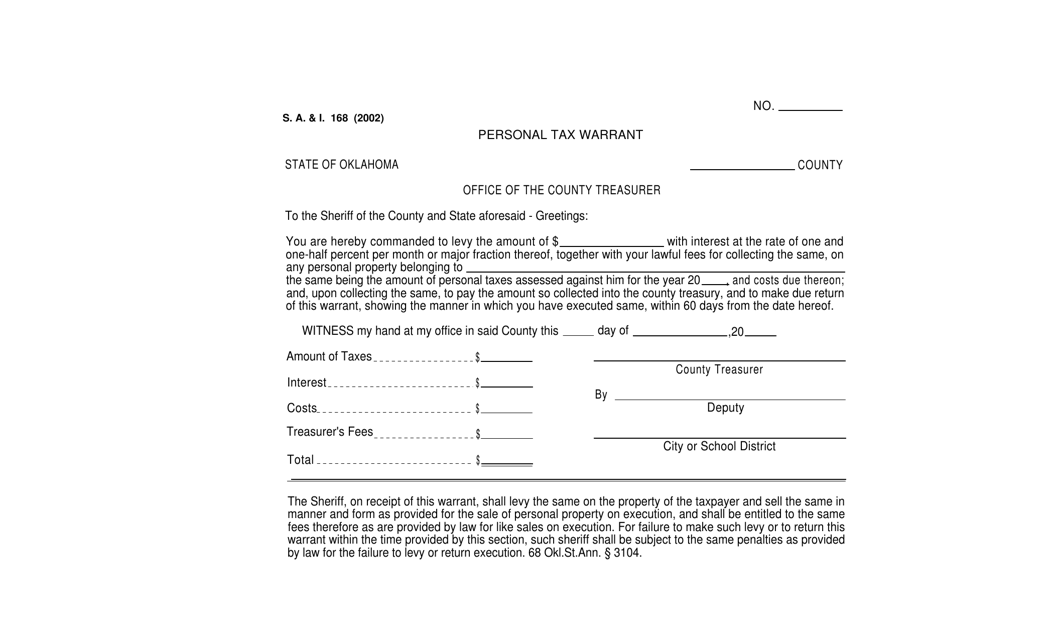

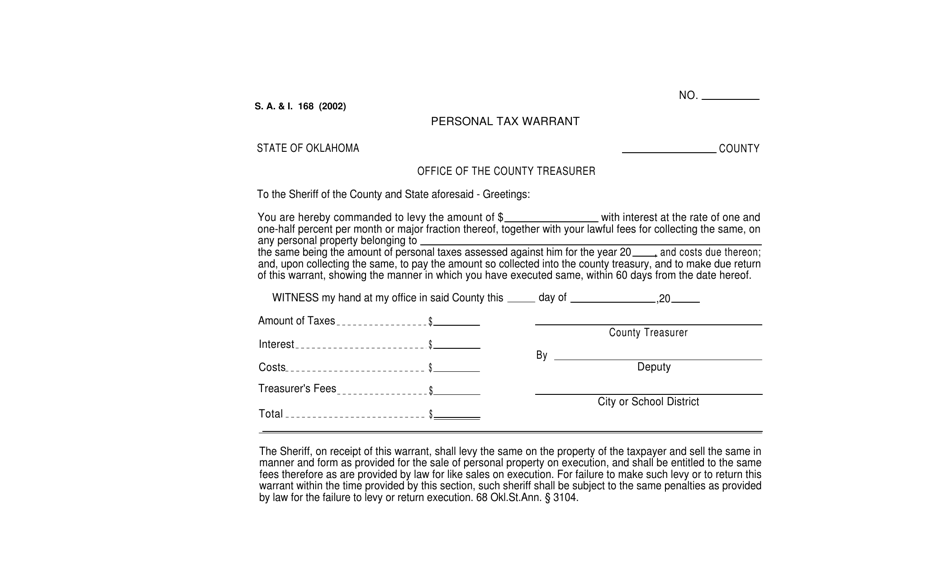

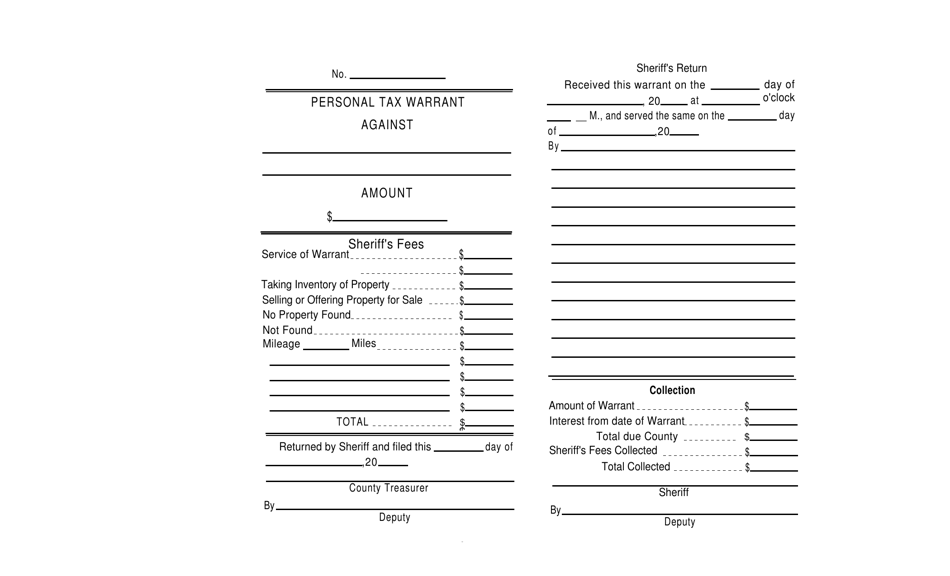

Form S.A.& I.168 Personal Tax Warrant - Oklahoma

What Is Form S.A.& I.168?

This is a legal form that was released by the Oklahoma State Auditor and Inspector - a government authority operating within Oklahoma. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is Form S.A.& I.168?

A: Form S.A.& I.168 is a Personal Tax Warrant used in Oklahoma.

Q: What is a Personal Tax Warrant?

A: A Personal Tax Warrant is a legal document issued by the state to collect unpaid taxes from an individual.

Q: Who issues Form S.A.& I.168?

A: Form S.A.& I.168 is issued by the Oklahoma Tax Commission.

Q: When is Form S.A.& I.168 used?

A: Form S.A.& I.168 is used when an individual has unpaid taxes in Oklahoma and the state needs to take legal action to collect the debt.

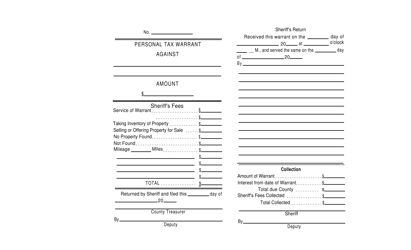

Q: What information is included in Form S.A.& I.168?

A: Form S.A.& I.168 includes the individual's name, address, tax debt amount, and other relevant information for tax collection.

Q: What should I do if I receive Form S.A.& I.168?

A: If you receive Form S.A.& I.168, you should contact the Oklahoma Tax Commission immediately to resolve your tax debt.

Q: What are the consequences of receiving Form S.A.& I.168?

A: Receiving Form S.A.& I.168 means that legal action is being taken to collect your unpaid taxes, which may include wage garnishment, bank levies, or property liens.

Form Details:

- Released on January 1, 2002;

- The latest edition provided by the Oklahoma State Auditor and Inspector;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a printable version of Form S.A.& I.168 by clicking the link below or browse more documents and templates provided by the Oklahoma State Auditor and Inspector.