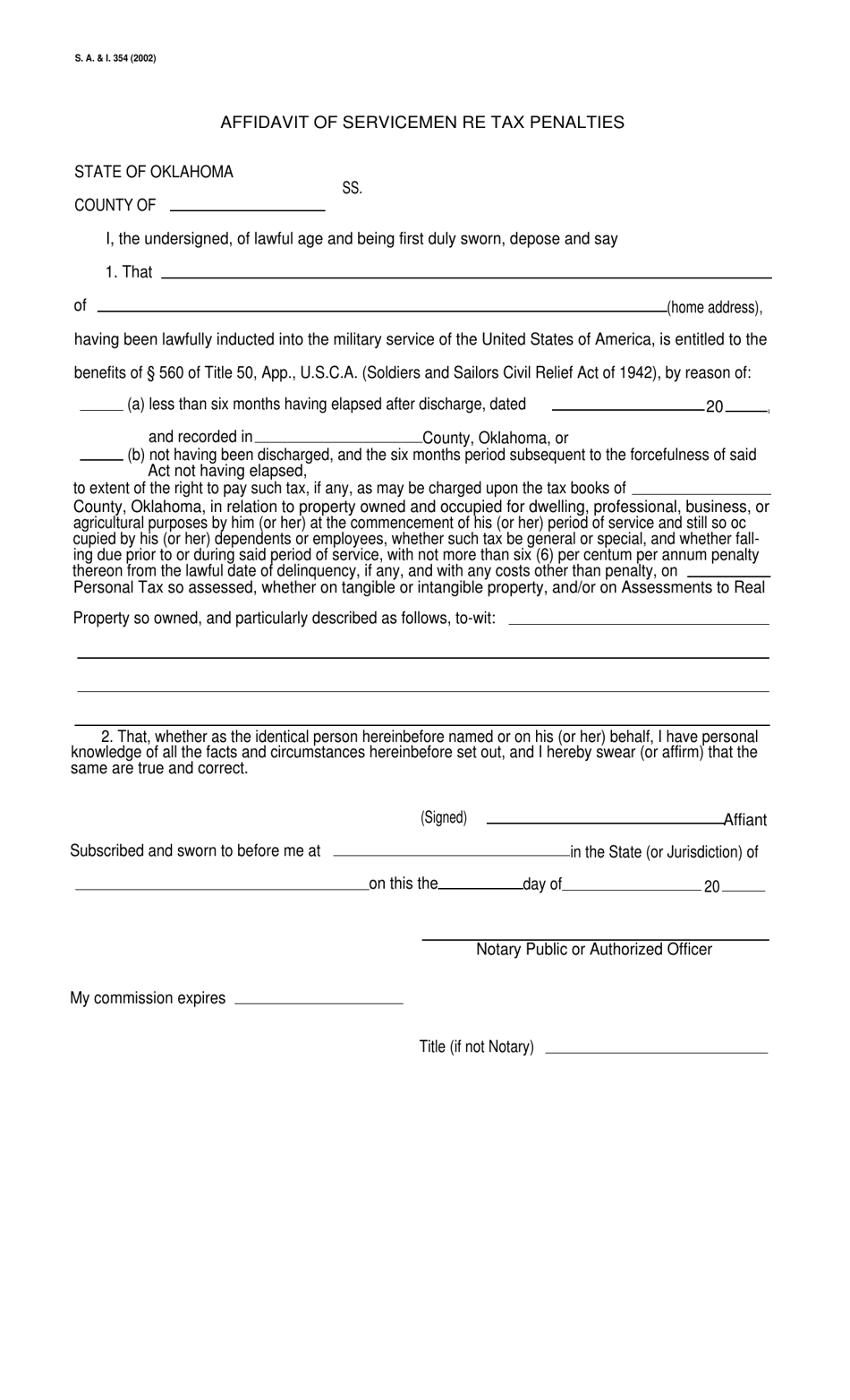

Form S.A.& I.354 Affidavit of Servicemen Re Tax Penalties - Oklahoma

What Is Form S.A.& I.354?

This is a legal form that was released by the Oklahoma State Auditor and Inspector - a government authority operating within Oklahoma. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is Form S.A.& I.354?

A: Form S.A.& I.354 is an affidavit for servicemen in Oklahoma regarding tax penalties.

Q: Who can use Form S.A.& I.354?

A: Servicemen in Oklahoma can use Form S.A.& I.354.

Q: What is the purpose of Form S.A.& I.354?

A: The purpose of Form S.A.& I.354 is to provide servicemen with a way to request relief from tax penalties in Oklahoma.

Q: Is Form S.A.& I.354 specific to Oklahoma?

A: Yes, Form S.A.& I.354 is specific to Oklahoma.

Q: What information is required on Form S.A.& I.354?

A: Form S.A.& I.354 requires the serviceman's personal information, details of the tax penalty, and reasons for requesting relief.

Q: Is there a deadline for submitting Form S.A.& I.354?

A: Yes, consult the instructions for Form S.A.& I.354 for the specific deadline.

Q: What happens after submitting Form S.A.& I.354?

A: After submitting Form S.A.& I.354, the Oklahoma Tax Commission will review the request for relief from tax penalties and make a decision.

Q: Can I appeal the decision made on my Form S.A.& I.354?

A: Yes, you can appeal the decision made on your Form S.A.& I.354 by following the instructions provided by the Oklahoma Tax Commission.

Form Details:

- Released on January 1, 2002;

- The latest edition provided by the Oklahoma State Auditor and Inspector;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form S.A.& I.354 by clicking the link below or browse more documents and templates provided by the Oklahoma State Auditor and Inspector.