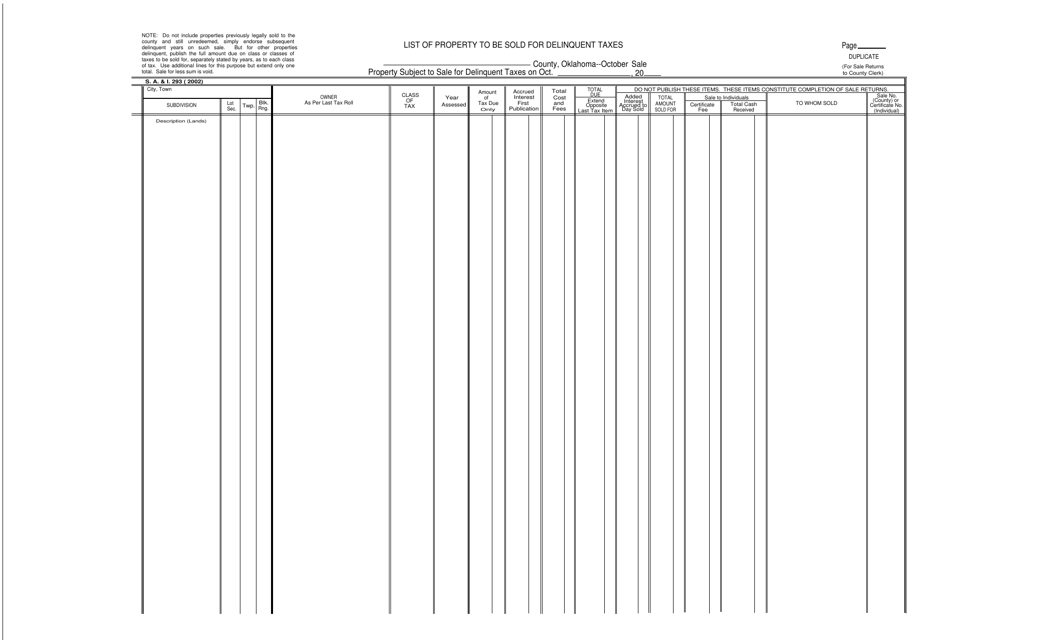

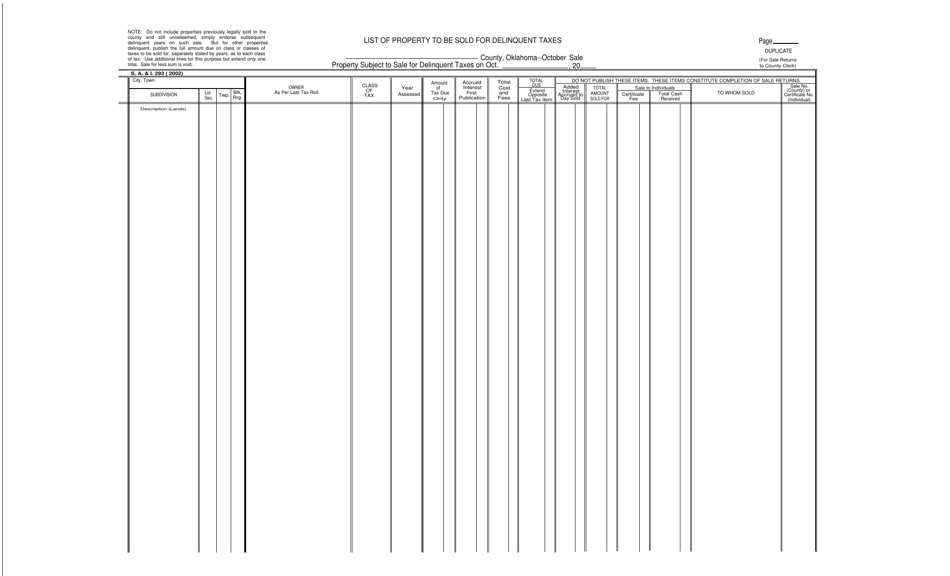

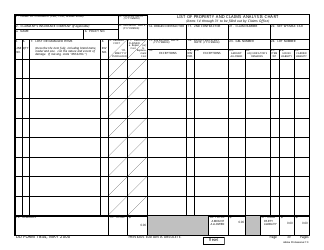

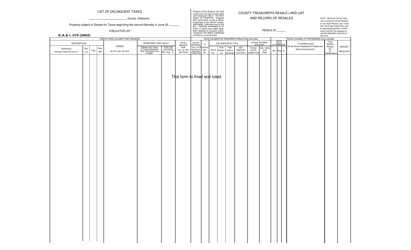

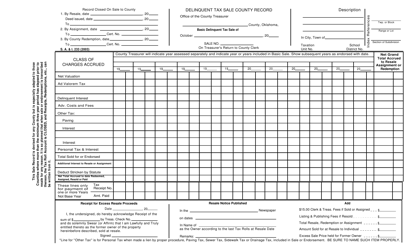

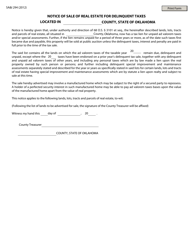

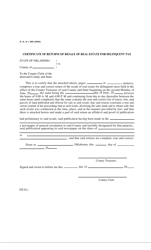

Form S.A.& I.293 List of Property to Be Sold for Delinquent Taxes - Oklahoma

What Is Form S.A.& I.293?

This is a legal form that was released by the Oklahoma State Auditor and Inspector - a government authority operating within Oklahoma. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is the Form S.A.& I.293?

A: Form S.A.& I.293 is a list of property to be sold for delinquent taxes in Oklahoma.

Q: What does the form list?

A: The form lists the real property parcels and the delinquent tax amounts that are due.

Q: What is the purpose of the form?

A: The purpose of the form is to provide a public notice of the properties that will be sold for unpaid taxes.

Q: Who prepares the form?

A: The form is prepared by the county treasurer's office.

Q: Can anyone access the form?

A: Yes, the form is a public record and can be accessed by anyone who is interested in the delinquent properties being sold.

Q: What should I do if my property is listed on the form?

A: If your property is listed on the form, you should contact the county treasurer's office to arrange for payment of the delinquent taxes.

Q: What happens if the taxes are not paid?

A: If the taxes are not paid, the property may be sold at a public auction to satisfy the tax debt.

Q: Are there any redemption rights for the property owner?

A: In Oklahoma, the property owner has the right to redeem the property within three years after the sale by paying the delinquent taxes plus any additional costs and interest.

Q: Can I bid on the properties listed on the form?

A: Yes, the properties can be bid on by any interested individual or entity at the public auction.

Form Details:

- Released on January 1, 2002;

- The latest edition provided by the Oklahoma State Auditor and Inspector;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form S.A.& I.293 by clicking the link below or browse more documents and templates provided by the Oklahoma State Auditor and Inspector.