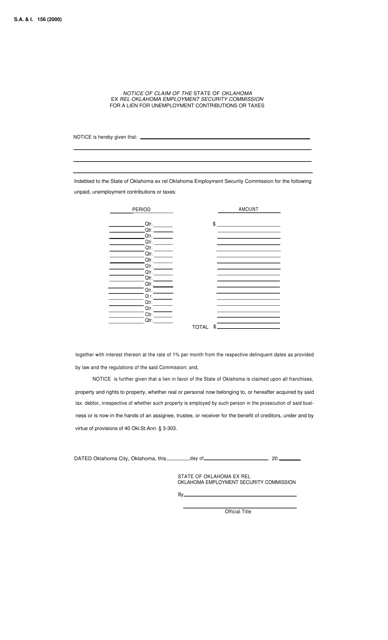

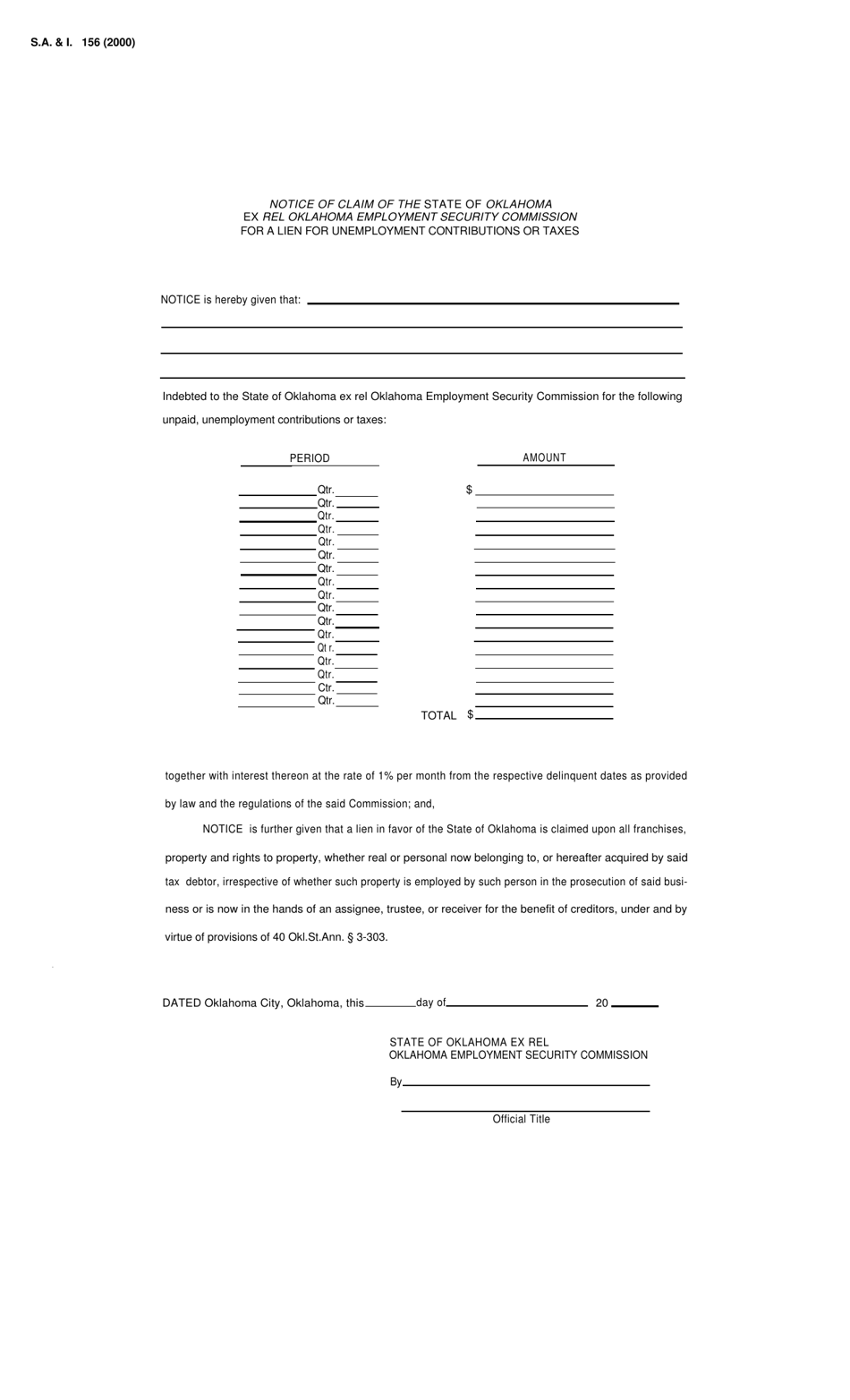

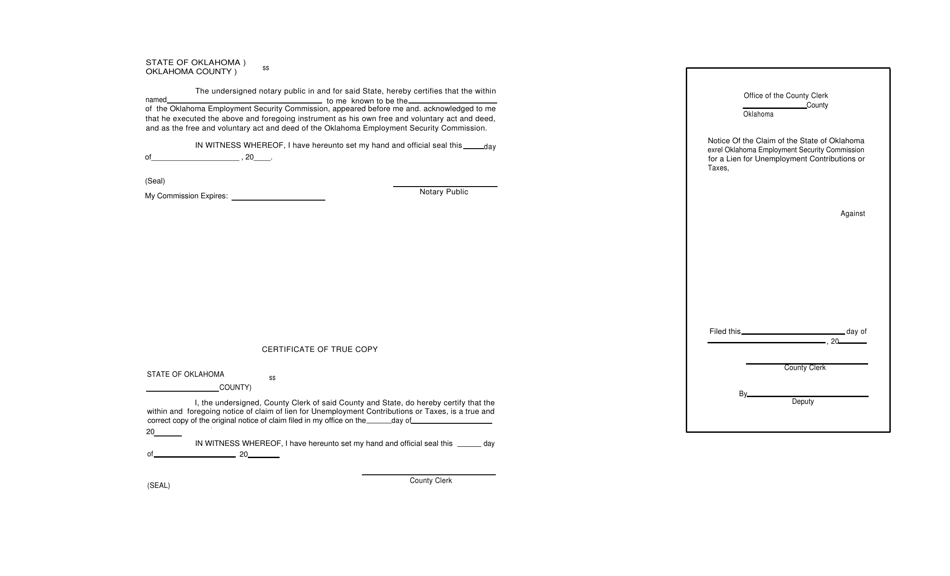

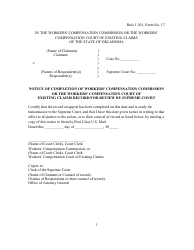

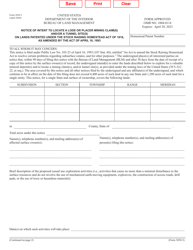

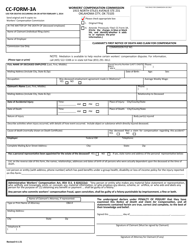

Form S.A.& I.156 Notice of Claim of the State of Oklahoma for a Lien for Unemployment Contributions or Taxes - Oklahoma

What Is Form S.A.& I.156?

This is a legal form that was released by the Oklahoma State Auditor and Inspector - a government authority operating within Oklahoma. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is Form S.A.& I.156?

A: Form S.A.& I.156 is a Notice of Claim of the State of Oklahoma for a Lien for Unemployment Contributions or Taxes.

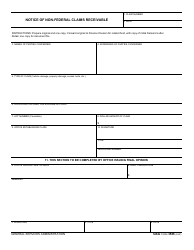

Q: Who files Form S.A.& I.156?

A: The State of Oklahoma files Form S.A.& I.156.

Q: What is the purpose of Form S.A.& I.156?

A: The purpose of Form S.A.& I.156 is to notify individuals or entities of a claim of lien by the State of Oklahoma for unpaid unemployment contributions or taxes.

Q: What happens if a lien is filed using Form S.A.& I.156?

A: If a lien is filed using Form S.A.& I.156, it indicates that the individual or entity owes unpaid unemployment contributions or taxes to the State of Oklahoma.

Q: How do I respond to a Form S.A.& I.156?

A: If you receive a Form S.A.& I.156, you should review it carefully and take appropriate action, such as contacting the State of Oklahoma to address the unpaid contributions or taxes.

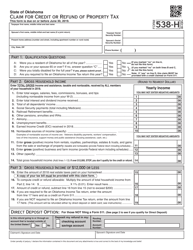

Q: What are unemployment contributions or taxes?

A: Unemployment contributions or taxes are payments made by employers to fund the unemployment insurance program, which provides benefits to eligible workers who are unemployed through no fault of their own.

Q: Can I dispute a claim of lien filed using Form S.A.& I.156?

A: Yes, if you believe that the claim of lien is incorrect or unjustified, you have the right to dispute it with the State of Oklahoma.

Q: Is Form S.A.& I.156 specific to Oklahoma?

A: Yes, Form S.A.& I.156 is specific to the State of Oklahoma and its laws regarding unemployment contributions or taxes.

Q: What should I do if I have questions about Form S.A.& I.156?

A: If you have questions about Form S.A.& I.156, it is recommended to consult with a legal or tax professional, or contact the State of Oklahoma for assistance.

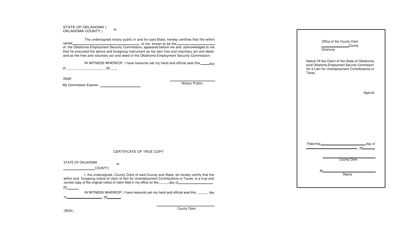

Form Details:

- Released on January 1, 2000;

- The latest edition provided by the Oklahoma State Auditor and Inspector;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a printable version of Form S.A.& I.156 by clicking the link below or browse more documents and templates provided by the Oklahoma State Auditor and Inspector.