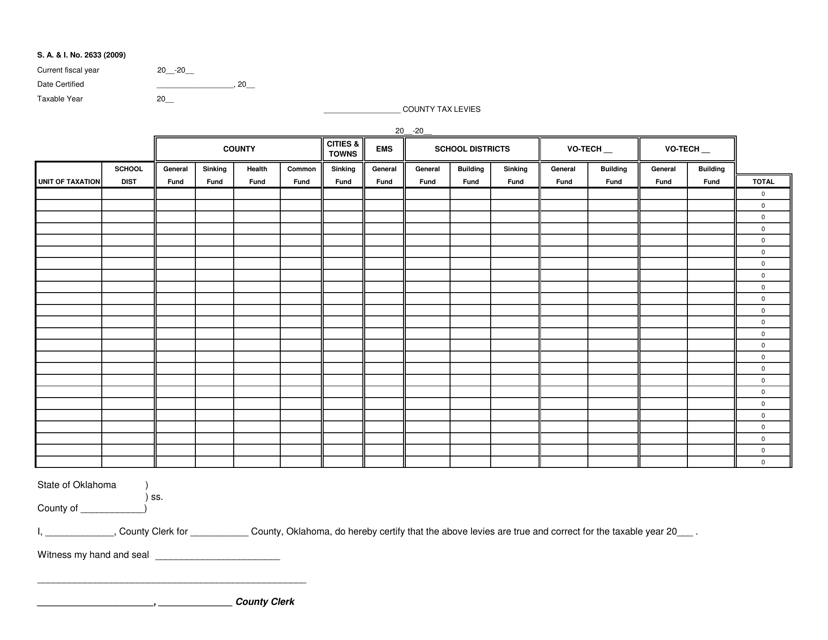

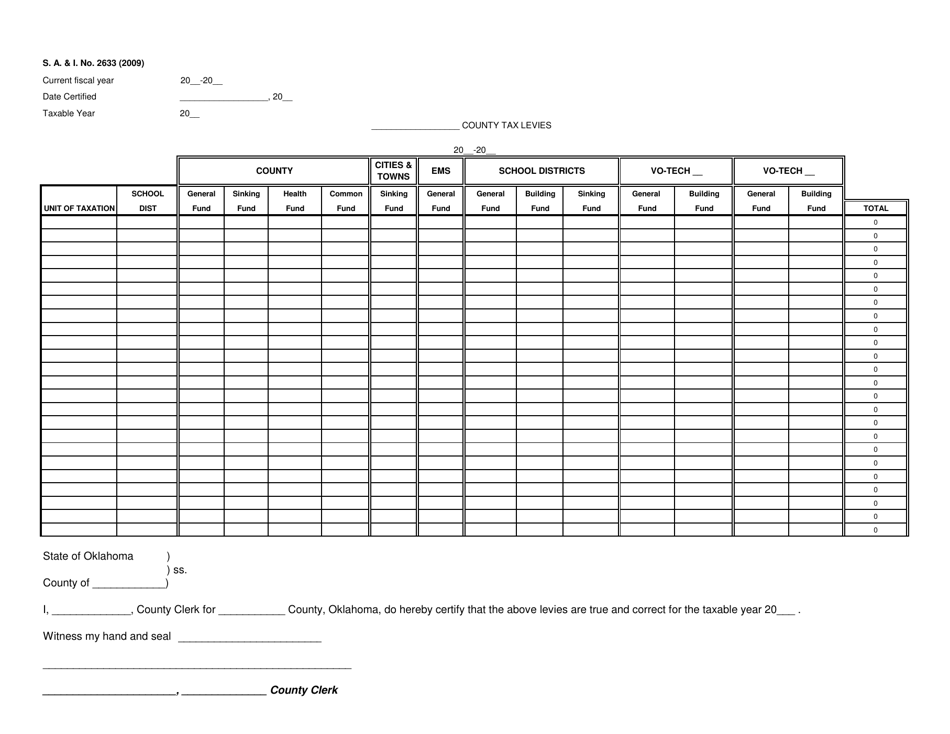

Form S.A.& I.2633 County Tax Levies - Oklahoma

What Is Form S.A.& I.2633?

This is a legal form that was released by the Oklahoma State Auditor and Inspector - a government authority operating within Oklahoma. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is Form S.A.& I.2633?

A: Form S.A.& I.2633 is a document related to county tax levies in Oklahoma.

Q: What are county tax levies?

A: County tax levies are taxes imposed by county governments in Oklahoma.

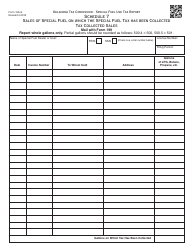

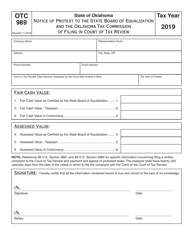

Q: What information is required on Form S.A.& I.2633?

A: Form S.A.& I.2633 requires information such as property identification, assessed value, and tax rates.

Q: Why do I need to fill out Form S.A.& I.2633?

A: You need to fill out Form S.A.& I.2633 to report and pay county tax levies on your property.

Q: When is the deadline to submit Form S.A.& I.2633?

A: The deadline to submit Form S.A.& I.2633 is typically the same as the deadline for paying property taxes in Oklahoma.

Q: What happens if I fail to file Form S.A.& I.2633?

A: Failing to file Form S.A.& I.2633 may result in penalties or interest being assessed on your property tax bill.

Q: Who should I contact for further assistance with Form S.A.& I.2633?

A: For further assistance with Form S.A.& I.2633, you should contact the Oklahoma County Assessor's office or the county government where your property is located.

Form Details:

- Released on January 1, 2009;

- The latest edition provided by the Oklahoma State Auditor and Inspector;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form S.A.& I.2633 by clicking the link below or browse more documents and templates provided by the Oklahoma State Auditor and Inspector.