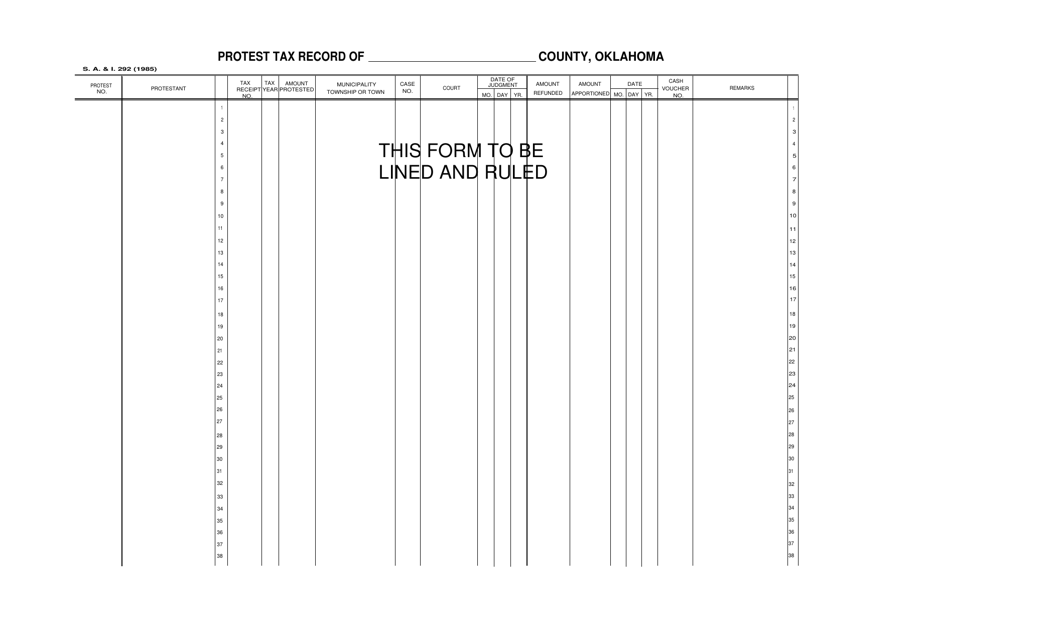

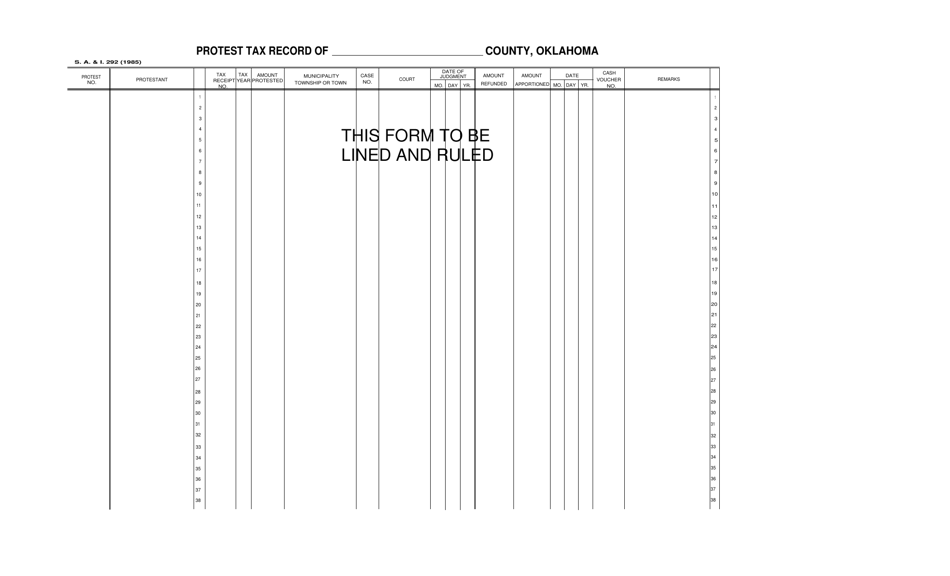

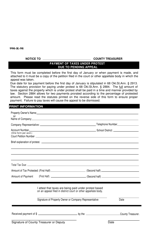

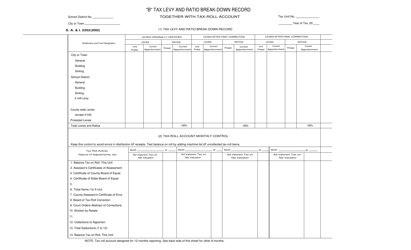

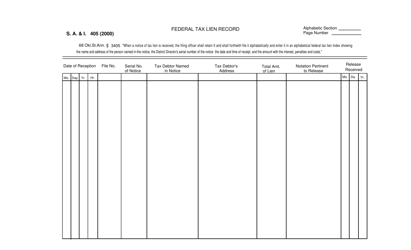

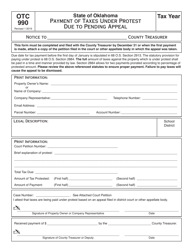

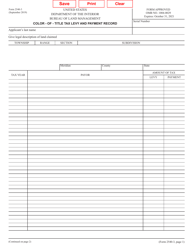

Form S.A.& I.292 Protest Tax Record - Oklahoma

What Is Form S.A.& I.292?

This is a legal form that was released by the Oklahoma State Auditor and Inspector - a government authority operating within Oklahoma. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is Form S.A.& I.292?

A: Form S.A.& I.292 is a form used to protest tax record in Oklahoma.

Q: Why would I need to file Form S.A.& I.292?

A: You would need to file Form S.A.& I.292 if you want to protest your tax record in Oklahoma.

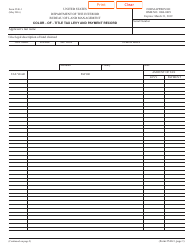

Q: What information should I provide on Form S.A.& I.292?

A: You should provide your personal information, the tax record you are protesting, the reason for protest, and any supporting documentation.

Q: What happens after I file Form S.A.& I.292?

A: After you file Form S.A.& I.292, the Oklahoma Tax Commission will review your protest and make a determination.

Q: What should I do if my protest is denied?

A: If your protest is denied, you may have the option to appeal the decision.

Form Details:

- Released on January 1, 1985;

- The latest edition provided by the Oklahoma State Auditor and Inspector;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form S.A.& I.292 by clicking the link below or browse more documents and templates provided by the Oklahoma State Auditor and Inspector.