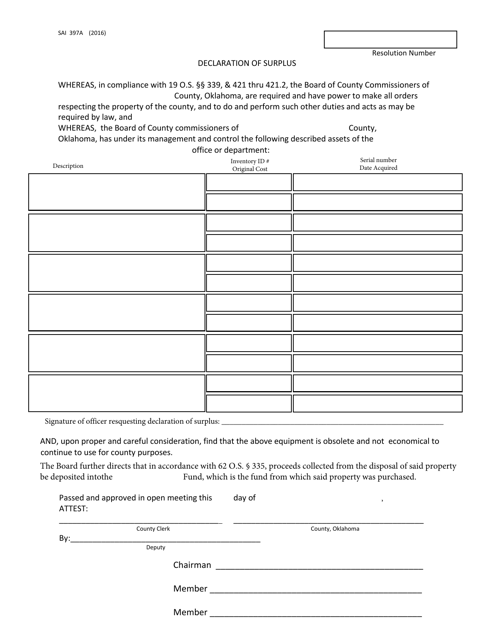

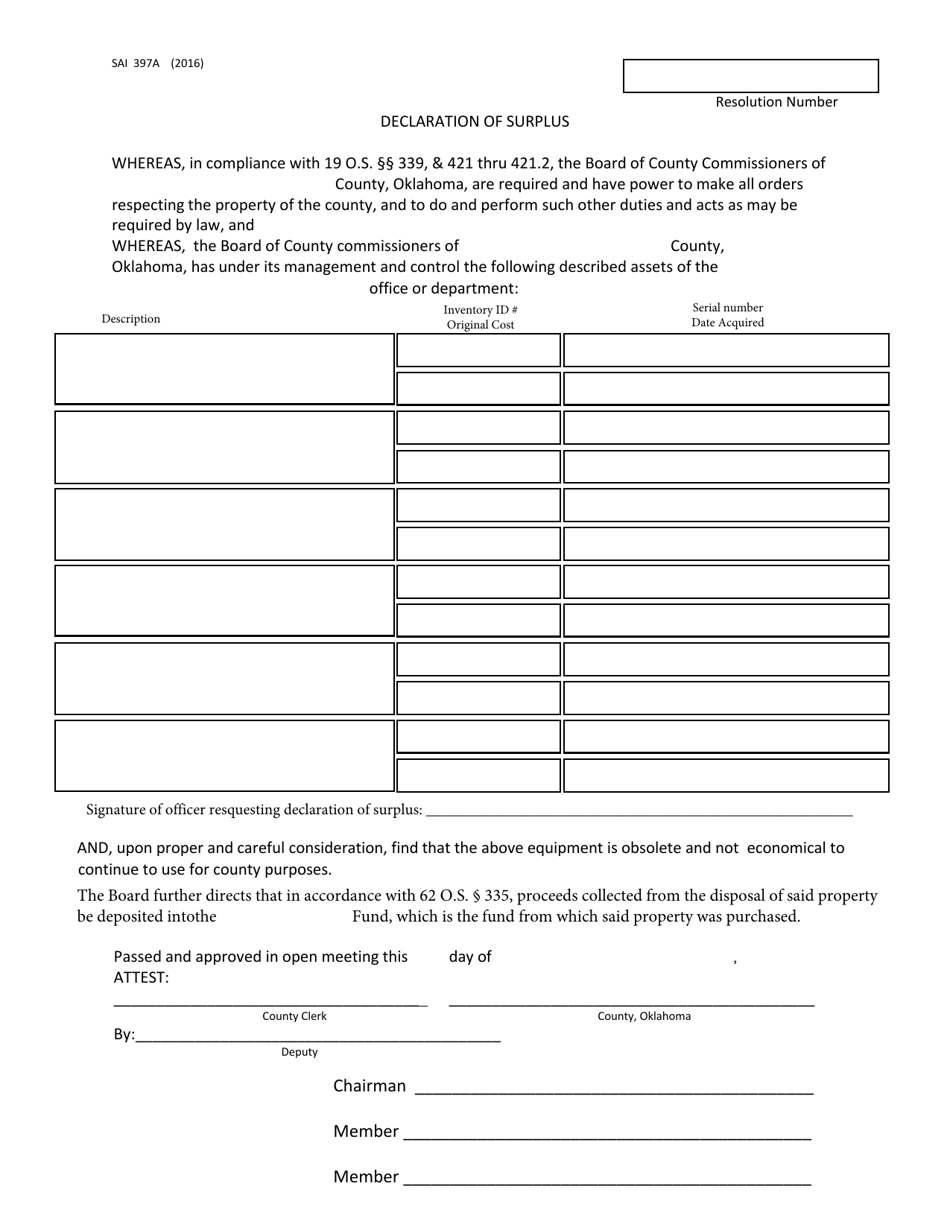

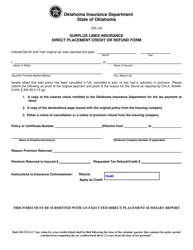

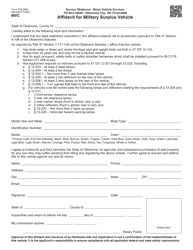

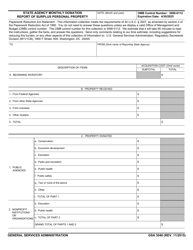

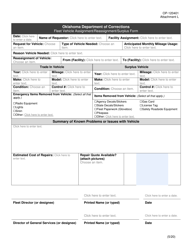

Form S.A.& I.397A Declaration of Surplus - Oklahoma

What Is Form S.A.& I.397A?

This is a legal form that was released by the Oklahoma State Auditor and Inspector - a government authority operating within Oklahoma. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is Form S.A.& I.397A?

A: Form S.A.& I.397A is a declaration of surplus form in Oklahoma.

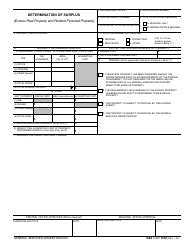

Q: What is the purpose of Form S.A.& I.397A?

A: The purpose of Form S.A.& I.397A is to report surplus funds from the sale of real estate in Oklahoma.

Q: Who needs to file Form S.A.& I.397A?

A: The person or entity that received the surplus funds from the sale of real estate in Oklahoma needs to file Form S.A.& I.397A.

Q: How do I file Form S.A.& I.397A?

A: Form S.A.& I.397A can be filed by submitting a completed form to the county clerk's office where the surplus funds were deposited.

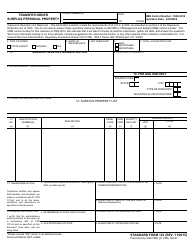

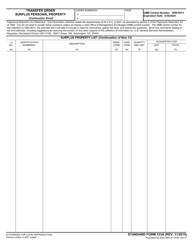

Q: What information is required on Form S.A.& I.397A?

A: Form S.A.& I.397A requires information such as the case number, name of the recipient, amount of surplus funds, and a legal description of the property.

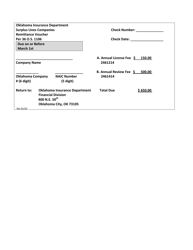

Q: Are there any fees associated with filing Form S.A.& I.397A?

A: There may be filing fees associated with submitting Form S.A.& I.397A, but the specific fees vary by county.

Q: When should I file Form S.A.& I.397A?

A: Form S.A.& I.397A should be filed as soon as possible after receiving the surplus funds from the sale of real estate.

Q: Can I submit Form S.A.& I.397A electronically?

A: It is recommended to check with the county clerk's office where the surplus funds were deposited to see if electronic filing is available.

Form Details:

- Released on January 1, 2016;

- The latest edition provided by the Oklahoma State Auditor and Inspector;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form S.A.& I.397A by clicking the link below or browse more documents and templates provided by the Oklahoma State Auditor and Inspector.