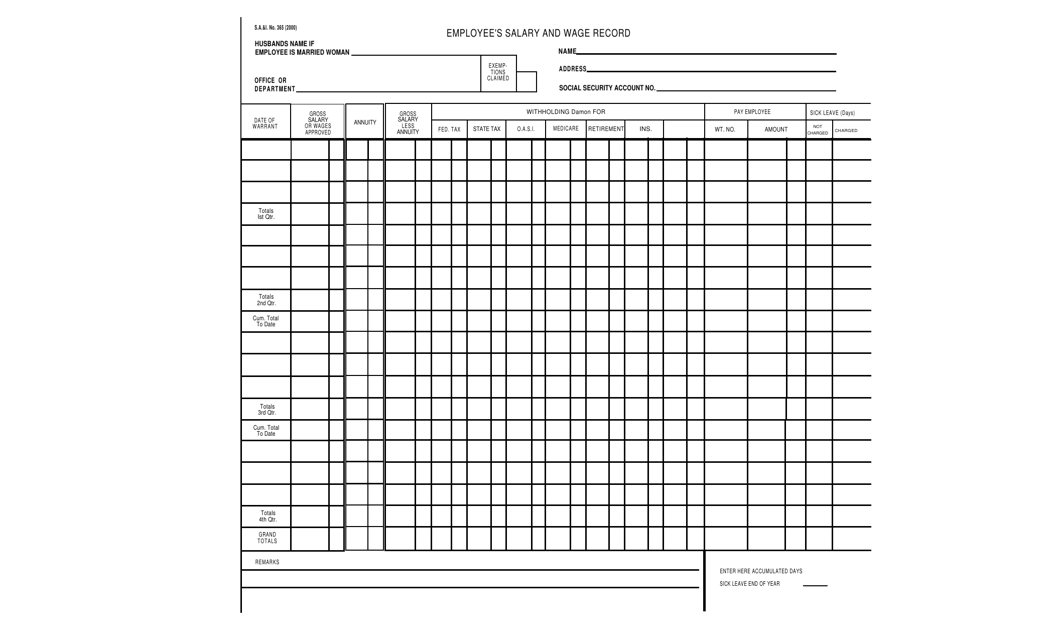

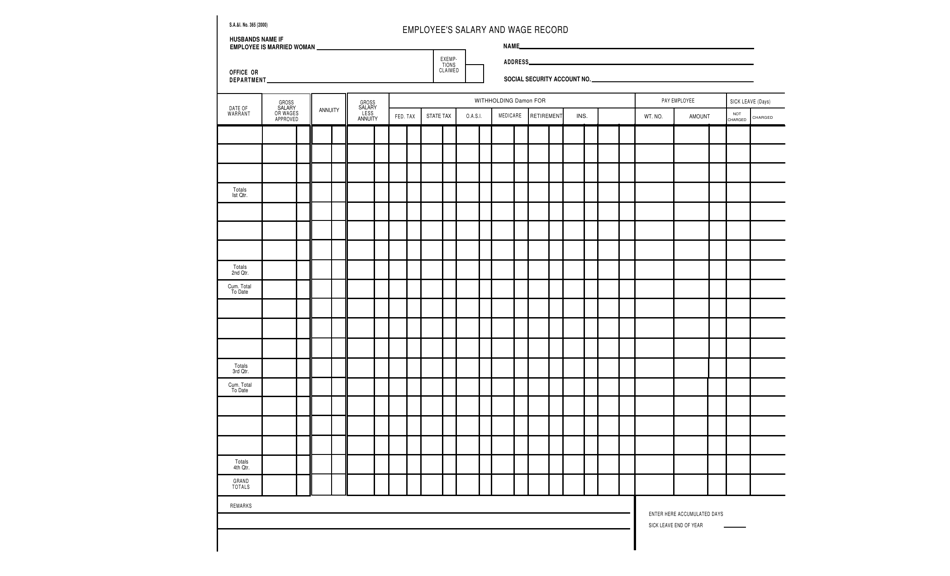

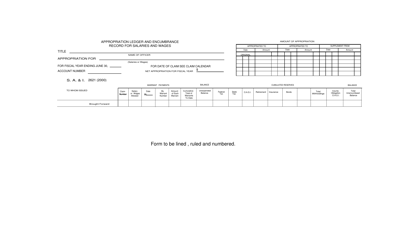

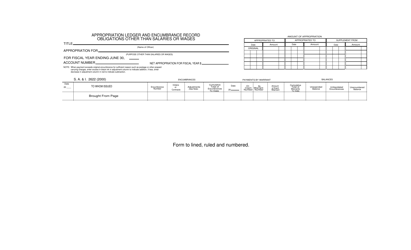

Form S.A.& I.365 Employee's Salary and Wage Record - Oklahoma

What Is Form S.A.& I.365?

This is a legal form that was released by the Oklahoma State Auditor and Inspector - a government authority operating within Oklahoma. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is Form S.A.& I.365?

A: Form S.A.& I.365 is the Employee's Salary and Wage Record form used in Oklahoma.

Q: What is the purpose of Form S.A.& I.365?

A: The purpose of Form S.A.& I.365 is to track and report employee salaries and wages in Oklahoma.

Q: Who is required to file Form S.A.& I.365?

A: Employers in Oklahoma are required to file Form S.A.& I.365.

Q: When is Form S.A.& I.365 due?

A: Form S.A.& I.365 is due on or before February 28th of each year.

Q: How can Form S.A.& I.365 be filed?

A: Form S.A.& I.365 can be filed electronically or by mail.

Q: Are there any penalties for not filing Form S.A.& I.365?

A: Yes, there are penalties for not filing Form S.A.& I.365, including potential fines.

Form Details:

- Released on January 1, 2000;

- The latest edition provided by the Oklahoma State Auditor and Inspector;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a printable version of Form S.A.& I.365 by clicking the link below or browse more documents and templates provided by the Oklahoma State Auditor and Inspector.