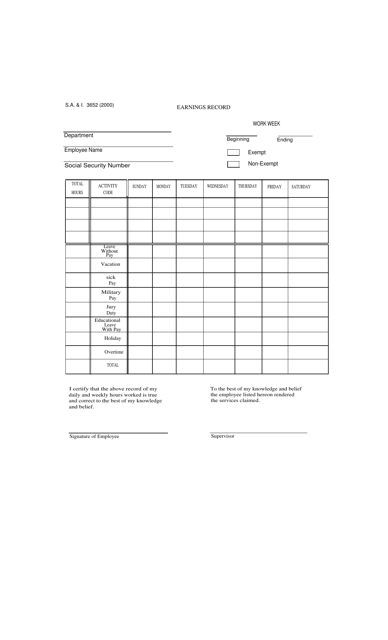

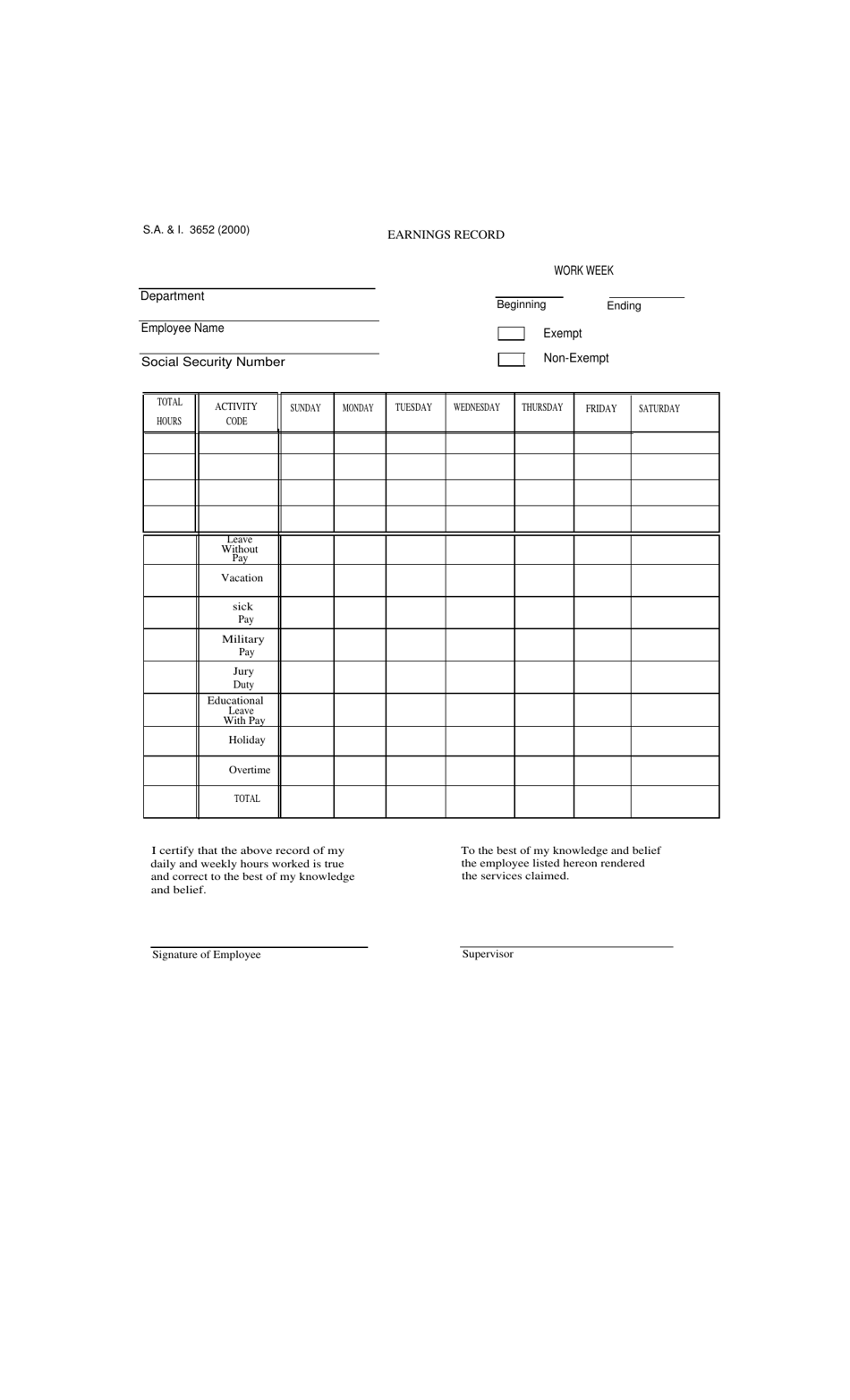

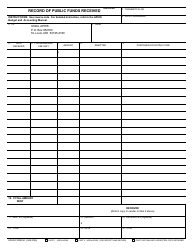

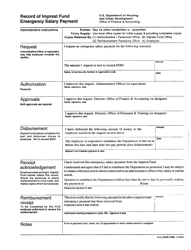

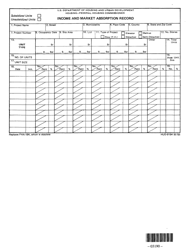

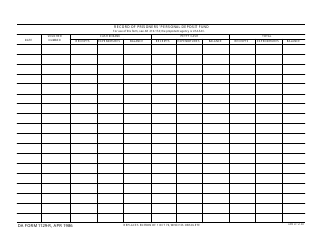

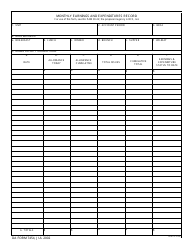

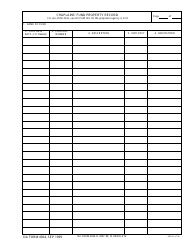

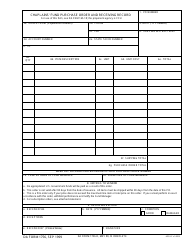

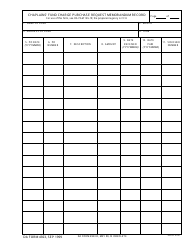

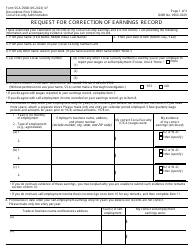

Form S.A.& I.3652 Earnings Record - Oklahoma

What Is Form S.A.& I.3652?

This is a legal form that was released by the Oklahoma State Auditor and Inspector - a government authority operating within Oklahoma. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is Form S.A.& I.3652?

A: Form S.A.& I.3652 is an Earnings Record form that is specific to Oklahoma.

Q: Who needs to file Form S.A.& I.3652?

A: Individuals who are employed and work in Oklahoma need to file Form S.A.& I.3652.

Q: What information do I need to complete Form S.A.& I.3652?

A: You will need your personal information, such as your name, Social Security number, and address, as well as your employment and earnings information.

Q: When is the deadline to file Form S.A.& I.3652?

A: The deadline to file Form S.A.& I.3652 is typically April 15th of each year.

Q: Is there a filing fee for Form S.A.& I.3652?

A: No, there is no filing fee for Form S.A.& I.3652.

Q: What happens if I don't file Form S.A.& I.3652?

A: Failure to file Form S.A.& I.3652 may result in penalties and interest charges.

Q: Can I file Form S.A.& I.3652 electronically?

A: Yes, you can file Form S.A.& I.3652 electronically if you choose to do so.

Q: Can I amend my Form S.A.& I.3652 after it has been filed?

A: Yes, you can amend your Form S.A.& I.3652 if you need to make any changes or corrections to your reported earnings.

Q: What should I do with my completed Form S.A.& I.3652?

A: You should keep a copy of your completed Form S.A.& I.3652 for your records and submit it to the Oklahoma Tax Commission as instructed on the form.

Form Details:

- Released on January 1, 2000;

- The latest edition provided by the Oklahoma State Auditor and Inspector;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form S.A.& I.3652 by clicking the link below or browse more documents and templates provided by the Oklahoma State Auditor and Inspector.