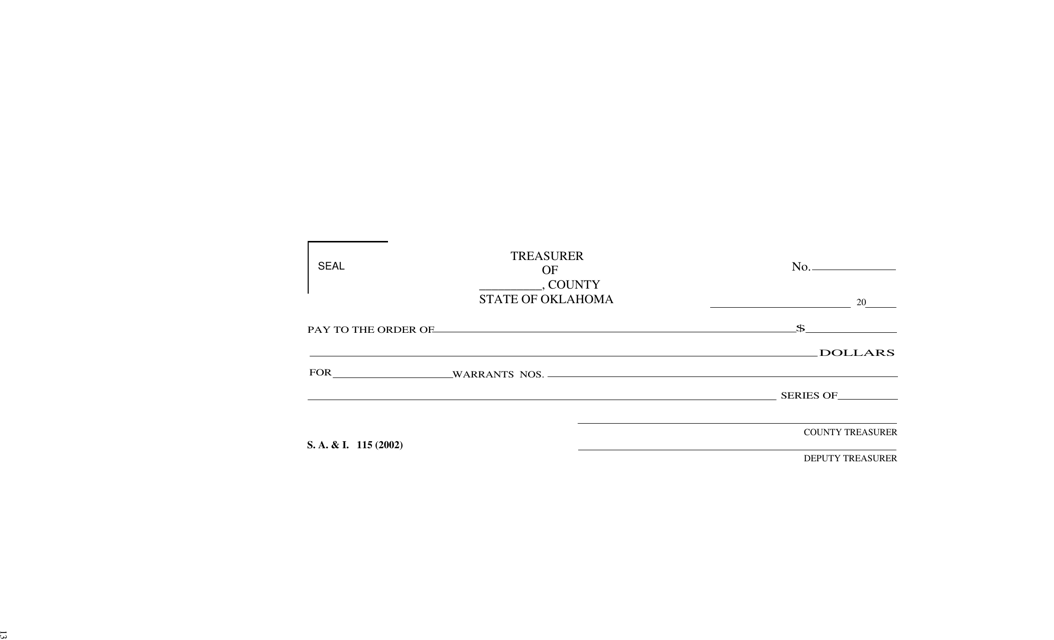

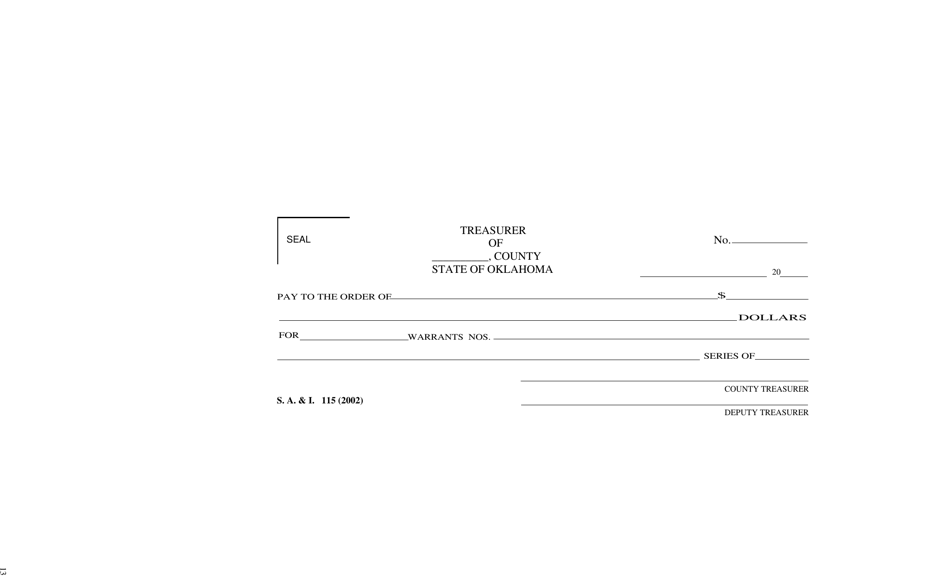

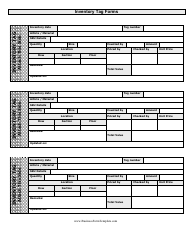

Form S.A.& I.115 - Oklahoma

What Is Form S.A.& I.115?

This is a legal form that was released by the Oklahoma State Auditor and Inspector - a government authority operating within Oklahoma. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is Form S.A.& I.115?

A: Form S.A.& I.115 is a tax form used in Oklahoma for reporting income or loss from a sole proprietorship or single-member LLC.

Q: Who needs to file Form S.A.& I.115?

A: Any individual who operates a sole proprietorship or single-member LLC in Oklahoma and has income or loss from that business needs to file this form.

Q: When is Form S.A.& I.115 due?

A: Form S.A.& I.115 is due on or before April 15th of each year.

Q: What information do I need to fill out Form S.A.& I.115?

A: You will need your business income and expense information, as well as your personal information and tax identification number.

Q: Can I e-file Form S.A.& I.115?

A: Yes, you can e-file Form S.A.& I.115 if you meet the eligibility requirements and use approved software.

Form Details:

- Released on January 1, 2002;

- The latest edition provided by the Oklahoma State Auditor and Inspector;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form S.A.& I.115 by clicking the link below or browse more documents and templates provided by the Oklahoma State Auditor and Inspector.