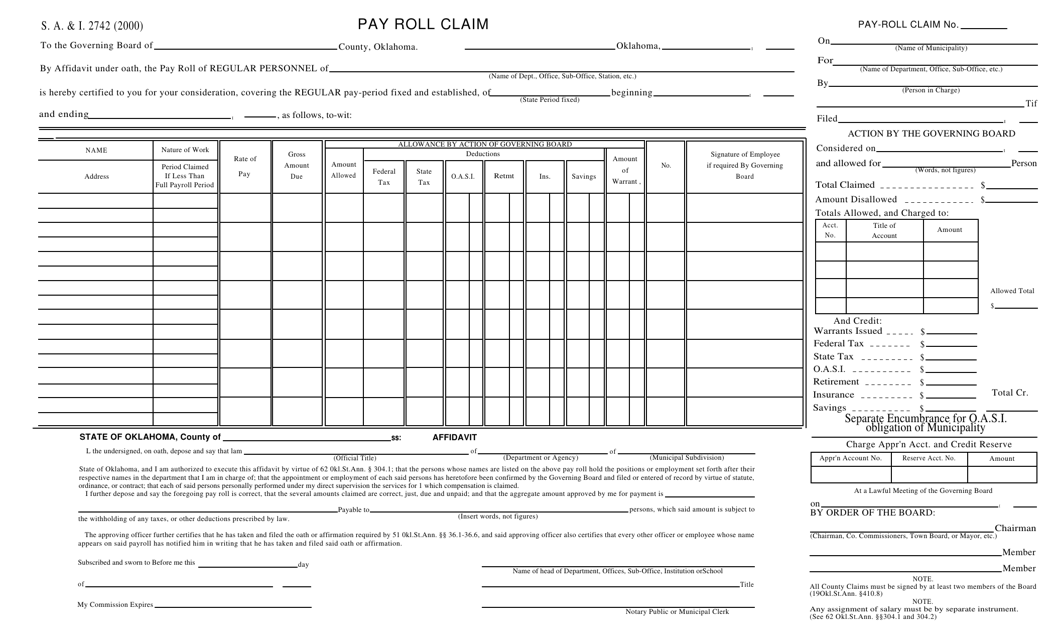

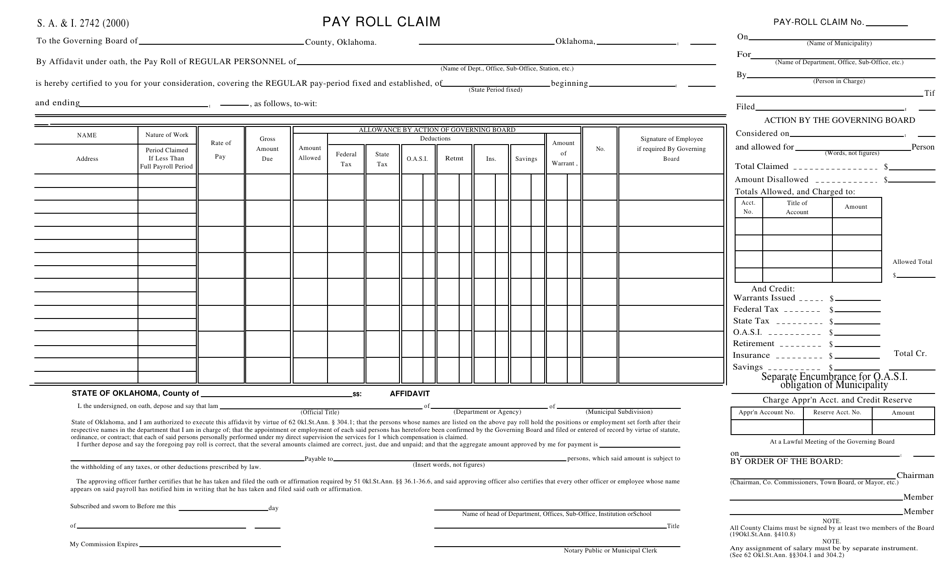

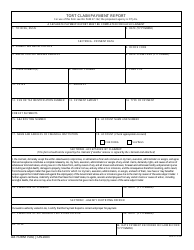

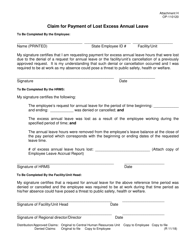

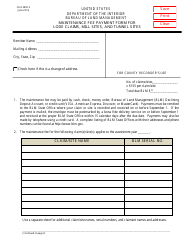

Form S.A.& I.2742 Pay Roll Claim - Oklahoma

What Is Form S.A.& I.2742?

This is a legal form that was released by the Oklahoma State Auditor and Inspector - a government authority operating within Oklahoma. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is Form S.A.& I.2742?

A: Form S.A.& I.2742 is a Pay Roll Claim form.

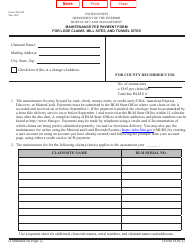

Q: What is the purpose of Form S.A.& I.2742?

A: The purpose of Form S.A.& I.2742 is to claim pay roll expenses in Oklahoma.

Q: Who can use Form S.A.& I.2742?

A: Form S.A.& I.2742 can be used by individuals or businesses in Oklahoma to claim pay roll expenses.

Q: Is Form S.A.& I.2742 specific to Oklahoma?

A: Yes, Form S.A.& I.2742 is specific to Oklahoma and cannot be used for pay roll claims in other states.

Q: Is there a deadline for submitting Form S.A.& I.2742?

A: Yes, the deadline for submitting Form S.A.& I.2742 is determined by the Oklahoma Tax Commission.

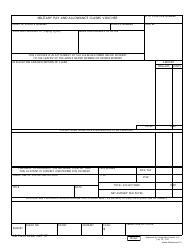

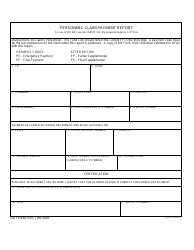

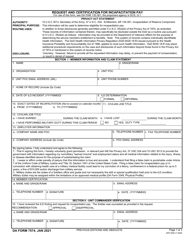

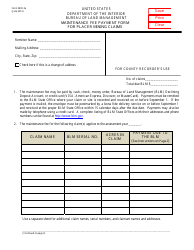

Q: What information is required on Form S.A.& I.2742?

A: Form S.A.& I.2742 requires information such as the claimant's name, address, and details of pay roll expenses.

Q: Are there any supporting documents required with Form S.A.& I.2742?

A: Yes, it may require supporting documents such as pay roll records or receipts to substantiate the claim.

Q: What happens after submitting Form S.A.& I.2742?

A: After submitting Form S.A.& I.2742, it will be reviewed by the Oklahoma Tax Commission for approval.

Q: Can I claim pay roll expenses from previous years with Form S.A.& I.2742?

A: No, Form S.A.& I.2742 can only be used to claim pay roll expenses for the current tax year.

Form Details:

- Released on January 1, 2000;

- The latest edition provided by the Oklahoma State Auditor and Inspector;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form S.A.& I.2742 by clicking the link below or browse more documents and templates provided by the Oklahoma State Auditor and Inspector.